Tax Templates

Documents:

2882

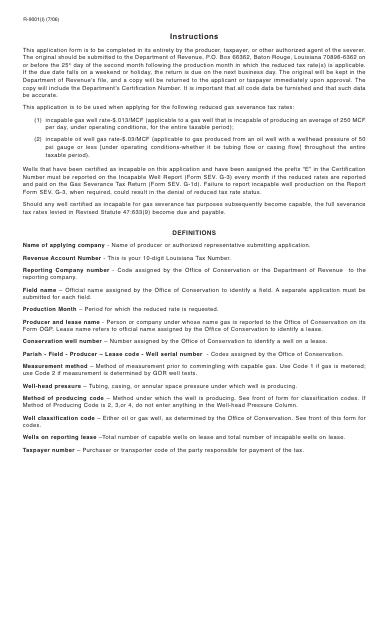

This Form is used for applying for certification of incapable wells in Louisiana. It provides instructions on how to complete the application process.

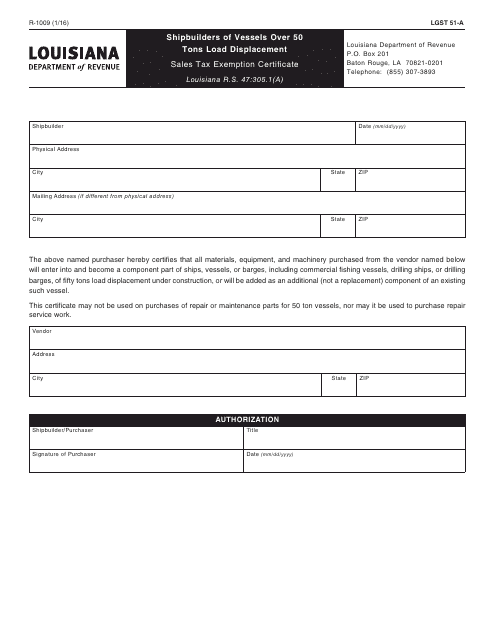

This form is used for shipbuilders in Louisiana to claim a sales tax exemption on vessels over 50 tons load displacement.

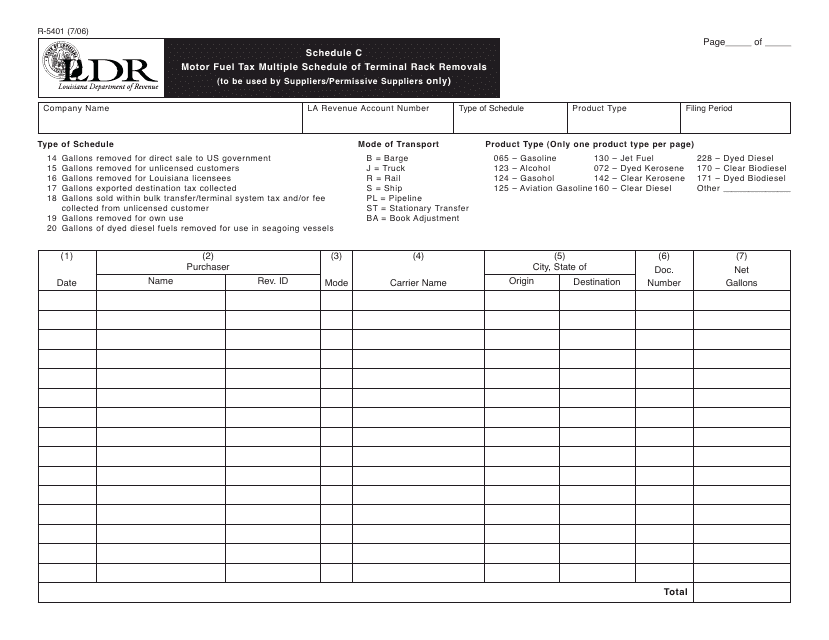

This document is used for reporting multiple terminal rack removals of motor fuel in Louisiana for tax purposes.

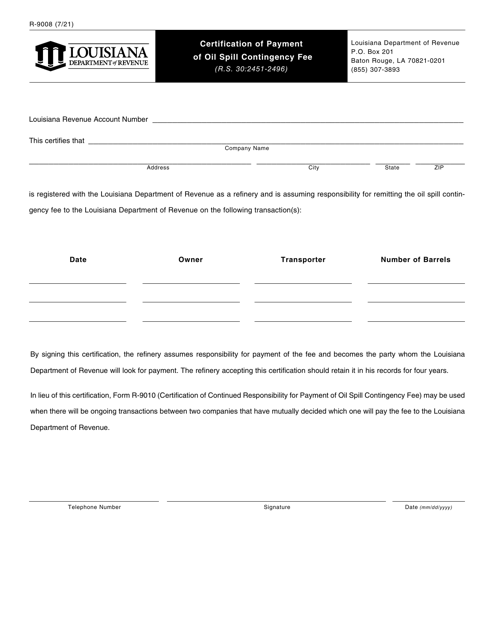

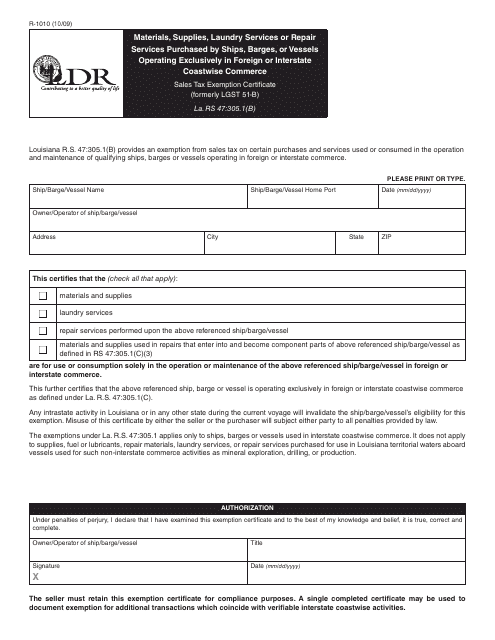

This form is used for recording the materials, supplies, laundry services, or repair services purchased by ships, barges, and vessels that operate exclusively in foreign or interstate coastwise commerce in Louisiana.

