Tax Templates

Documents:

2882

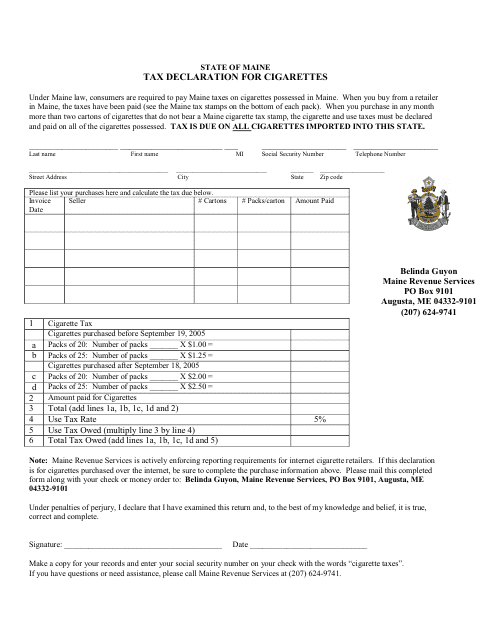

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

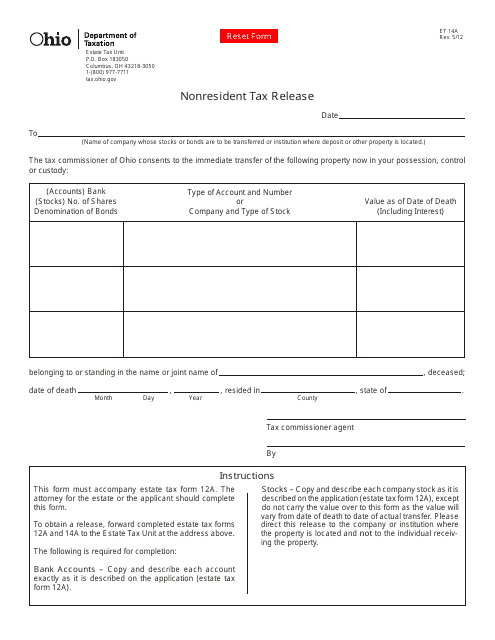

This form is used for nonresidents in Ohio to request a tax release.

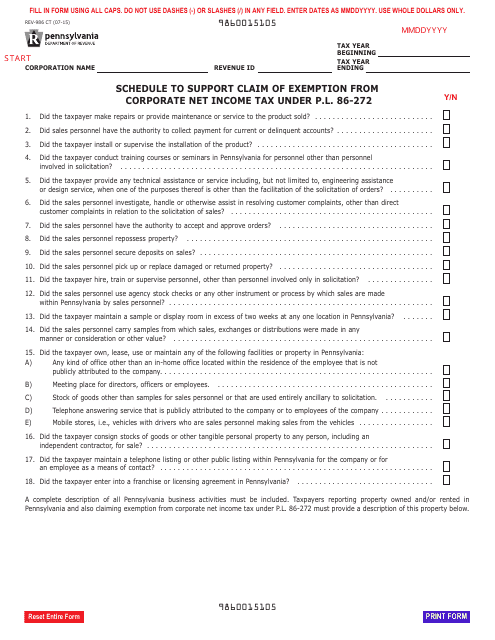

This Form is used for claiming exemption from corporate net income tax in Pennsylvania under P.l. 86-272.

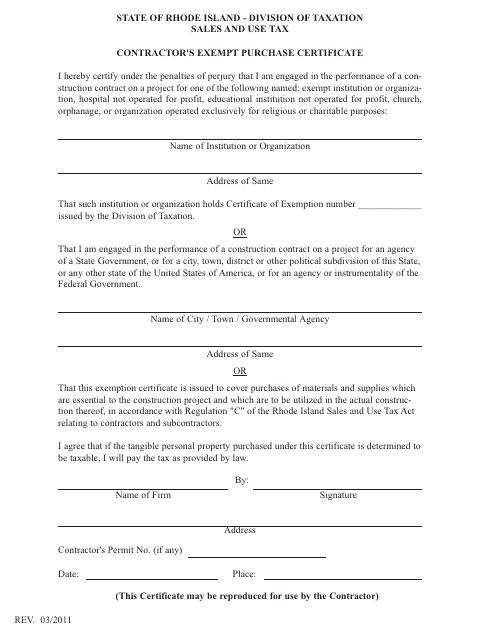

This Form is used for contractors in Rhode Island to claim exemptions on certain purchases. It allows them to avoid paying sales tax on qualifying items.

This Form is used for obtaining an Exemption Certificate in Rhode Island for the purpose of recycling, reusing or treating hazardous waste.

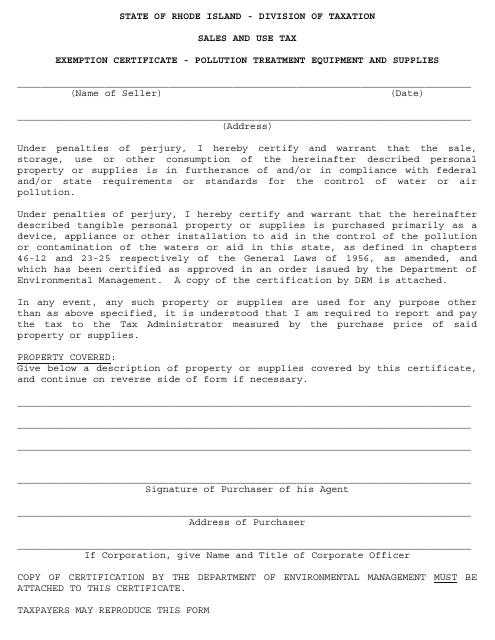

This form is used for applying for an exemption certificate for pollution treatment equipment and supplies in the state of Rhode Island.

