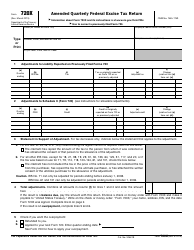

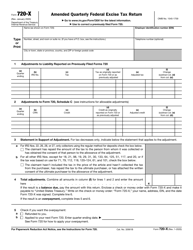

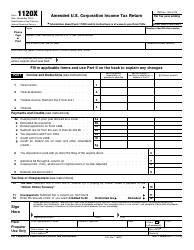

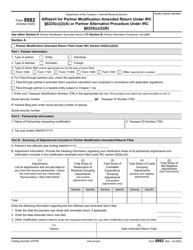

This version of the form is not currently in use and is provided for reference only. Download this version of

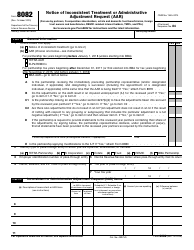

IRS Form 1065X

for the current year.

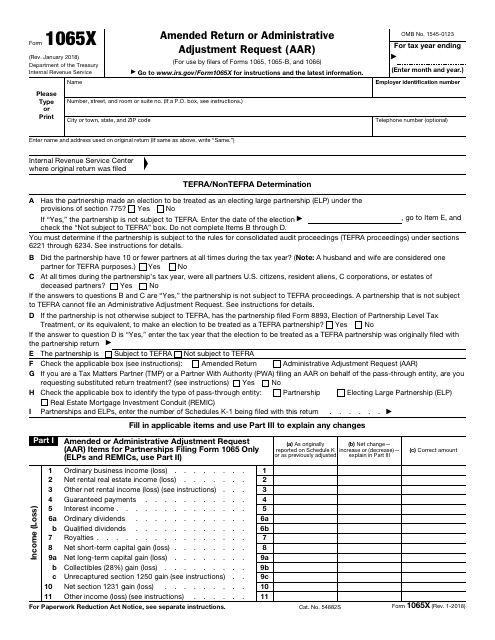

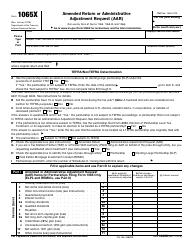

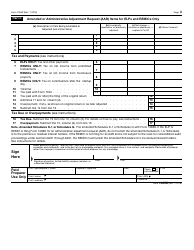

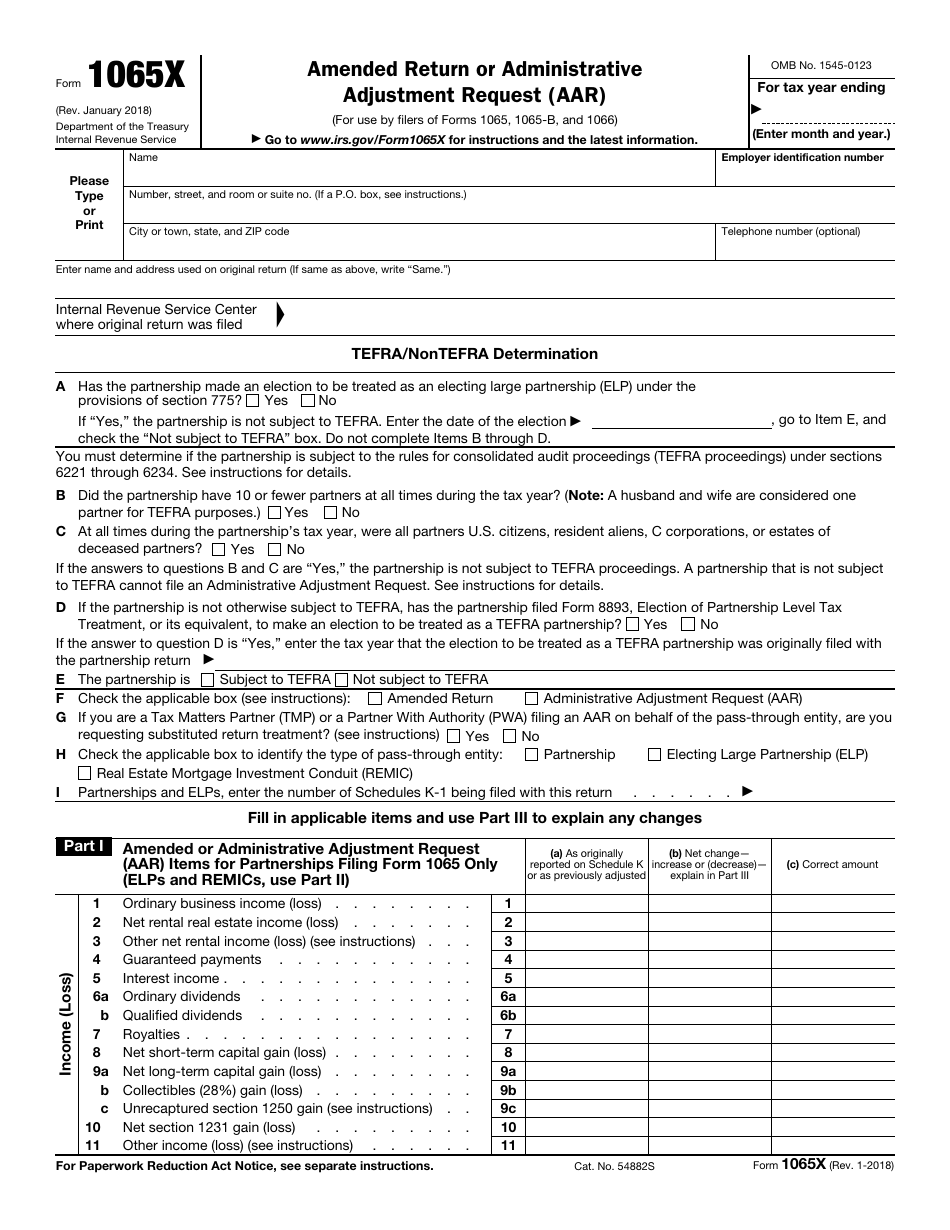

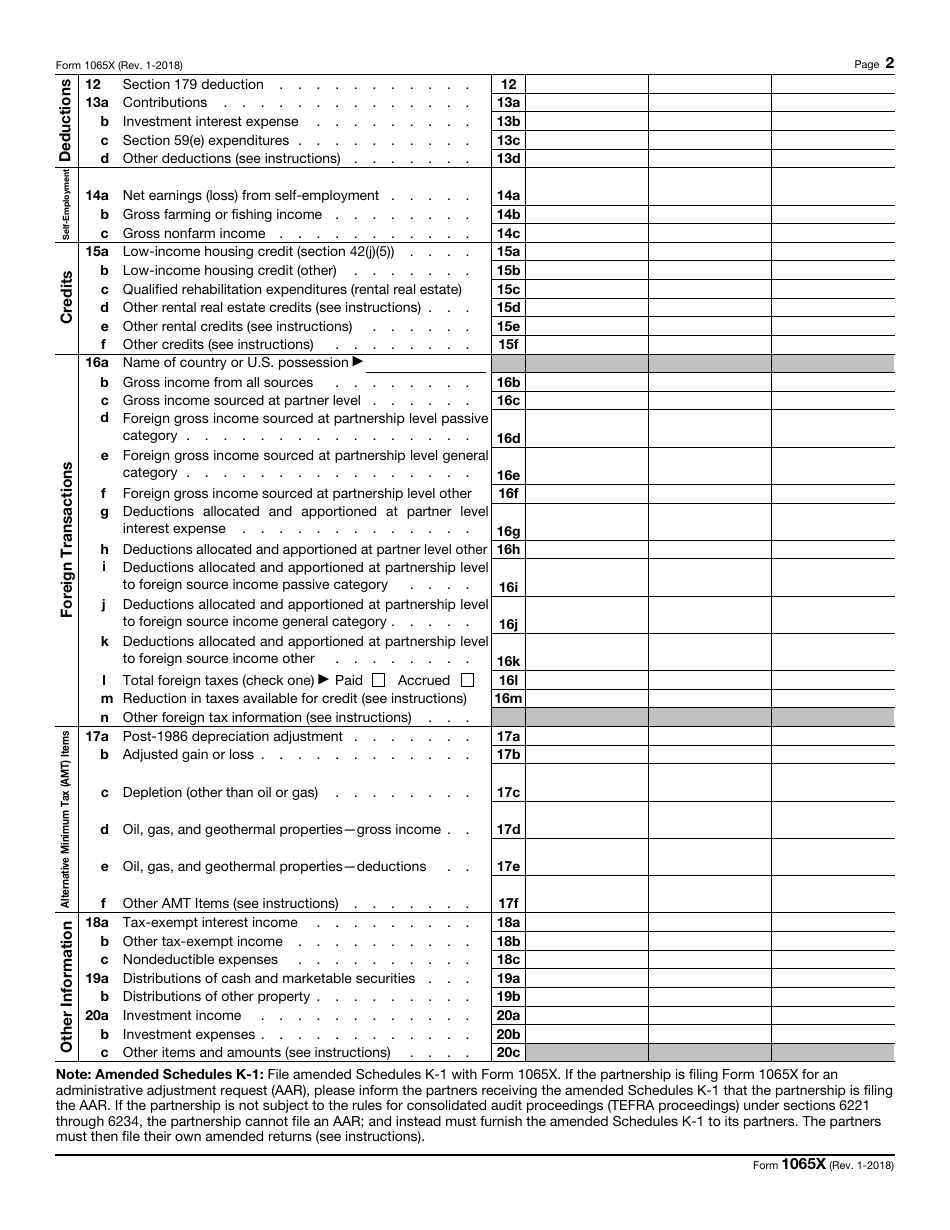

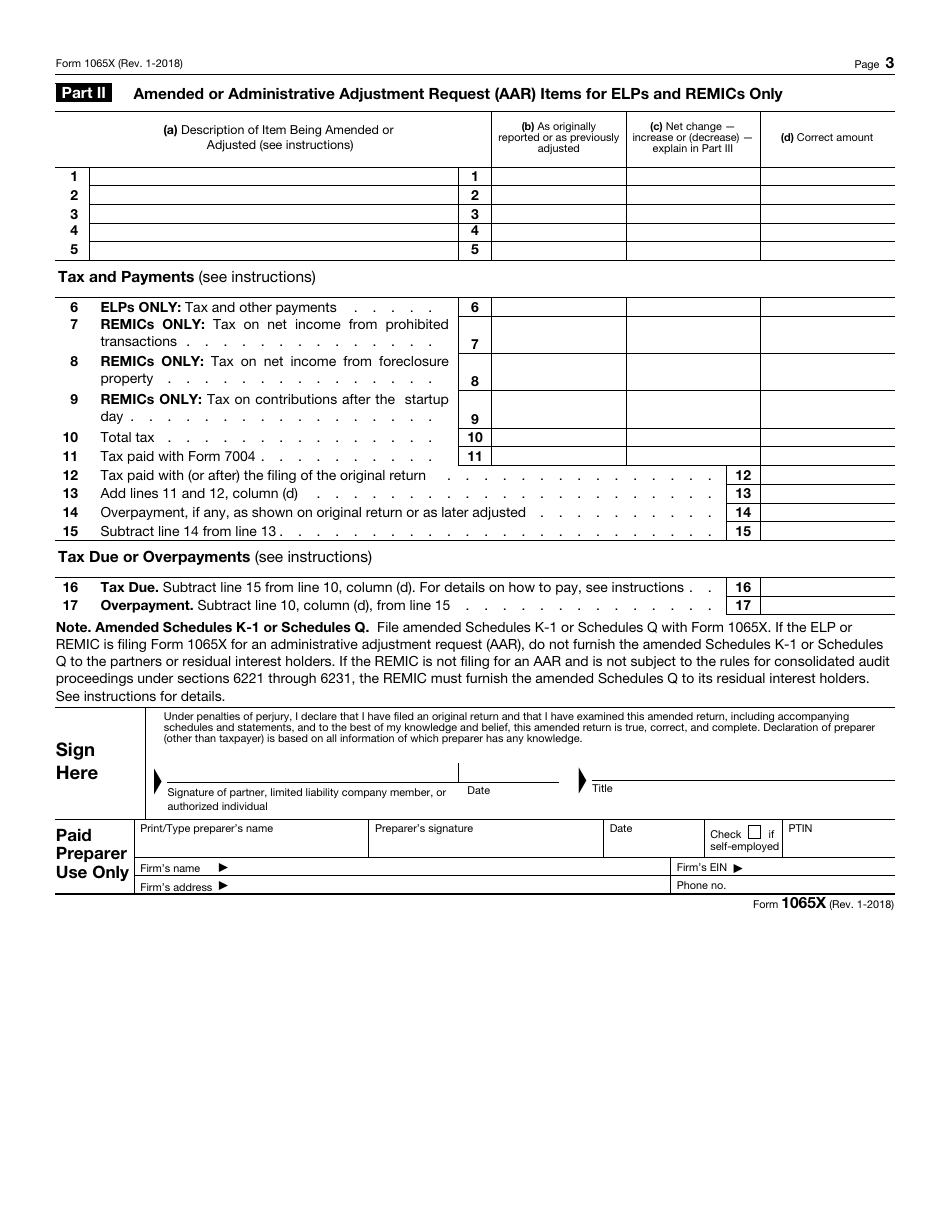

