Tax Templates

Documents:

2882

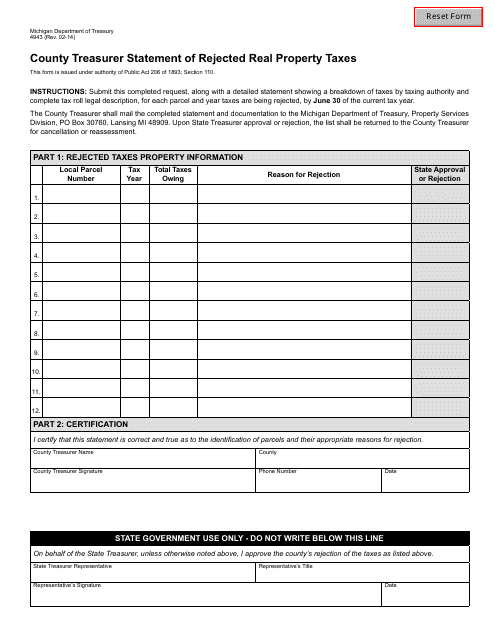

This Form is used for reporting rejected real property taxes to the County Treasurer in Michigan.

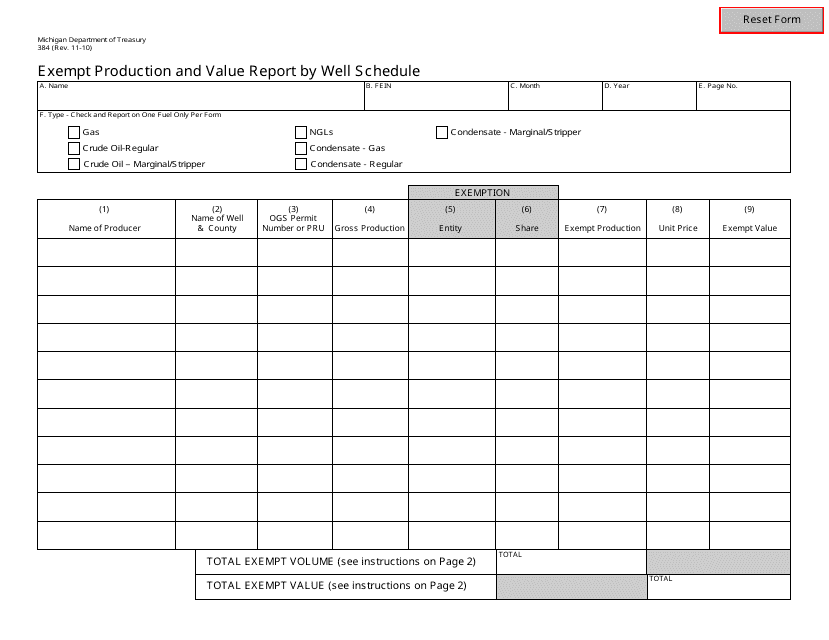

This form is used for reporting exempt production and value of oil and gas wells in Michigan.

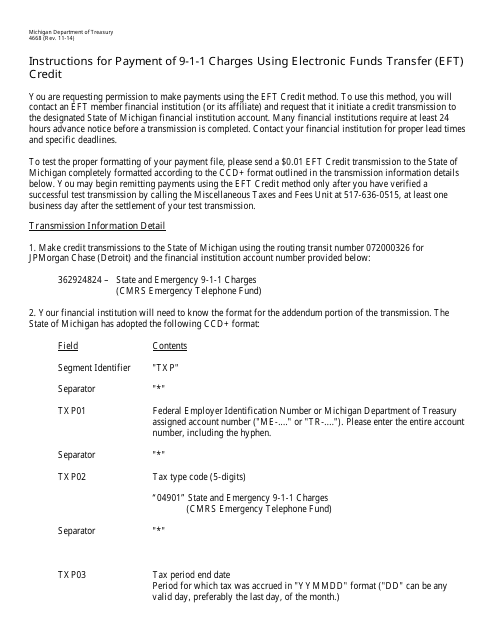

This Form is used for making electronic payments for 9-1-1 charges in Michigan.

