Tax Templates

Documents:

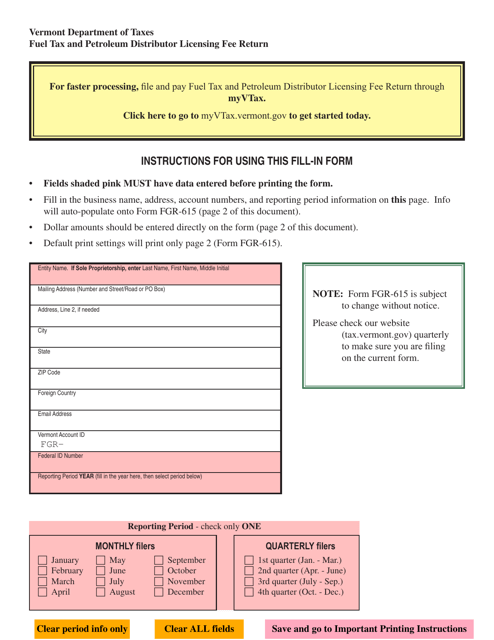

2882

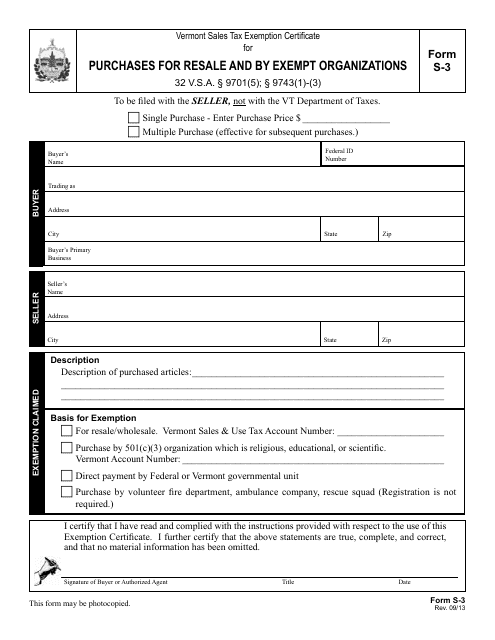

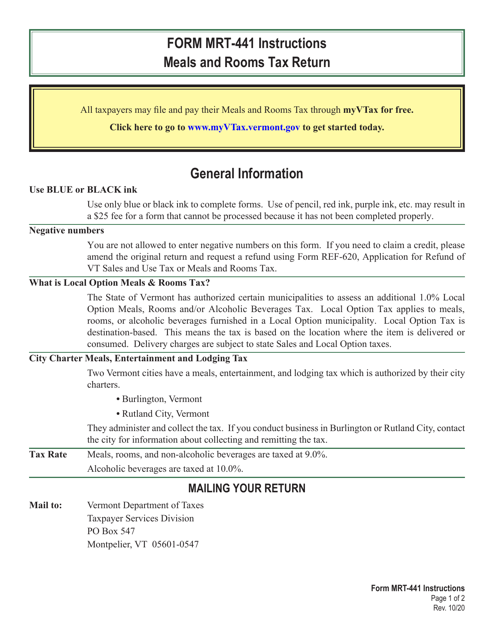

This Form is used for reporting purchases made for resale or by exempt organizations in the state of Vermont.

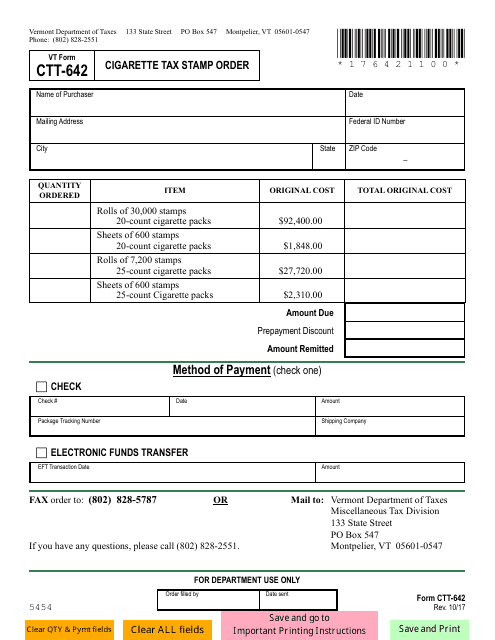

This Form is used for ordering cigarette tax stamps in Vermont.

