Tax Templates

Documents:

2882

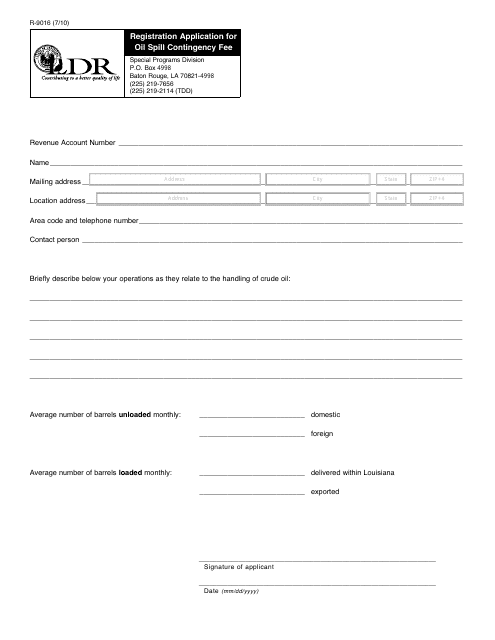

This form is used for registering and applying for an oil spill contingency fee in the state of Louisiana.

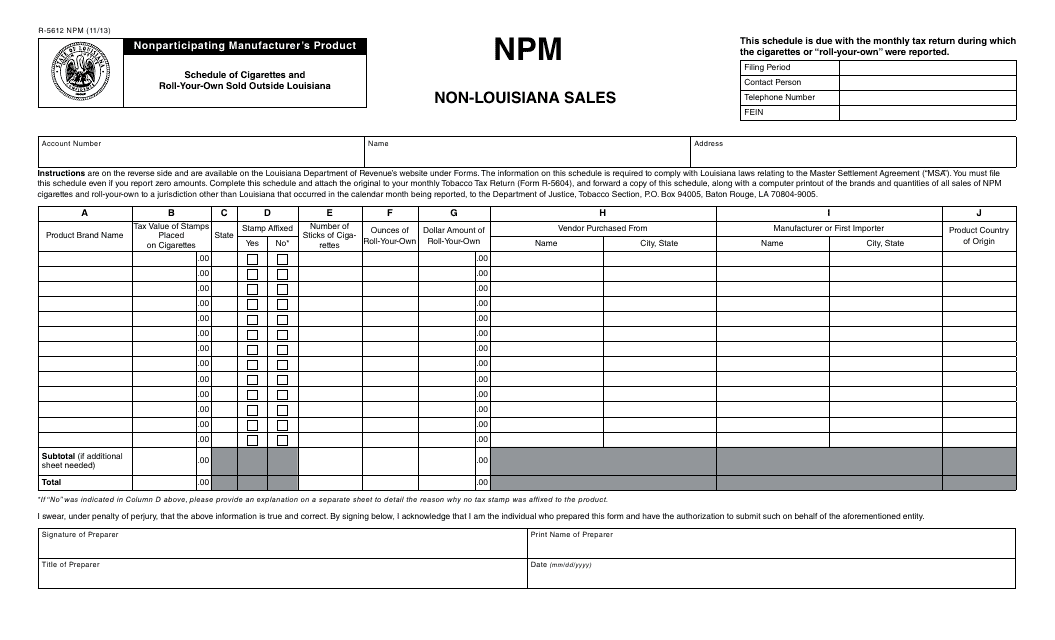

This form is used for Nonparticipating Manufacturer's to report the sale of cigarettes and roll-your-own tobacco products outside of Louisiana. It specifically focuses on sales made in areas outside of Louisiana.