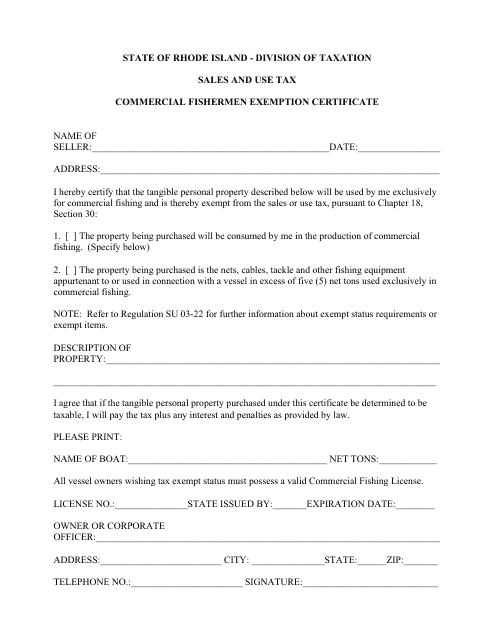

This document is for commercial fishermen in Rhode Island who are exempt from specific regulations.

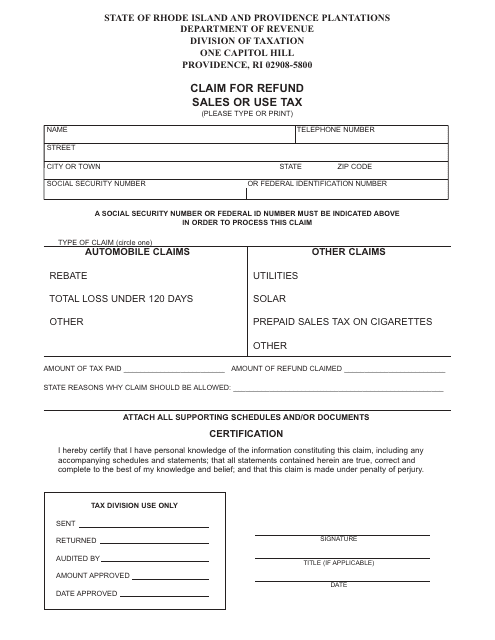

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

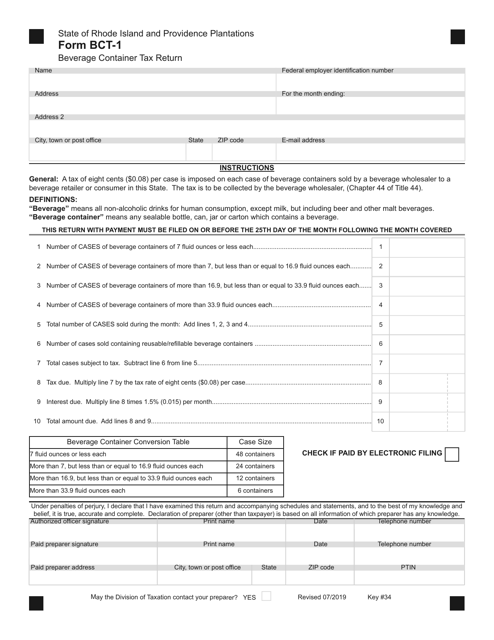

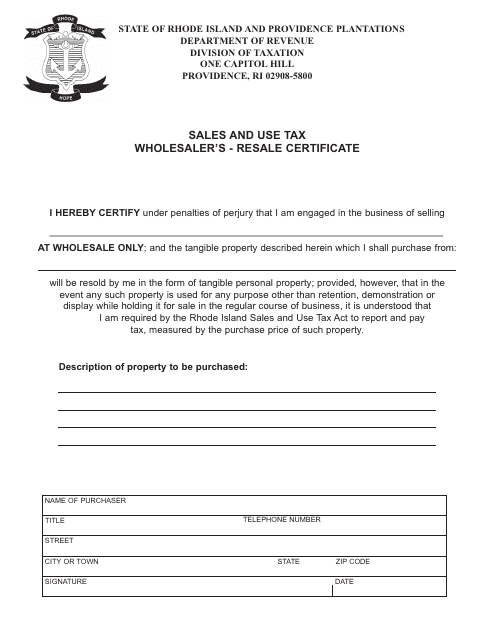

This document is used by wholesalers in Rhode Island to obtain a resale certificate, which allows them to purchase goods for resale without paying sales tax.

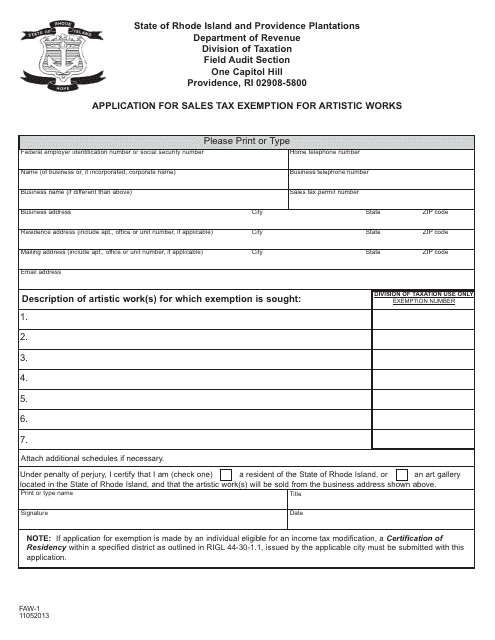

This form is used for applying for sales tax exemption on artistic works in Rhode Island. It is used by artists and sellers of artistic works to claim exemption from paying sales tax on their sales.