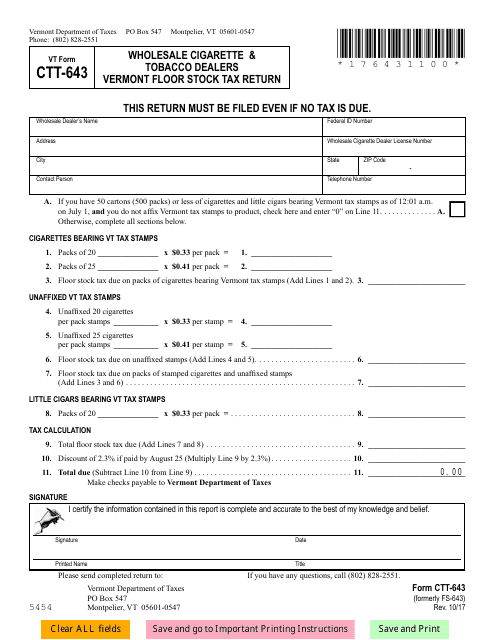

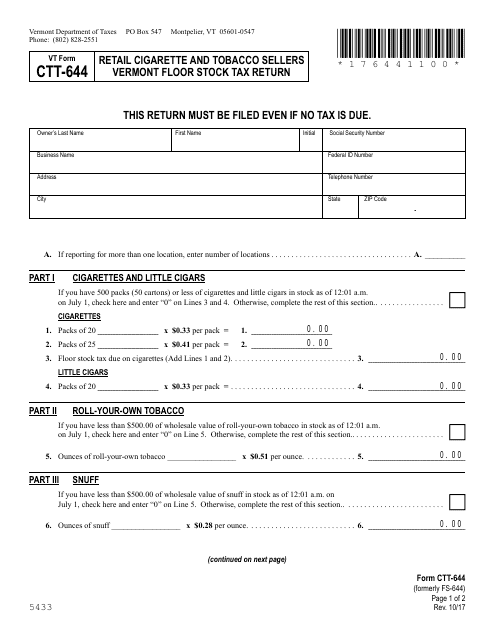

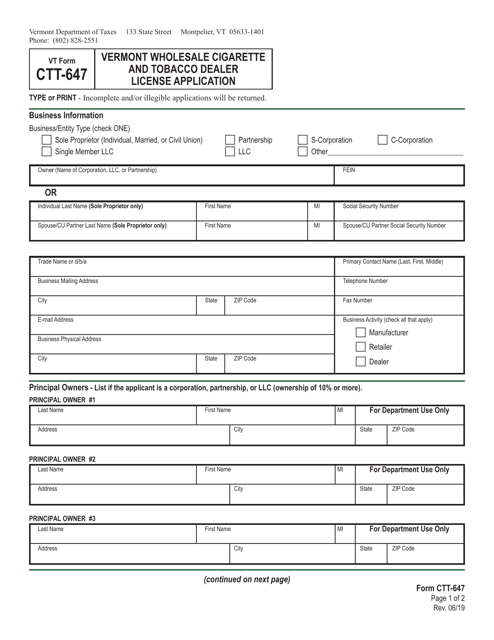

This document is used for filing the Vermont Floor Stock Tax Return for wholesale cigarette and tobacco dealers in Vermont.

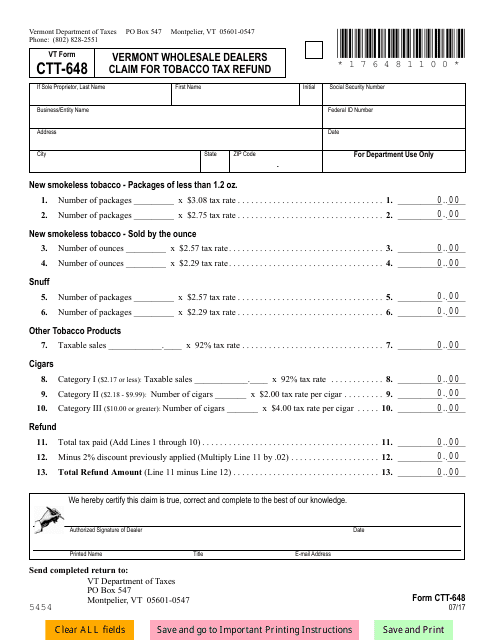

This form is used for Vermont wholesale dealers to claim a refund on tobacco tax.