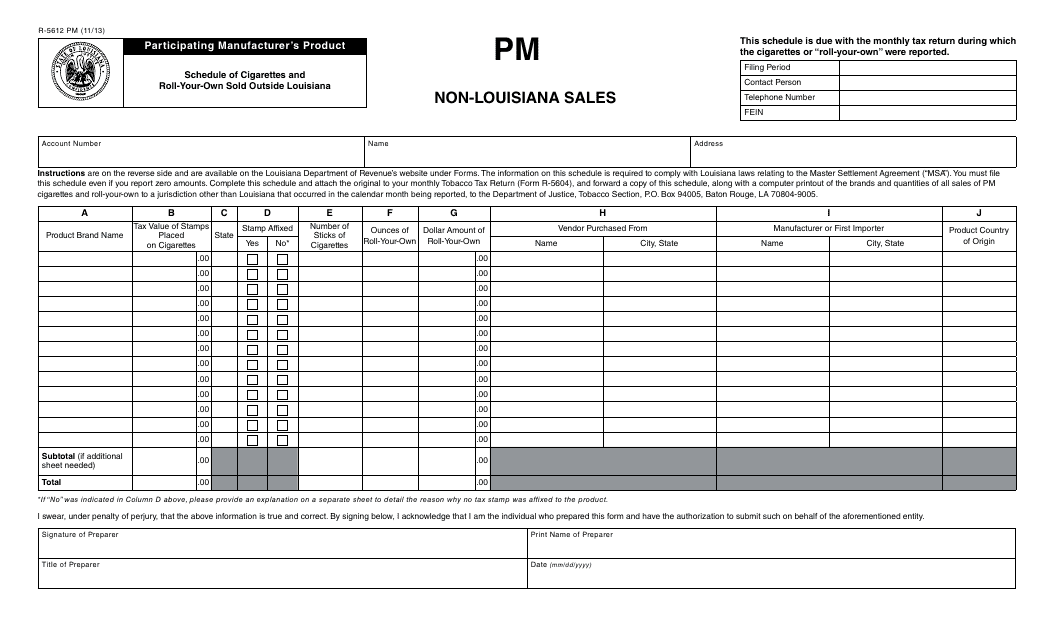

This form is used for participating manufacturers to report the sales of cigarettes and roll-your-own tobacco products that are sold outside of Louisiana. It is specifically for non-Louisiana sales.

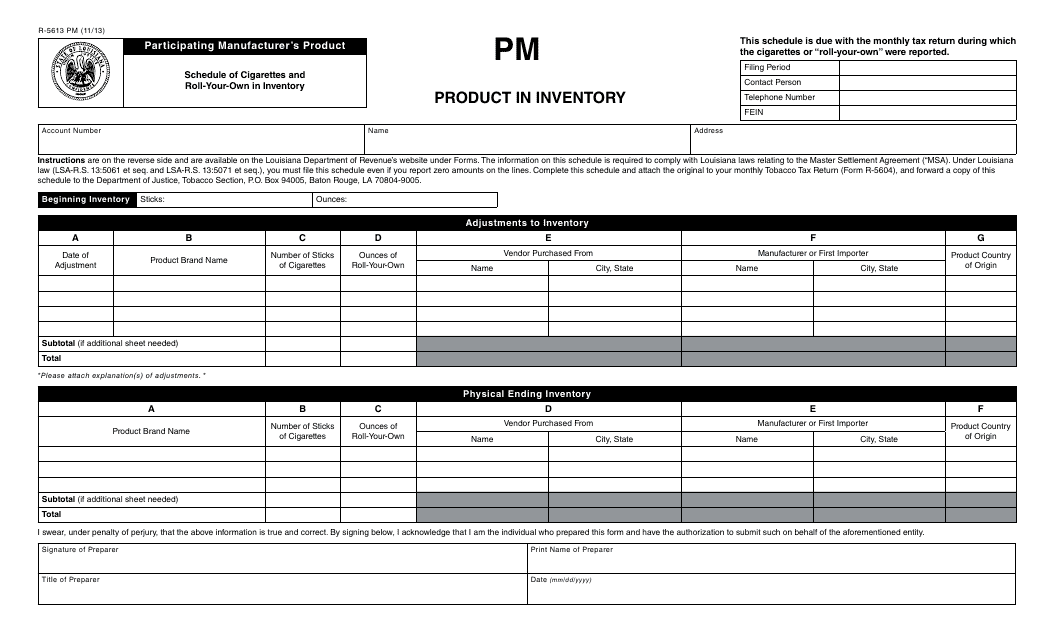

This Form is used for Participating Manufacturers in Louisiana to report their inventory of cigarettes and roll-your-own products. It is required for compliance with state tobacco regulations.

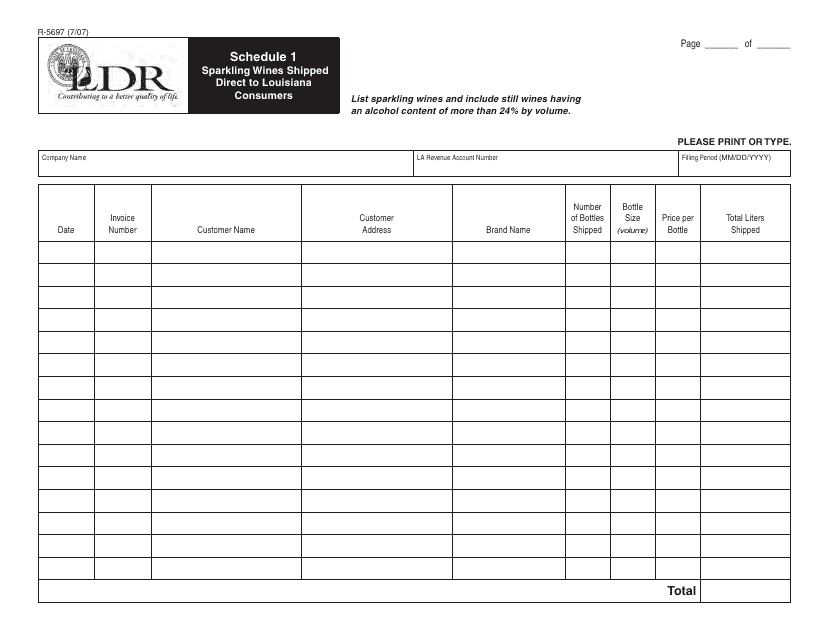

This Form is used for reporting and remitting taxes on sparkling wines shipped directly to Louisiana consumers. It applies to businesses and individuals who sell or ship sparkling wines to Louisiana residents.

