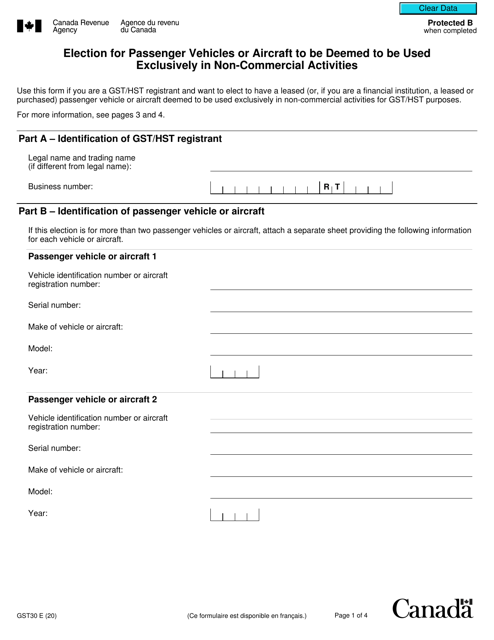

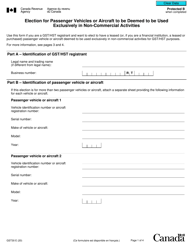

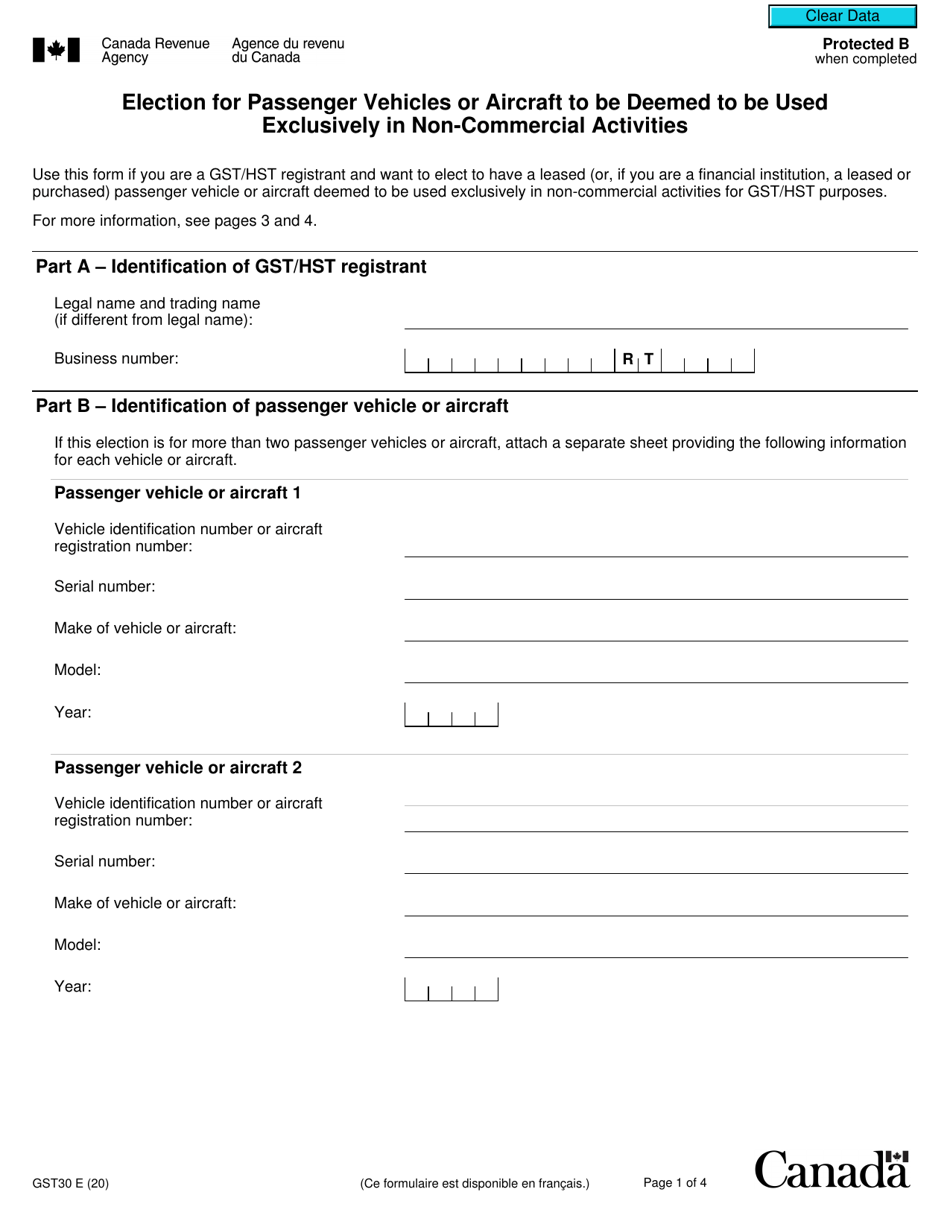

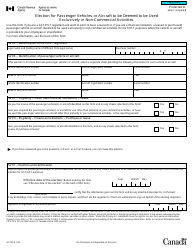

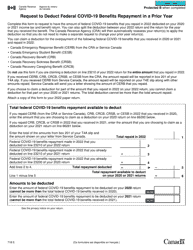

Form GST30 Election for Passenger Vehicles or Aircraft to Be Deemed to Be Used Exclusively in Non-commercial Activities - Canada