This Form is used for retailers selling cigarettes and tobacco in Vermont to file their floor stock tax return. The form is used to calculate and remit the tax due on the remaining inventory of cigarettes and tobacco products at the end of the tax period.

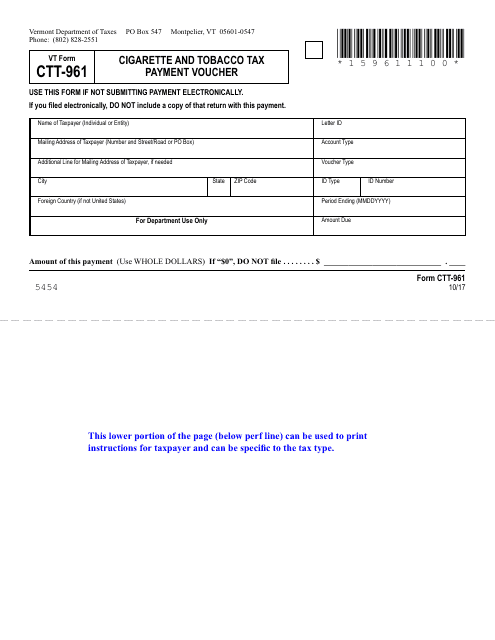

This form is used for making cigarette and tobacco tax payments in Vermont.

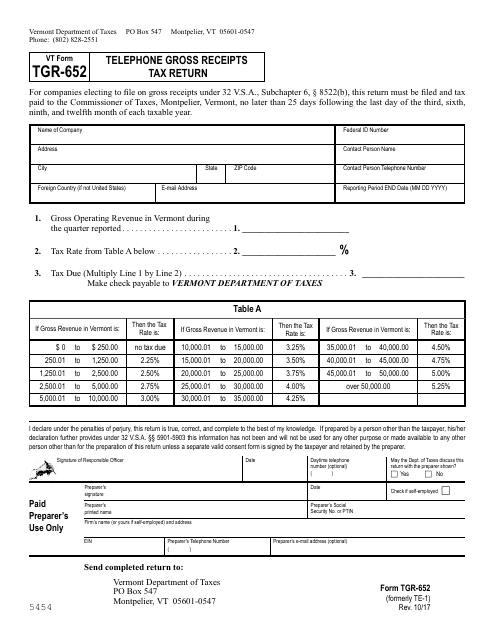

This Form is used for reporting telephone gross receipts for tax purposes in the state of Vermont.

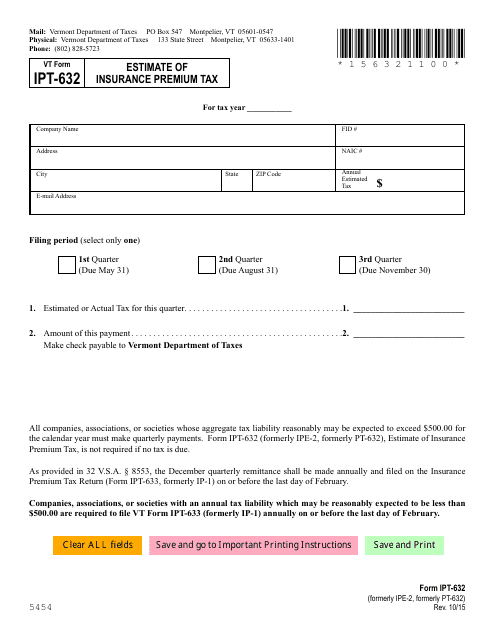

This form is used for estimating insurance premium tax in Vermont.

