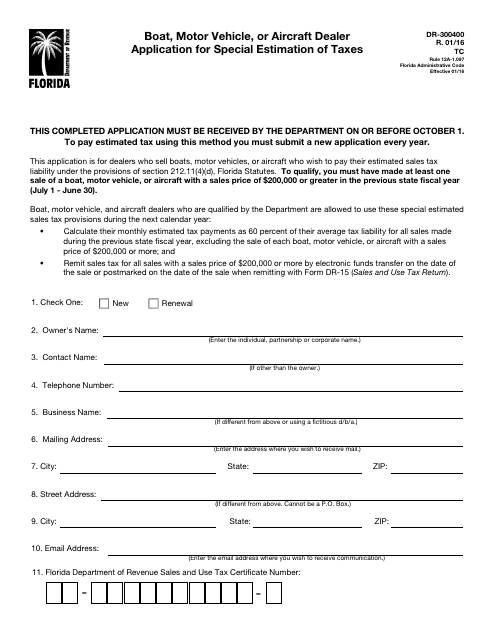

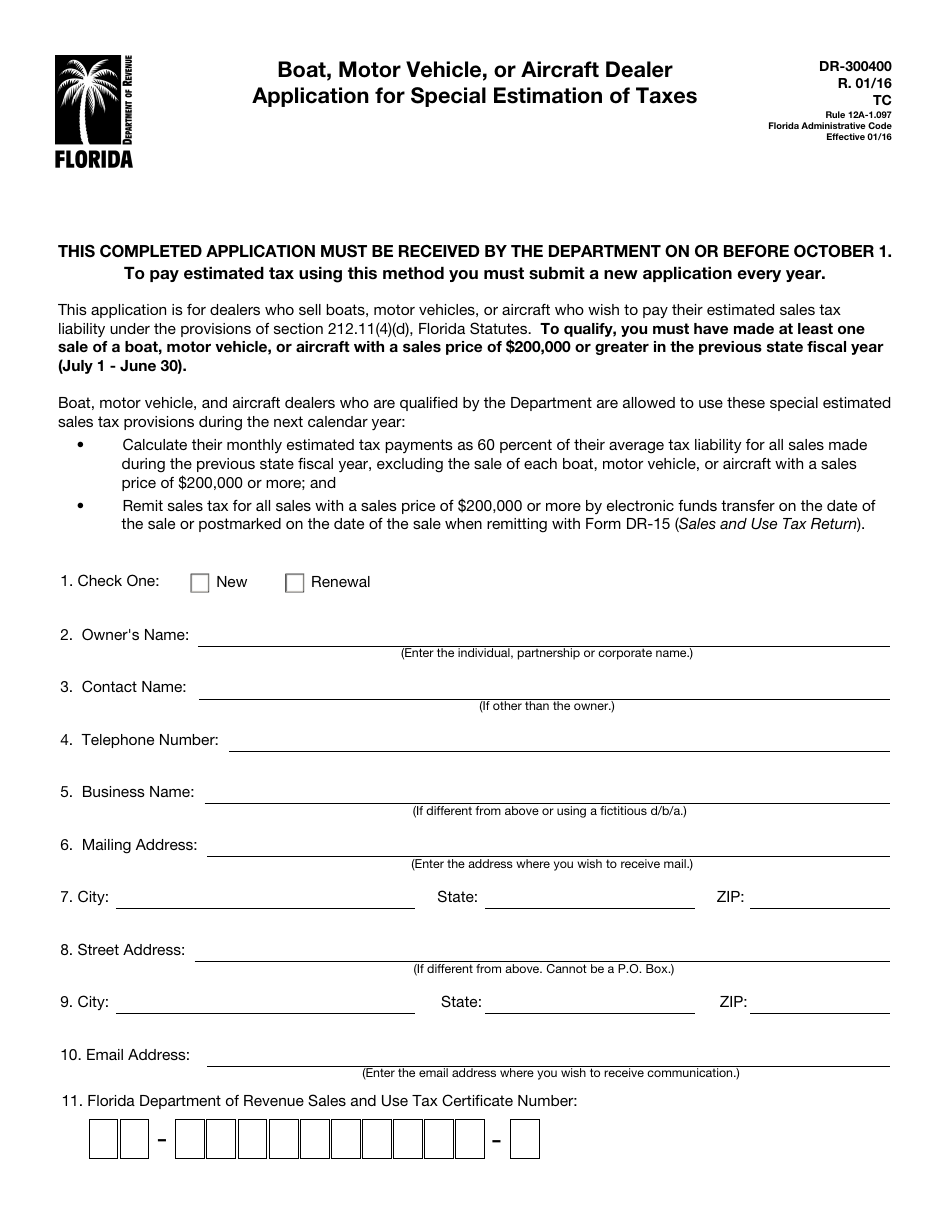

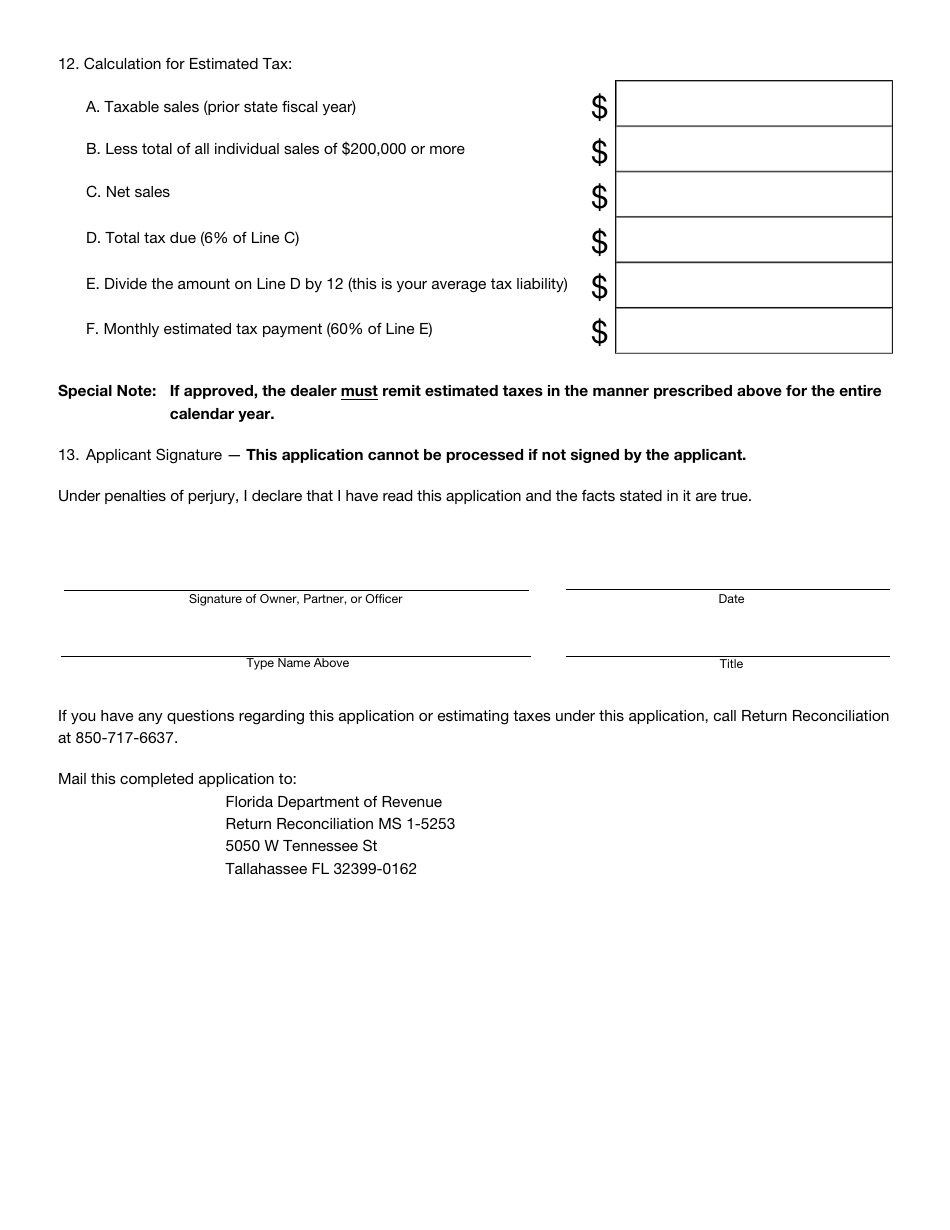

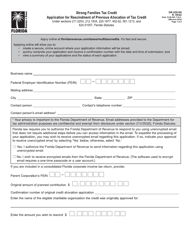

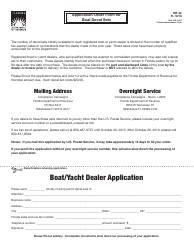

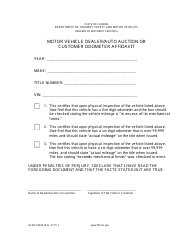

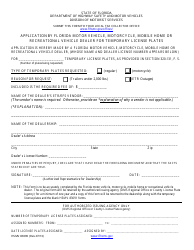

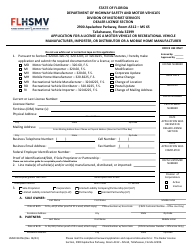

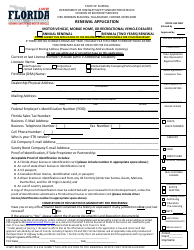

Form DR-300400 Boat, Motor Vehicle, or Aircraft Dealer Application for Special Estimation of Taxes - Florida

What Is Form DR-300400?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-300400?

A: Form DR-300400 is the Boat, Motor Vehicle, or Aircraft Dealer Application for Special Estimation of Taxes in Florida.

Q: Who needs to use Form DR-300400?

A: This form is used by boat, motor vehicle, or aircraft dealers in Florida who want to apply for special estimation of taxes.

Q: What is the purpose of Form DR-300400?

A: The purpose of Form DR-300400 is to allow dealers to apply for special estimation of taxes for their boat, motor vehicle, or aircraft sales in Florida.

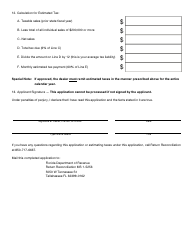

Q: What information do I need to provide on Form DR-300400?

A: You will need to provide your dealer information, vehicle details, estimated sales amount, and other relevant details as requested on the form.

Q: Are there any fees associated with Form DR-300400?

A: There may be certain fees associated with the special estimation of taxes, which will be outlined in the instructions for the form or provided by the Florida Department of Revenue.

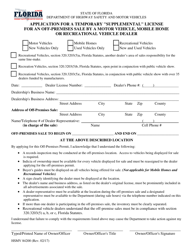

Q: When should I submit Form DR-300400?

A: You should submit Form DR-300400 prior to conducting any boat, motor vehicle, or aircraft sales in Florida, as it is used to estimate and report your tax liability.

Q: Is there a deadline for submitting Form DR-300400?

A: The specific deadline for submitting Form DR-300400 may vary, so it is important to check the instructions or contact the Florida Department of Revenue for the correct due date.

Q: What happens after I submit Form DR-300400?

A: After you submit Form DR-300400, the Florida Department of Revenue will review your application and provide you with further instructions or notifications regarding your special estimation of taxes.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-300400 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.