Tax Templates

Documents:

2882

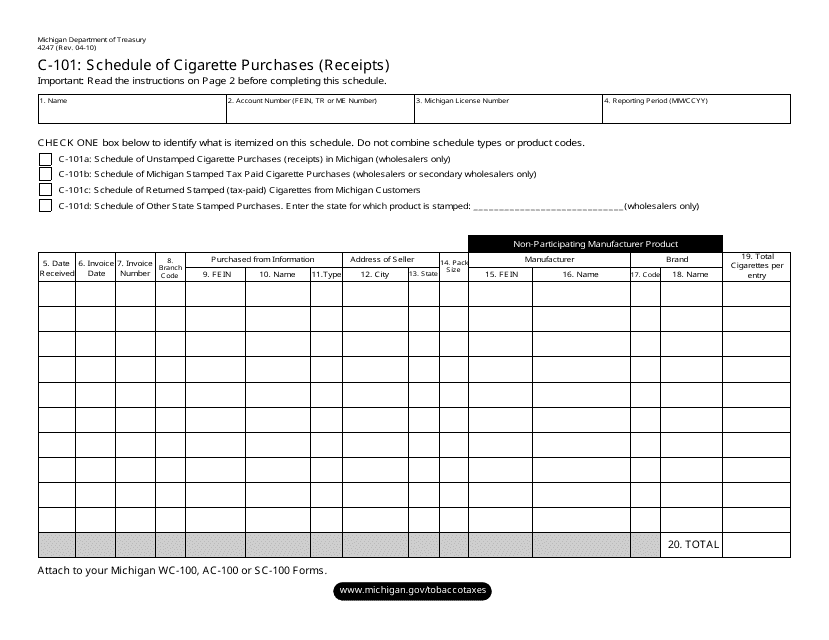

This form is used for reporting cigarette purchases (receipts) in the state of Michigan.

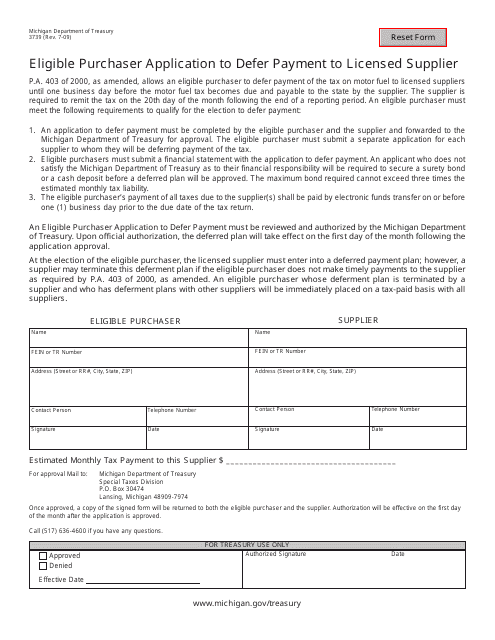

This form is used for Michigan residents who are eligible purchasers looking to defer payment to a licensed supplier.

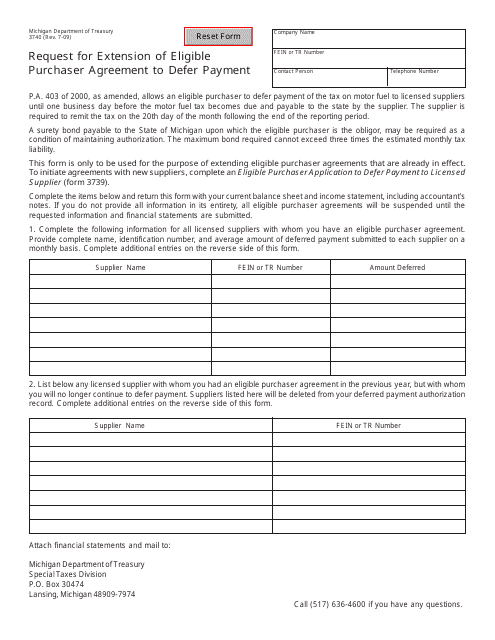

This form is used for requesting an extension of an eligible purchaser agreement in Michigan to defer payment.

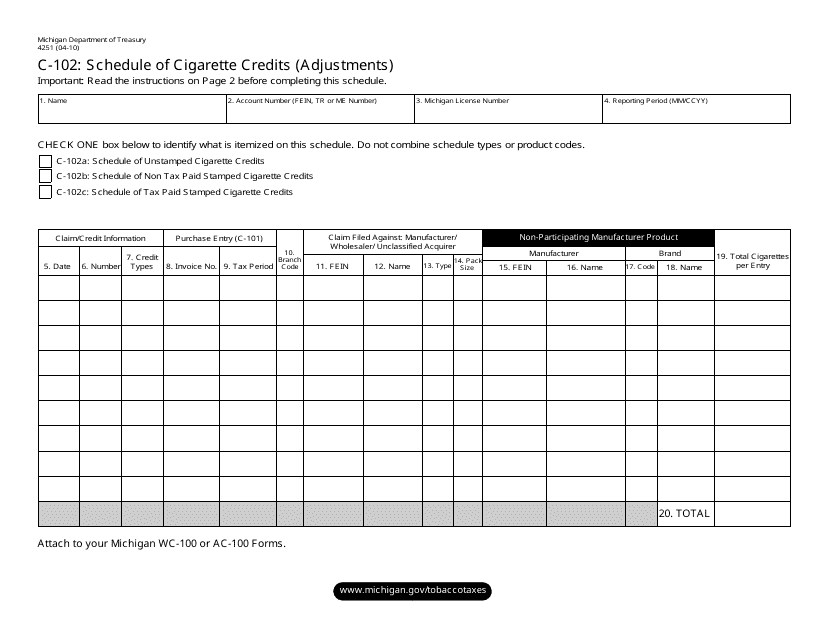

This form is used for reporting and adjusting cigarette credits in the state of Michigan.

