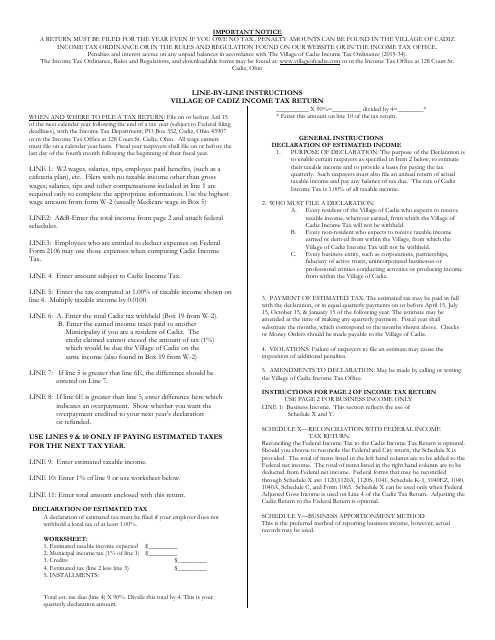

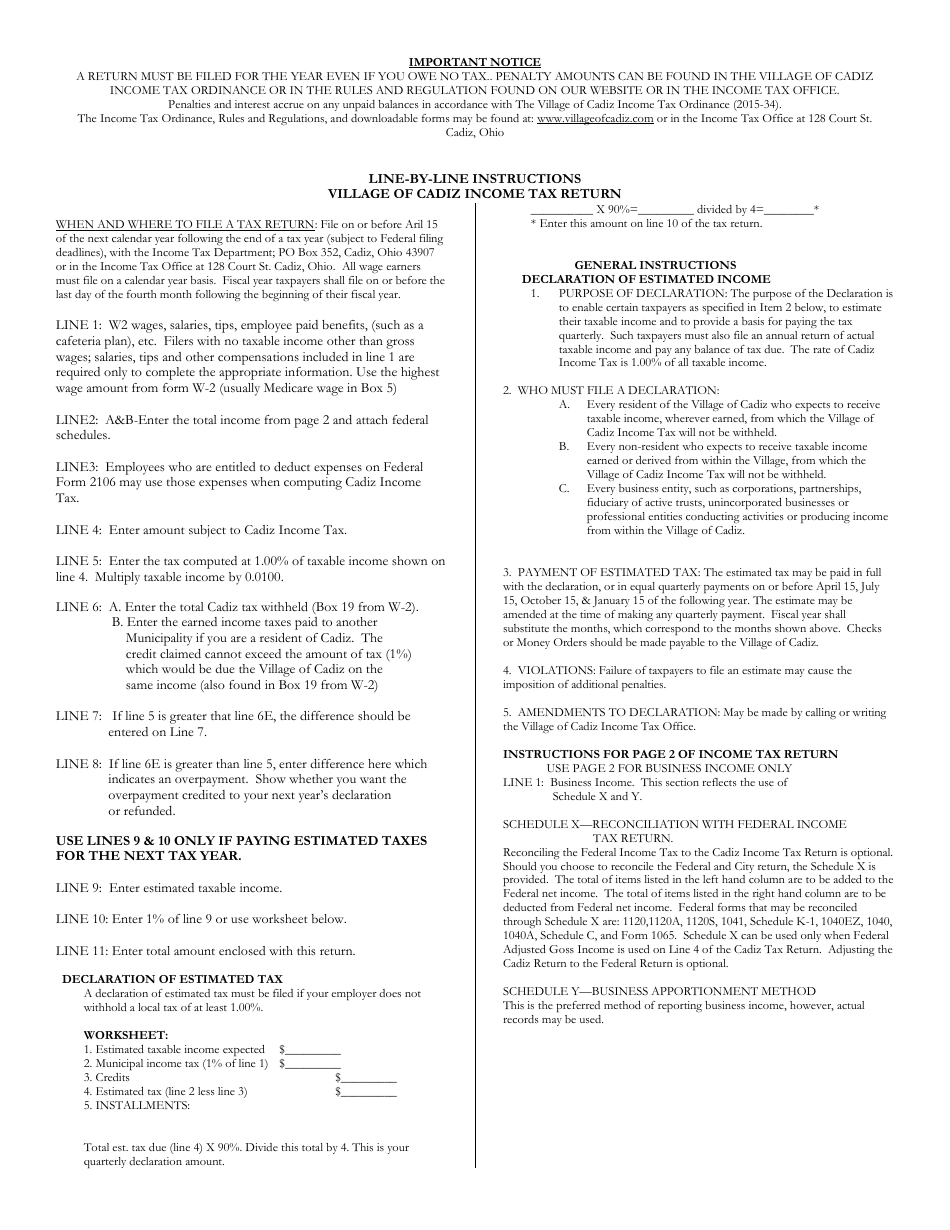

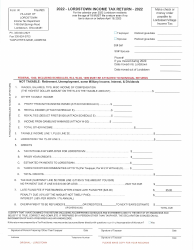

Instructions for Village of Cadiz Income Tax Return - Village of Cadiz, Ohio

This document was released by Ohio Department of Taxation and contains the most recent official instructions for Village of Cadiz Income Tax Return .