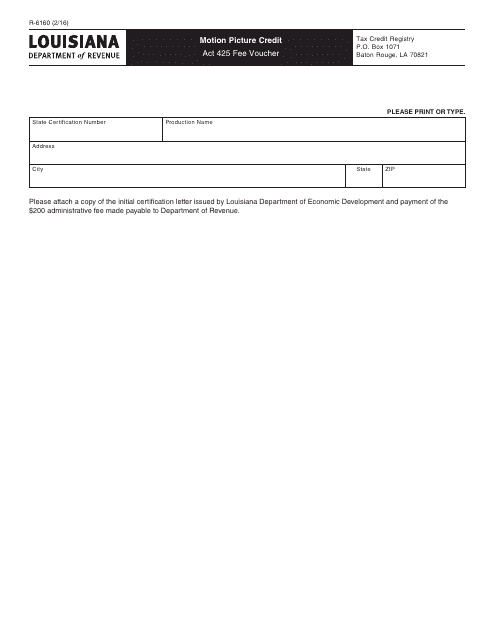

This form is used for submitting the fee voucher for the motion picture tax credit under Act 425 in the state of Louisiana.

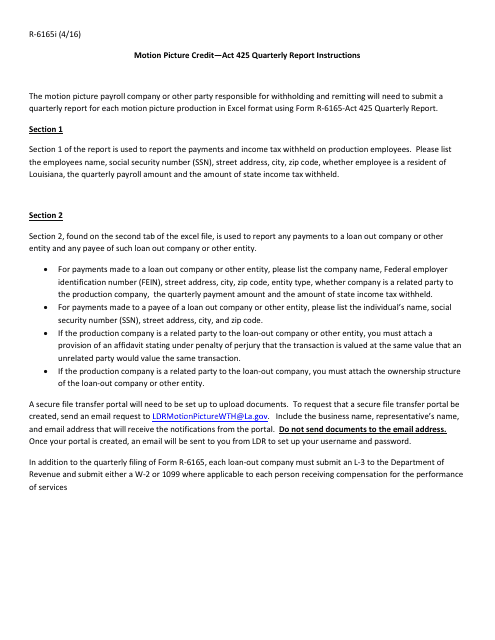

This Form is used for filing a quarterly report relating to the Louisiana Motion Picture Tax Credit.

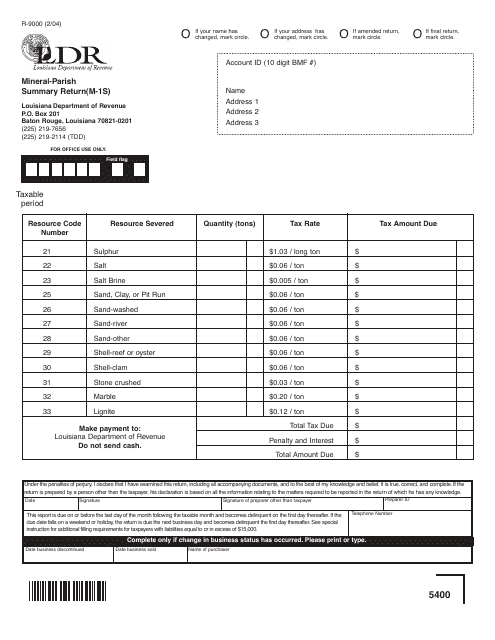

This form is used for submitting a mineral-parish summary return in Louisiana.

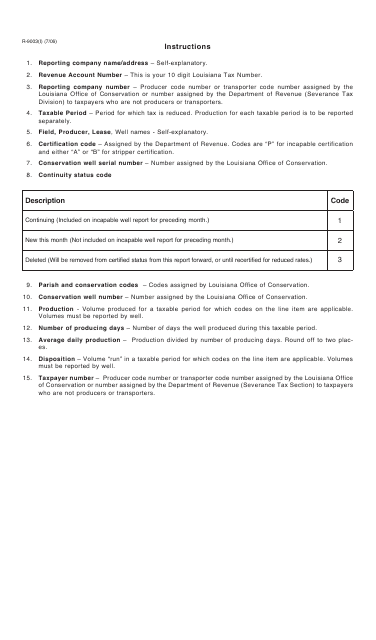

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

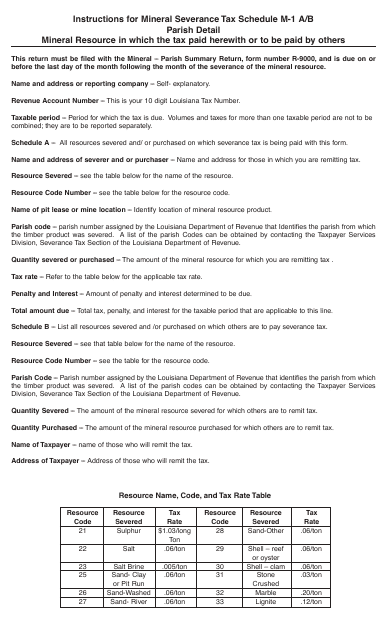

This document provides instructions for completing Schedule M-1 A/B, which is used for reporting mineral severance tax in the state of Louisiana.