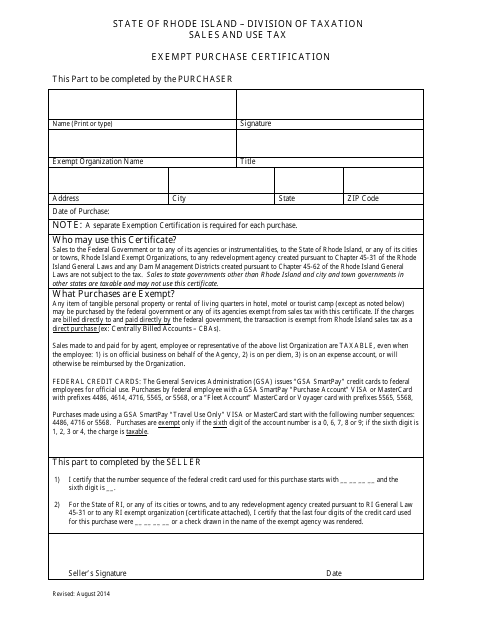

This form is used for certifying that a purchase is exempt from certain taxes in the state of Rhode Island.

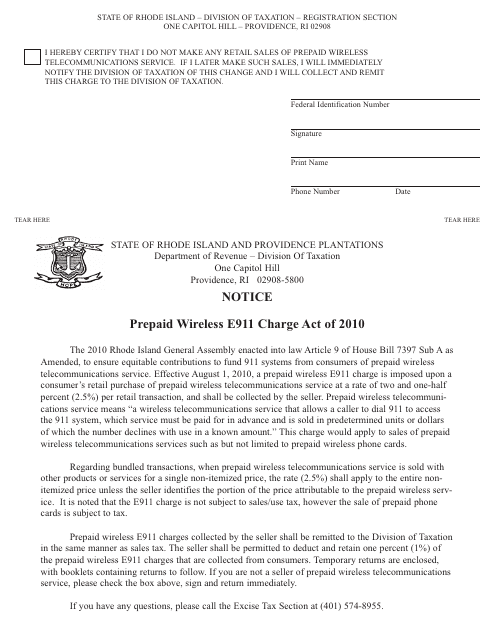

This Form is used for opting out of the Prepaid Wireless Telecommunications Charge in Rhode Island.

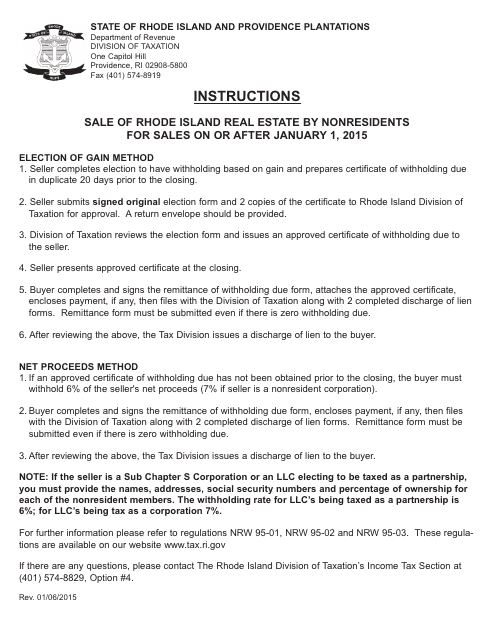

This document provides instructions for nonresidents on how to sell real estate in Rhode Island for sales that occurred on or after January 1, 2015. It outlines the specific requirements and steps that need to be followed during the sales process.

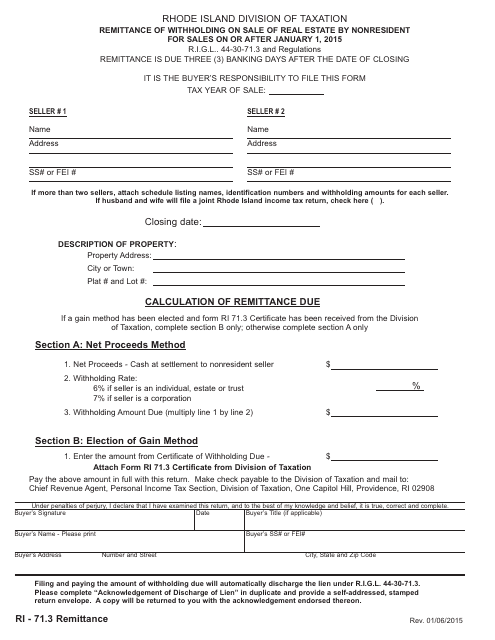

This type of document is used for remitting withholding taxes on the sale of real estate by nonresidents in Rhode Island.