FAQ

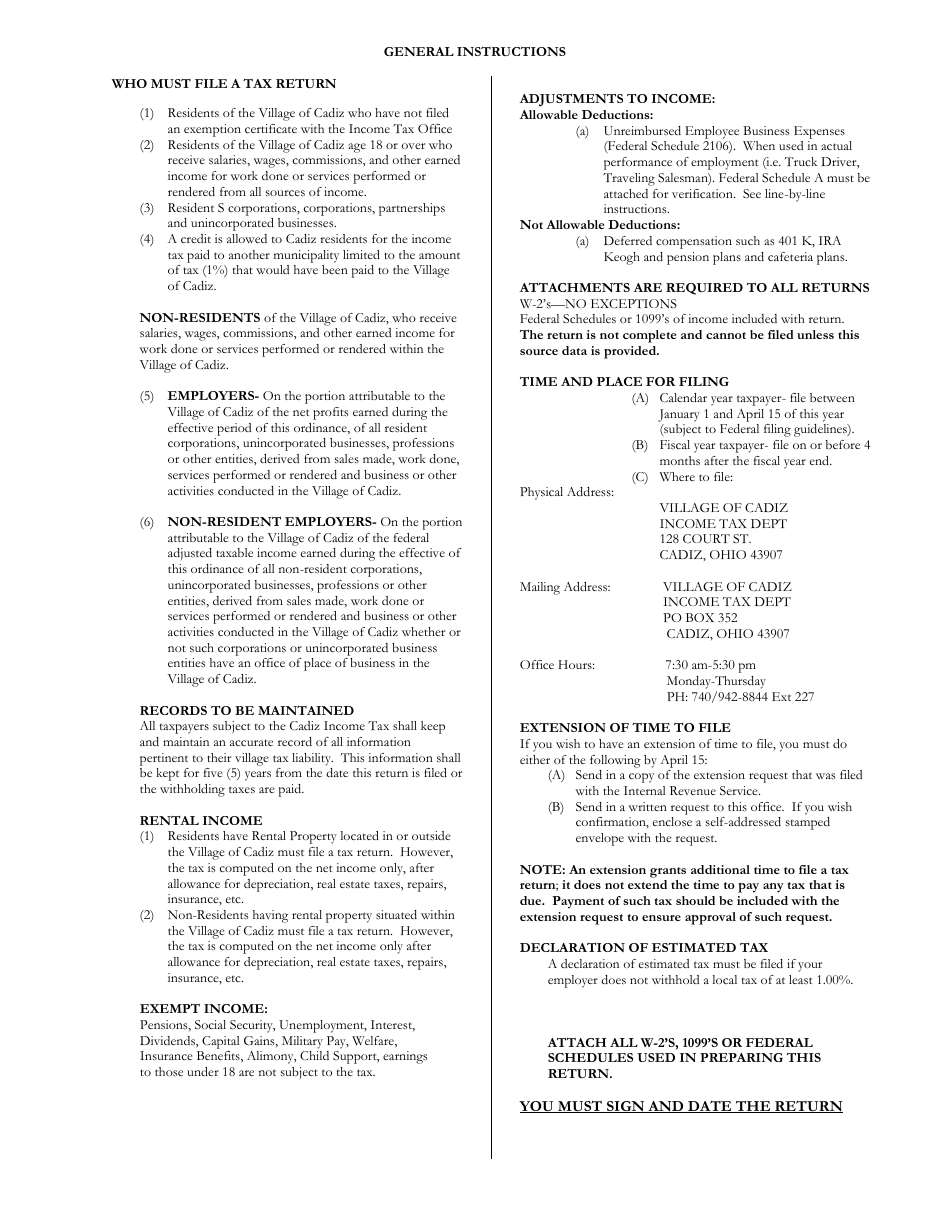

Q: Who needs to file the Village of Cadiz Income Tax Return?

A: All residents of the Village of Cadiz, Ohio who have income are required to file a tax return.

Q: What is the deadline for filing the Village of Cadiz Income Tax Return?

A: The deadline for filing the tax return is April 15th.

Q: What if I can't file my tax return by the deadline?

A: You can file for an extension, but any taxes owed must still be paid by April 15th to avoid penalties.

Q: Are there any deductions or credits available on the Village of Cadiz Income Tax Return?

A: Yes, there are various deductions and credits available, such as the standard deduction and the Earned Income Credit. Consult the instructions for more information.

Q: Do I need to include my federal income tax return with the Village of Cadiz Income Tax Return?

A: No, you do not need to include your federal income tax return. Only include the necessary forms and schedules for the Village of Cadiz.

Q: What if I have questions or need assistance with my tax return?

A: You can contact the Village of Cadiz Tax Department for assistance or consult a tax professional.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Ohio Department of Taxation.