This version of the form is not currently in use and is provided for reference only. Download this version of

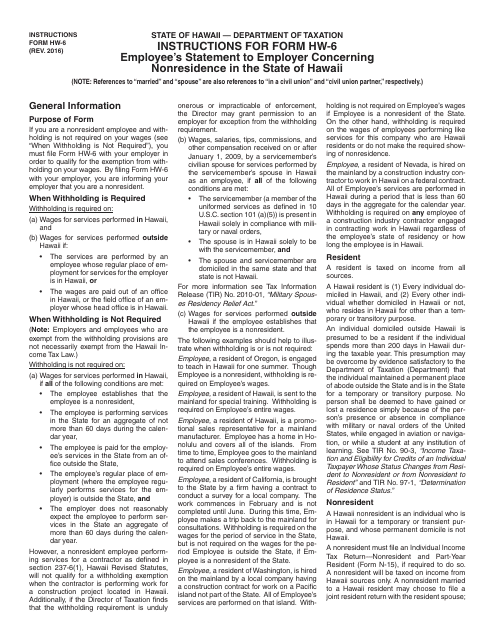

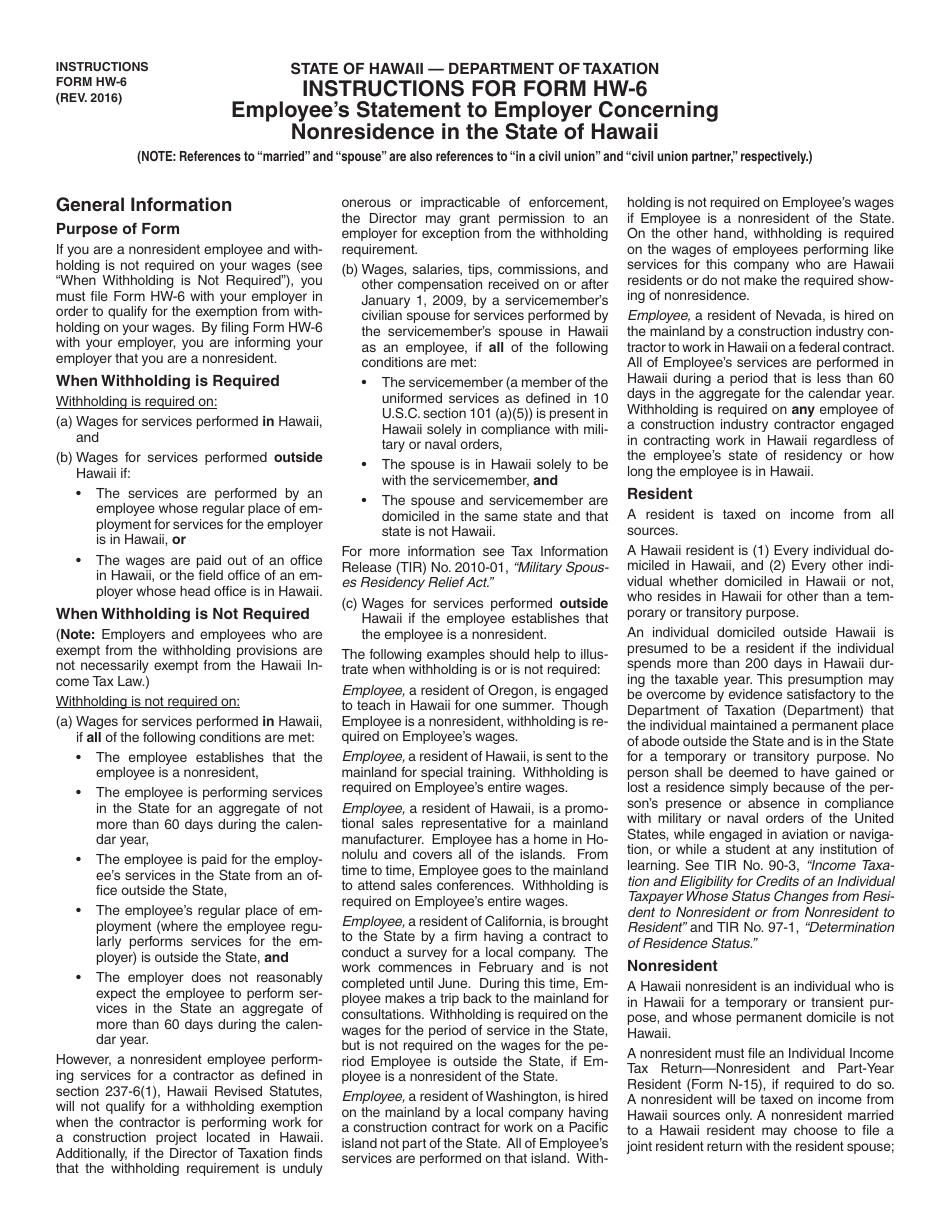

Instructions for Form HW-6

for the current year.

Instructions for Form HW-6 Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii - Hawaii

This document contains official instructions for Form HW-6 , Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii - a form released and collected by the Hawaii Department of Taxation.

FAQ

Q: What is Form HW-6?

A: Form HW-6 is Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii.

Q: Why do I need to fill out Form HW-6?

A: You need to fill out Form HW-6 if you are claiming nonresidence status in the state of Hawaii for tax purposes.

Q: Who should fill out Form HW-6?

A: Employees who are claiming nonresidence status in Hawaii for tax purposes should fill out Form HW-6.

Q: What information do I need to provide on Form HW-6?

A: You need to provide information about your residency status and the number of days you were present in Hawaii during the tax year.

Q: When do I need to submit Form HW-6?

A: You need to submit Form HW-6 to your employer by the end of February each year.

Q: What happens if I don't submit Form HW-6?

A: If you don't submit Form HW-6, your employer may withhold Hawaii state taxes from your paycheck.

Q: Can I claim nonresidence status if I live in Hawaii?

A: No, you cannot claim nonresidence status if you live in Hawaii. Nonresidence status is for individuals who have established residency in another state.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.