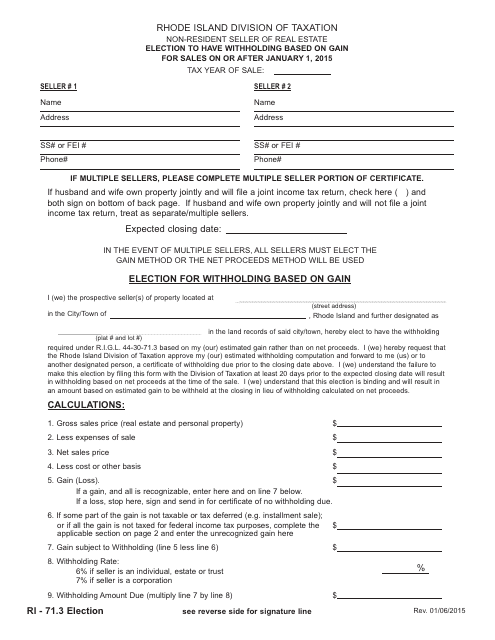

This form is used for non-resident sellers of real estate in Rhode Island who want to elect to have withholding based on their gain from the sale. This is applicable for sales that occurred on or after January 1, 2015.

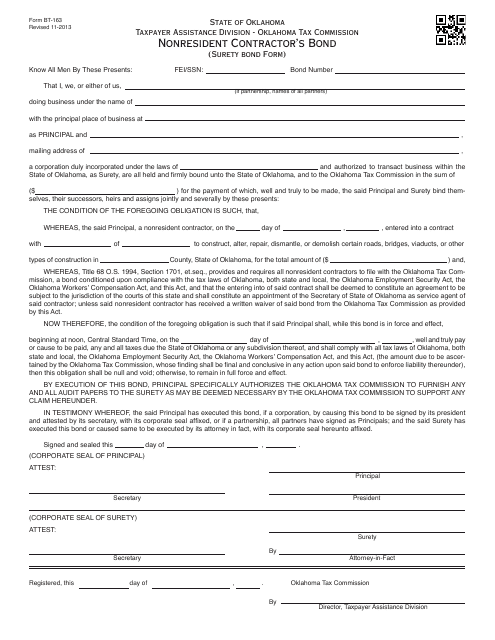

This type of document is used for obtaining a nonresident contractor's bond in Oklahoma. It is for contractors who are not residents of Oklahoma but want to work on construction projects in the state. The bond ensures that the contractor will fulfill their obligations and responsibilities as outlined in their contract.

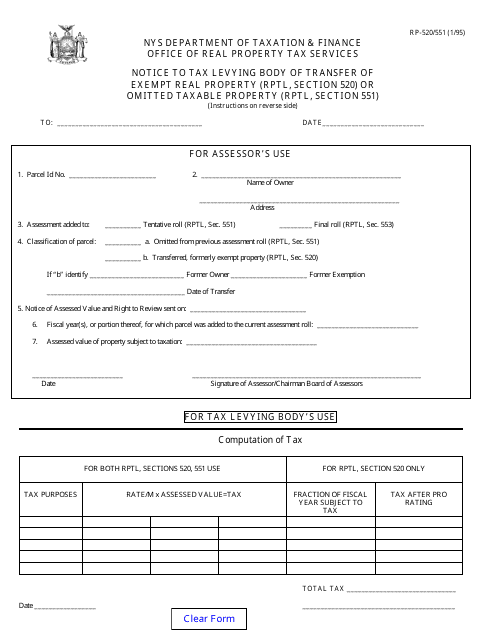

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.

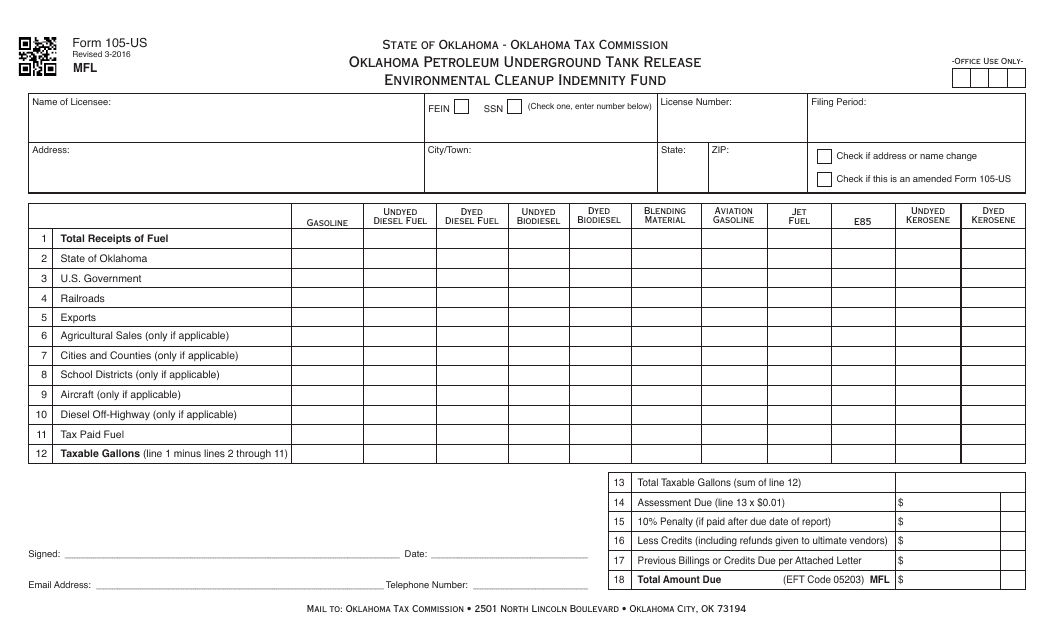

This Form is used for applying for the Oklahoma Petroleum Underground Tank Release Environmental Cleanup Indemnity Fund in the US. It provides financial assistance for the cleanup of underground petroleum tanks.

