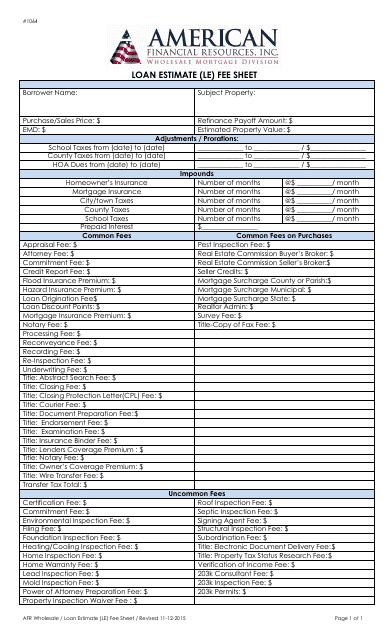

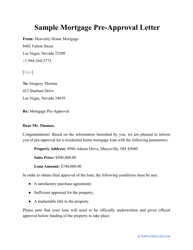

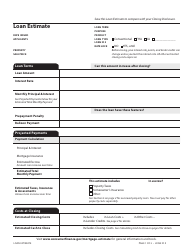

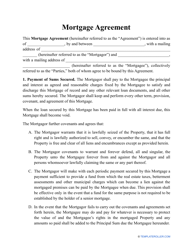

Loan Estimate (Le) Fee Sheet - American Financial Resources, Inc.

The Loan Estimate (LE) Fee Sheet from American Financial Resources, Inc. provides information about the estimated fees and costs associated with obtaining a loan from them. It helps borrowers understand the potential expenses involved in the loan process.

FAQ

Q: What is a Loan Estimate (LE) fee sheet?

A: A Loan Estimate (LE) fee sheet is a document that provides detailed information about the costs associated with obtaining a mortgage loan.

Q: What information does a Loan Estimate (LE) fee sheet include?

A: A Loan Estimate (LE) fee sheet includes information about the loan amount, interest rate, closing costs, and other fees associated with the mortgage loan.

Q: Why is a Loan Estimate (LE) fee sheet important?

A: A Loan Estimate (LE) fee sheet is important because it helps borrowers understand and compare the costs associated with different mortgage loan offers.

Q: Who provides the Loan Estimate (LE) fee sheet?

A: The Loan Estimate (LE) fee sheet is typically provided by the lender or mortgage broker.

Q: Can the costs listed on the Loan Estimate (LE) fee sheet change?

A: Yes, the costs listed on the Loan Estimate (LE) fee sheet can change, but only under certain circumstances outlined by the Consumer Financial Protection Bureau (CFPB).

Q: When should I receive a Loan Estimate (LE) fee sheet?

A: According to the CFPB, you should receive a Loan Estimate (LE) fee sheet within three business days of applying for a mortgage loan.

Q: Are there any fees associated with obtaining a Loan Estimate (LE) fee sheet?

A: No, lenders are not allowed to charge any fees for providing a Loan Estimate (LE) fee sheet. The purpose of this document is to give borrowers an estimate of the costs, not to generate revenue for the lender.

Q: Can I shop around for a mortgage loan after receiving a Loan Estimate (LE) fee sheet?

A: Yes, you are encouraged to shop around and compare mortgage loan offers after receiving a Loan Estimate (LE) fee sheet. This can help you find the best loan terms and costs for your specific situation.