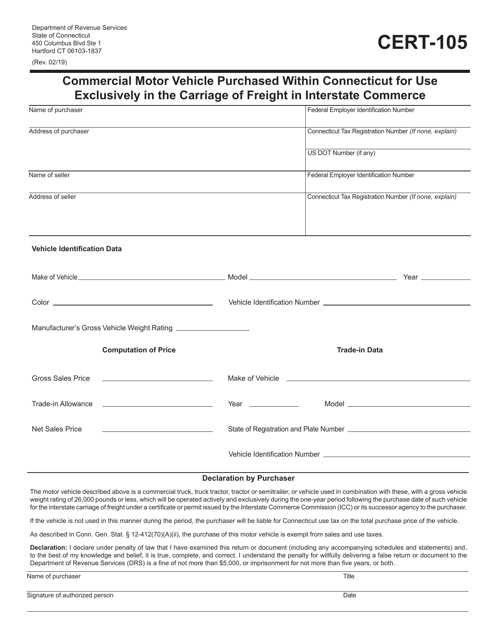

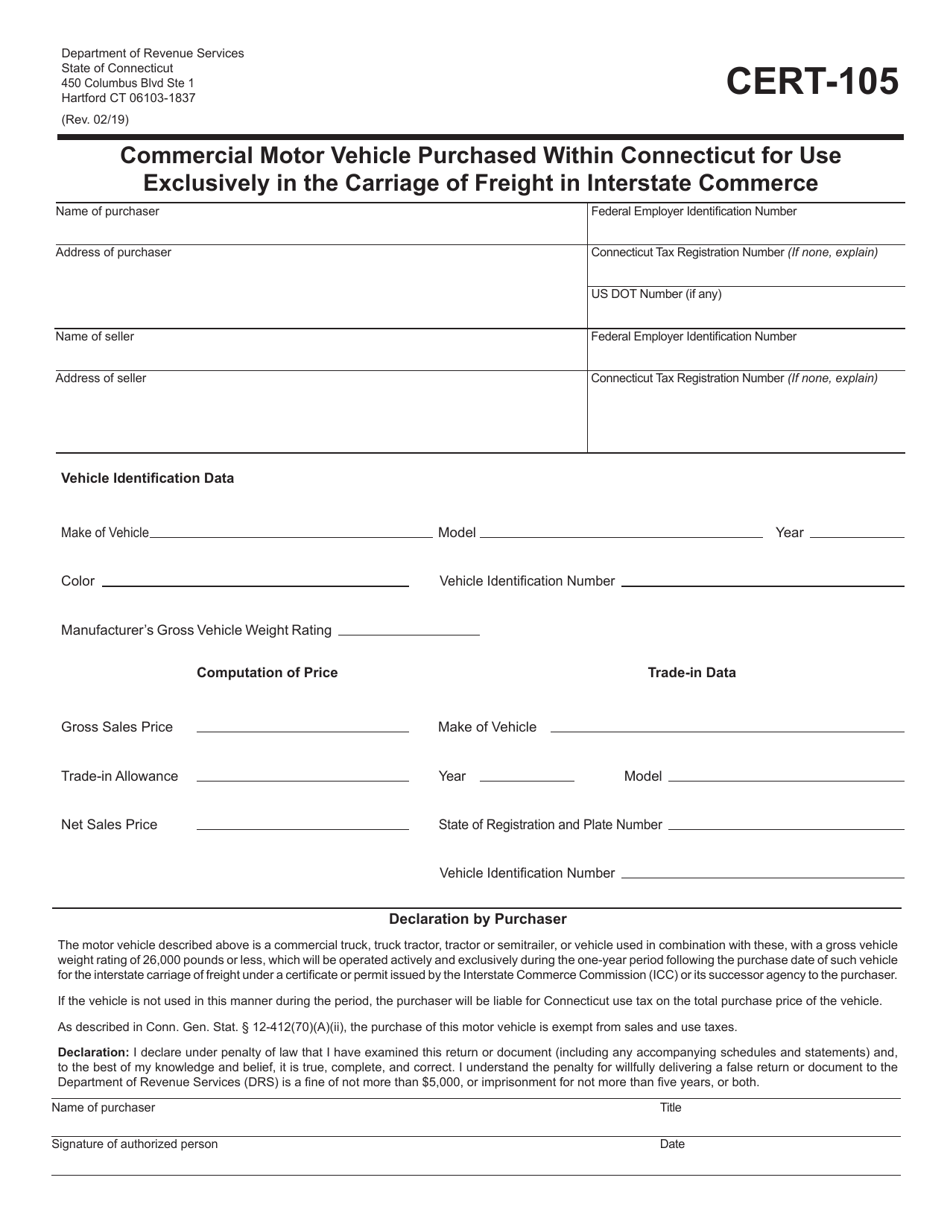

Form CERT-105 Commercial Motor Vehicle Purchased Within Connecticut for Use Exclusively in the Carriage of Freight in Interstate Commerce - Connecticut

What Is Form CERT-105?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CERT-105 form?

A: The CERT-105 form is a document related to the purchase of a commercial motor vehicle within Connecticut.

Q: What is the purpose of the CERT-105 form?

A: The purpose of the CERT-105 form is to certify that the commercial motor vehicle will be used exclusively for the carriage of freight in interstate commerce.

Q: Who needs to fill out the CERT-105 form?

A: The buyer of a commercial motor vehicle purchased within Connecticut for use exclusively in the carriage of freight in interstate commerce needs to fill out the CERT-105 form.

Q: Are there any fees associated with filing the CERT-105 form?

A: There are no fees associated with filing the CERT-105 form.

Q: Is it mandatory to file the CERT-105 form?

A: Yes, it is mandatory to file the CERT-105 form when purchasing a commercial motor vehicle within Connecticut for use exclusively in the carriage of freight in interstate commerce.

Q: What are the consequences of not filing the CERT-105 form?

A: Failure to file the CERT-105 form may result in penalties or fines.

Q: Is the CERT-105 form applicable only to Connecticut residents?

A: No, the CERT-105 form is applicable to anyone purchasing a commercial motor vehicle within Connecticut for use exclusively in the carriage of freight in interstate commerce.

Q: Can the CERT-105 form be used for other purposes?

A: No, the CERT-105 form is specifically for the purchase of a commercial motor vehicle within Connecticut for use exclusively in the carriage of freight in interstate commerce.

Q: What other documents may be required in addition to the CERT-105 form?

A: Additional documents, such as proof of payment of sales tax or proof of ownership, may be required in addition to the CERT-105 form.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-105 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.