This version of the form is not currently in use and is provided for reference only. Download this version of

Form 44-016

for the current year.

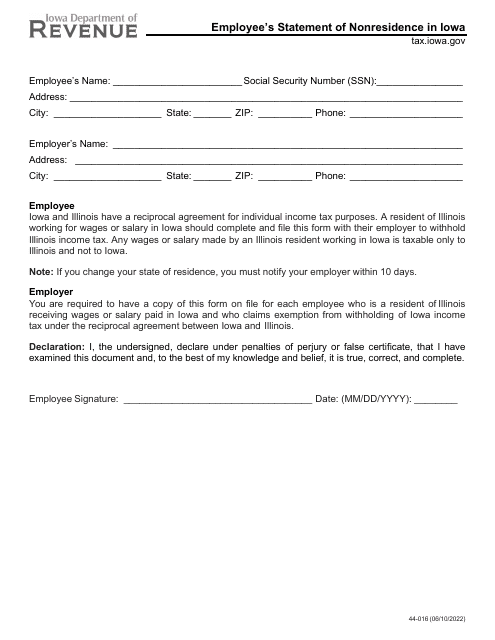

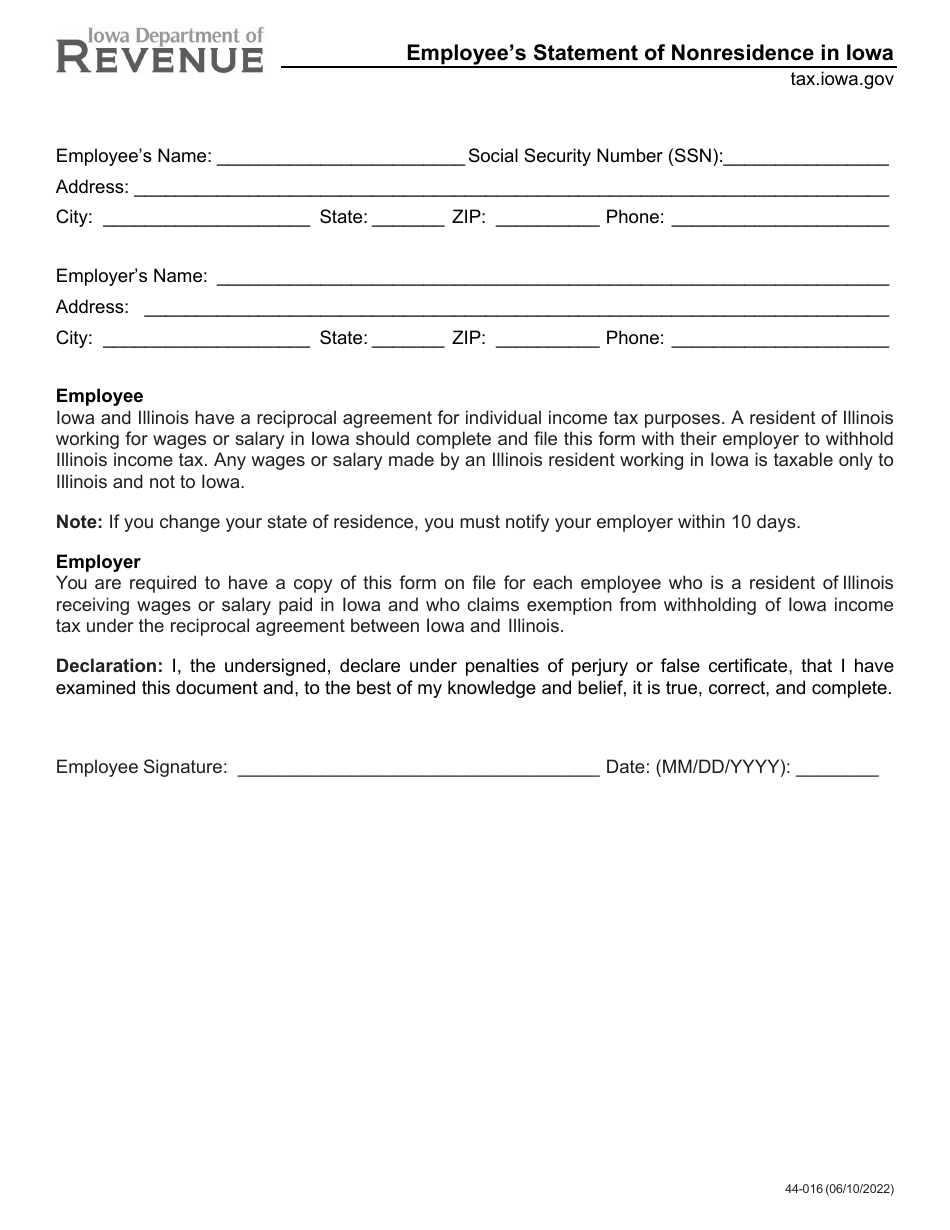

Form 44-016 Employee's Statement of Nonresidence in Iowa - Iowa

What Is Form 44-016?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 44-016?

A: Form 44-016 is the Employee's Statement of Nonresidence in Iowa.

Q: Who needs to file Form 44-016?

A: Employees who are nonresidents of Iowa and work in Iowa need to file Form 44-016.

Q: What is the purpose of Form 44-016?

A: The purpose of Form 44-016 is for nonresidents of Iowa to declare their nonresident status.

Q: When should Form 44-016 be filed?

A: Form 44-016 should be filed as soon as an employee becomes aware of their nonresident status in Iowa.

Q: Is Form 44-016 for residents of Iowa?

A: No, Form 44-016 is specifically for nonresidents of Iowa.

Q: What information is required on Form 44-016?

A: Form 44-016 requires information such as the employee's name, address, social security number, and nonresident status.

Q: What happens after filing Form 44-016?

A: After filing Form 44-016, the employee's nonresident status will be recognized for tax purposes in Iowa.

Q: Can nonresidents of Iowa claim exemptions on Form 44-016?

A: Yes, nonresidents of Iowa may claim certain exemptions on Form 44-016.

Q: Are there any penalties for not filing Form 44-016?

A: Failure to file Form 44-016 may result in penalties and the loss of certain exemptions for nonresidents of Iowa.

Form Details:

- Released on June 10, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 44-016 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.