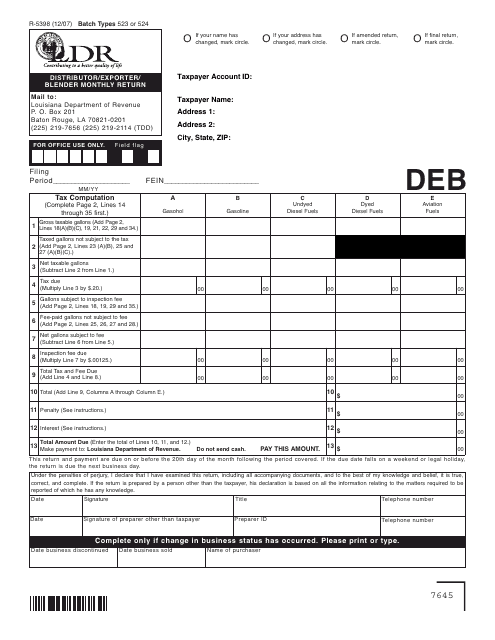

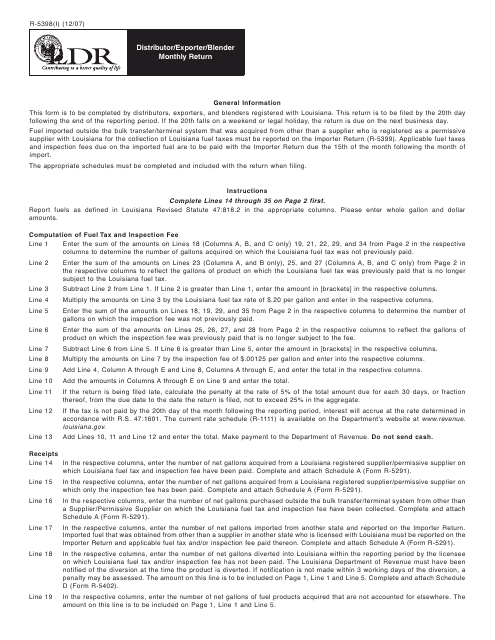

This form is used for distributors, exporters, and blenders in Louisiana to file their monthly returns.

This form is used for reporting monthly sales and use tax information for distributors, exporters, and blenders in the state of Louisiana. It provides instructions on how to fill out and submit the Form R-5398.

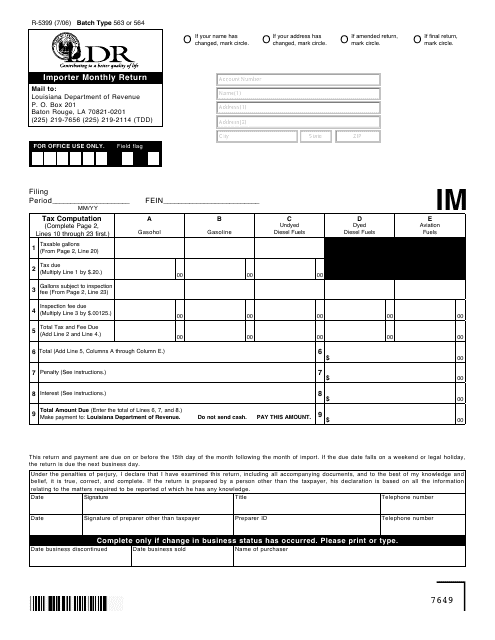

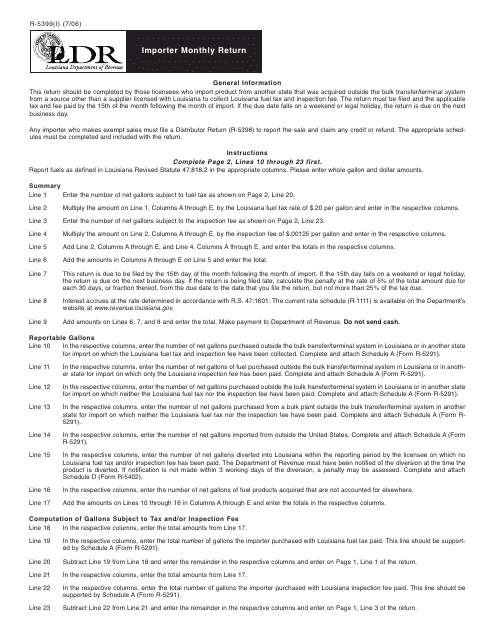

This Form is used for filing monthly import data by businesses in Louisiana.

This Form is used for reporting monthly imports to the state of Louisiana.

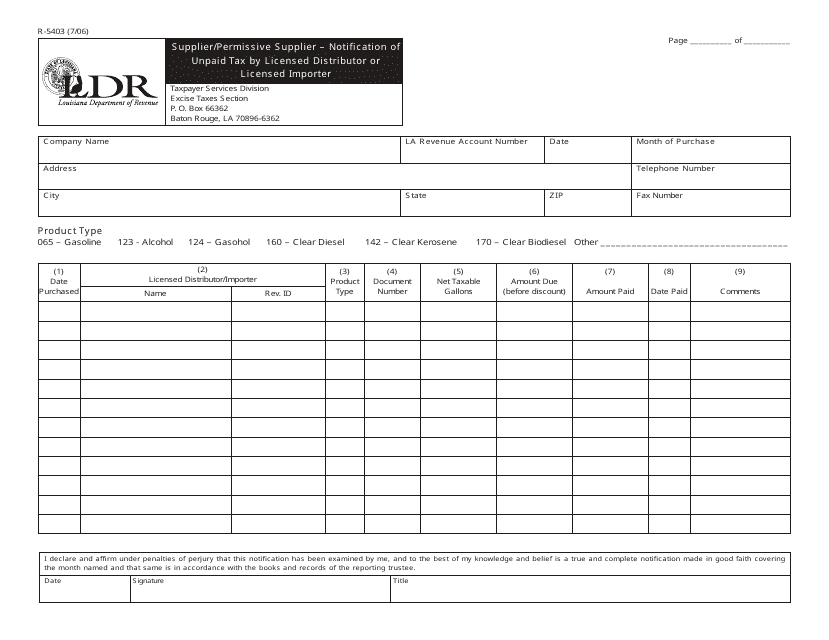

This form is used for licensed distributors or importers in Louisiana to notify the state of any unpaid taxes by suppliers or permissive suppliers.