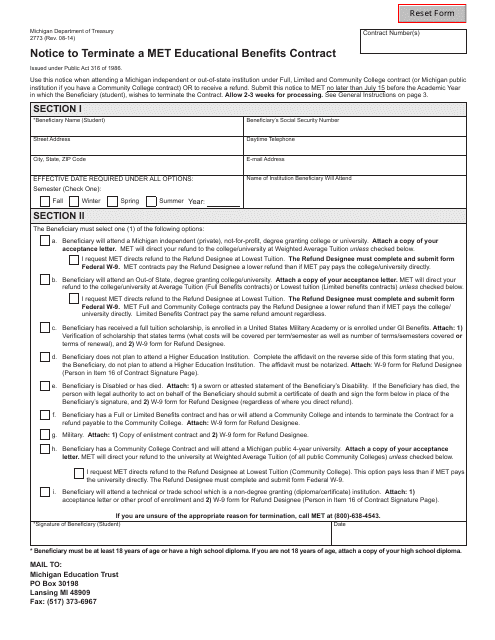

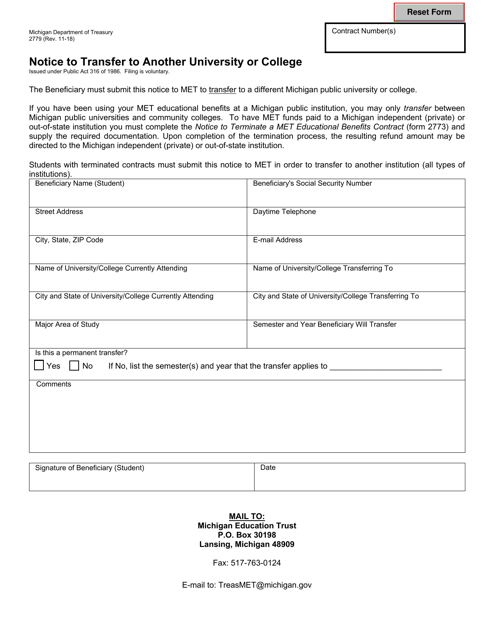

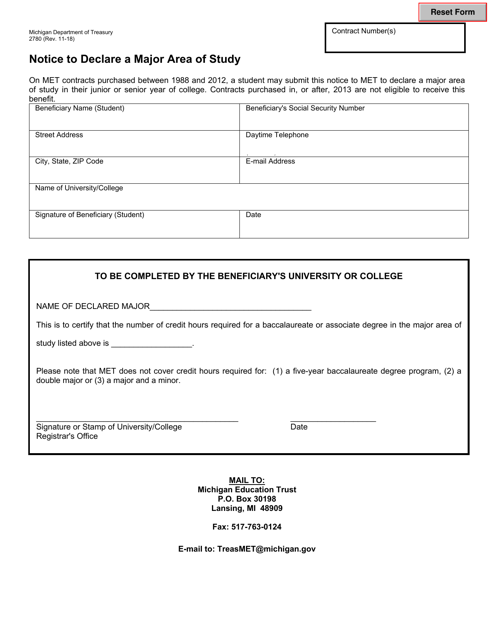

This form is used for terminating a Michigan MET Educational Benefits contract.

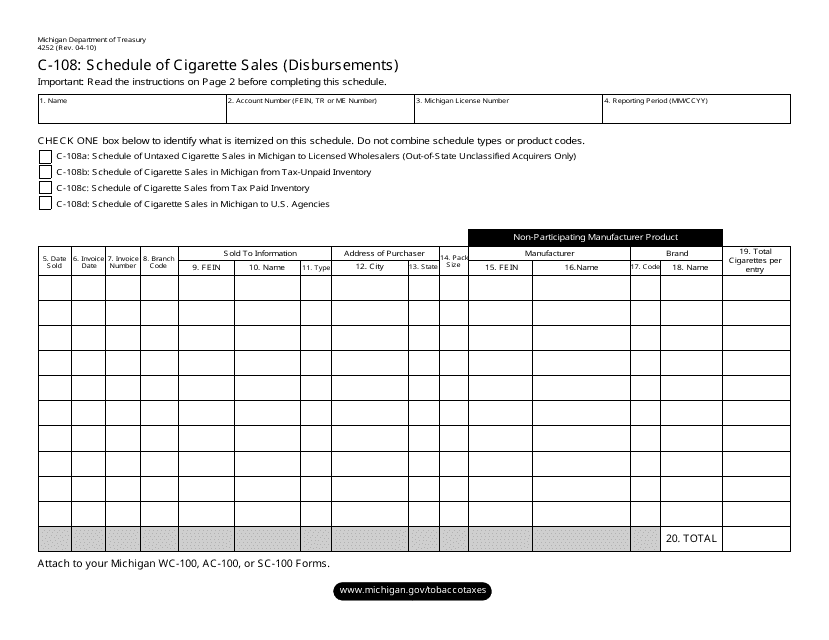

This form is used for reporting and documenting cigarette sales disbursements in the state of Michigan.

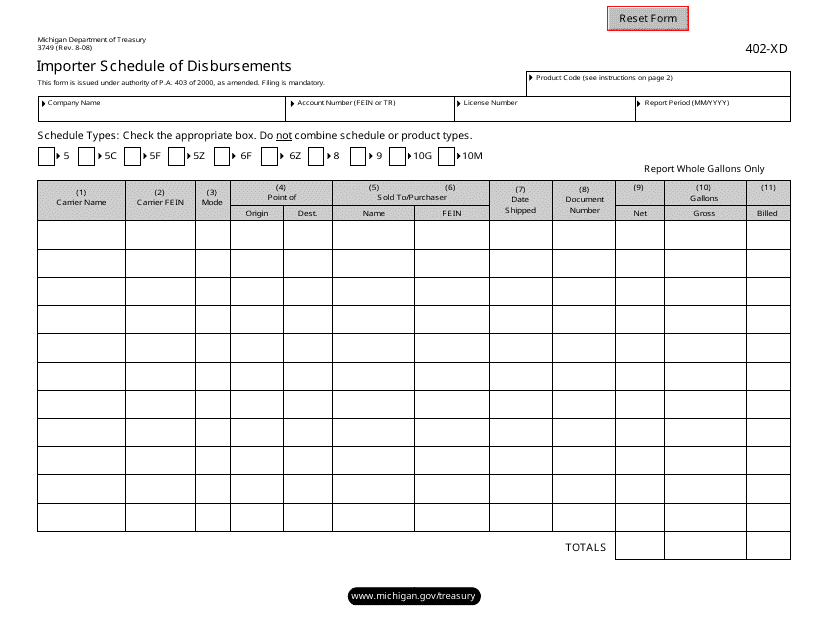

This Form is used for reporting the schedule of disbursements by an importer in Michigan.

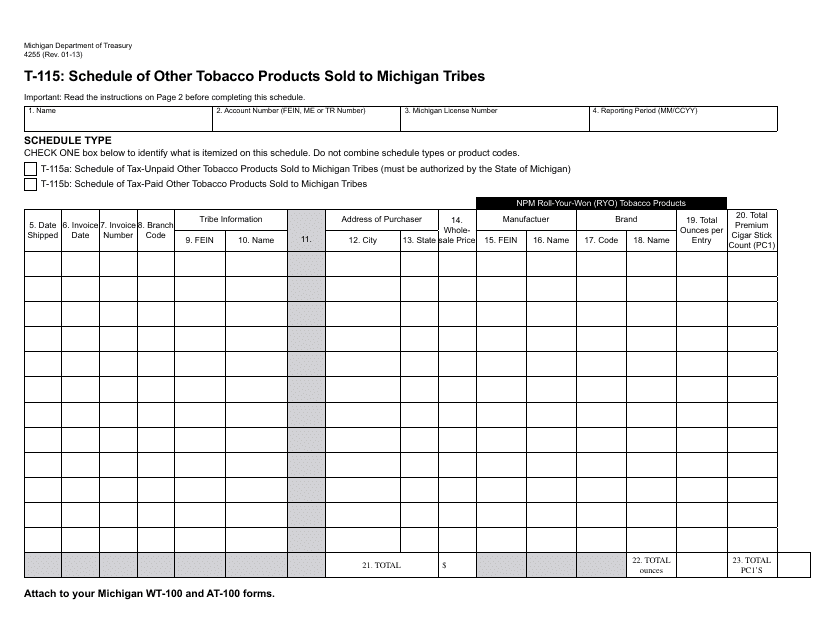

This form is used for reporting the sale of other tobacco products to Michigan tribes.