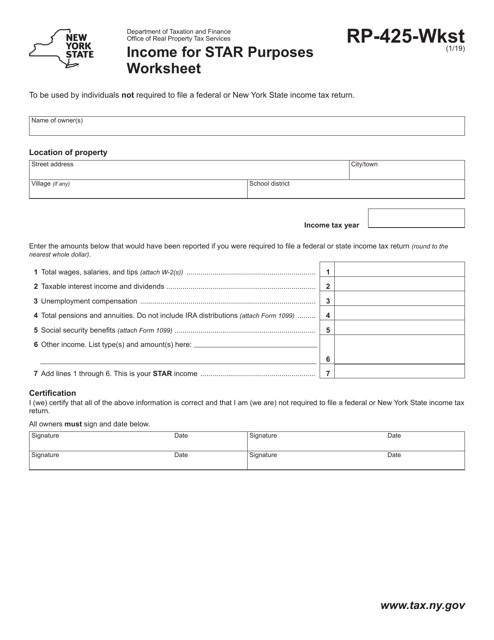

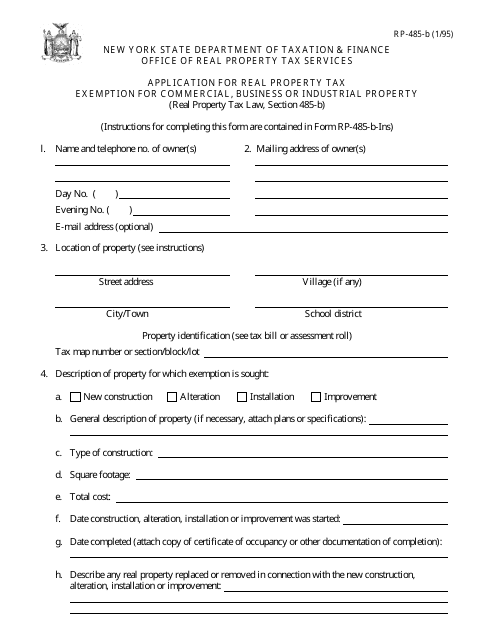

This form is used for applying for a real property tax exemption for commercial, business or industrial property in the state of New York. It allows property owners to potentially receive a tax exemption for their eligible properties.

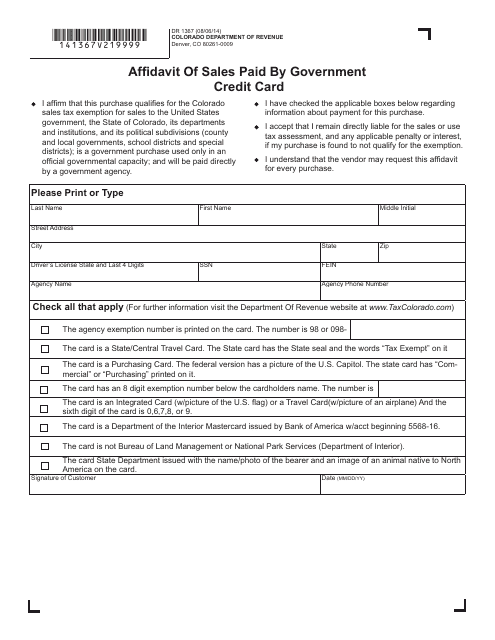

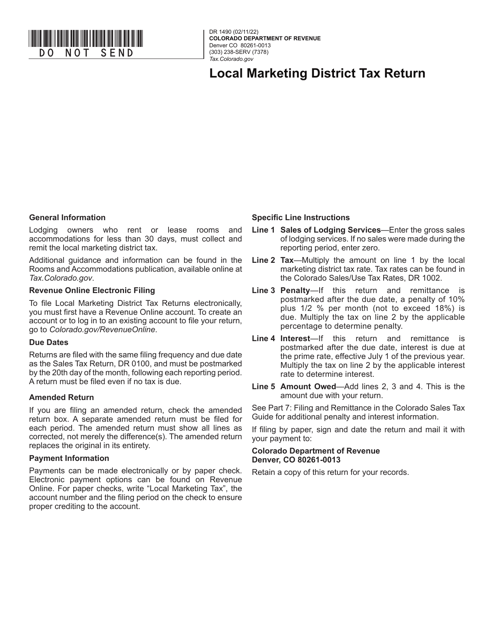

This form is used for reporting sales paid by a government credit card in the state of Colorado.

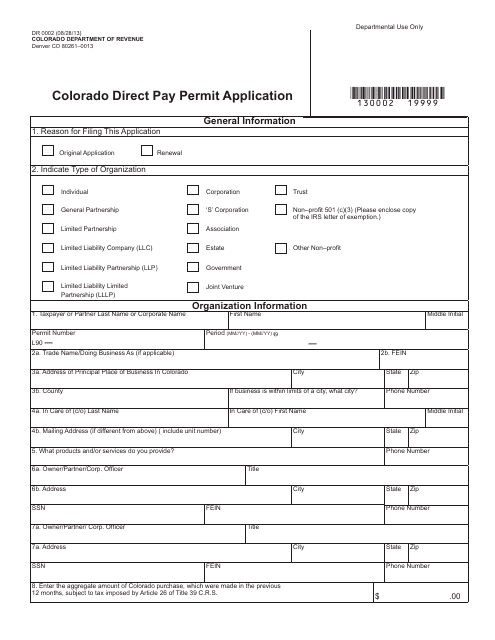

This form is used for applying for a direct pay permit in the state of Colorado.

