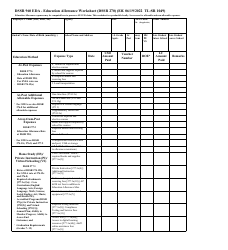

Housing Allowance Worksheet - Clergy Financial Resources

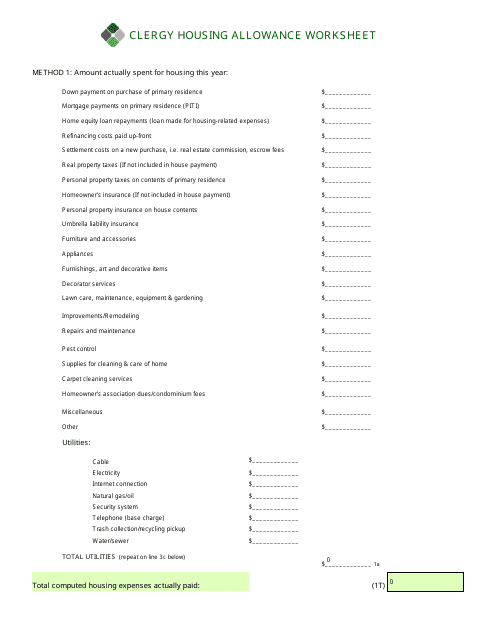

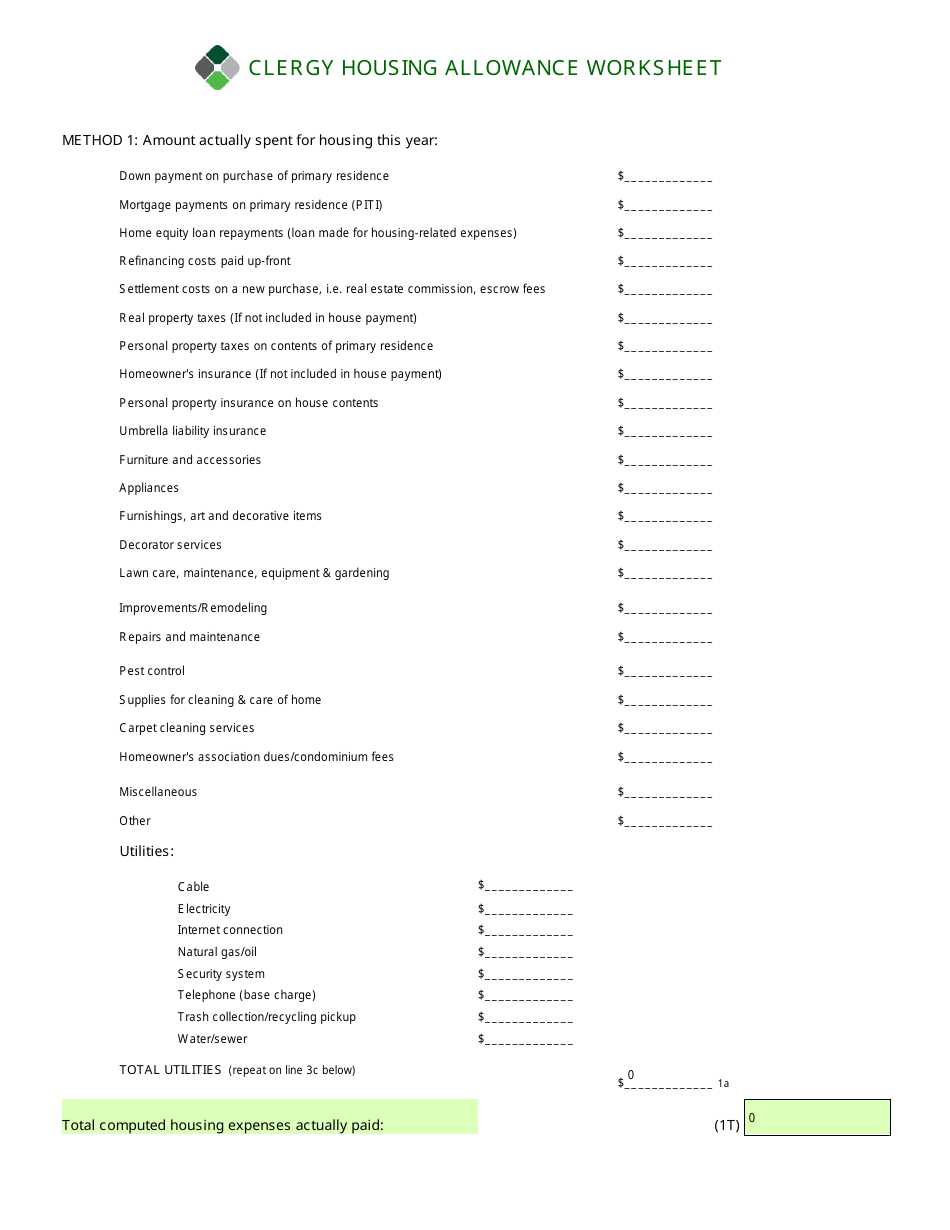

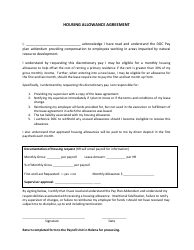

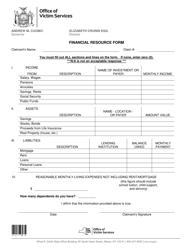

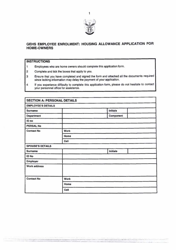

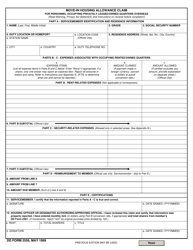

The Housing Allowance Worksheet - Clergy Financial Resources is used by clergy members to calculate their housing allowance, which is a tax benefit for ordained ministers in the United States.

The housing allowance worksheet is typically filed by clergy members themselves.

FAQ

Q: What is a housing allowance?

A: A housing allowance is a specific amount of money designated for housing expenses that is provided to clergy members as part of their employment.

Q: Who can receive a housing allowance?

A: Clergy members, including ministers, pastors, priests, and other religious leaders, can receive a housing allowance.

Q: How is the amount of housing allowance determined?

A: The amount of housing allowance is typically determined by the employing church or religious organization, based on factors such as the clergy member's job responsibilities and the local housing market.

Q: Is a housing allowance taxable?

A: No, a housing allowance is not subject to federal income tax, as long as it is used for qualified housing expenses.

Q: What are qualified housing expenses?

A: Qualified housing expenses include rent or mortgage payments, utilities, repairs, and other costs directly related to housing.

Q: Can a housing allowance be used for other expenses?

A: No, a housing allowance can only be used for qualified housing expenses and cannot be used for other personal expenses.

Q: Is there a limit on the amount of housing allowance that can be received?

A: There is no specific limit on the amount of housing allowance a clergy member can receive, but it must be considered reasonable.

Q: Do clergy members need to keep records of housing expenses?

A: Yes, clergy members should keep records and receipts of their housing expenses to ensure compliance with tax regulations.

Q: Is a housing allowance available in Canada?

A: No, the concept of a housing allowance is primarily applicable to clergy members in the United States. Canadian tax laws may have different provisions for housing expenses.

Q: Are there any restrictions on using a housing allowance?

A: Yes, a housing allowance cannot exceed the actual housing expenses incurred by the clergy member, and it cannot be used for the purpose of making a profit.