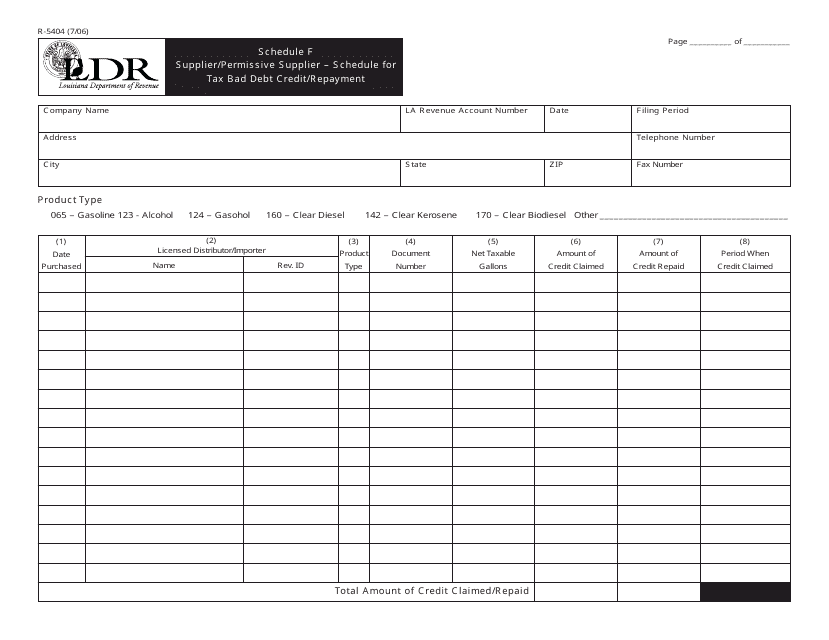

This form is used for reporting tax bad debt credit or repayment for suppliers and permissive suppliers in the state of Louisiana.

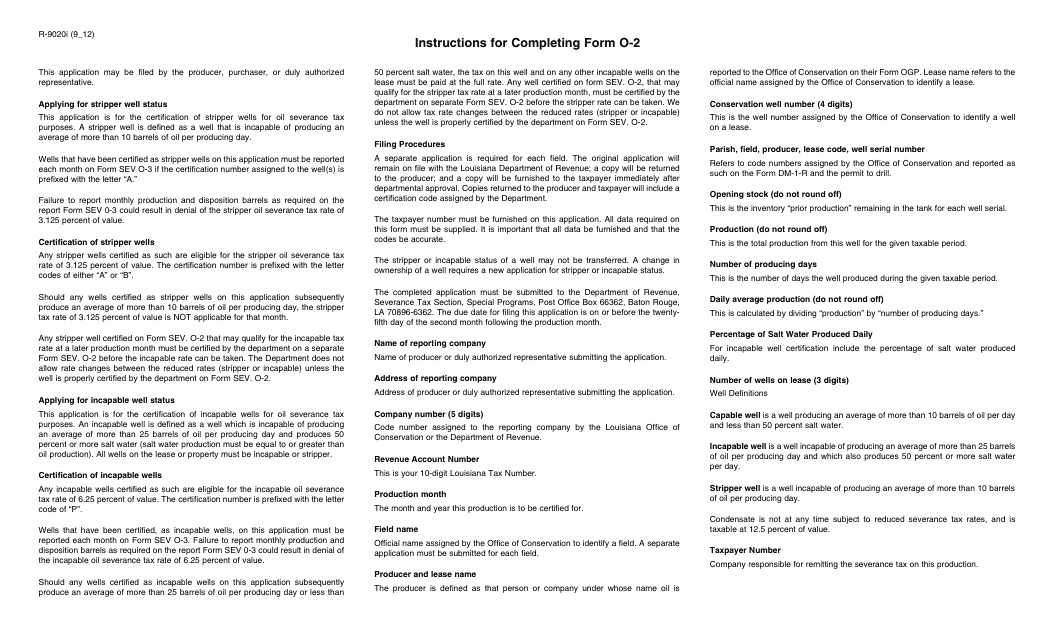

This document is used for applying for certification of stripper/incapable wells in Louisiana. It provides instructions for filling out Form O-2.

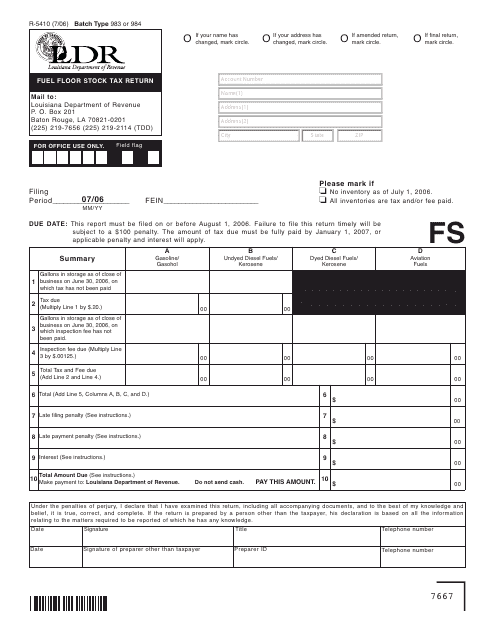

This form is used for reporting and paying fuel floor stock tax in the state of Louisiana. It is required for businesses that store fuel for sale or use in the state.

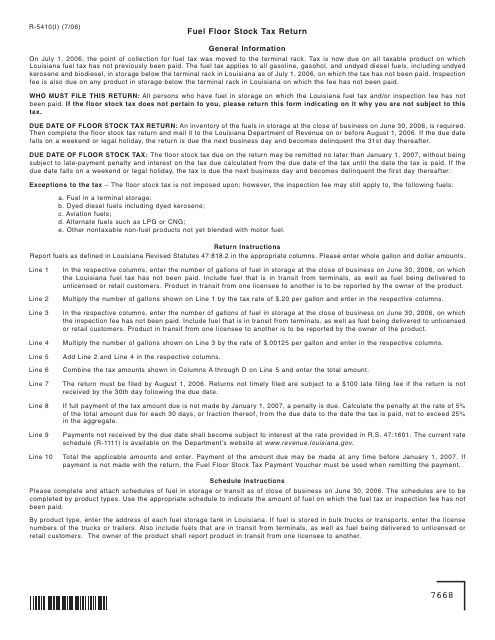

This Form is used for filing the Fuel Floor Stock Tax Return in the state of Louisiana. It provides instructions for reporting and paying taxes on fuel that is in stock for future use.