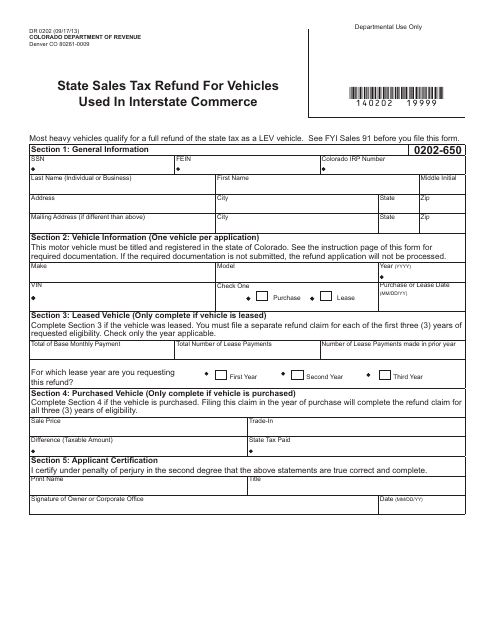

This form is used for claiming a refund of state sales tax paid on vehicles used for interstate commerce in the state of Colorado.

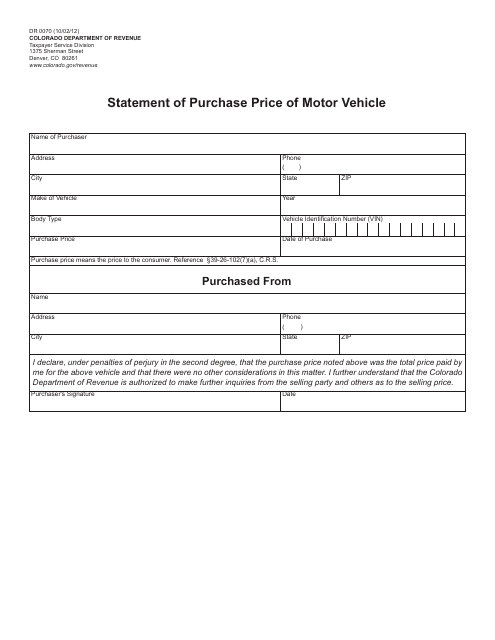

This form is used for recording the purchase price of a motor vehicle in the state of Colorado.

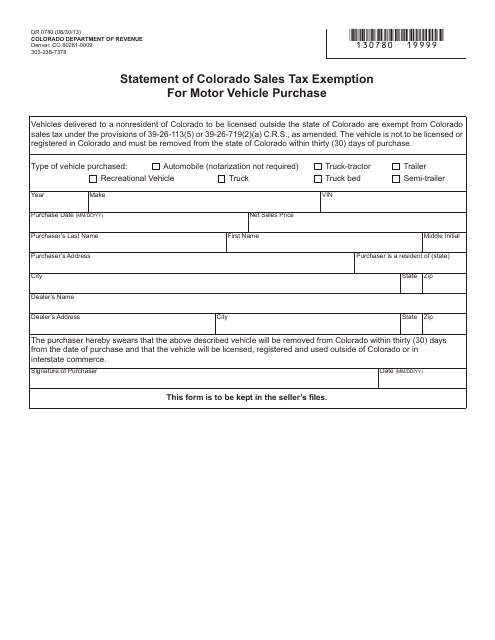

This form is used to declare an exemption from sales tax when purchasing a motor vehicle in Colorado.

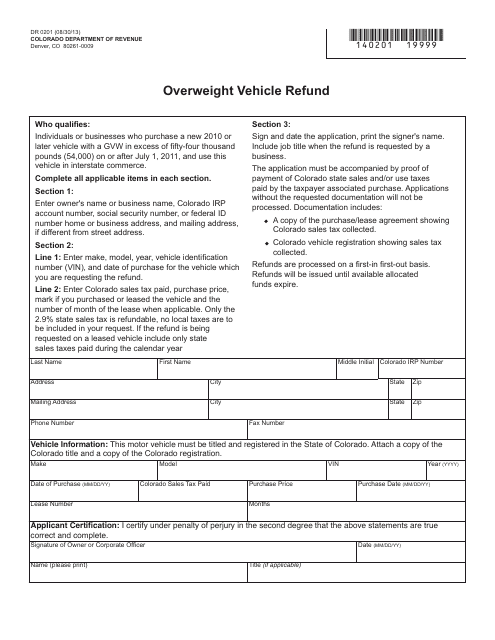

This Form is used for requesting a refund on vehicle registration fees for overweight vehicles in Colorado.