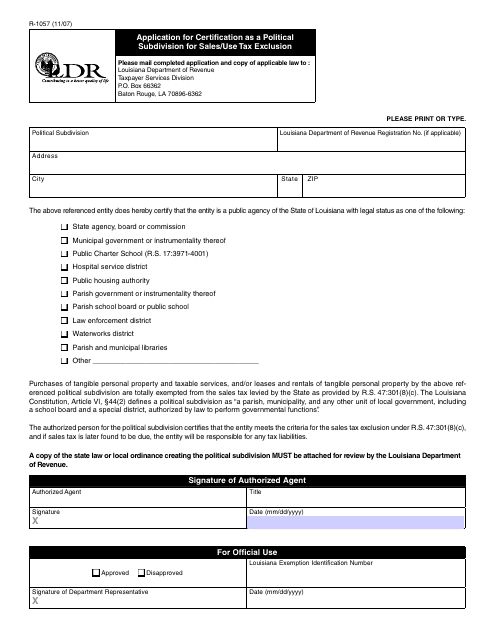

This form is used for applying to certify a political subdivision for sales/use tax exclusion in Louisiana.

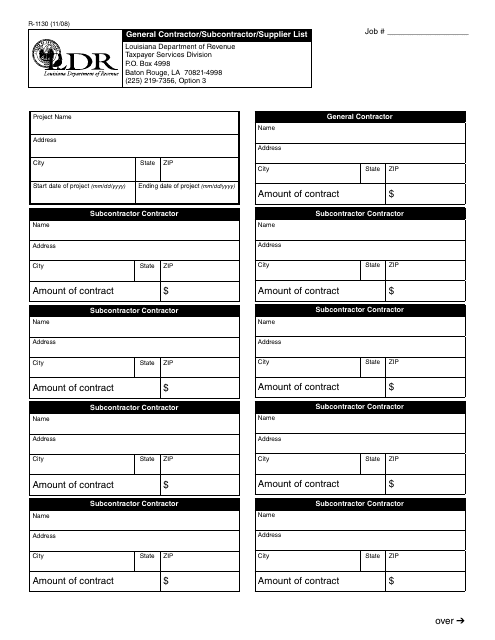

This form is used for providing a list of general contractors, subcontractors, and suppliers in Louisiana.

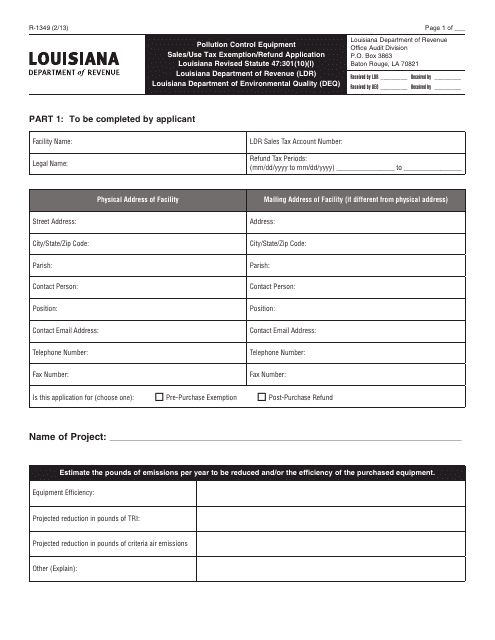

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

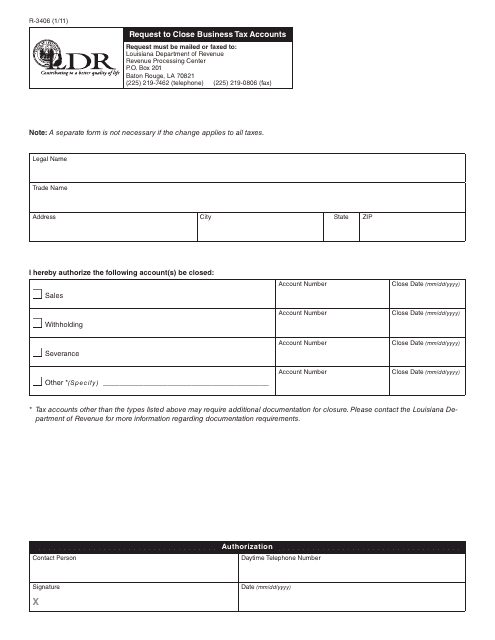

This form is used for requesting the closure of business tax accounts in the state of Louisiana.