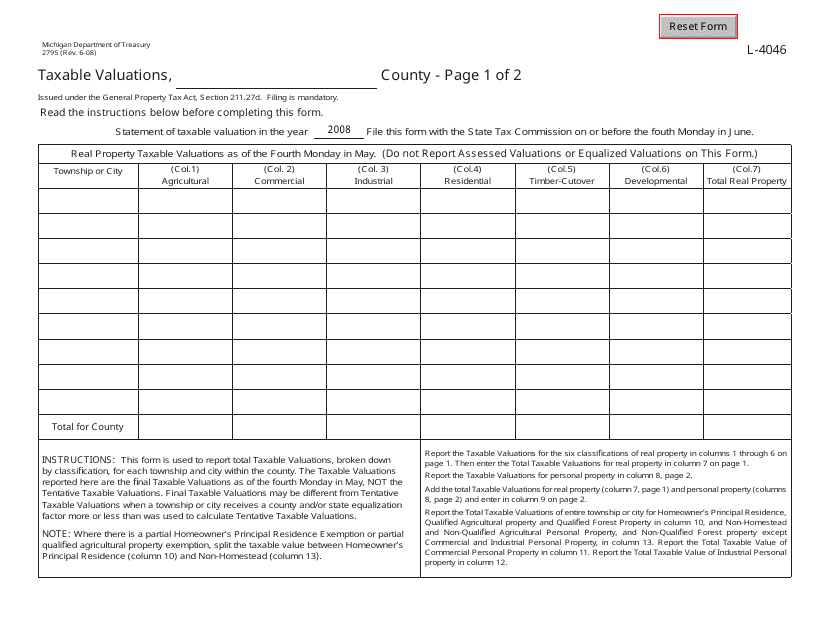

This form is used for reporting taxable valuations in the state of Michigan. It is used by property owners to determine the value of their property for tax purposes. The form must be filed annually with the local tax assessor's office.

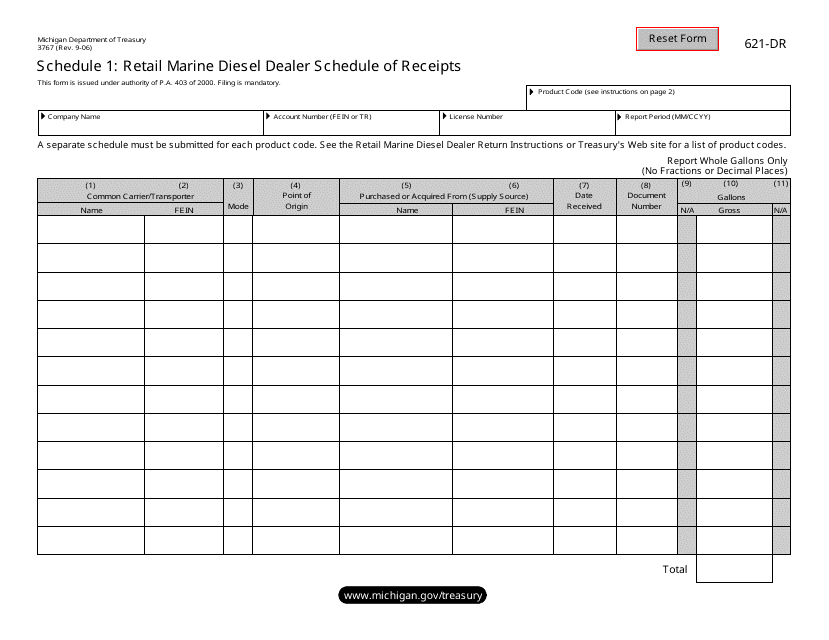

This Form is used for reporting the schedule of receipts for retail marine diesel dealers in Michigan.

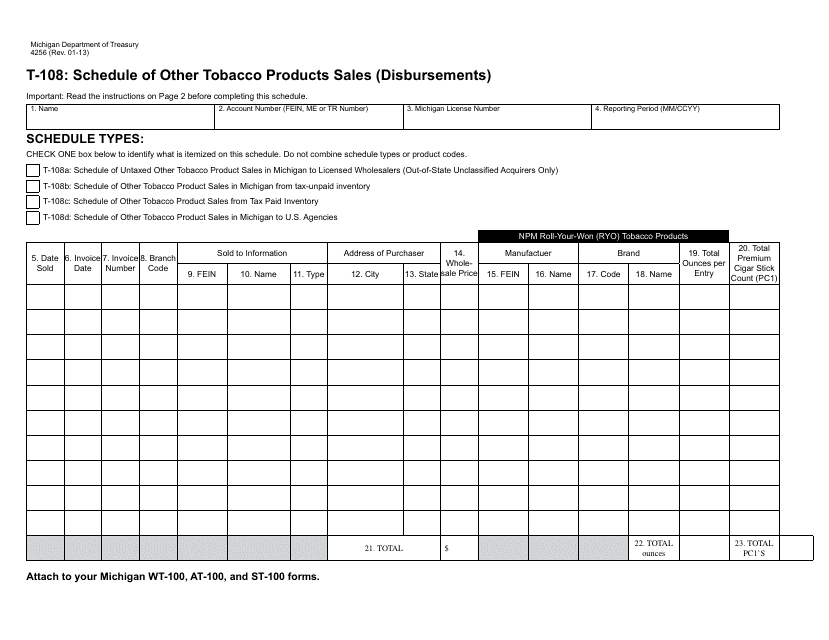

This form is used for reporting the sales or disbursements of other tobacco products in the state of Michigan. It is a schedule within Form 4256 Schedule T-108.