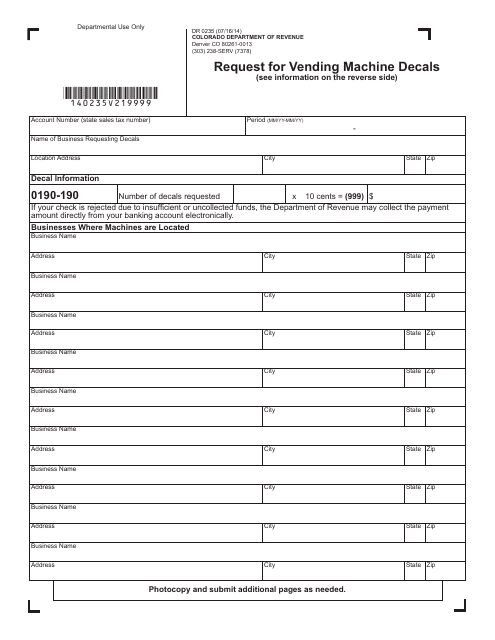

This form is used for requesting vending machine decals in the state of Colorado.

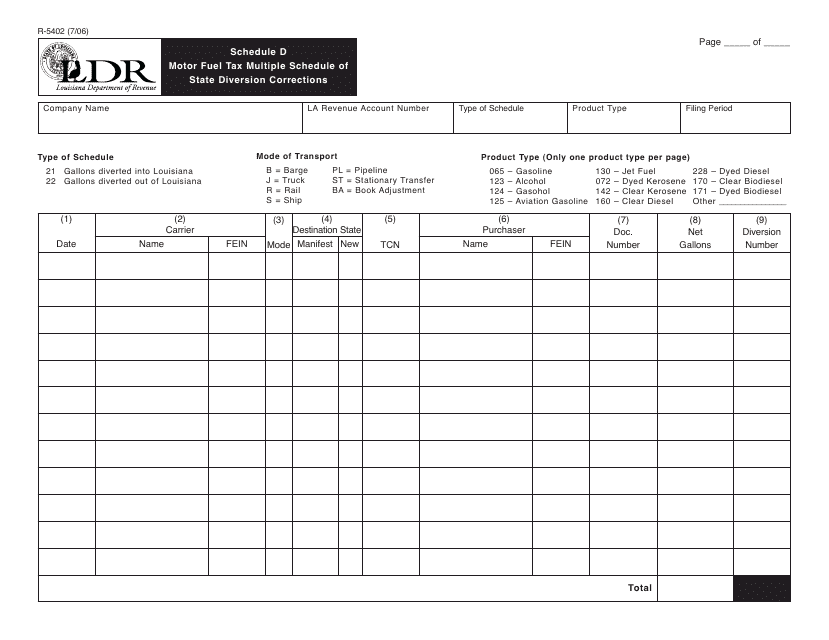

This form is used for reporting and correcting any errors or discrepancies in the motor fuel tax diversion amounts for multiple locations within the state of Louisiana.

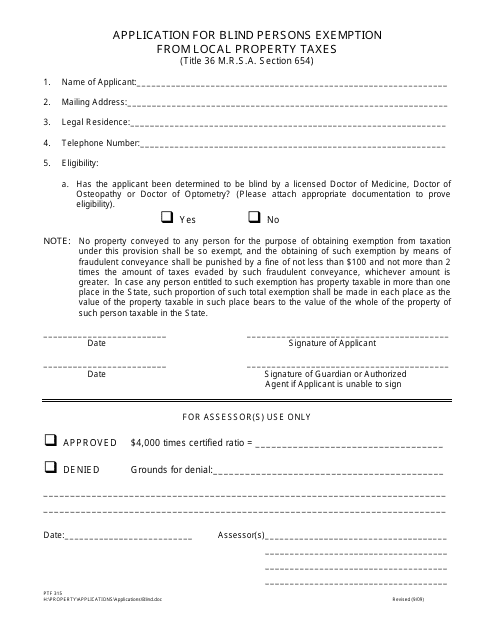

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

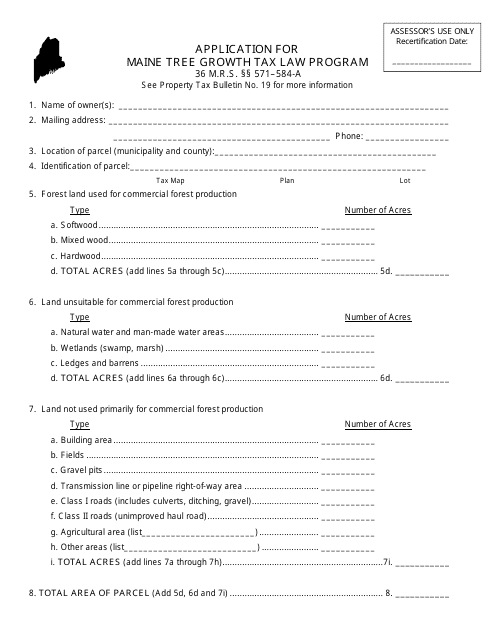

This document is an application form for the Maine Tree Growth Tax Law Program, a program in the state of Maine that provides tax incentives for landowners who actively manage their forest lands for timber production.