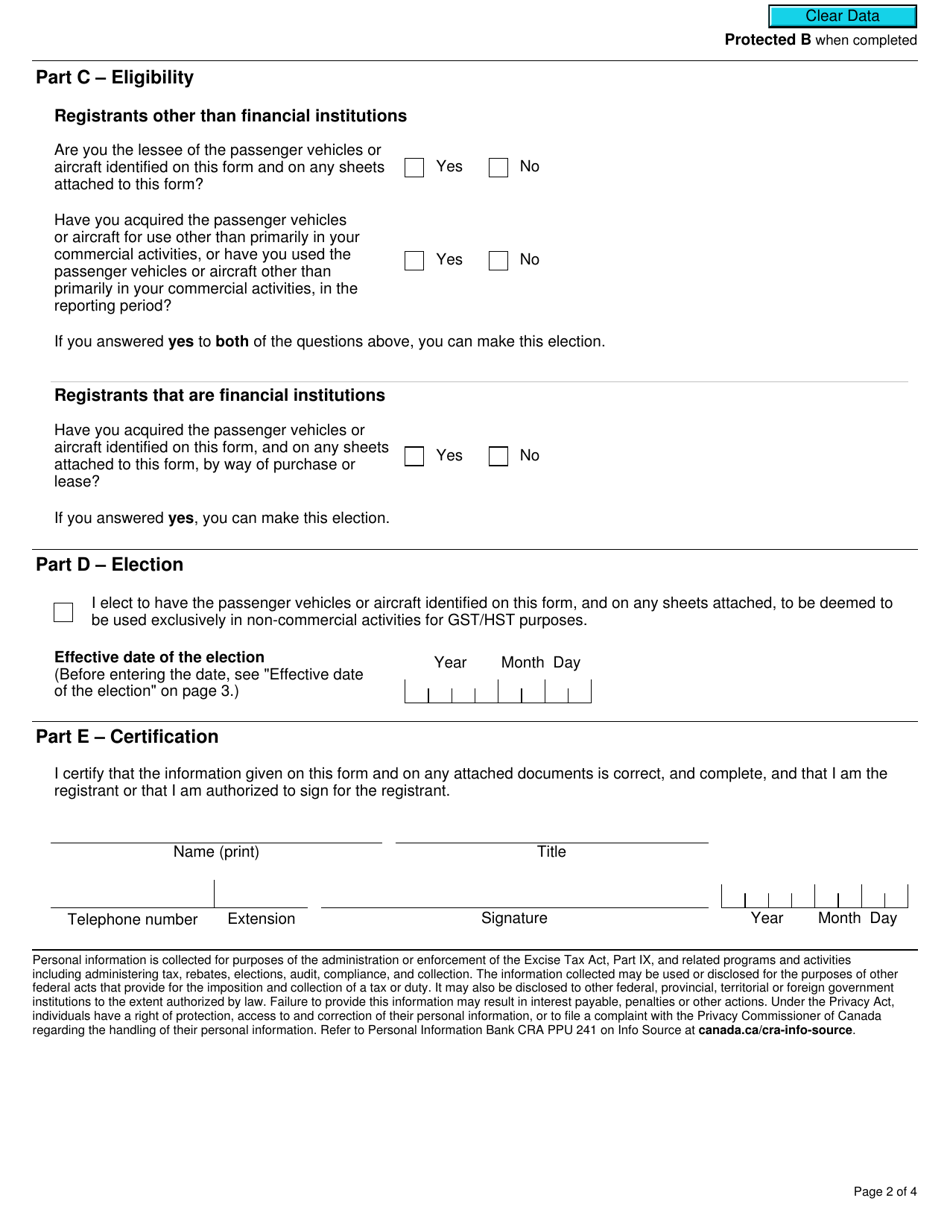

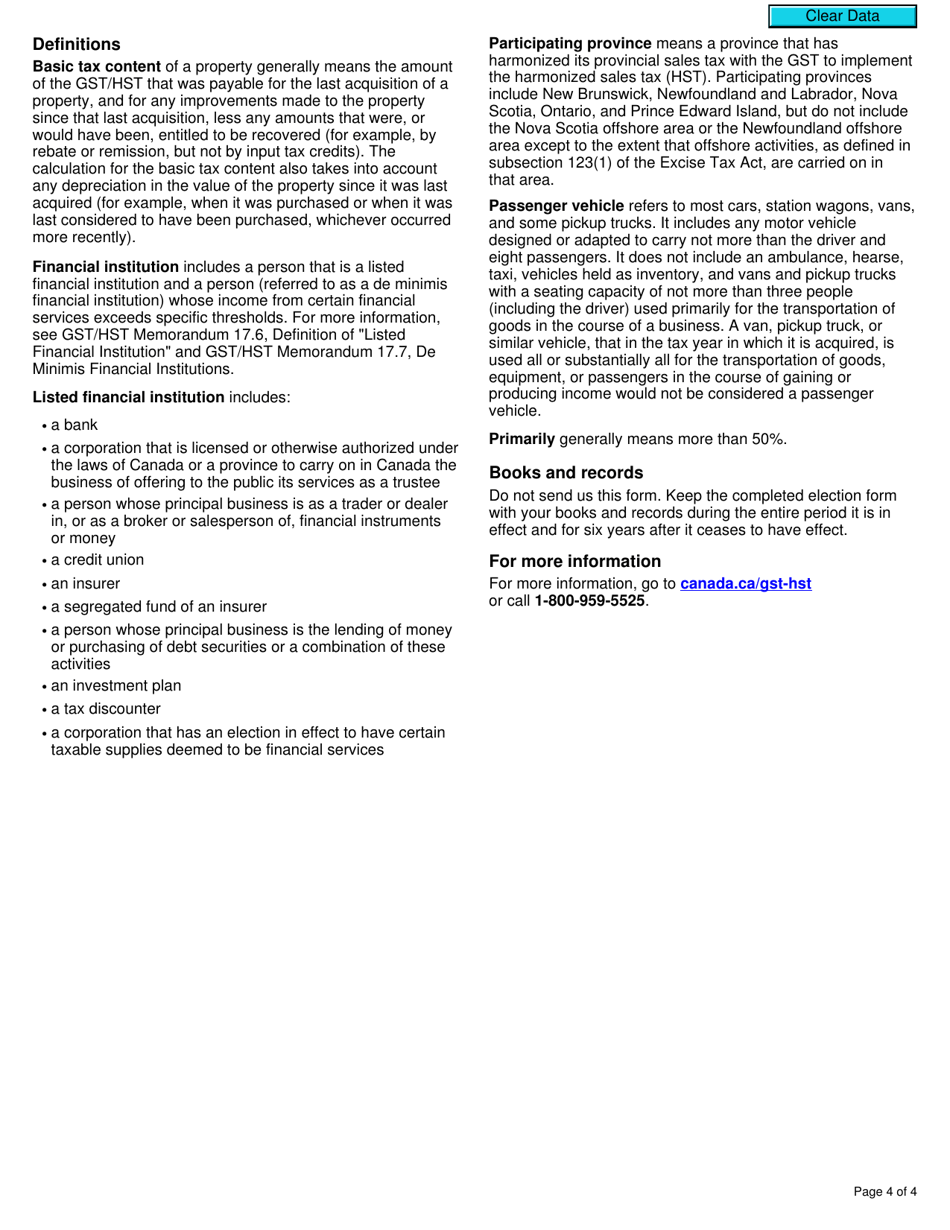

Form GST30 Election for Passenger Vehicles or Aircraft to Be Deemed to Be Used Exclusively in Non-commercial Activities in Canada is used to declare that a vehicle or aircraft will be used only for non-commercial purposes. This allows individuals or organizations to claim input tax credits for the GST/HST paid on the purchase or lease of these vehicles.

The form GST30 Election for passenger vehicles or aircraft to be deemed to be used exclusively in non-commercial activities in Canada is filed by the individual or organization that intends to use the vehicle or aircraft solely for non-commercial purposes.

Form GST30 Election for Passenger Vehicles or Aircraft to Be Deemed to Be Used Exclusively in Non-commercial Activities - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST30?

A: Form GST30 is a form used in Canada.

Q: What is the purpose of Form GST30?