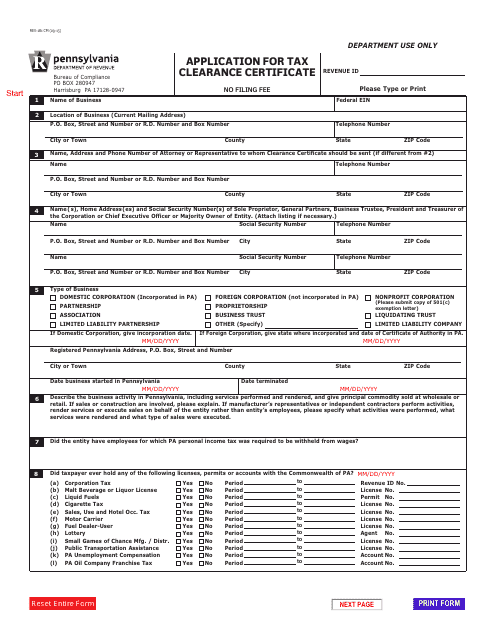

This form is used for applying for a Tax Clearance Certificate in Pennsylvania.

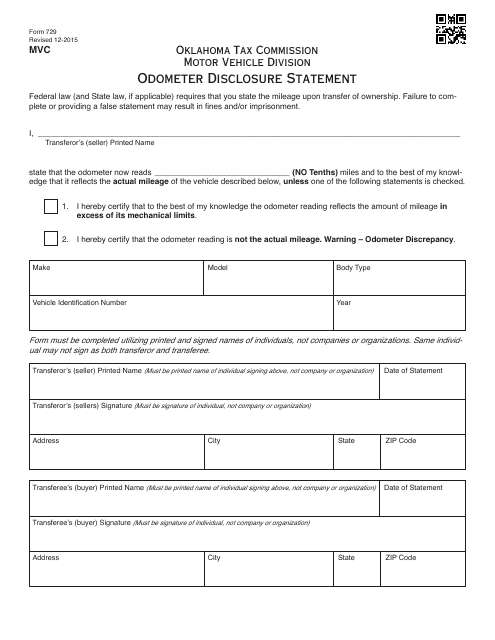

This document is used for disclosing the odometer reading when buying or selling a vehicle in Oklahoma, USA.

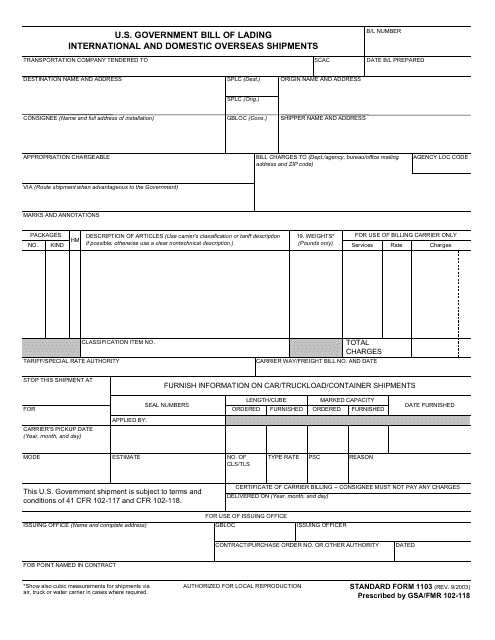

This form is used for creating a U.S. Government Bill of Lading for both international and domestic overseas shipments.

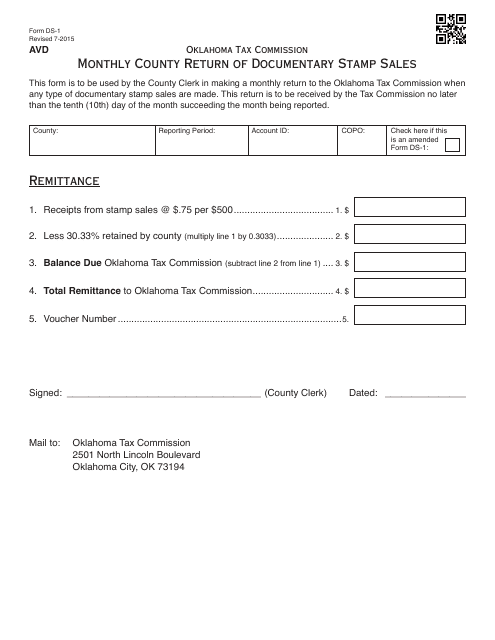

This document is a monthly return form used by counties in Oklahoma to report and record sales of documentary stamps.