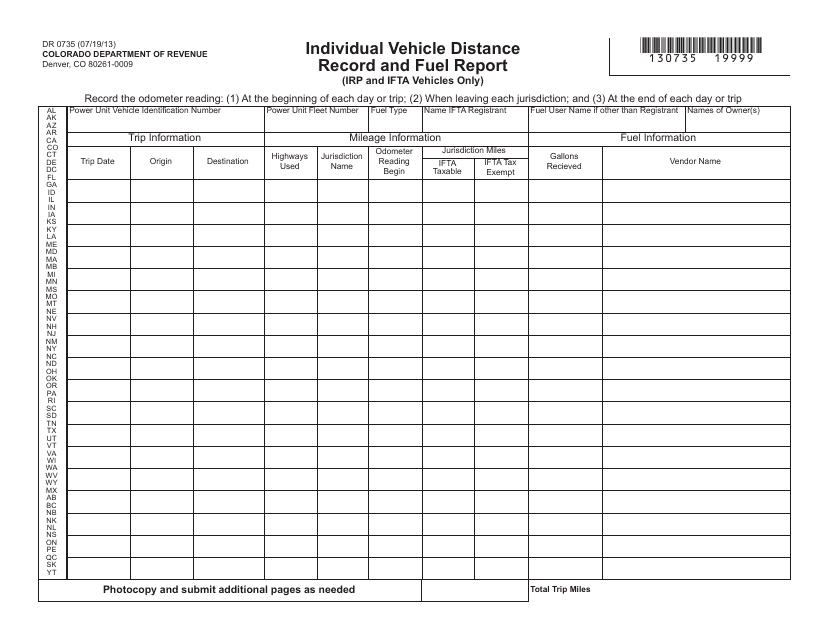

This form is used for recording the distance traveled and fuel consumption of an individual vehicle in Colorado. It is used to track and report fuel usage for various purposes.

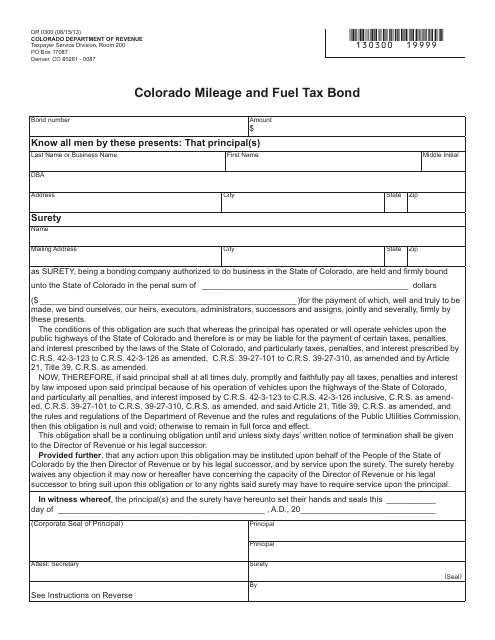

This form is used for obtaining a Mileage and Fuel Tax Bond in the state of Colorado.

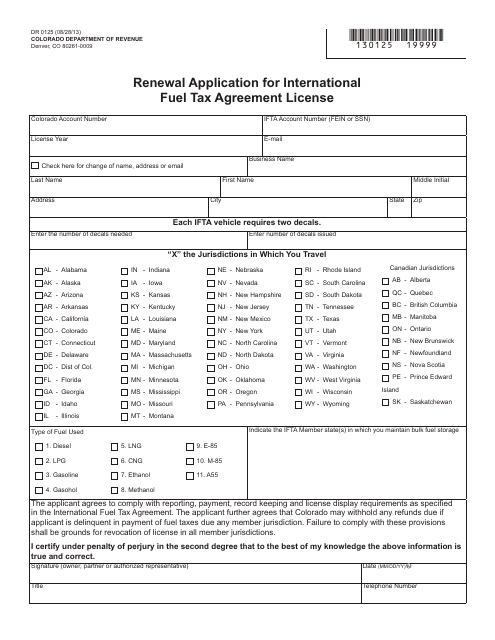

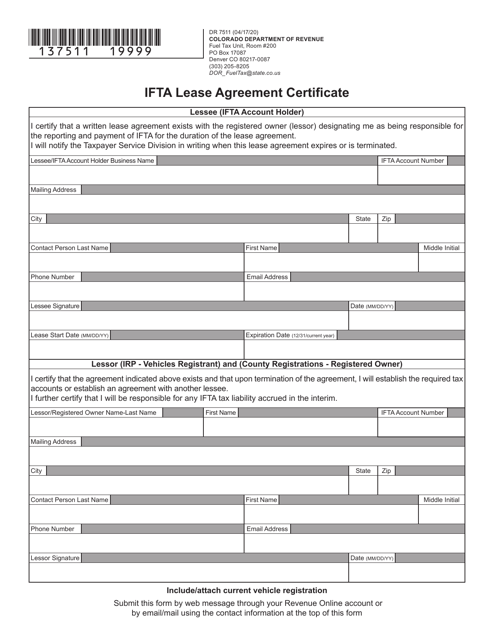

This Form is used for renewing an International Fuel Tax Agreement (IFTA) License in Colorado.