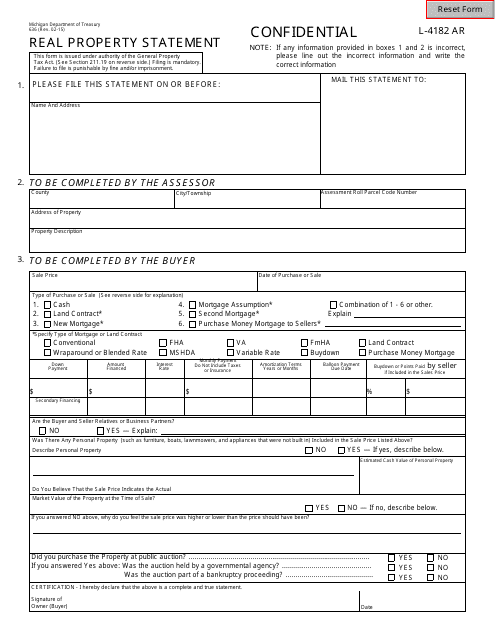

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

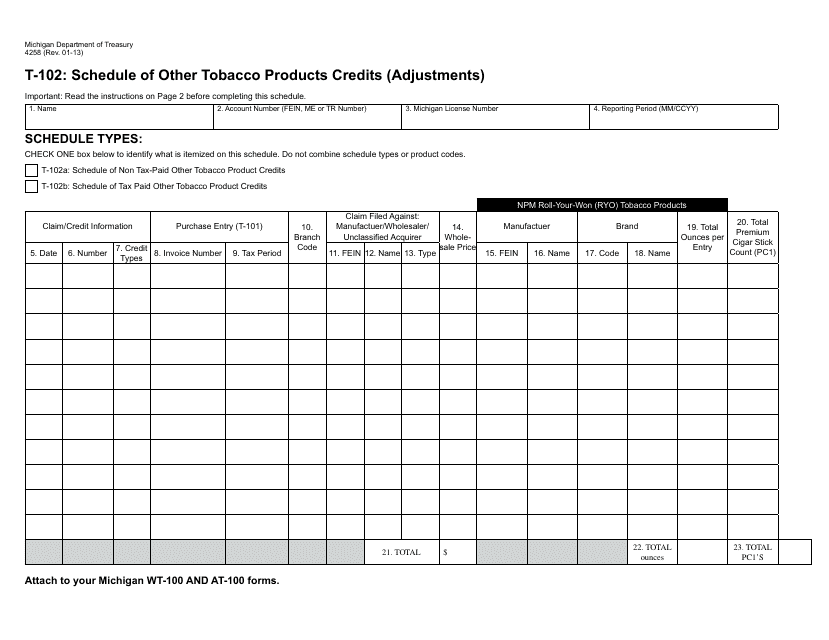

This form is used for reporting adjustments and credits related to other tobacco products in the state of Michigan.

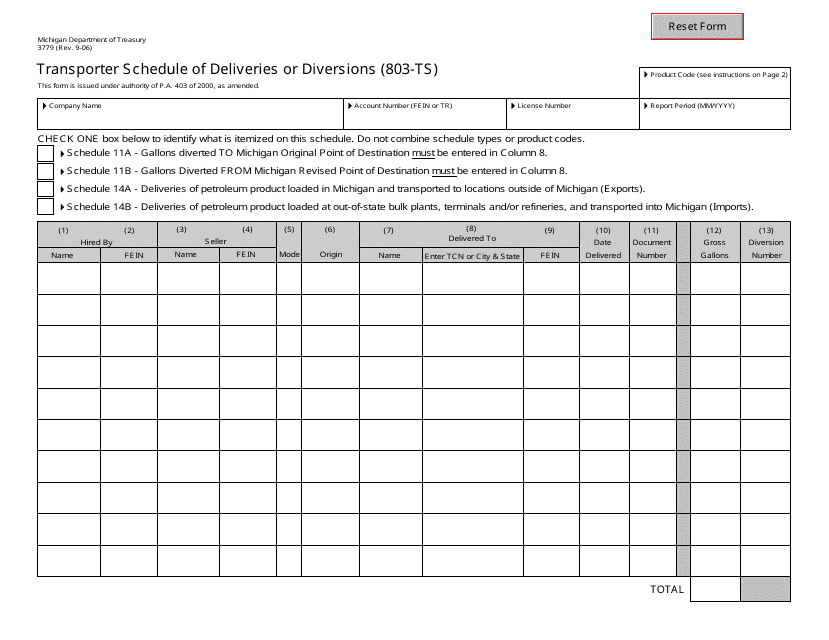

This form is used for scheduling and recording deliveries or diversions by transporters in the state of Michigan.

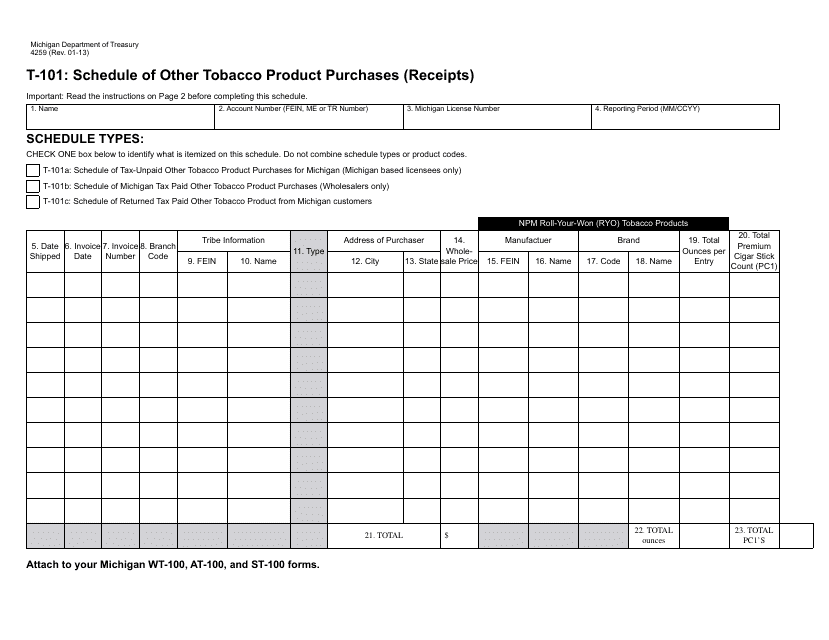

This form is used for reporting the purchase and receipt of other tobacco products in the state of Michigan.

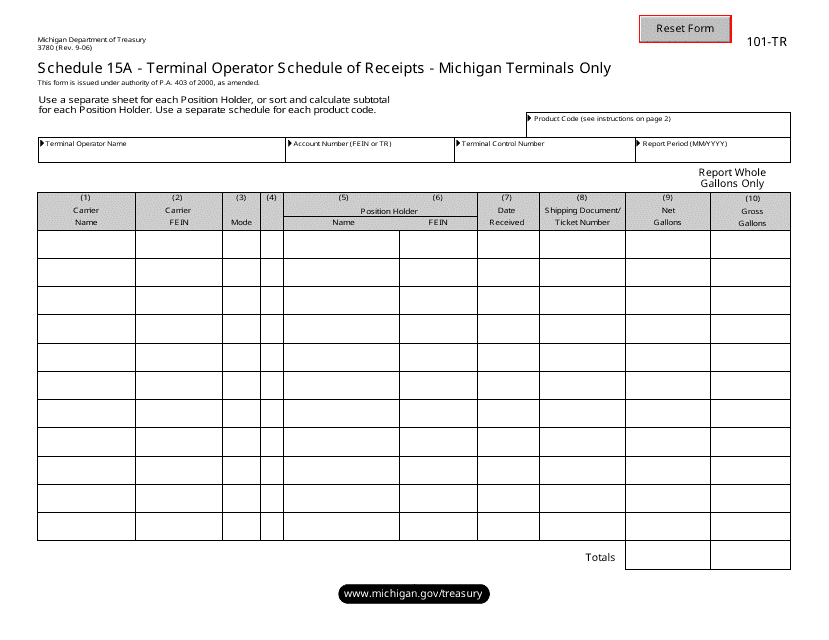

This form is used for Michigan terminals to report their schedule of receipts.