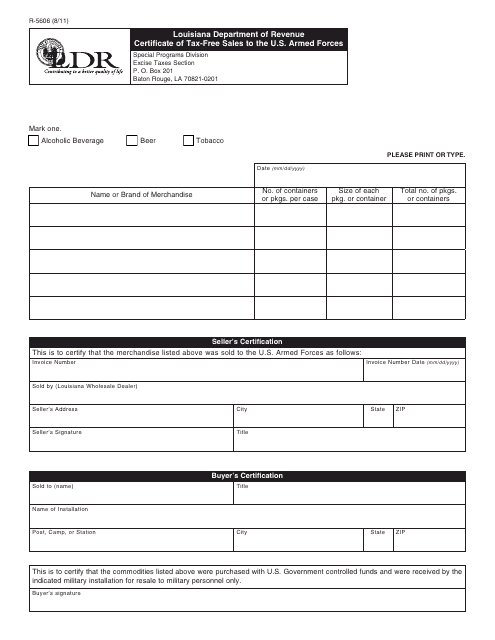

This form is used for certifying tax-free sales made to the U.S. Armed Forces in Louisiana.

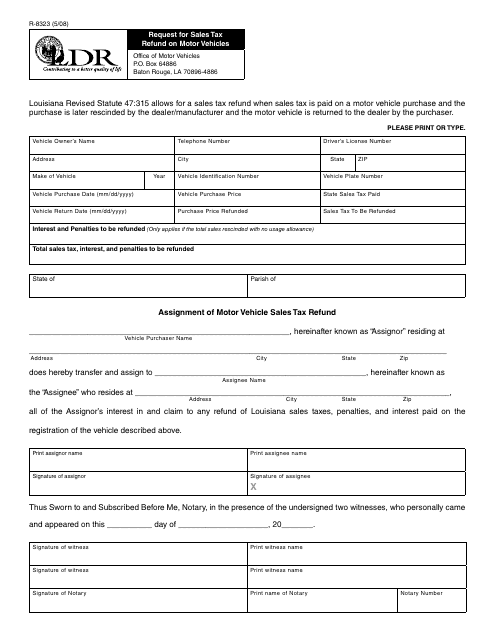

This form is used for requesting a sales tax refund on motor vehicles in the state of Louisiana.

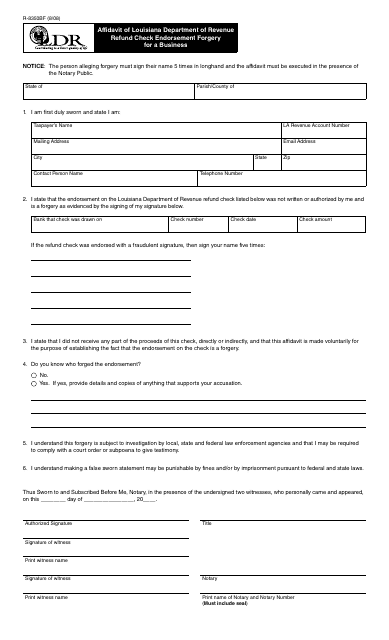

This form is used for reporting and addressing incidents of check forgery involving business refund checks issued by the Louisiana Department of Revenue.

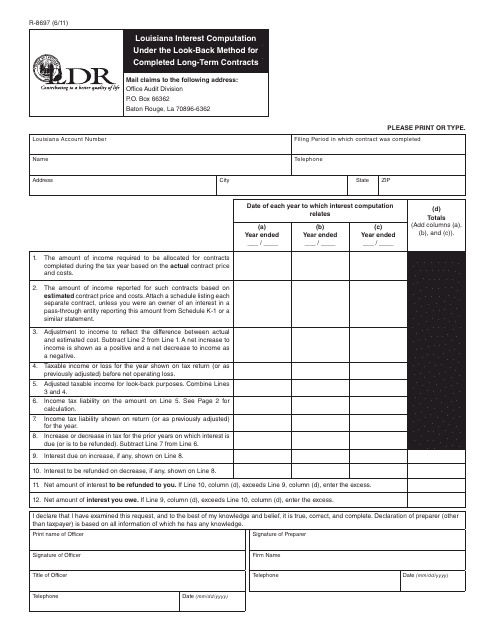

This form is used for calculating interest under the look-back method for completed long-term contracts in the state of Louisiana.