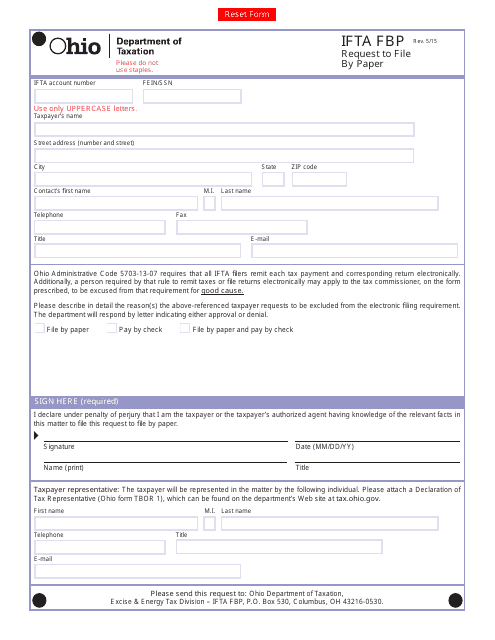

This form is used for requesting to file the International Fuel Tax Agreement (IFTA) Fuel Use Tax return by paper in the state of Ohio.

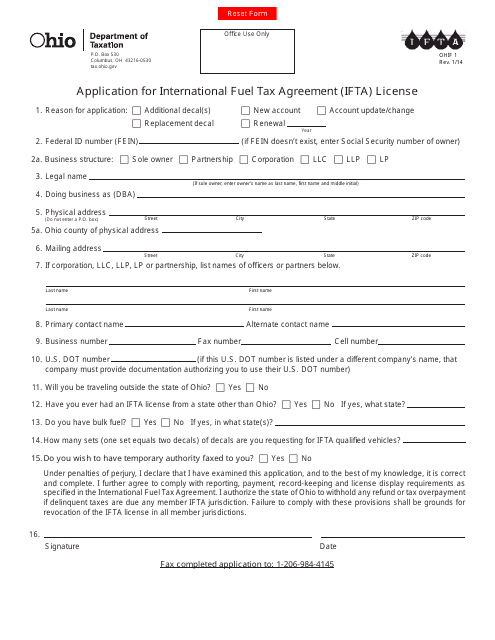

This Form is used for applying for an International Fuel Tax Agreement (IFTA) license in Ohio.

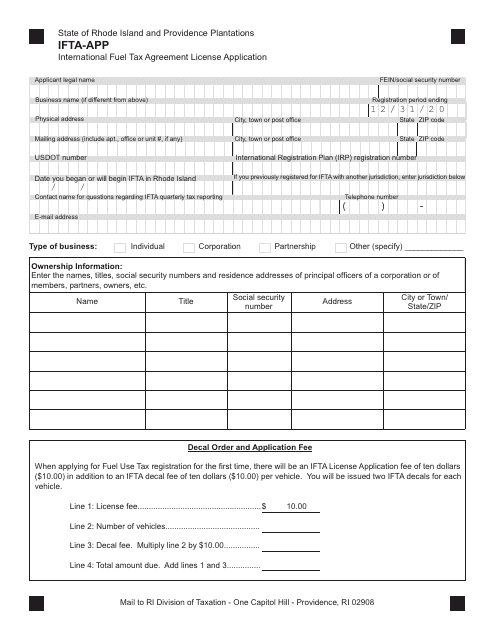

This document is an application form for obtaining an International Fuel Tax Agreement (IFTA) license in Rhode Island. It is used by individuals or businesses engaged in interstate commercial transportation to report and pay fuel taxes.

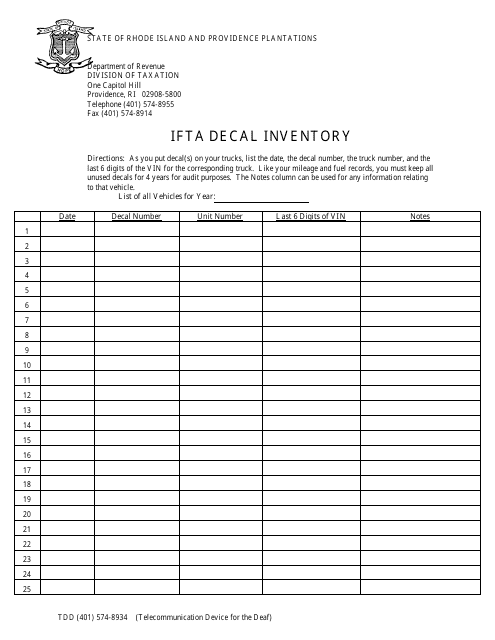

This form is used to track the inventory of IFTA decals in Rhode Island. It helps to ensure that the correct number of decals are available for distribution to qualifying vehicles.