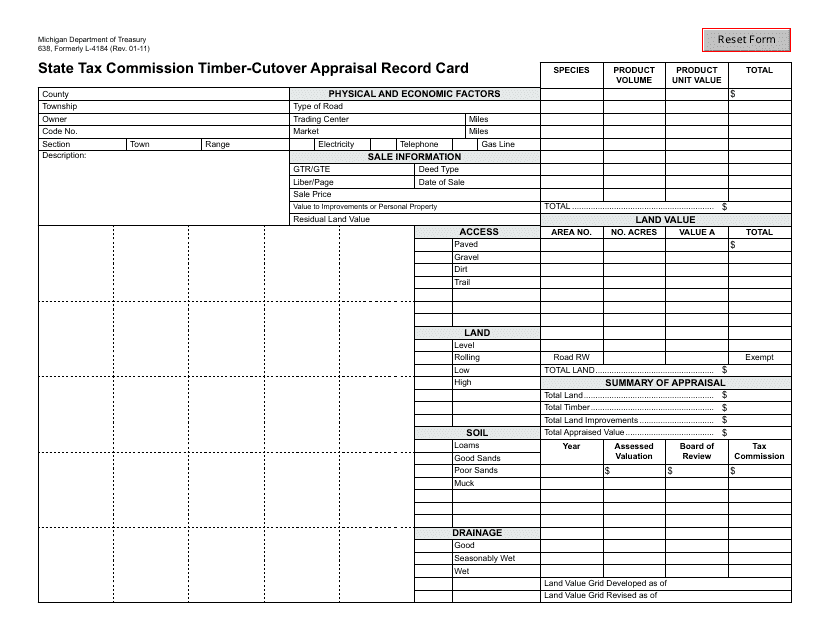

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

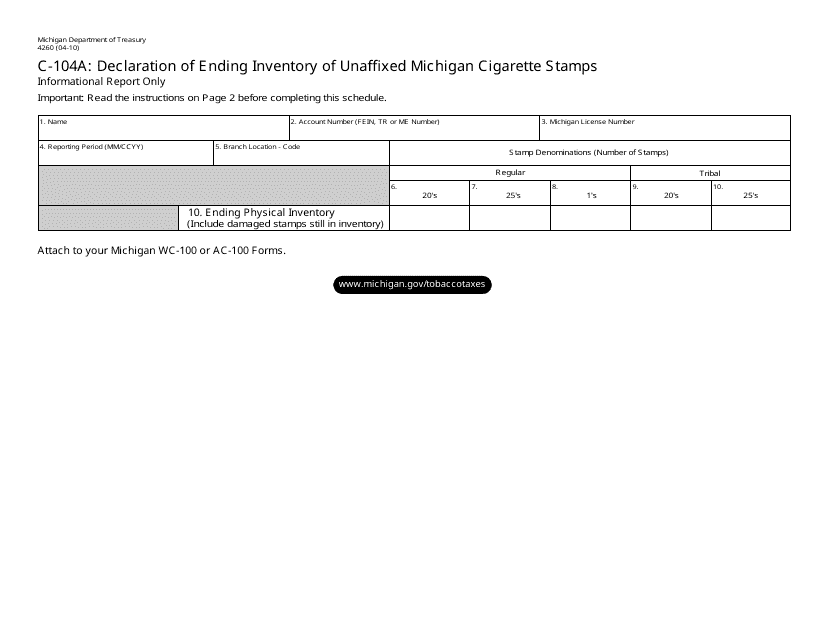

This form is used for declaring the ending inventory of unaffixed Michigan cigarette stamps in the state of Michigan.

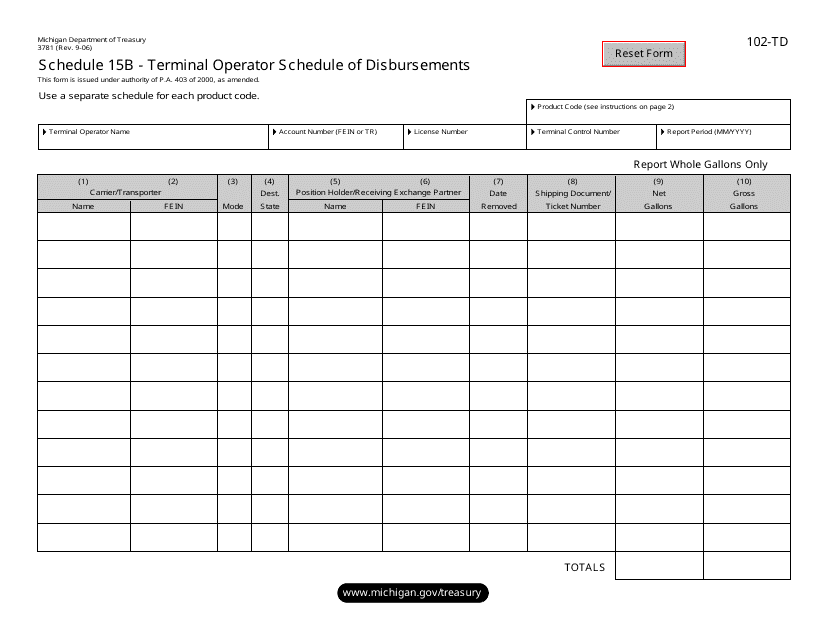

This form is used for reporting the schedule of disbursements for terminal operators in Michigan.

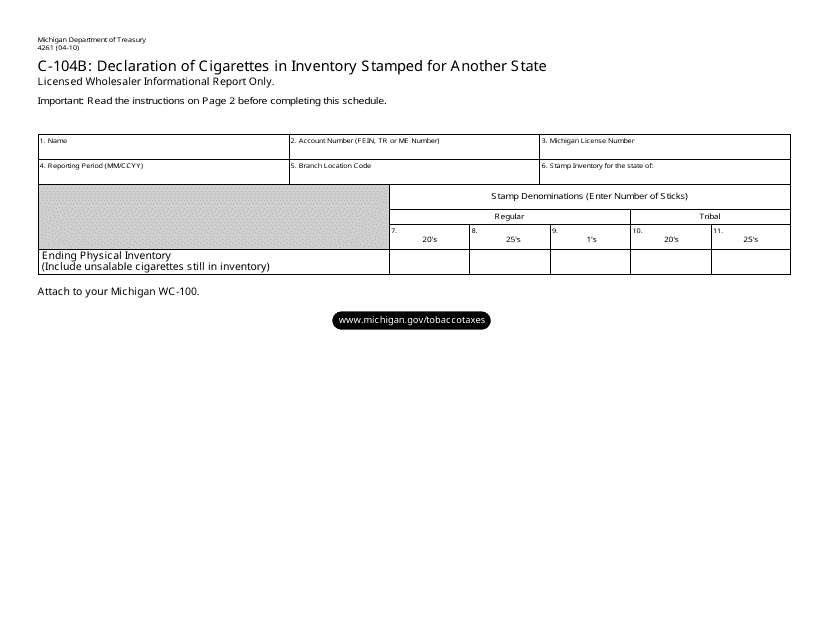

This Form is used for declaring cigarettes in inventory that are stamped for another state, specifically for the state of Michigan.