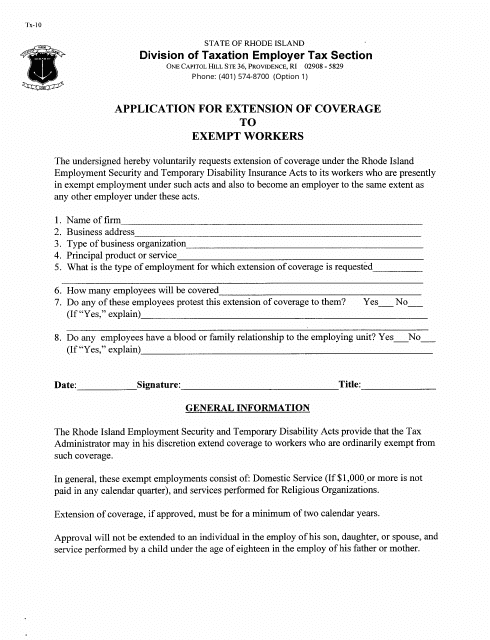

This Form is used for religious organizations in Rhode Island to apply for an extension of coverage to exempt workers.

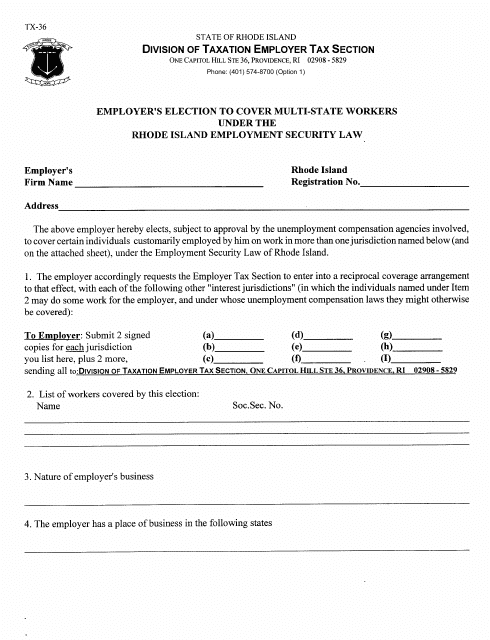

This document is for employers who have workers in multiple states and want to elect coverage for their workers in Rhode Island.