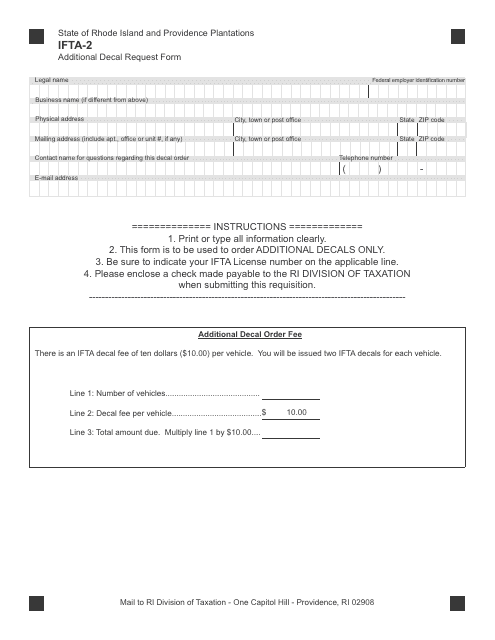

This Form is used for requesting additional decals under the International Fuel Tax Agreement (IFTA) in Rhode Island.

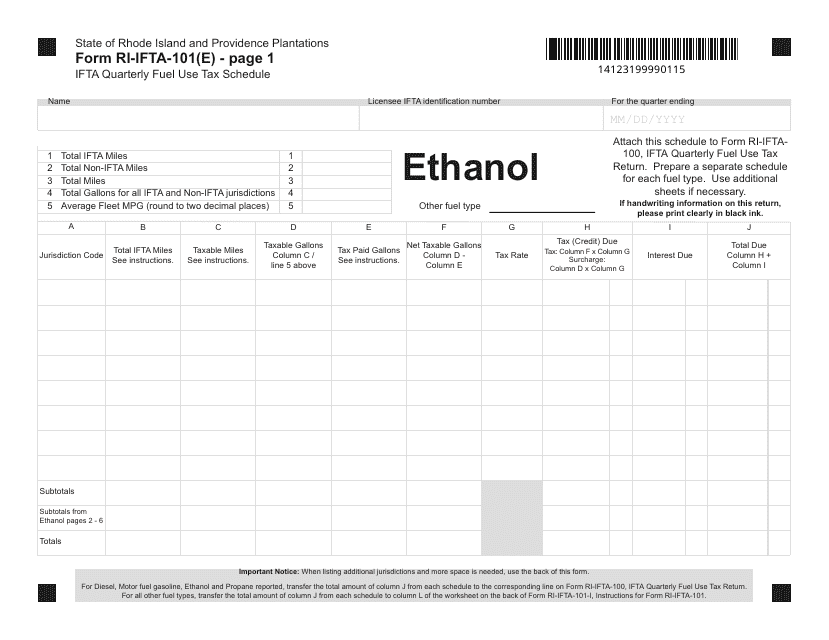

This Form is used for reporting quarterly fuel use tax for ethanol in Rhode Island.

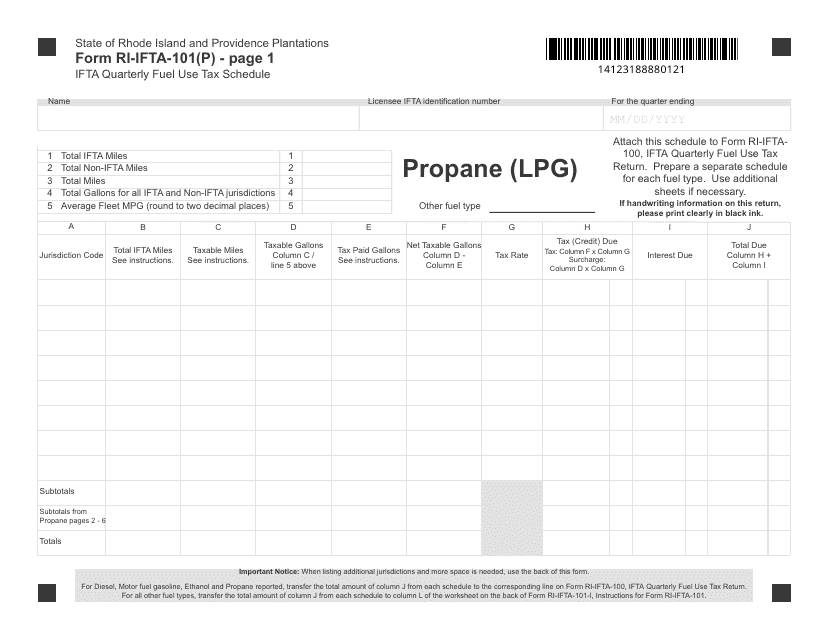

This form is used for reporting the quarterly fuel use tax for propane (LPG) in Rhode Island.

