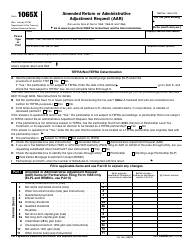

Instructions for IRS Form 1065X Amended Return or Administrative Adjustment Request (AAR)

This document contains official instructions for IRS Form 1065X , Amended Return or Administrative Adjustment Request (Aar) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065X is available for download through this link.

FAQ

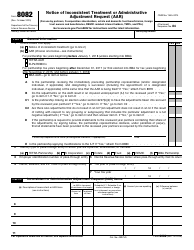

Q: What is Form 1065X?

A: Form 1065X is used to file an amended return or administrative adjustment request for a partnership.

Q: When should I file Form 1065X?

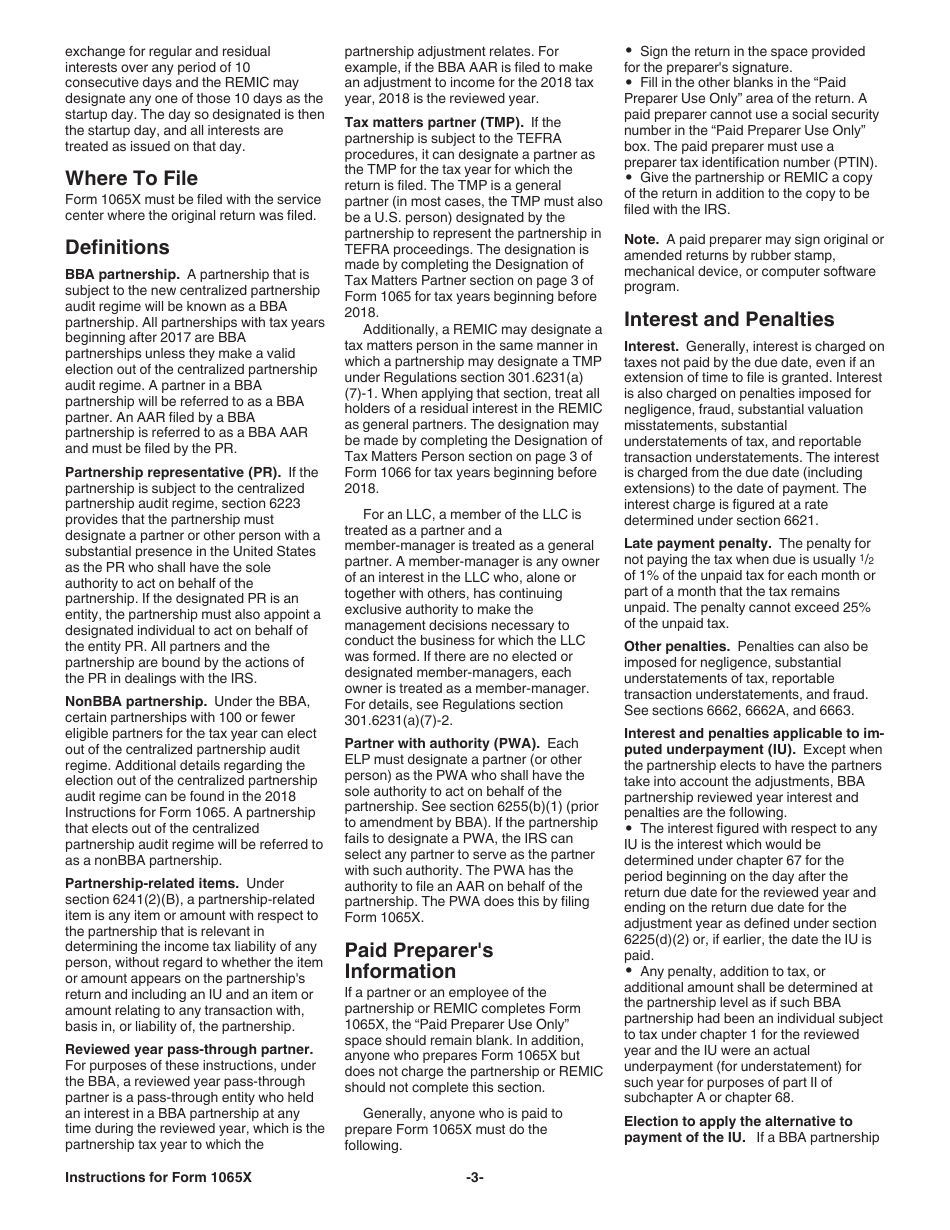

A: File Form 1065X to correct errors or changes to a previously filed Form 1065 within 3 years from the original due date or 2 years from the date you paid the tax, whichever is later.

Q: What is an amended return?

A: An amended return is a form filed to correct errors or make changes to a previously filed tax return.