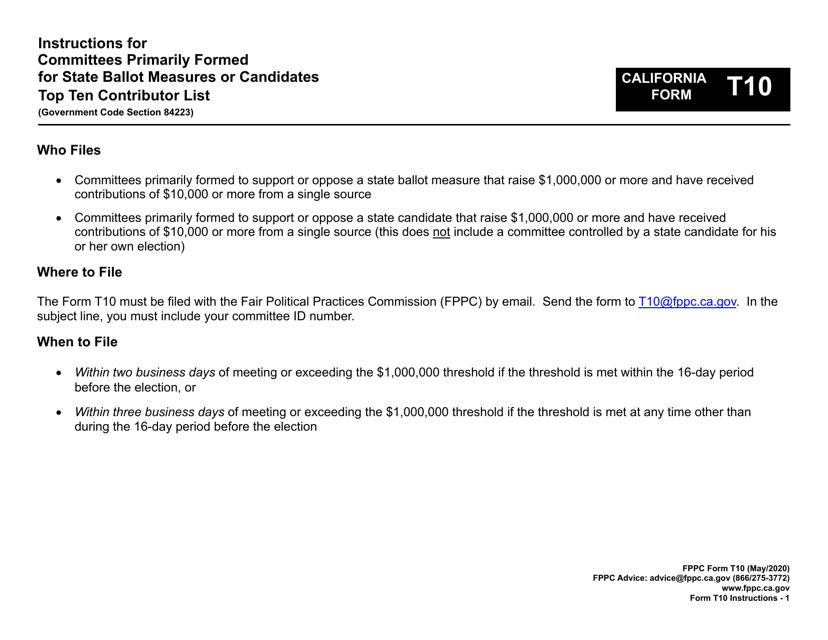

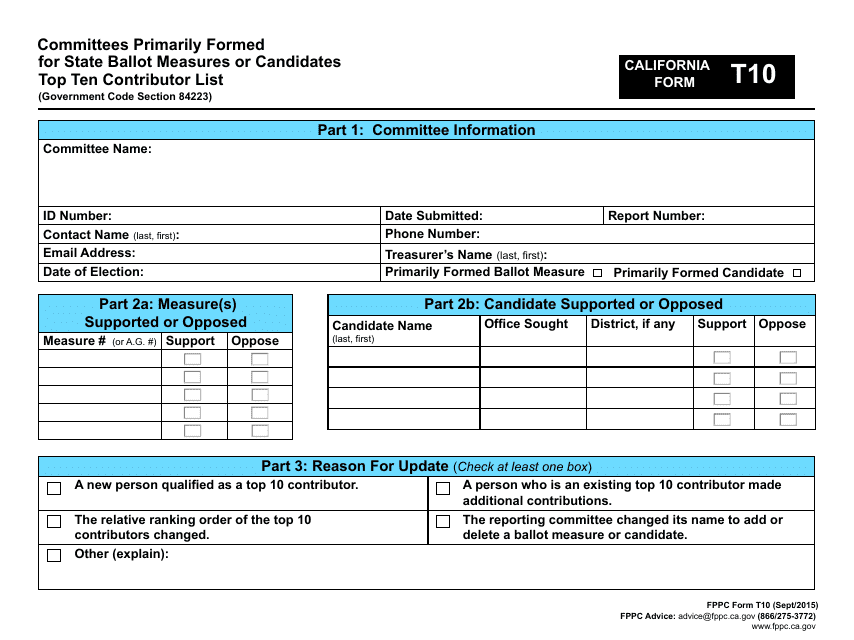

This document is used for disclosing the top ten contributors to committees primarily formed for state ballot measures or candidates in California. It provides transparency in campaign financing.

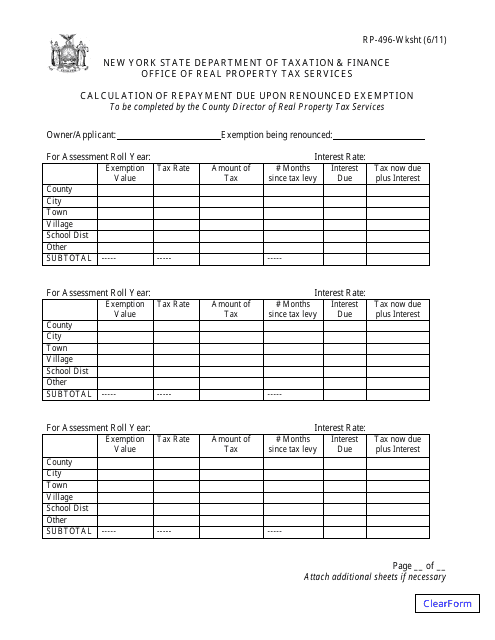

This form is used for calculating the repayment amount due upon renounced exemption in the state of New York.

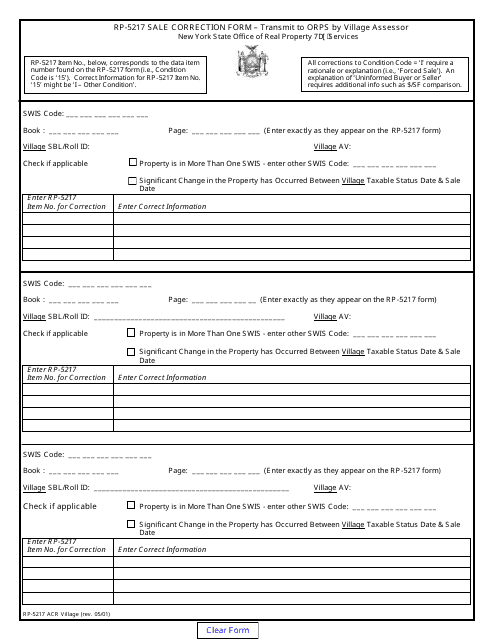

This form is used for correcting the sales information for a property in a village in New York.

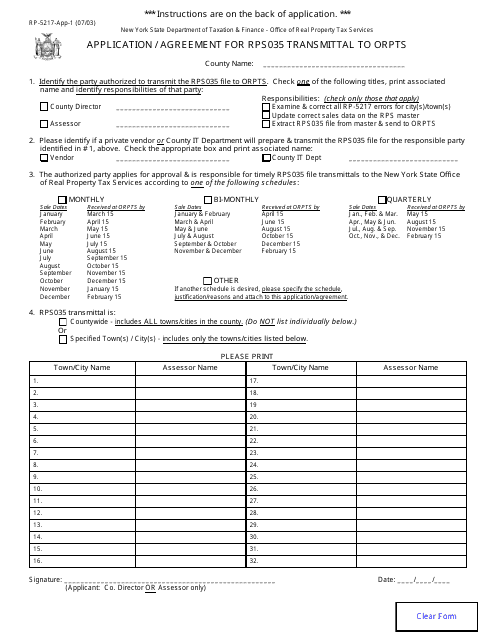

This form is used for submitting an application and agreement for the transmittal of RP-5217-APP-1 to the Office of Real Property Tax Services (ORPTS) in New York.