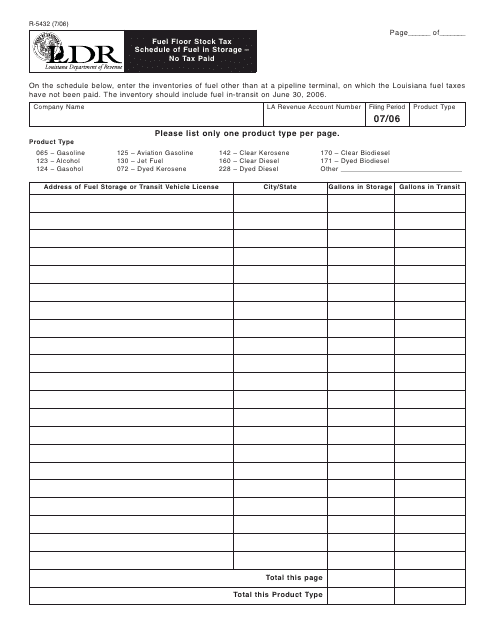

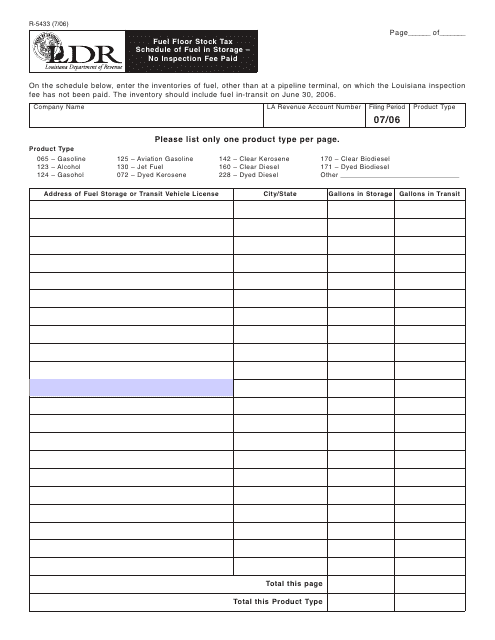

This form is used for reporting the amount of fuel in storage for which no tax has been paid in the state of Louisiana.

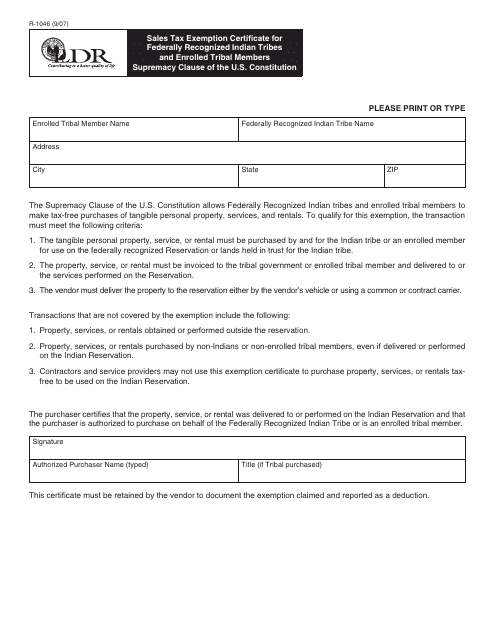

This form is used for obtaining a sales tax exemption for federally recognized Indian tribes and enrolled tribal members in Louisiana. It is based on the Supremacy Clause of the U.S. Constitution.

This form is used for reporting the amount of fuel in storage and no inspection fee has been paid for it in Louisiana.

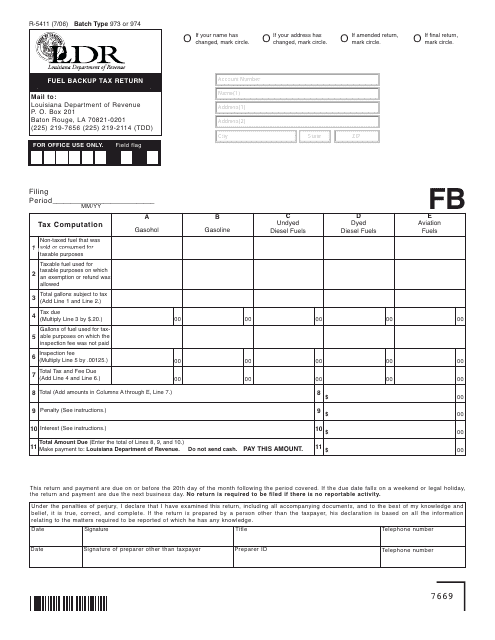

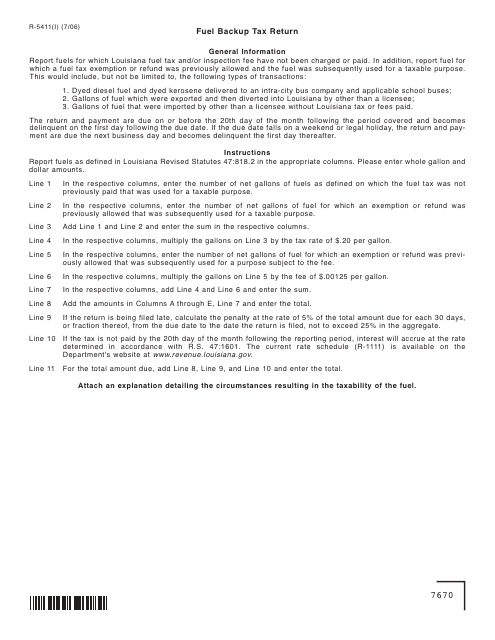

This form is used for filing the Fuel Backup Tax Return in the state of Louisiana.

This document provides instructions for filing the Form R-5411 Fuel Backup Tax Return in the state of Louisiana. It guides taxpayers on how to accurately complete the form and meet their tax obligations related to fuel backup taxes.

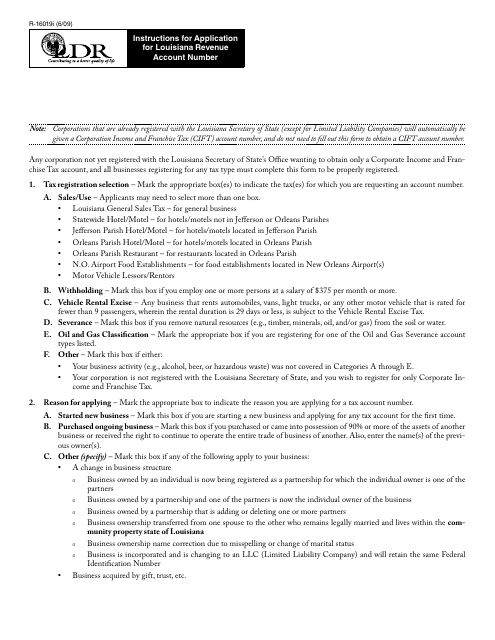

This document is used for applying for a Louisiana Revenue Account Number in Louisiana. It provides instructions on filling out Form R-16019.