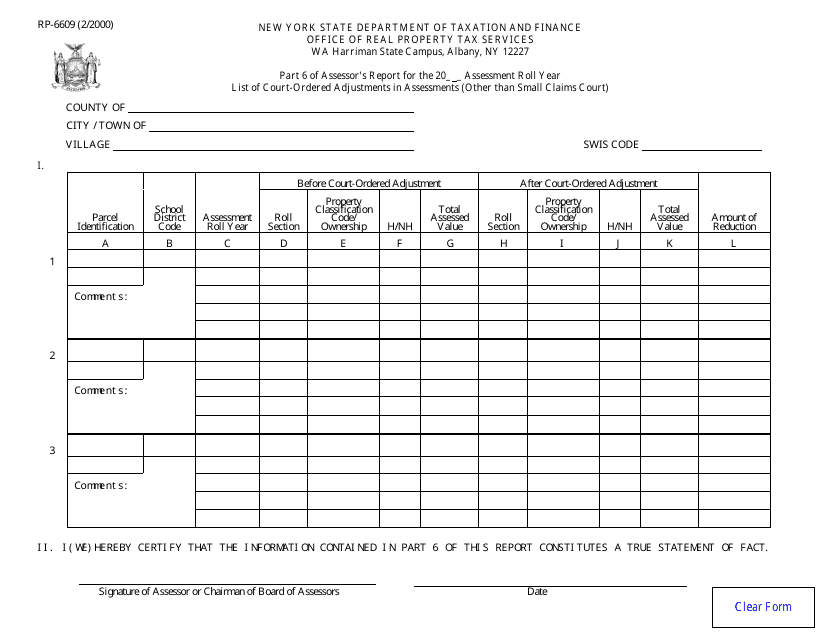

This form is used to provide a list of court-ordered adjustments in assessments in New York, excluding small claims court cases.

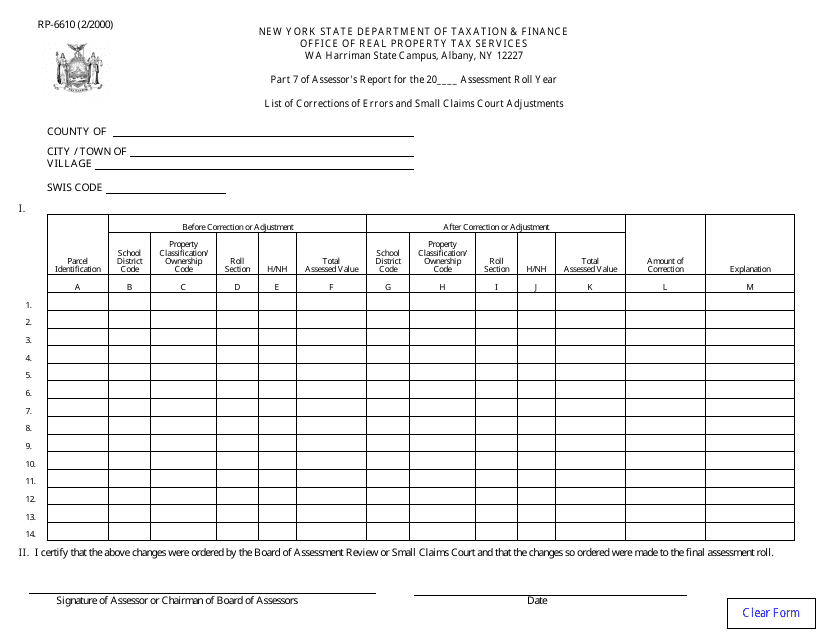

This form is used for listing corrections of errors and making adjustments in small claims court cases in New York.

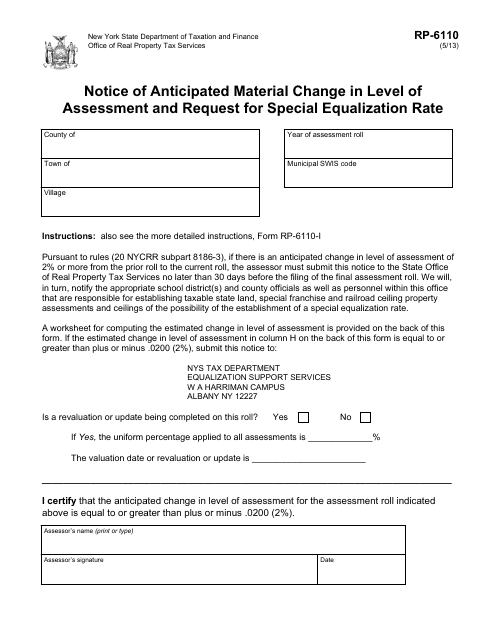

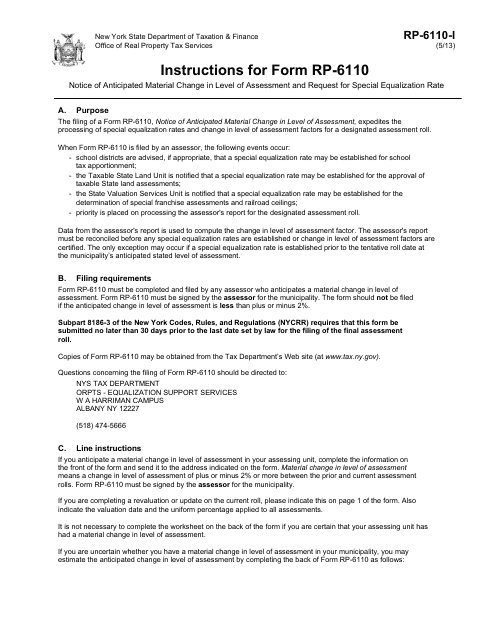

This form is used for notifying the assessor's office in New York about any anticipated changes in the assessment level of a property. It also serves as a request for a special equalization rate.