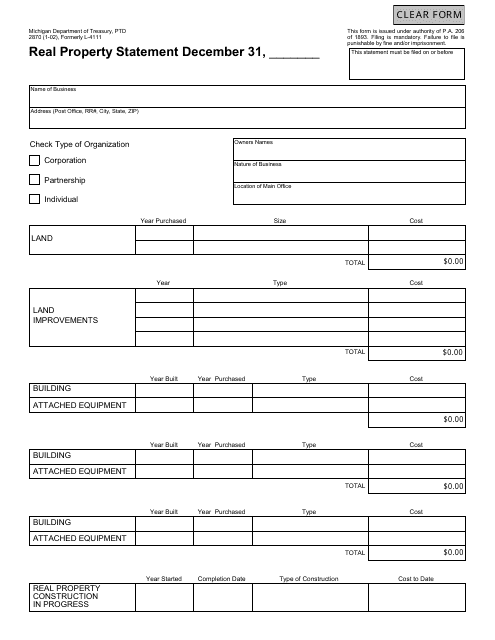

This form is used for filing a Real Property Statement in Michigan. It is also known as Form PTD2870 or Formerly L-4111.

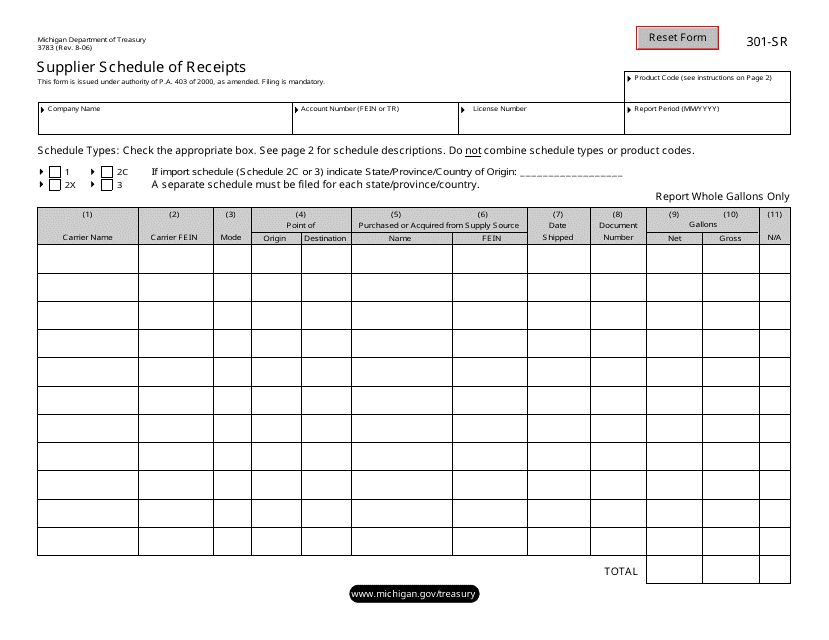

This form is used for suppliers in Michigan to provide a schedule of their receipts.

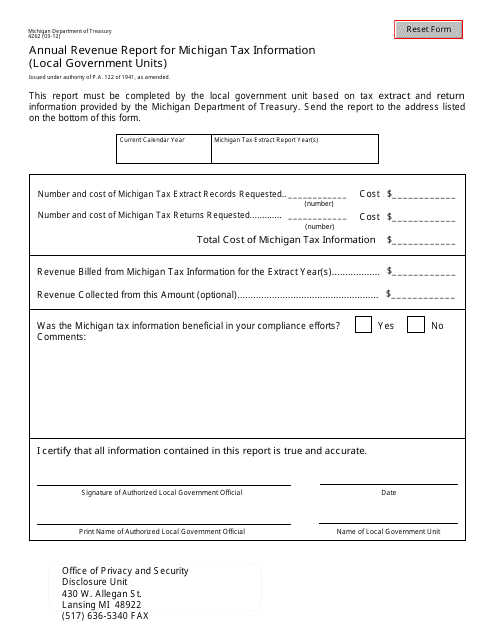

This form is used for reporting the annual revenue of local government units in Michigan for tax purposes.

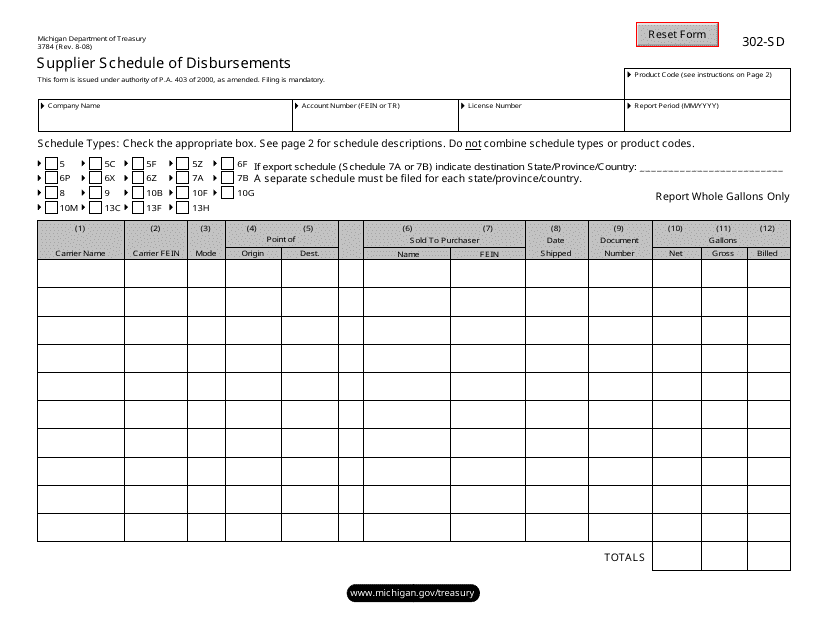

This form is used for suppliers in Michigan to provide a schedule of their disbursements.