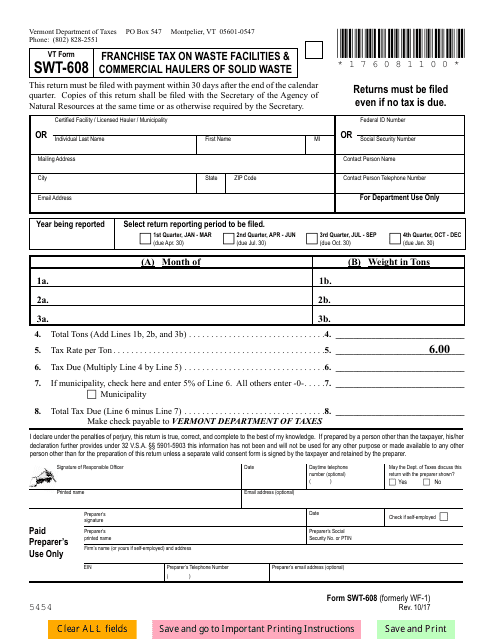

This Form is used for reporting and paying franchise tax on waste facilities and commercial haulers of solid waste in the state of Vermont.

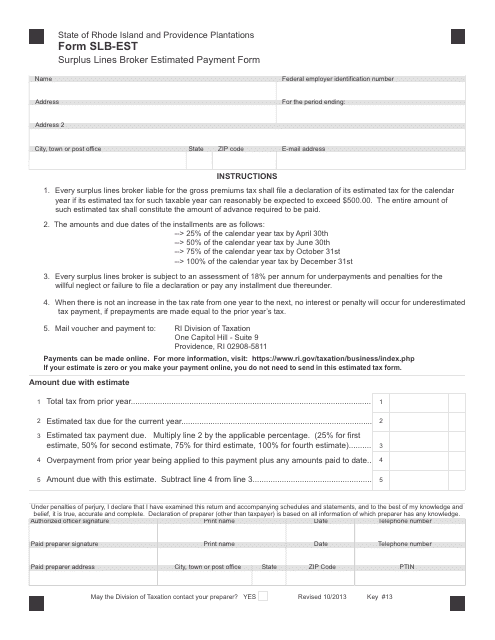

This form is used for surplus lines brokers in Rhode Island to make estimated payments.

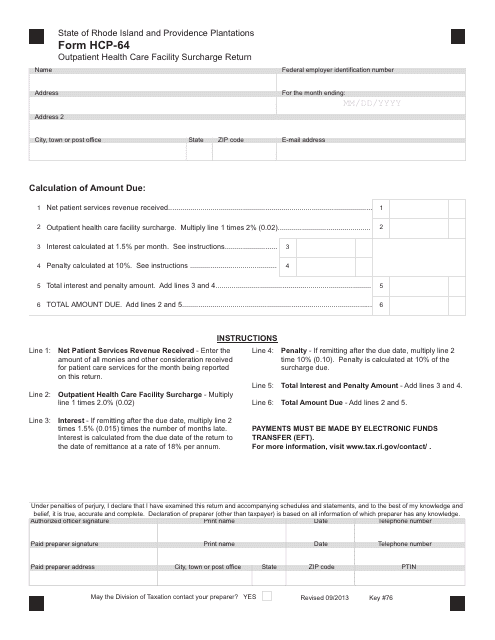

This form is used for reporting and paying the outpatient health care facility surcharge in Rhode Island.

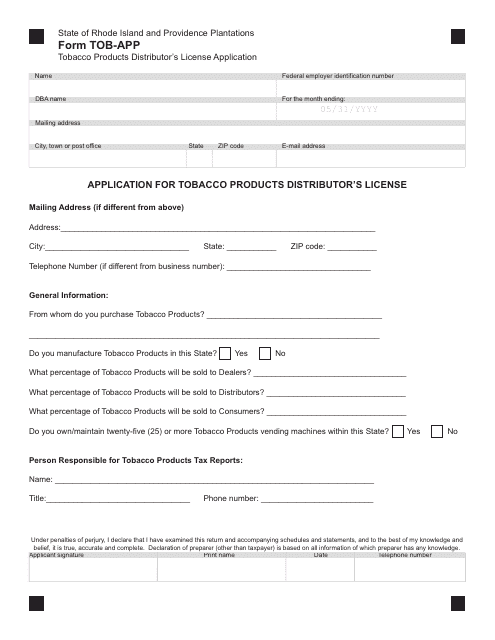

This document is used for applying for a tobacco products distributor's license in Rhode Island.