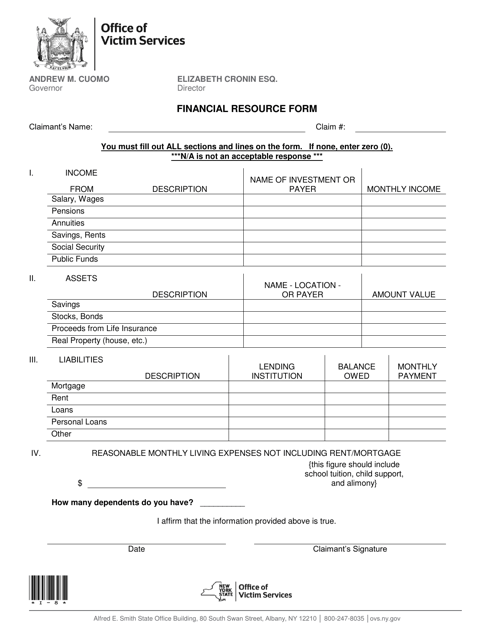

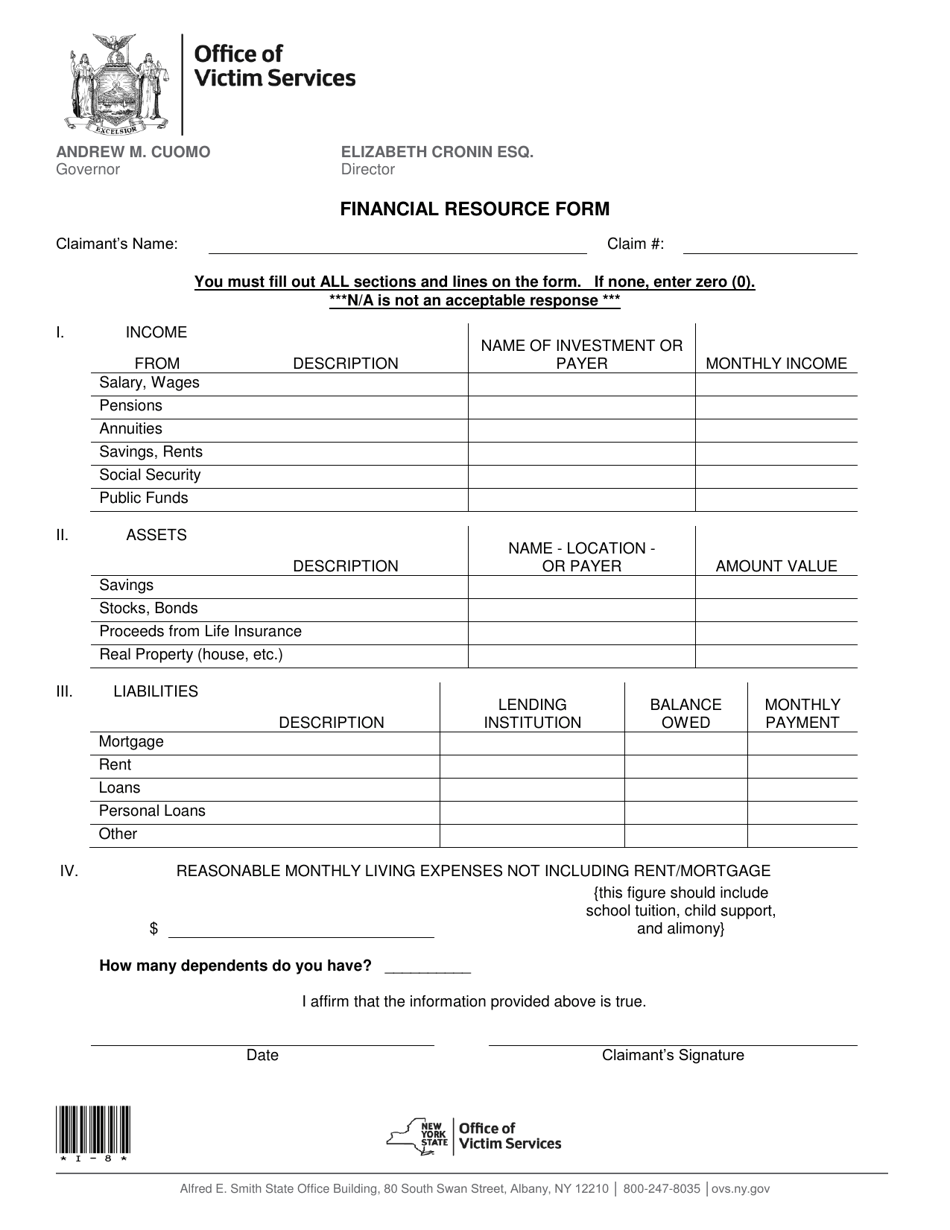

Form I-8 Financial Resource Form - New York

What Is Form I-8?

This is a legal form that was released by the New York State Office of Victim Services - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-8?

A: Form I-8 is a financial resource form.

Q: What is the purpose of Form I-8?

A: The purpose of Form I-8 is to provide information about an individual's financial resources.

Q: Who is required to fill out Form I-8?

A: Individuals who are applying for certain benefits or services may be required to fill out Form I-8.

Q: What information is required on Form I-8?

A: Form I-8 requires information about the individual's income, assets, and liabilities.

Q: Is there a fee to file Form I-8?

A: There is usually no fee to file Form I-8, but check the instructions for any specific filing requirements and associated fees.

Q: What happens after I submit Form I-8?

A: After submitting Form I-8, the agency will review the information provided to determine eligibility for the requested benefits or services.

Q: Are there any penalties for providing false information on Form I-8?

A: Yes, providing false information on Form I-8 can result in penalties, including fines and potential legal consequences.

Q: Can I get help filling out Form I-8?

A: Yes, you can seek assistance from the agency or a professional to help you fill out Form I-8 correctly.

Form Details:

- The latest edition provided by the New York State Office of Victim Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-8 by clicking the link below or browse more documents and templates provided by the New York State Office of Victim Services.