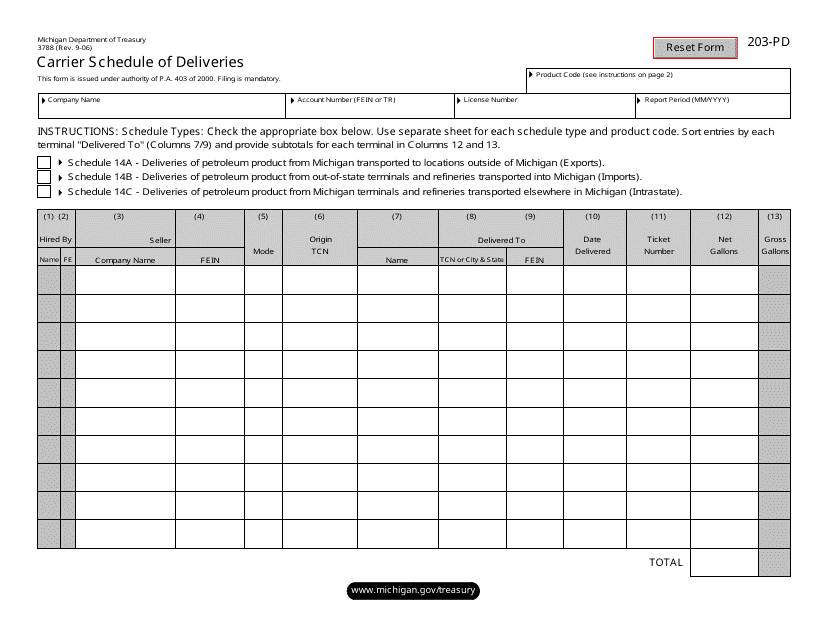

This form is used for carriers in Michigan to schedule their deliveries.

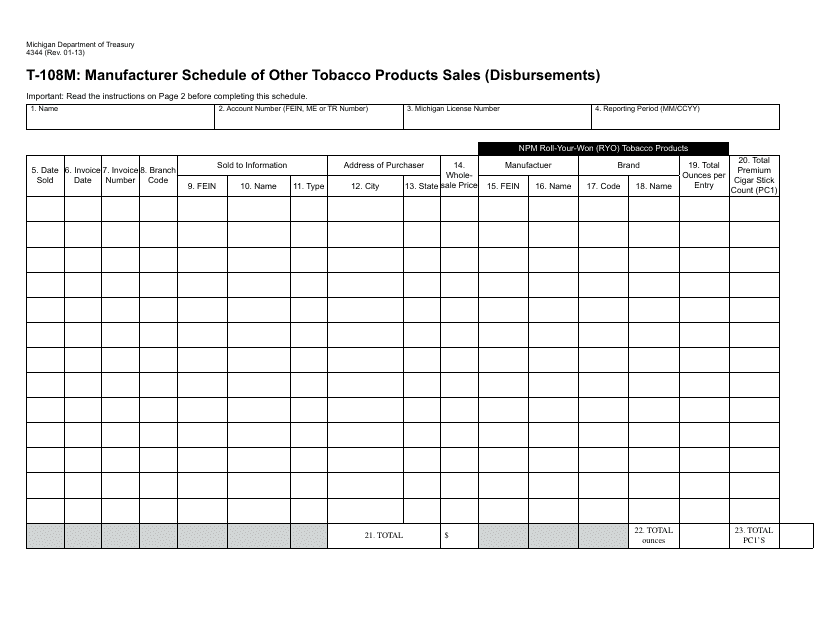

This Form is used for manufacturers in Michigan to report sales and disbursements of other tobacco products.

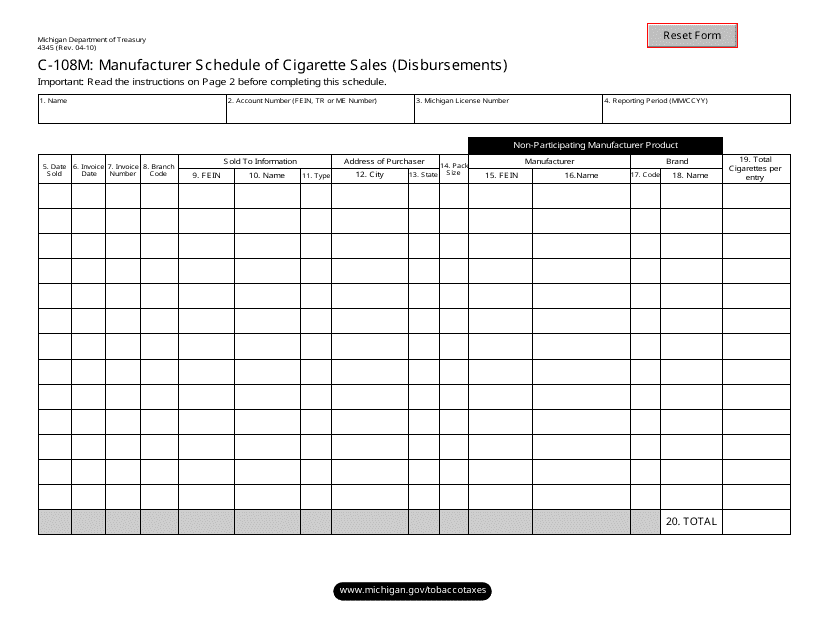

This form is used for reporting cigarette sales and disbursements by manufacturers in the state of Michigan.

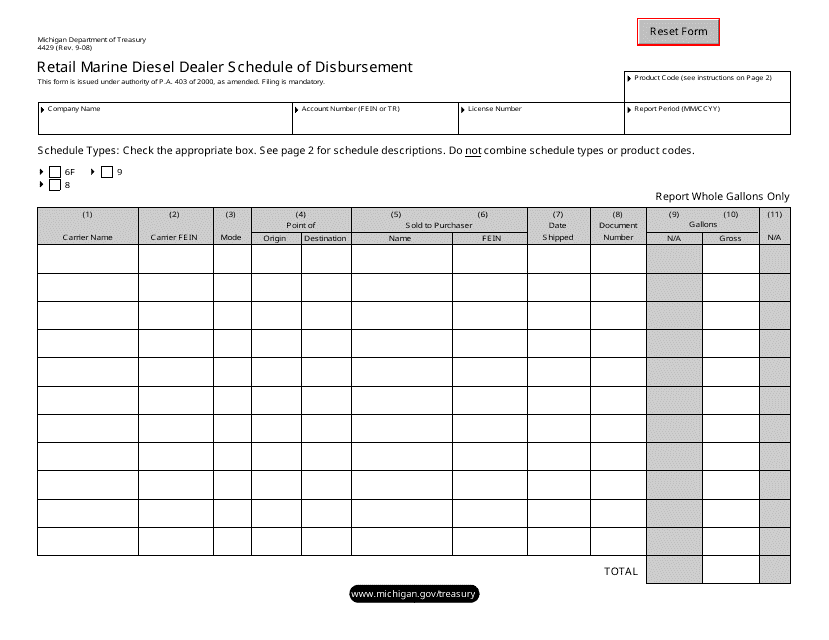

This form is used for retail marine diesel dealers in Michigan to provide a schedule of their disbursements.