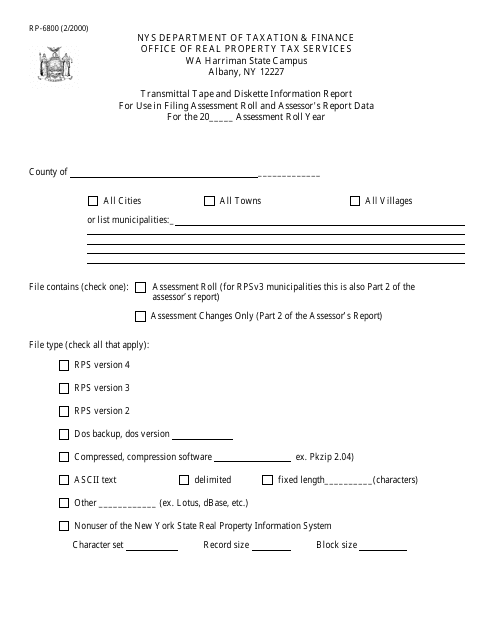

This form is used for reporting and transmitting tape and diskette information related to the assessment roll and assessor's report data in New York.

This Form is used for notifying the local assessor in New York about any anticipated material change in the property's assessment level and requesting a special equalization rate.

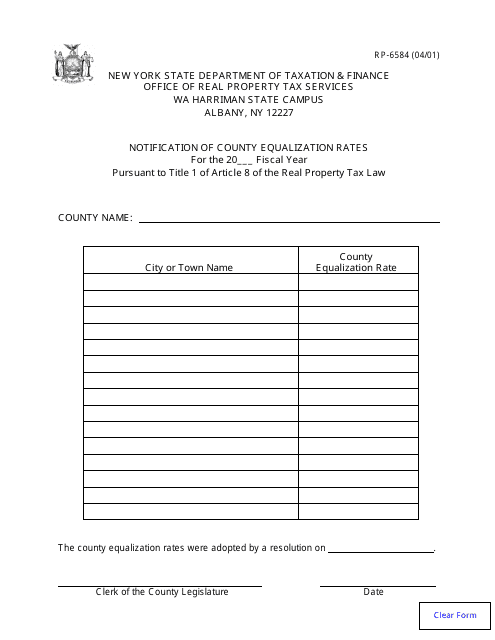

This form is used for notifying individuals of the county equalization rates in New York. It provides information on how property assessments and taxes are calculated, helping residents understand their tax obligations.

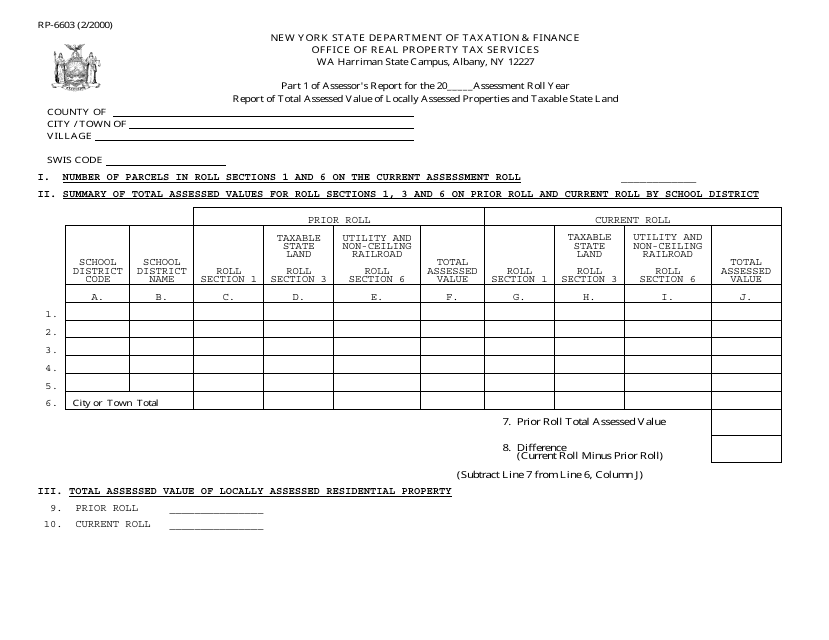

This form is used for reporting the total assessed value of locally assessed properties and taxable state land in New York.

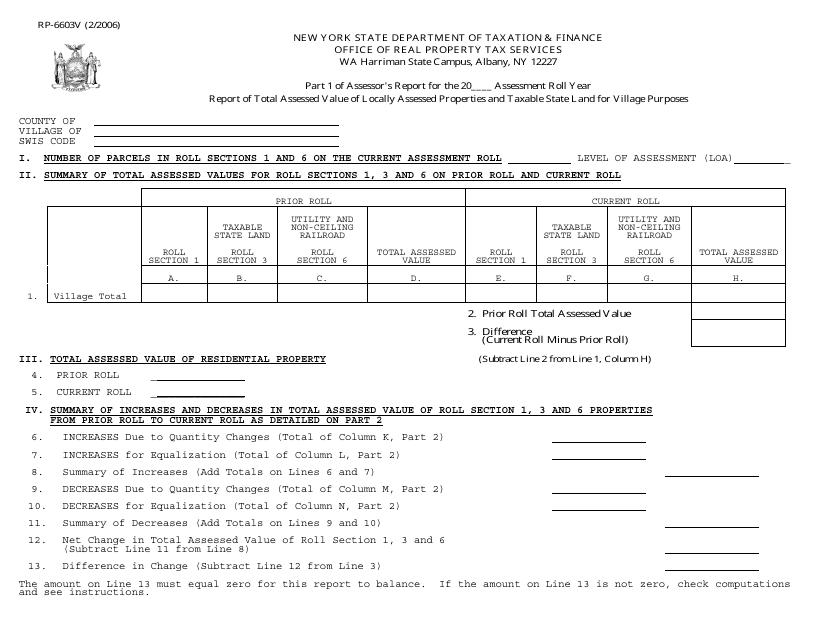

This document is part 1 of the Assessor's Report in the state of New York. It provides information on the total assessed value of locally assessed properties and taxable state land for village purposes.