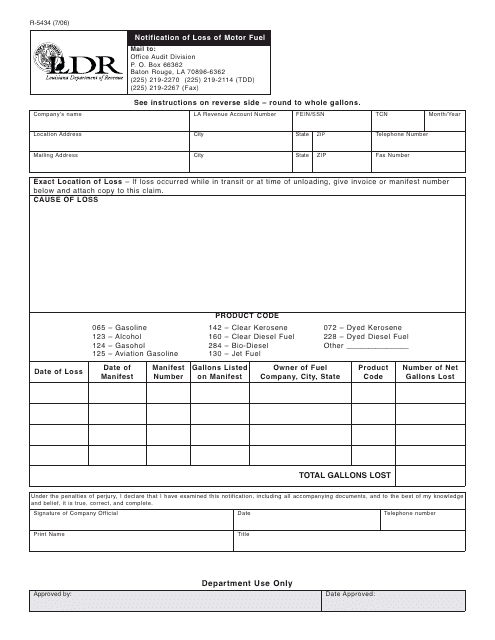

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

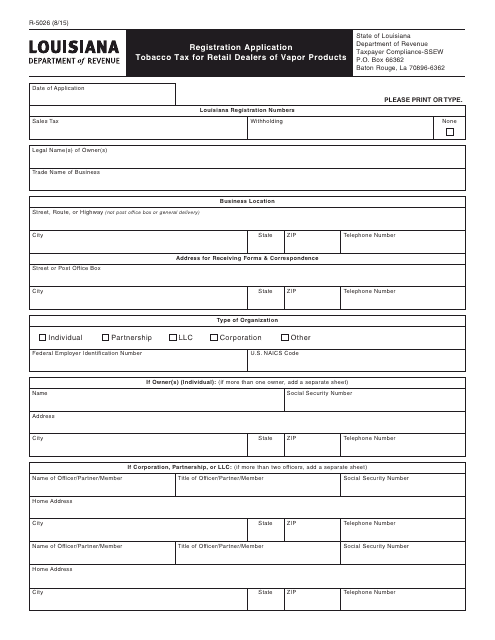

This form is used for retail dealers of vapor products in Louisiana to apply for registration and pay tobacco tax.