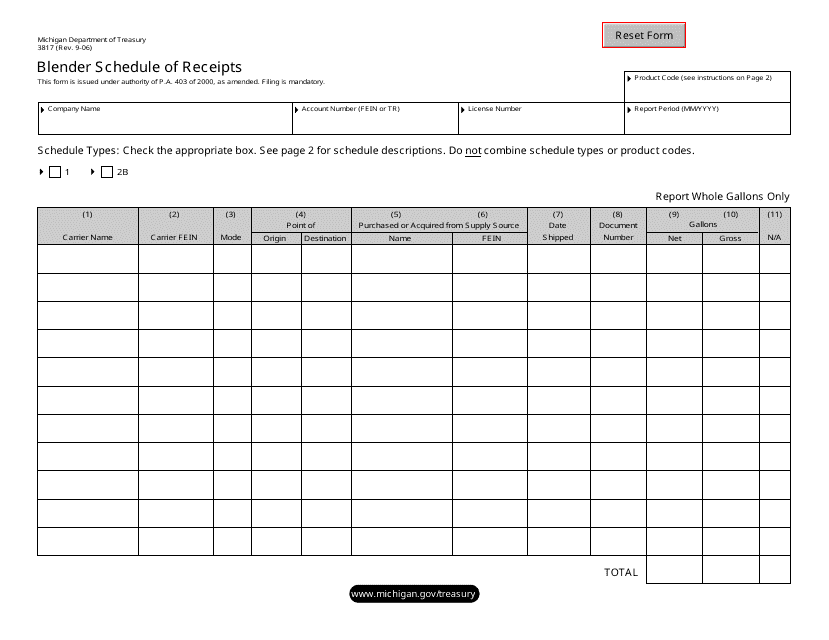

This form is used for keeping track of receipts for blenders in the state of Michigan.

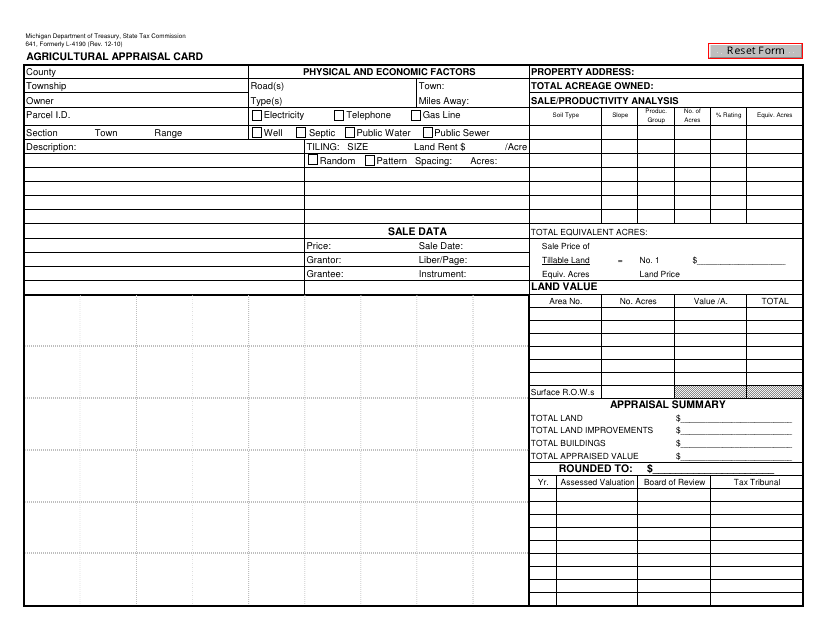

This form is used for agricultural property owners in Michigan to apply for a property tax assessment based on the agricultural use of their land.

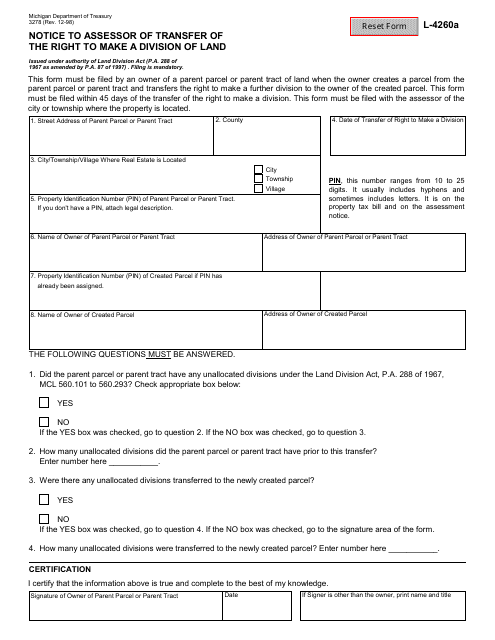

This Form is used for notifying the assessor in Michigan about the transfer of the right to make a division of land.

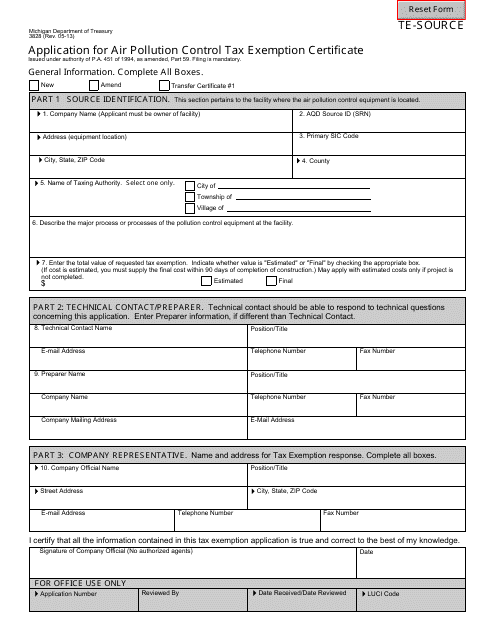

This form is used for applying for an air pollution control tax exemption certificate in Michigan. It allows businesses to request a tax exemption for equipment used to control air pollution.

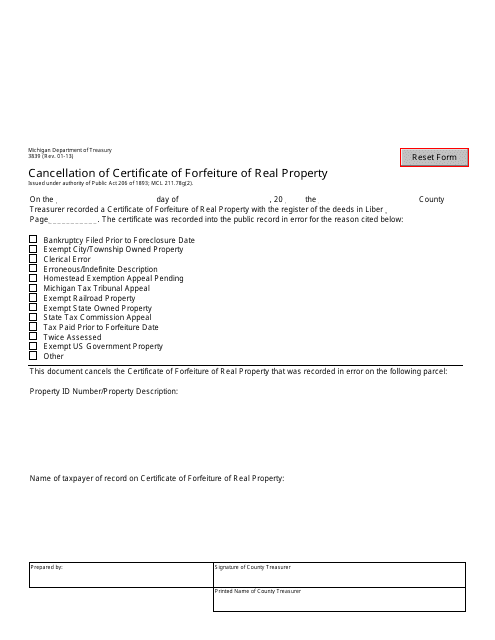

This Form is used for cancelling a certificate of forfeiture of real property in Michigan.