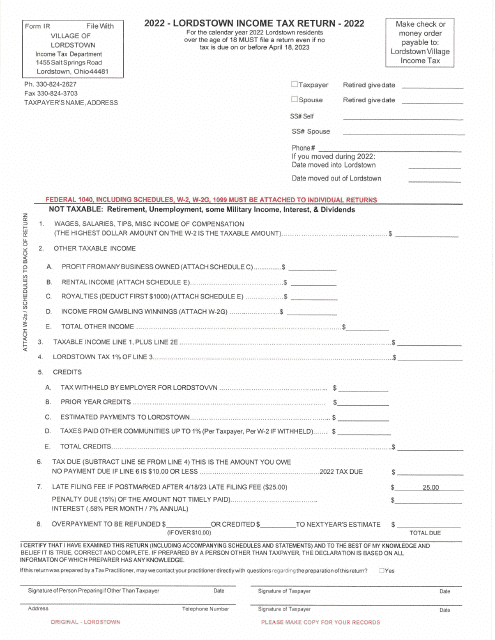

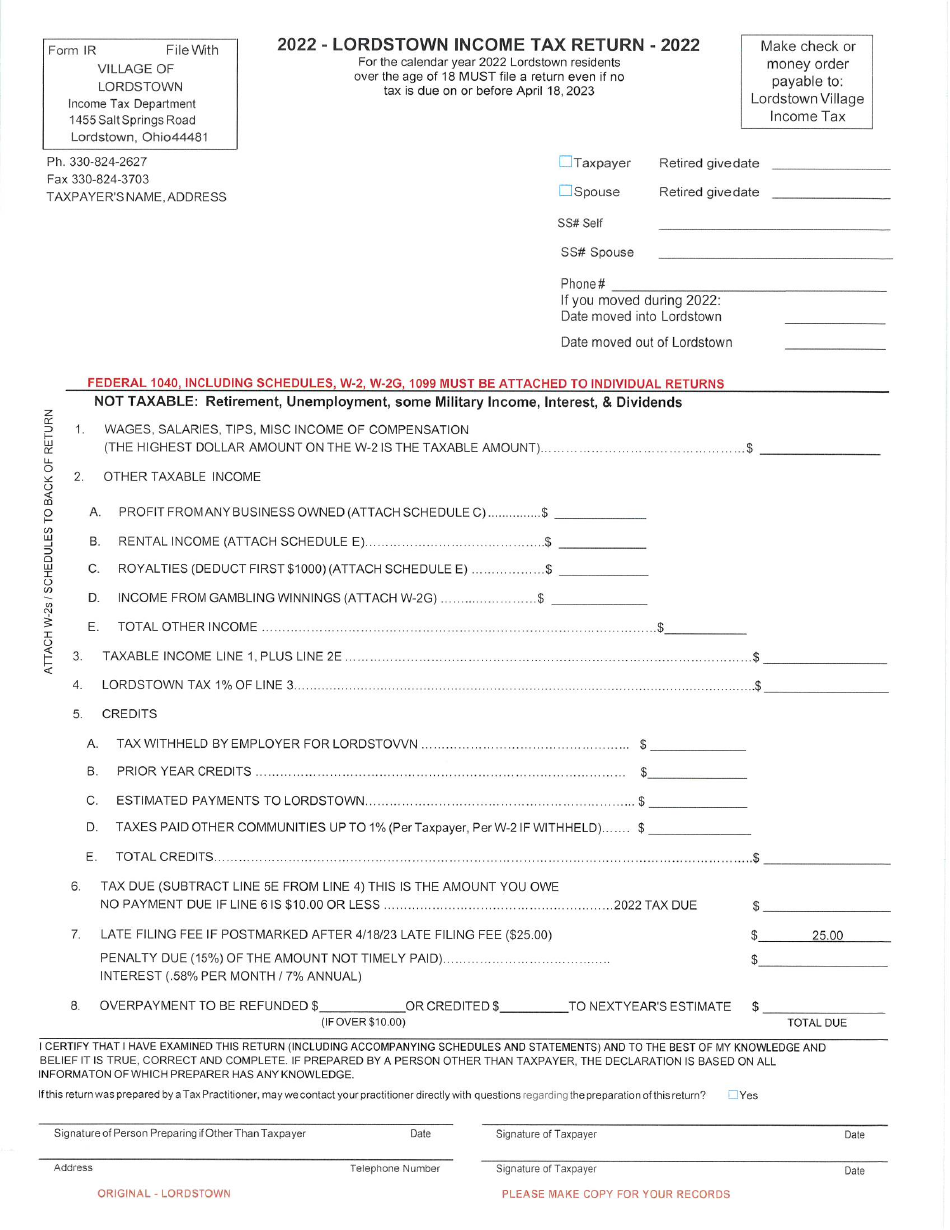

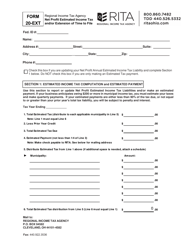

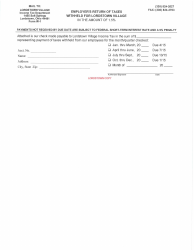

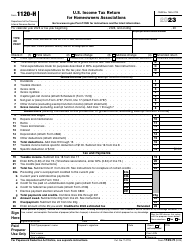

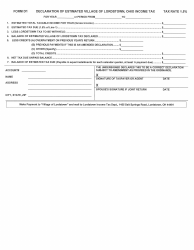

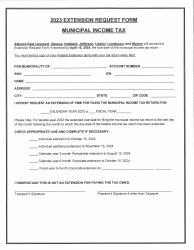

Income Tax Return - Village of Lordstown, Ohio

Income Tax Return is a legal document that was released by the Tax Department - Village of Lordstown, Ohio - a government authority operating within Ohio. The form may be used strictly within Village of Lordstown.

FAQ

Q: What is the deadline for filing income tax return in Lordstown, Ohio?

A: The deadline for filing income tax return in Lordstown, Ohio is usually April 15th, or the next business day if it falls on a weekend or holiday.

Q: What is the income tax rate in the Village of Lordstown, Ohio?

A: The income tax rate in the Village of Lordstown, Ohio is 1% for residents and 0.5% for non-residents.

Q: Do I need to file an income tax return if I live in Lordstown, Ohio but work outside the Village?

A: Yes, if you are a Lordstown resident and work outside the Village, you still need to file an income tax return and report your non-Village income.

Q: Are there any exemptions or deductions available for income tax in Lordstown, Ohio?

A: Yes, there are various exemptions and deductions available for income tax in Lordstown, Ohio. You can contact the Village's income tax department for more information.

Form Details:

- The latest edition currently provided by the Tax Department - Village of Lordstown, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Department - Village of Lordstown, Ohio.