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

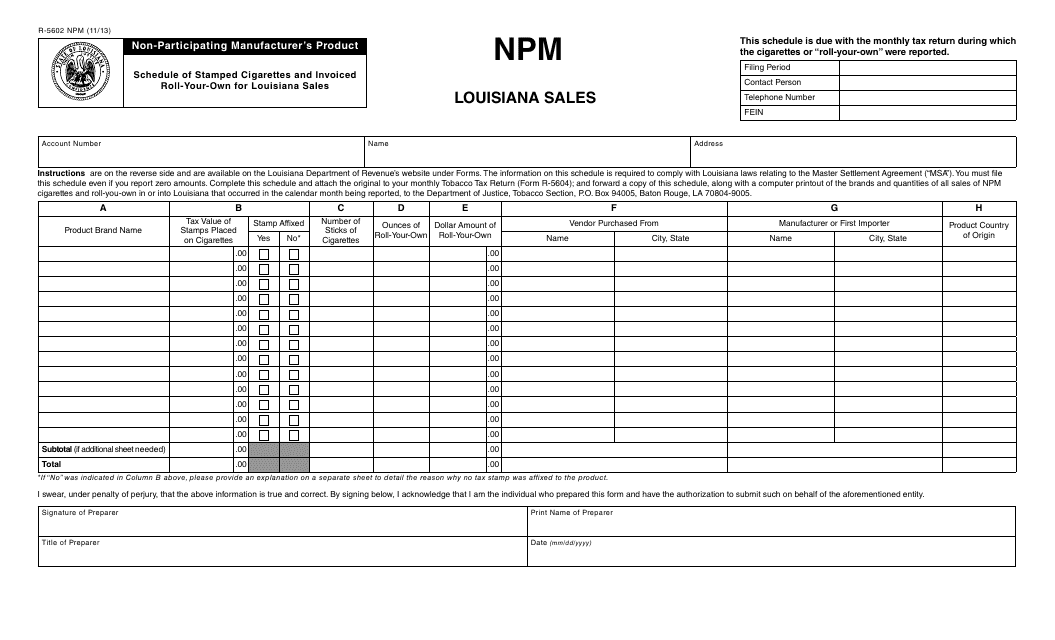

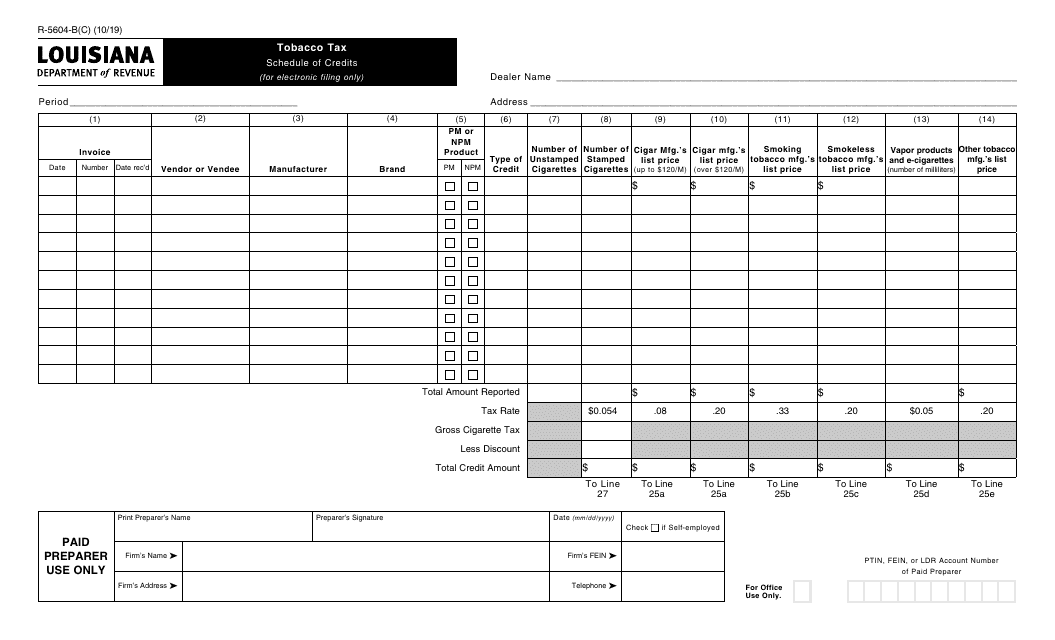

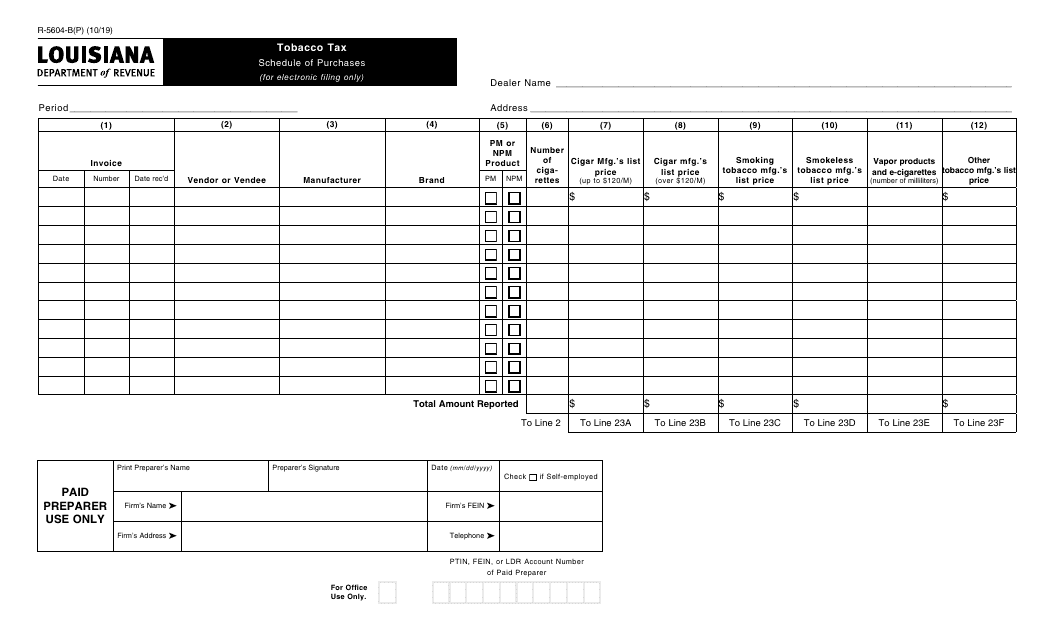

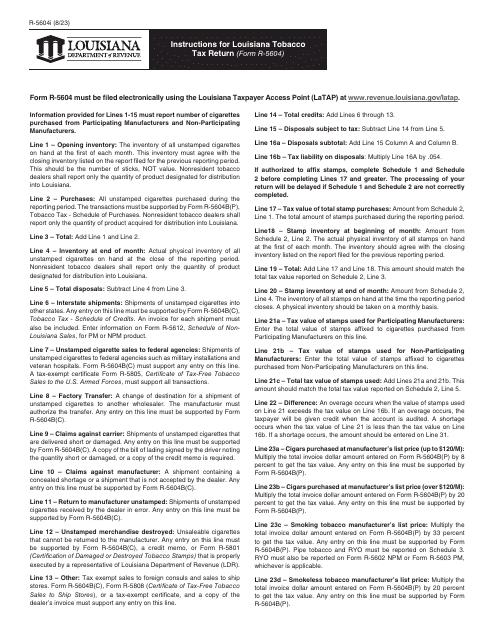

This form is used for non-participating manufacturers of cigarettes and roll-your-own tobacco products to report sales in the state of Louisiana. It includes information on stamped cigarettes and invoiced roll-your-own tobacco products.

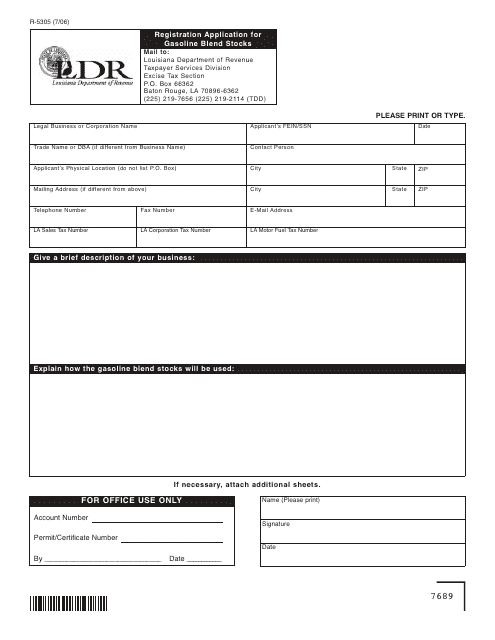

This form is used for registering gasoline blend stocks in Louisiana.

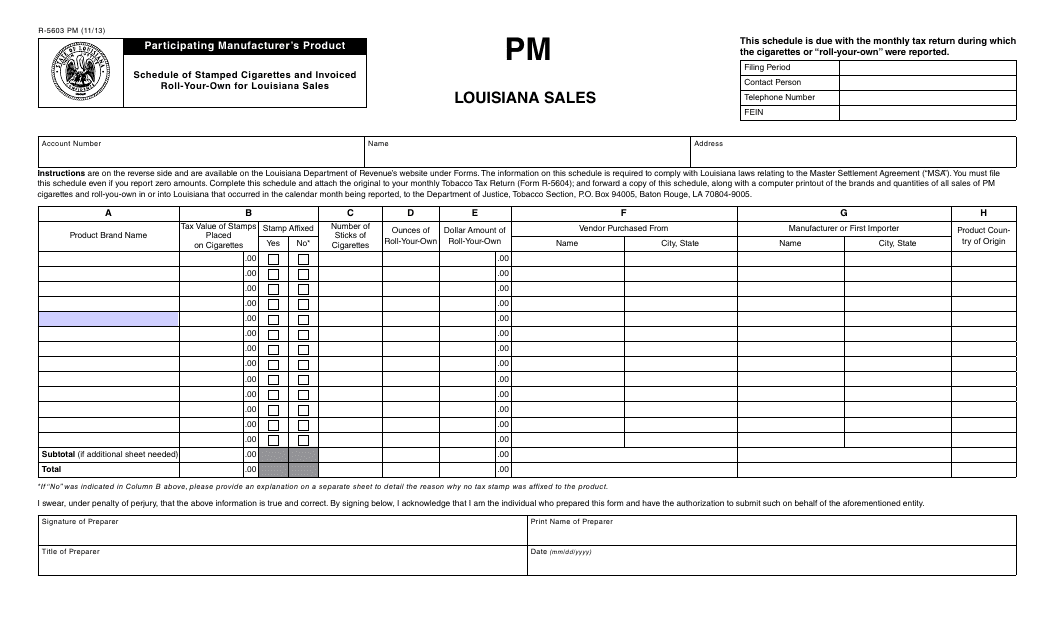

This form is used for participating cigarette manufacturers to report their sales of stamped cigarettes and roll-your-own tobacco in Louisiana.