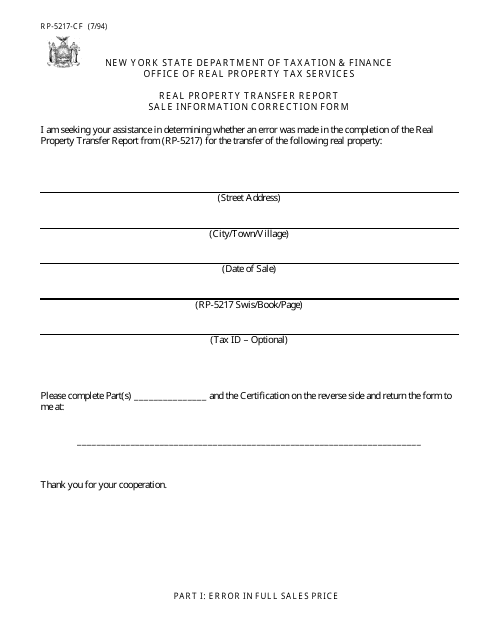

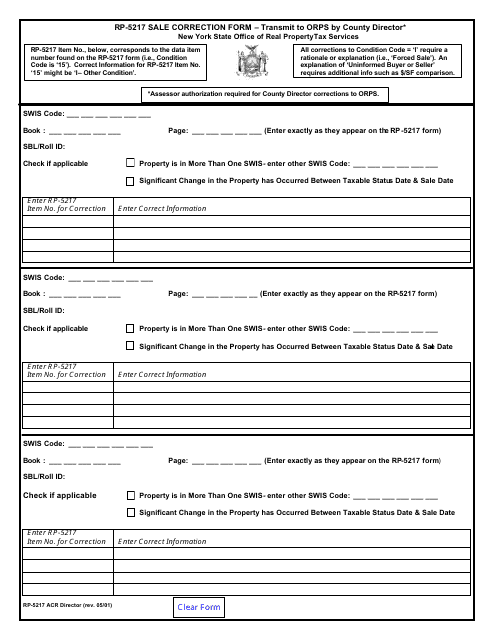

This form is used for correcting sale information on a real property transfer report in New York.

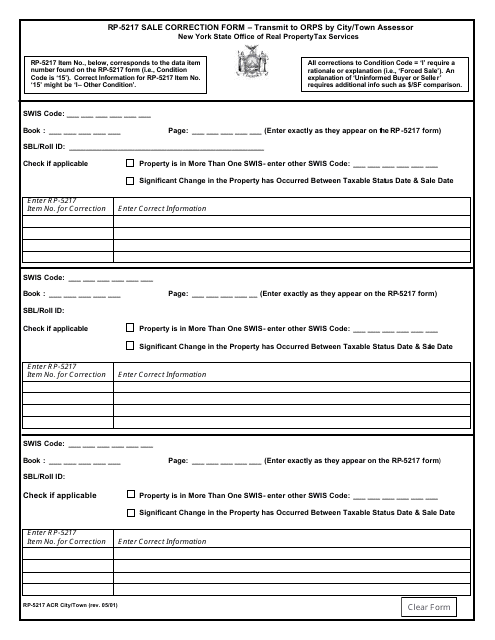

This Form is used for correcting the sale information for a property in a specific city or town in New York.

This form is used for correcting sales information on a property in New York.

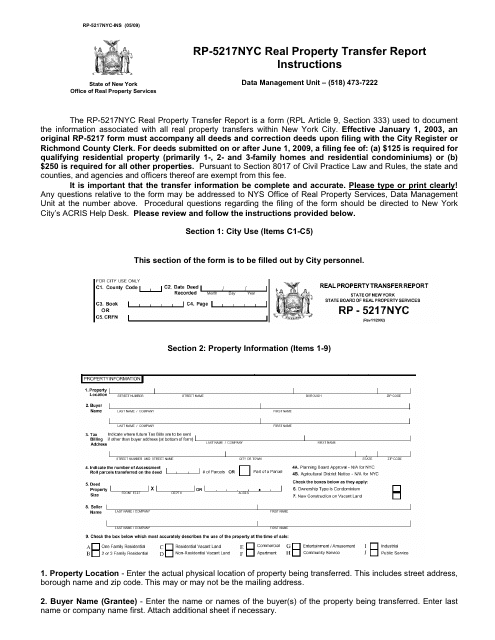

This form is used for reporting the transfer of real property in New York City. It provides instructions on how to properly complete the RP-5217NYC form.

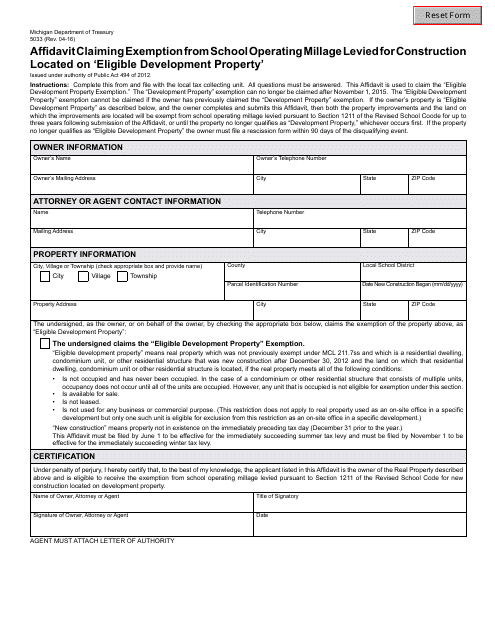

This form is used for claiming an exemption from school operating millage for constructions located on eligible development property in Michigan.