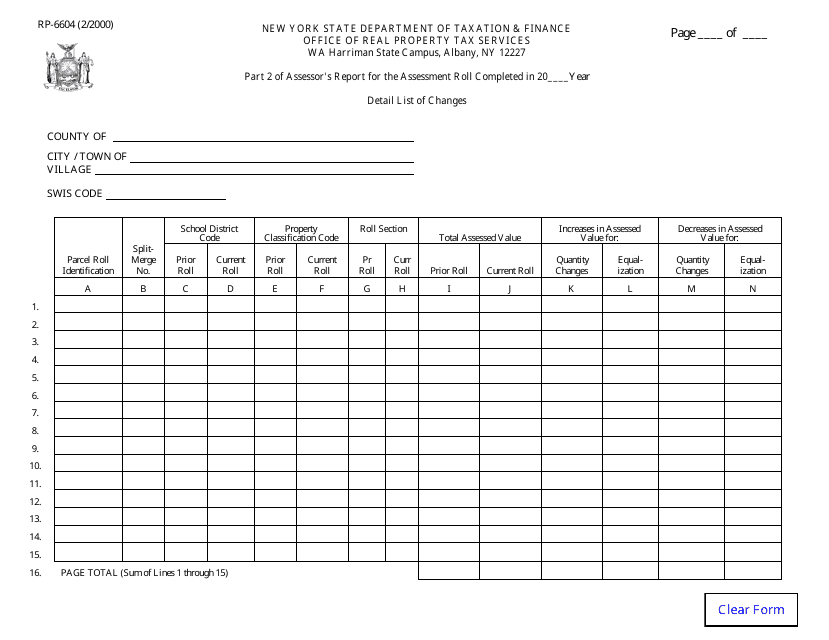

Form RP-6604 Part 2 of Assessor's Report for the Assessment Roll - Detail List of Changes - New York

This Form is used for providing a detailed list of changes to the Assessment Roll in New York. It is part 2 of the Assessor's Report.

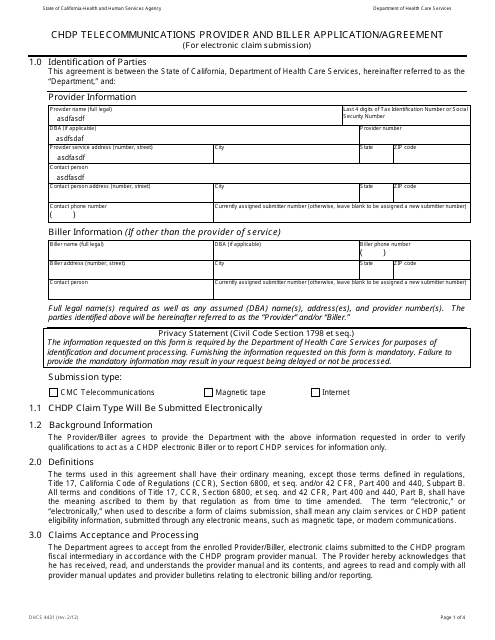

This form is used for Chdp Telecommunications Provider and Biller Application/Agreement in California.

This application form is used for individuals who want to apply for the Volunteer Firefighters / Ambulance Workers Exemption in Wyoming County, New York. It is specific to this county and is intended for those who wish to serve as volunteers in emergency services.

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption for residents of Cattaraugus County, New York.

This document is used for applying for a Volunteer Firefighters / Ambulance Workers Exemption in Dutchess County, New York.

This form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Schoharie County, New York.

This Form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Jefferson and St. Lawrence Counties, New York.

This form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Montgomery County, New York.

This form is used for applying for an exemption for volunteer firefighters and volunteer ambulance workers in Orange County, New York.

![Form RP-466-C [WYOMING] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Wyoming County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733891/form-rp-466-c-wyoming-application-volunteer-firefighters-ambulance-workers-exemption-use-in-wyoming-county-only-new-york_big.png)

![Form RP-466-C [CATTARAUGUS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Cattaraugus County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733892/form-rp-466-c-cattaraugus-application-volunteer-firefighters-ambulance-workers-exemption-use-in-cattaraugus-county-only-new-york_big.png)

![Form RP-466-C [DUTCHESS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Dutchess County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733893/form-rp-466-c-dutchess-application-volunteer-firefighters-ambulance-workers-exemption-use-in-dutchess-county-only-new-york_big.png)

![Form RP-466-E [SCHOHARIE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schoharie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733903/form-rp-466-e-schoharie-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schoharie-county-only-new-york_big.png)

![Form RP-466-F [JEFFERSON, ST. LAWRENCE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Jefferson and St. Lawrence Counties Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733904/form-rp-466-f-jefferson-st-lawrence-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-jefferson-and-st-lawrence-counties-only-new-york_big.png)

![Form RP-466-F [MONTGOMERY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Montgomery County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733905/form-rp-466-f-montgomery-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-montgomery-county-only-new-york_big.png)

![Form RP-466-F [ORANGE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Orange County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733906/form-rp-466-f-orange-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-orange-county-only-new-york_big.png)