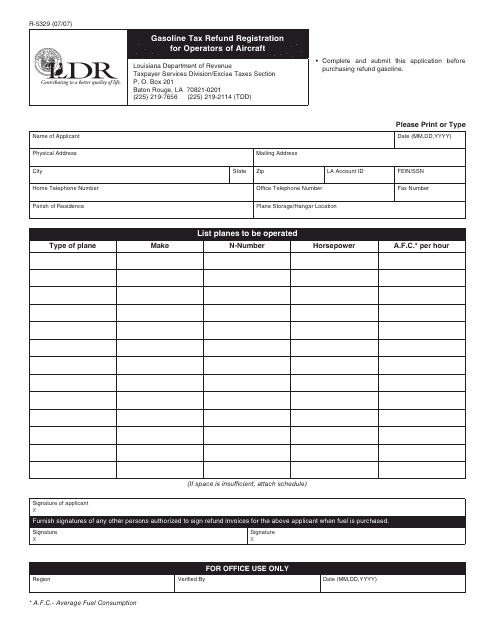

This Form is used for registering operators of aircraft in Louisiana to claim a refund of gasoline tax.

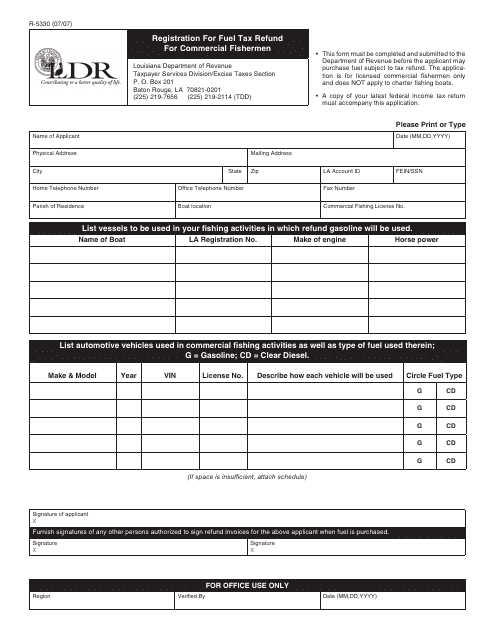

This form is used for fishermen in Louisiana to register for a fuel tax refund for their commercial fishing activities.

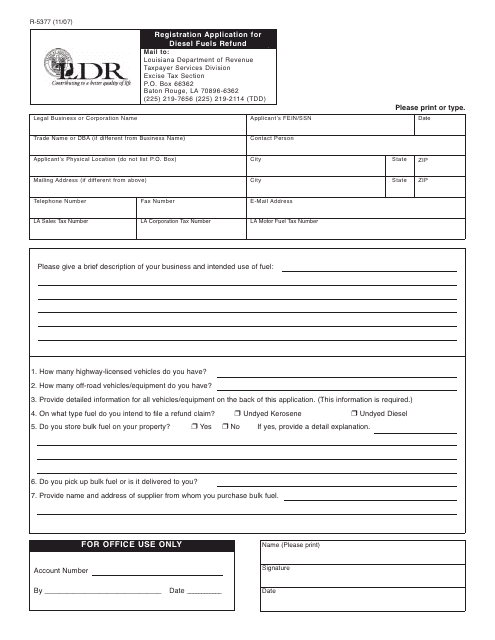

This form is used for applying for a refund on diesel fuels in the state of Louisiana.

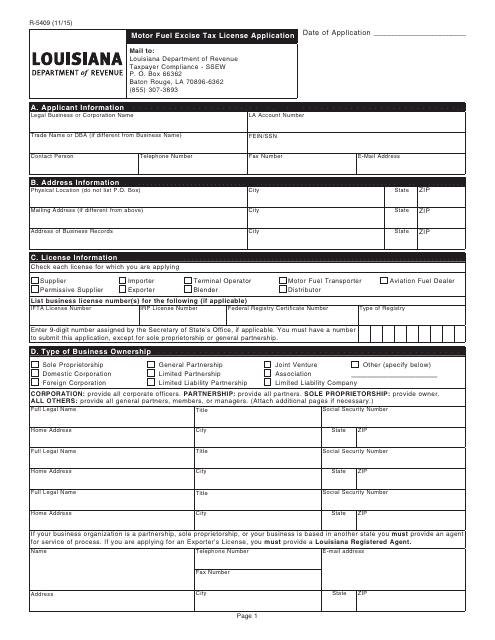

This Form is used for applying for a motor fuel excise tax license in the state of Louisiana.

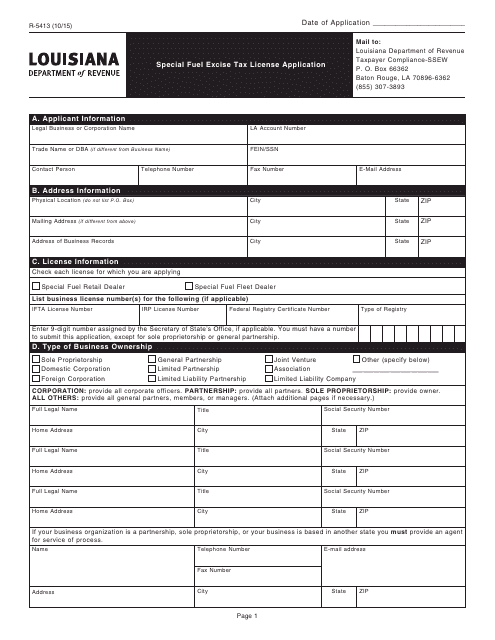

This form is used for applying for a special fuel excise tax license in the state of Louisiana.