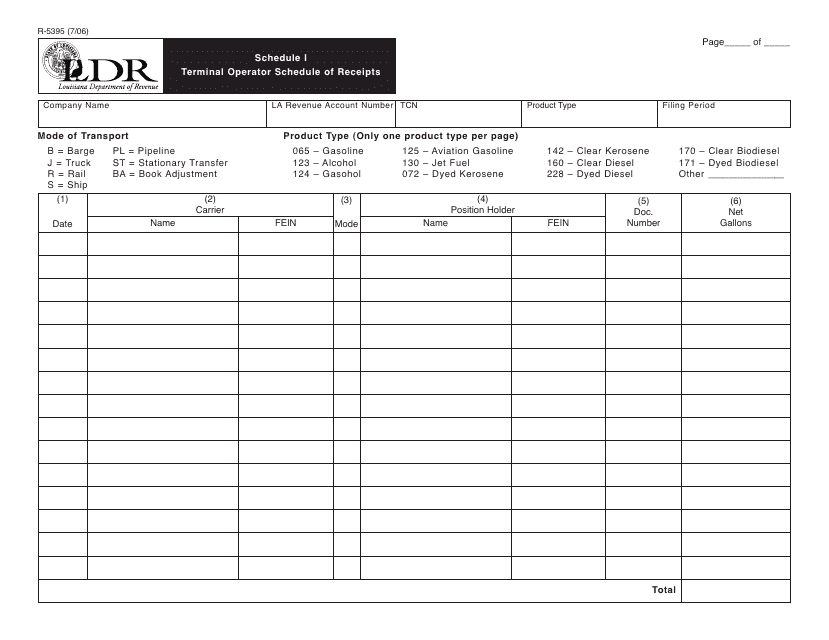

This document is used for reporting the schedule of receipts for terminal operators in Louisiana.

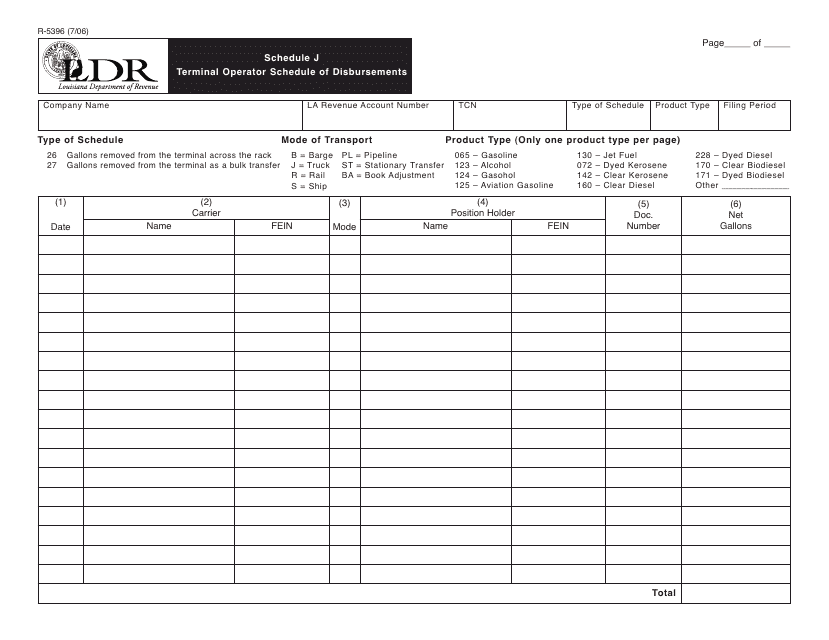

This form is used for reporting the schedule of disbursements for terminal operators in Louisiana.

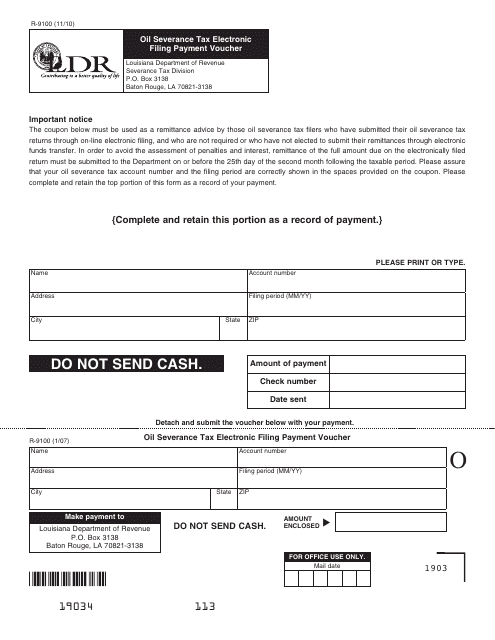

This form is used for making electronic payments related to the oil severance tax in Louisiana.