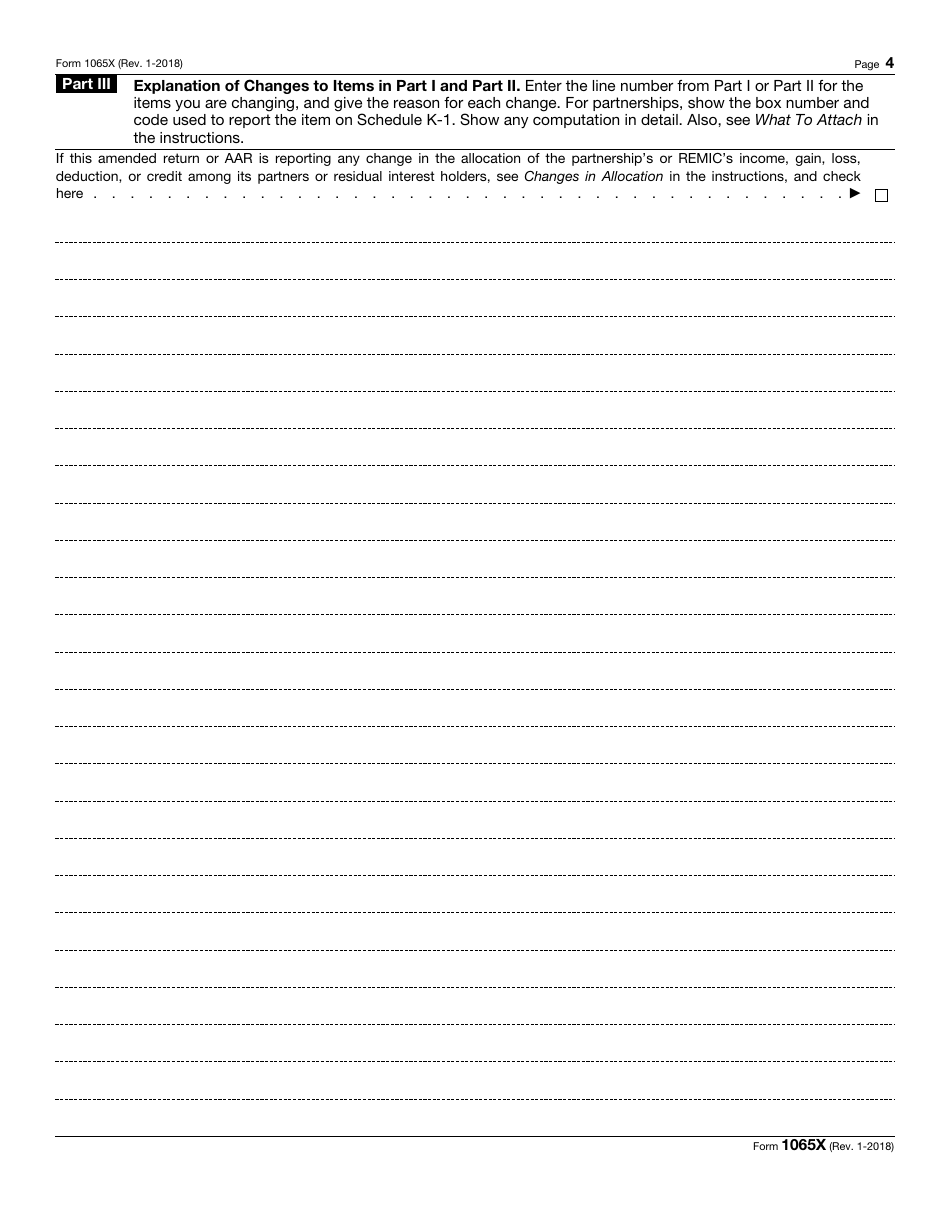

IRS Form 1065X Amended Return or Administrative Adjustment Request (AAR)

What Is IRS Form 1065X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065X?

A: IRS Form 1065X is used to file an amended return for a partnership or a limited liability company taxed as a partnership.

Q: What is an amended return?

A: An amended return is a corrected version of a previously filed tax return.

Q: What is an Administrative Adjustment Request (AAR)?

A: An Administrative Adjustment Request (AAR) is used to request a change in partnership tax accounting methods without filing an amended return.

Q: When should I use IRS Form 1065X?

A: Use IRS Form 1065X when you need to make changes to your partnership tax return after it has already been filed.

Q: What information should be included in IRS Form 1065X?

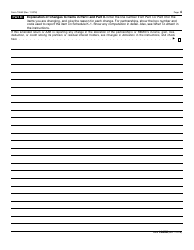

A: IRS Form 1065X should include the corrected information from the original return and an explanation of the changes made.

Q: Is there a deadline for filing IRS Form 1065X?

A: Yes, IRS Form 1065X should be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later.

Q: Can IRS Form 1065X be e-filed?

A: No, IRS Form 1065X cannot be e-filed. It must be filed by mail.

Q: What should I do if I made a mistake on my partnership tax return?

A: If you made a mistake on your partnership tax return, you should file an amended return using IRS Form 1065X to correct the error.

Q: Is it possible to amend a partnership tax return multiple times?

A: Yes, it is possible to amend a partnership tax return multiple times by filing additional IRS Form 1065X.

Form Details:

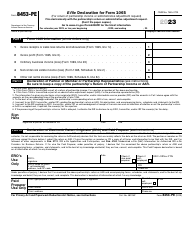

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065X through the link below or browse more documents in our library of IRS Forms.