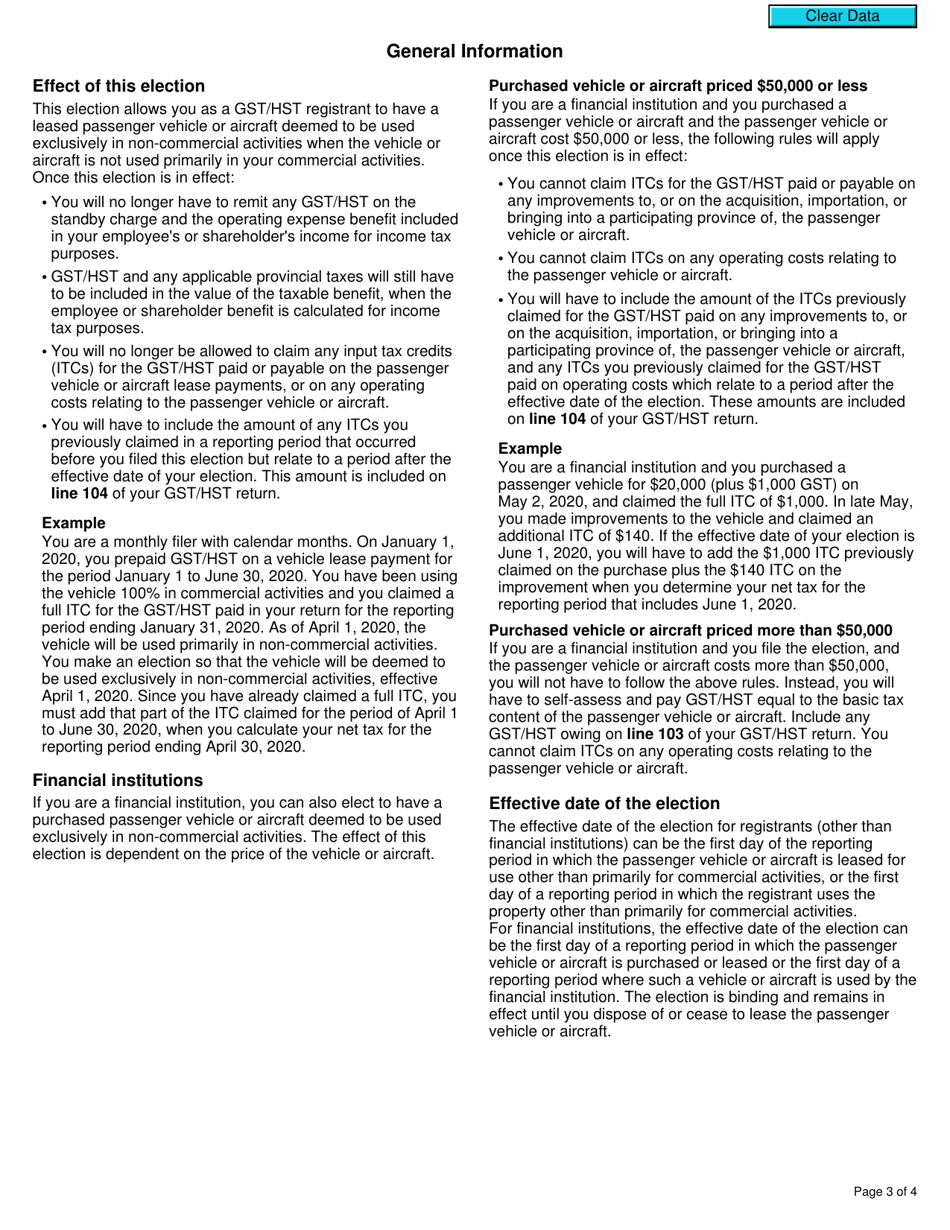

A: The purpose of Form GST30 is to elect that passenger vehicles or aircraft are used exclusively in non-commercial activities.

Q: What does it mean for a vehicle or aircraft to be deemed to be used exclusively in non-commercial activities?

A: It means that the vehicle or aircraft is used only for personal or non-profit purposes, and not for any commercial activities.

Q: Why would someone need to use Form GST30?

A: Someone would need to use Form GST30 if they want to declare that their vehicle or aircraft is used exclusively for non-commercial activities and is therefore exempt from certain taxes and regulations.

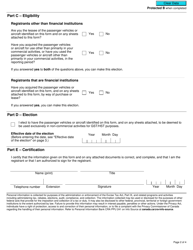

Q: Are there any eligibility requirements for using Form GST30?

A: Yes, there are eligibility requirements that must be met in order to use Form GST30. These requirements may vary depending on the specific circumstances and regulations.