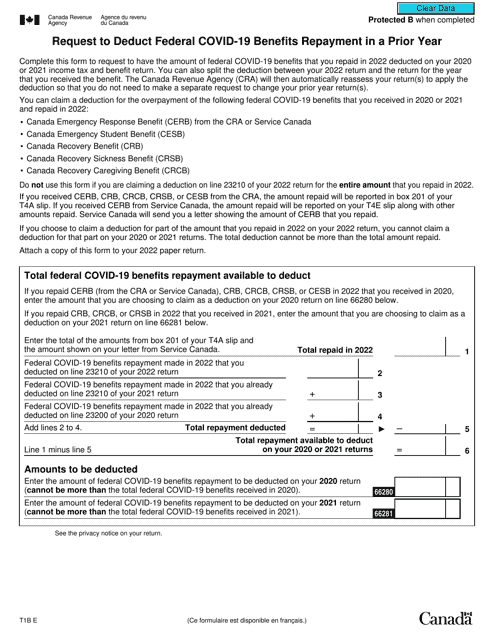

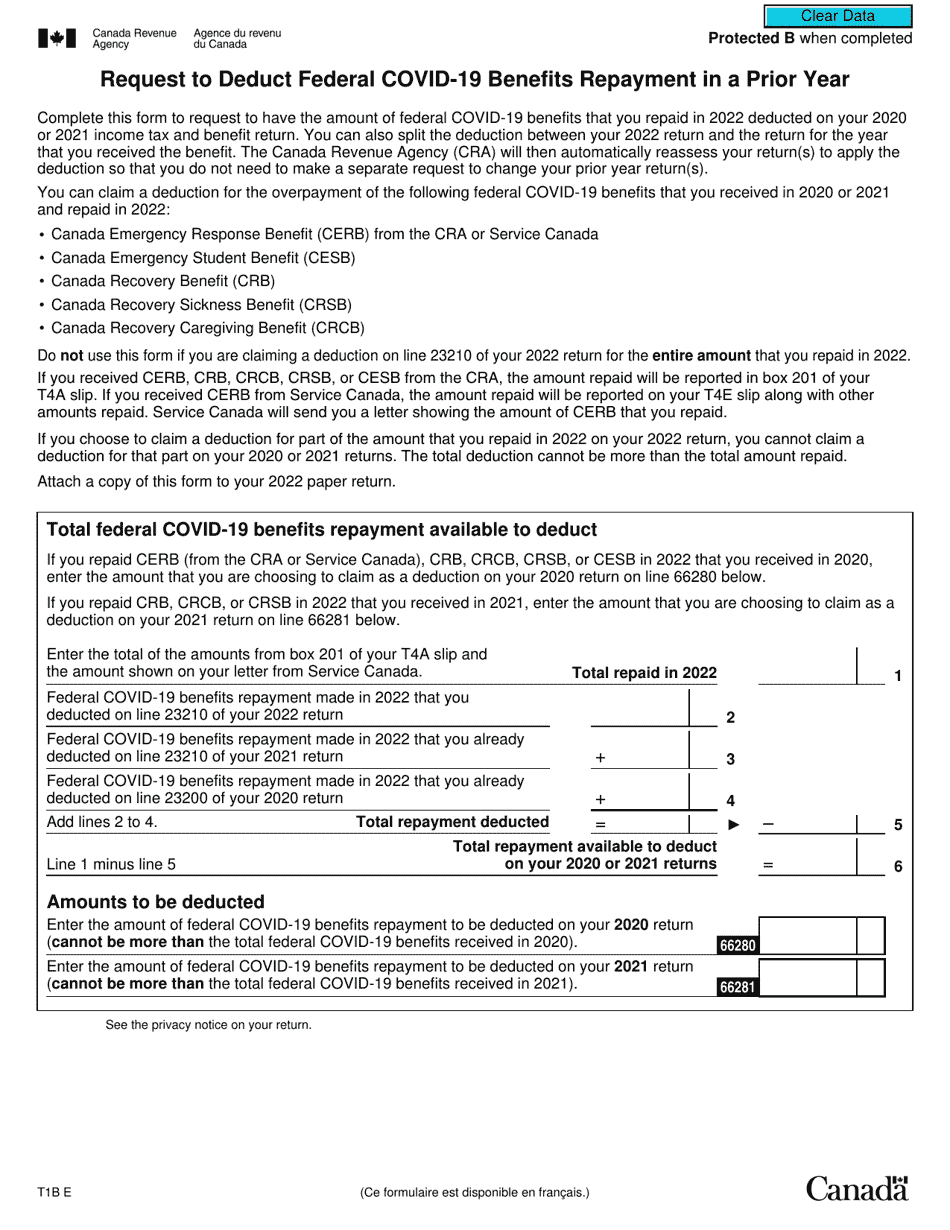

Form T1B Request to Deduct Federal Covid-19 Benefits Repayment in a Prior Year - Canada

Form T1B, Request to Deduct Federal Covid-19 Benefits Repayment in a Prior Year, is used in Canada to request the deduction of the repayment of Covid-19 benefits received in a previous tax year from your current year's tax return. It allows individuals to repay the Covid-19 benefits and reduce any tax owing for the year.

The taxpayer files the Form T1B request to deduct federal Covid-19 benefits repayment in a prior year in Canada.

FAQ

Q: What is Form T1B used for?

A: Form T1B is used to request a deduction for the repayment of federal Covid-19 benefits in a prior year.

Q: Who can use Form T1B?

A: Individuals who have repaid federal Covid-19 benefits can use Form T1B to request a deduction.

Q: What are federal Covid-19 benefits?

A: Federal Covid-19 benefits refer to the various financial support programs provided by the government during the Covid-19 pandemic, such as the Canada Emergency Response Benefit (CERB).

Q: Is Form T1B specific to Canada?

A: Yes, Form T1B is specific to Canada and is used for requesting deductions related to federal Covid-19 benefits repayment in a prior year.

Q: When should I submit Form T1B?

A: You should submit Form T1B as soon as possible after repaying federal Covid-19 benefits to ensure accurate tax filing for the relevant year.

Q: Is there a deadline for submitting Form T1B?

A: There is no specific deadline mentioned for submitting Form T1B, but it is recommended to submit it in a timely manner.

Q: What happens after I submit Form T1B?

A: After you submit Form T1B, the CRA will review your request and determine if you are eligible for the deduction. You will receive a notice of assessment with the outcome.

Q: Do I need to provide supporting documents with Form T1B?

A: It is not explicitly mentioned whether supporting documents are required with Form T1B. However, it is advisable to keep all relevant documents related to the repayment of federal Covid-19 benefits for future reference.

Q: Can I e-file Form T1B?

A: As of now, Form T1B cannot be e-filed. It must be submitted by mail or fax to the CRA.