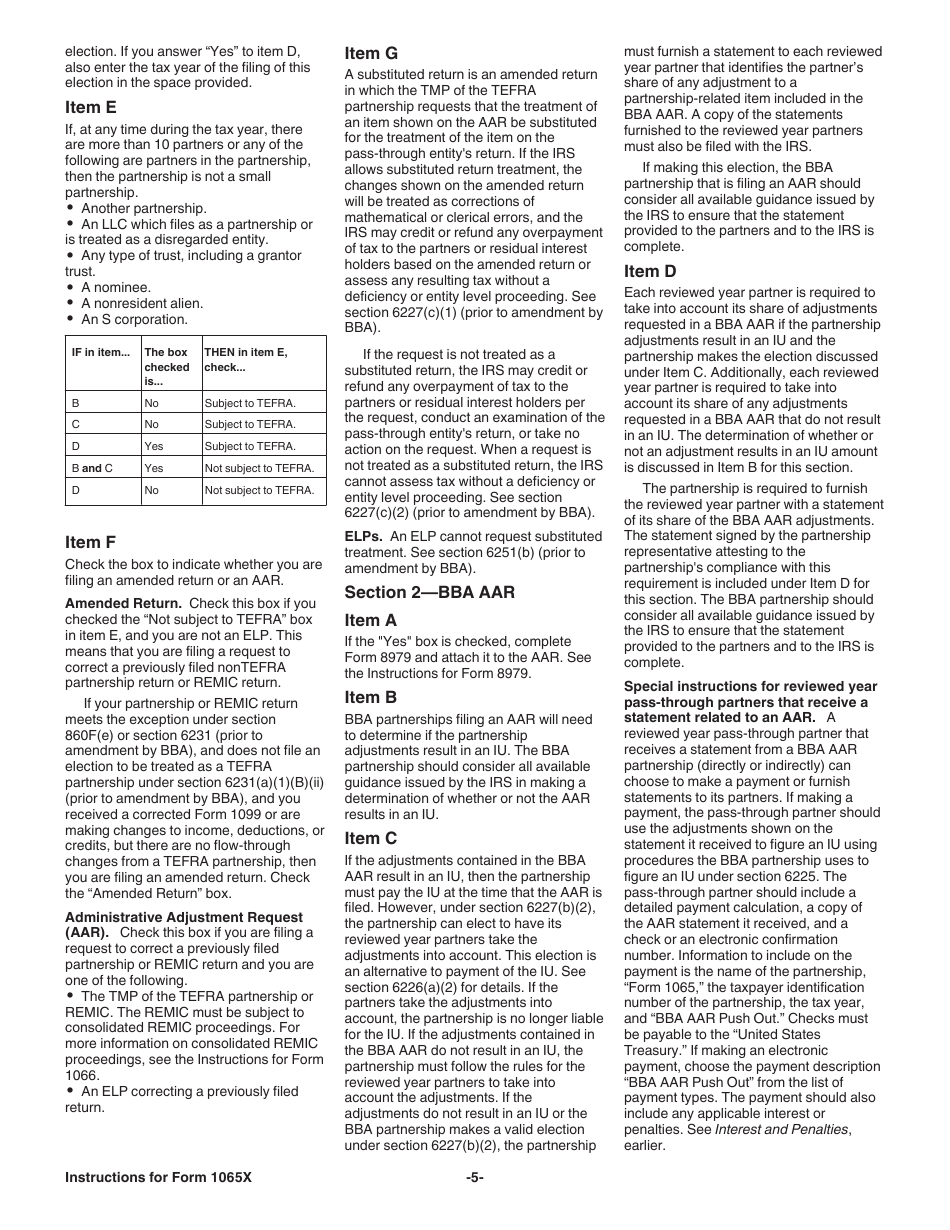

Q: What is an Administrative Adjustment Request (AAR)?

A: An AAR is a request to the Internal Revenue Service (IRS) to make adjustments to a partnership's tax return.

Q: Who can file Form 1065X?

A: Partnerships can file Form 1065X to amend their tax return or request administrative adjustments.

Q: Do I need to attach a copy of the original return to Form 1065X?

A: Yes, you must attach a copy of the original return to Form 1065X when filing an amended return.

Q: How do I file Form 1065X?

A: Form 1065X must be filed by mail to the address specified in the IRS instructions. Electronic filing is not available for Form 1065X.

Q: What documentation should I include with Form 1065X?

A: Include any necessary documentation to support the changes or adjustments being made on Form 1065X.

Q: Can I file Form 1065X electronically?

A: No, electronic filing is not available for Form 1065X. It must be filed by mail.

Q: What happens after I file Form 1065X?

A: After you file Form 1065X, the IRS will review your amended return or administrative adjustment request and notify you of any changes or adjustments made.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.