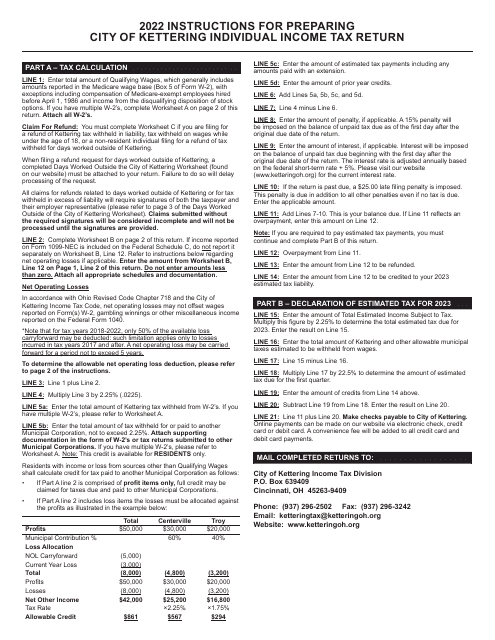

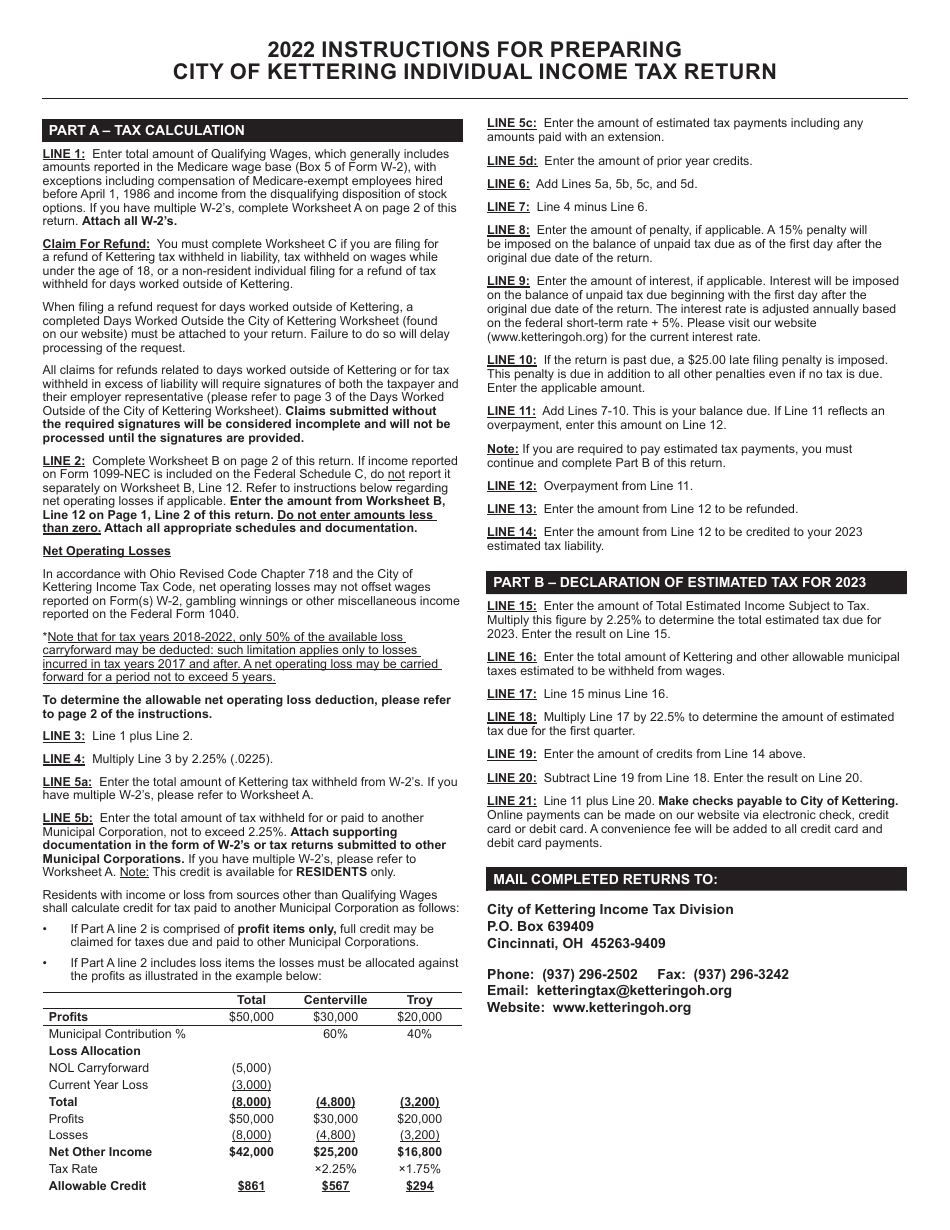

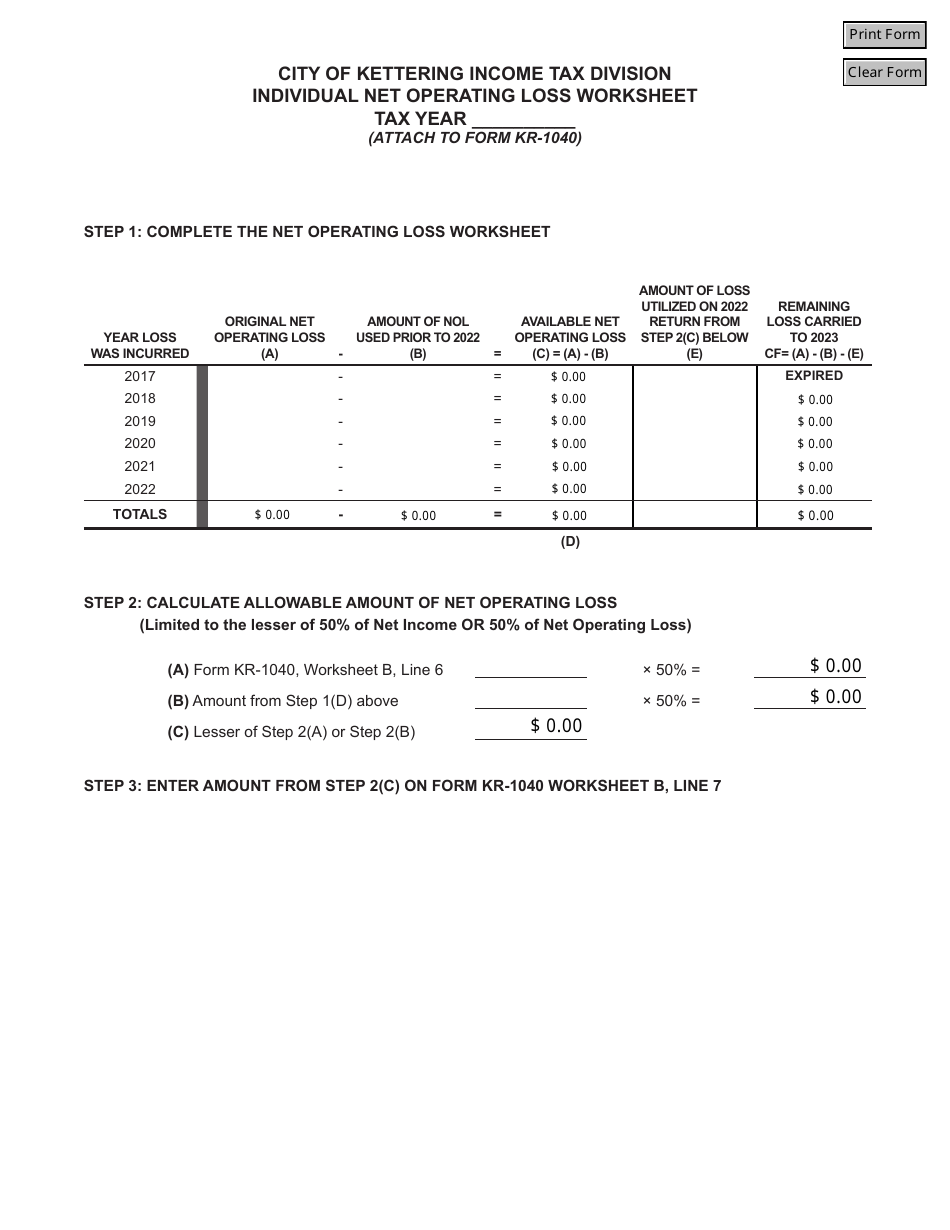

Instructions for Form KR-1040 Individual Income Tax Return - City of Kettering, Ohio

This document contains official instructions for Form KR-1040 , Individual Income Tax Return - a form released and collected by the Income Tax Division - City of Kettering, Ohio. An up-to-date fillable Form KR-1040 is available for download through this link.

FAQ

Q: What is Form KR-1040?

A: Form KR-1040 is the Individual Income Tax Return specific to the City of Kettering, Ohio.

Q: Who needs to file Form KR-1040?

A: Residents of Kettering, Ohio who have taxable income need to file Form KR-1040.

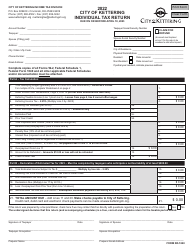

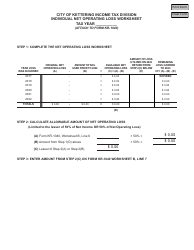

Q: What information is required on Form KR-1040?

A: Form KR-1040 requires information about your income, deductions, and credits.

Q: When is the deadline to file Form KR-1040?

A: The deadline to file Form KR-1040 is typically April 15th, unless it falls on a weekend or holiday, in which case it is extended to the next business day.

Q: What happens if I don't file Form KR-1040?

A: If you are required to file Form KR-1040 and fail to do so, you may face penalties and interest on any unpaid taxes.

Q: Can I file Form KR-1040 electronically?

A: Yes, the City of Kettering, Ohio provides an electronic filing option for Form KR-1040.

Q: Can I claim deductions and credits on Form KR-1040?

A: Yes, you can claim deductions and credits on Form KR-1040, similar to the federal income tax return.

Q: Are there any special rules or regulations specific to Form KR-1040?

A: Form KR-1040 follows the tax laws and regulations specific to the City of Kettering, Ohio, which may differ from federal tax laws.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Division - City of Kettering, Ohio.