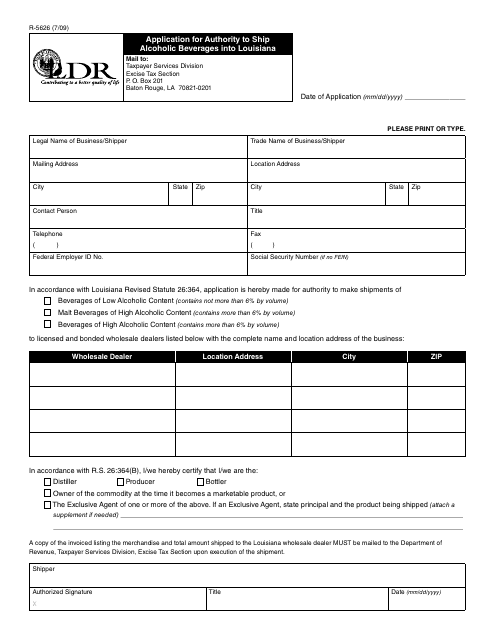

This form is used for applying for the authority to ship alcoholic beverages into Louisiana.

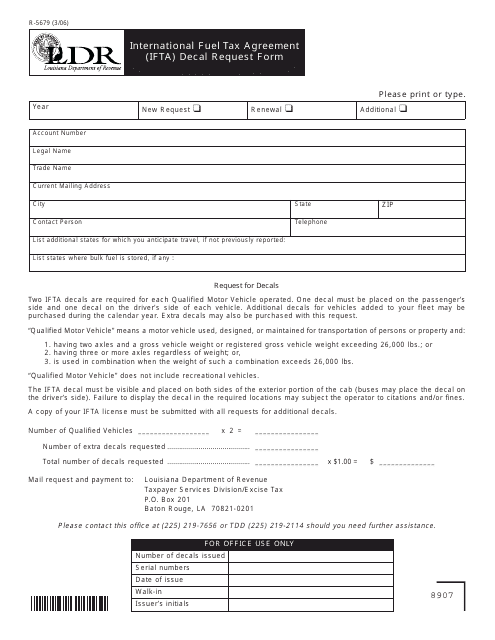

This form is used for requesting International Fuel Tax Agreement (IFTA) decals in Louisiana. It is required for commercial vehicles that operate across state lines and need to report and pay fuel taxes.

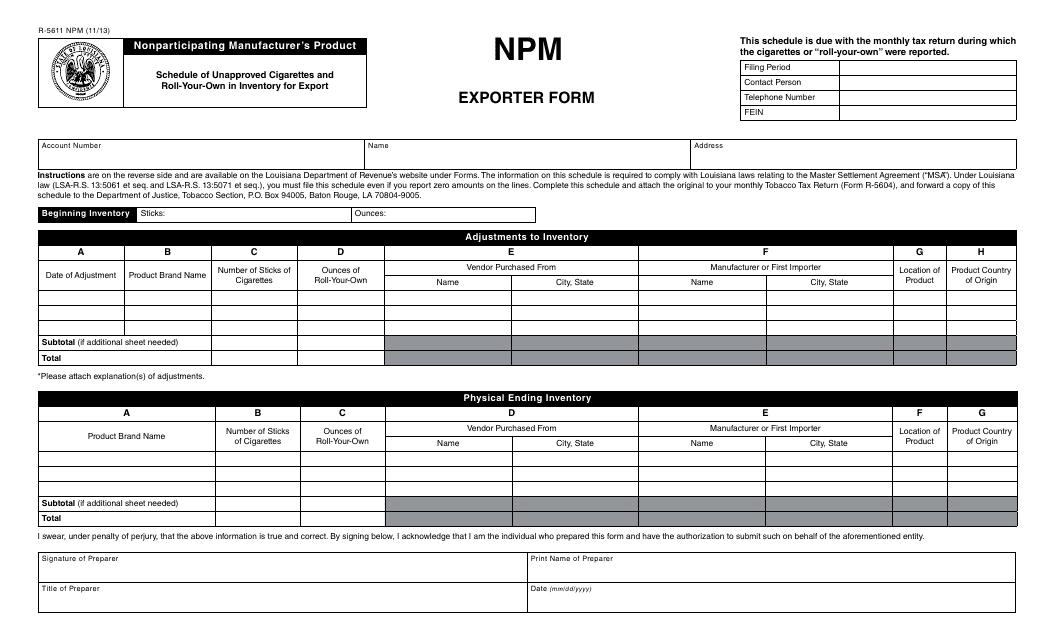

This form is used for Nonparticipating Manufacturer's (NPM) in Louisiana to submit a schedule of unapproved cigarettes and roll-your-own tobacco that are in inventory for export.

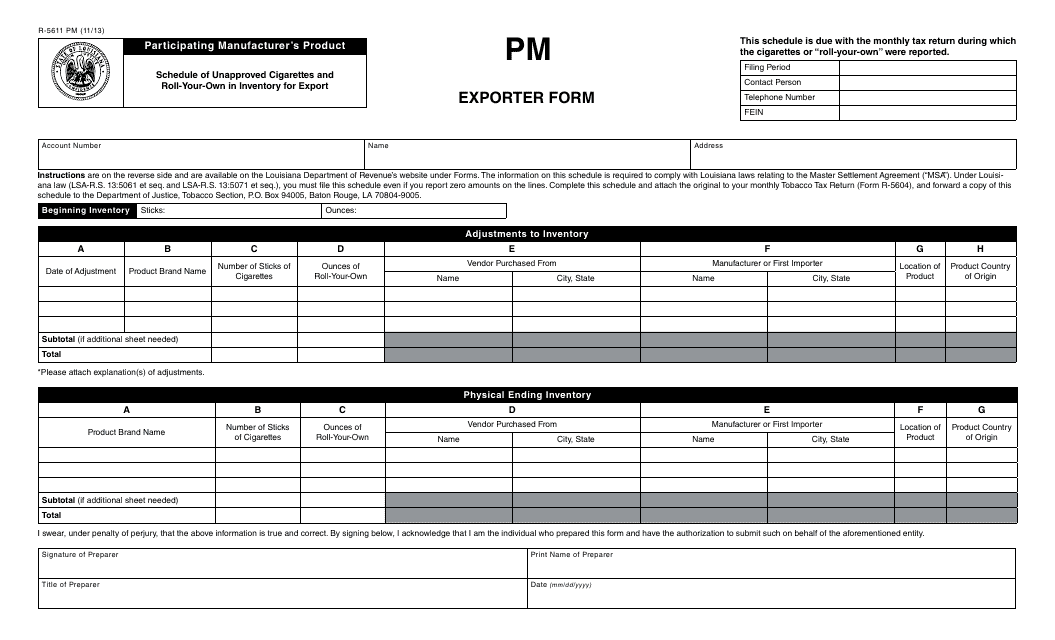

This form is used for participating manufacturers in Louisiana to list and report any unapproved cigarettes and roll-your-own products that are in their inventory for export.