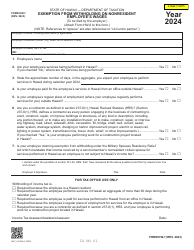

Form HW-4 Employee's Withholding Allowance and Status Certificate - Hawaii

What Is Form HW-4?

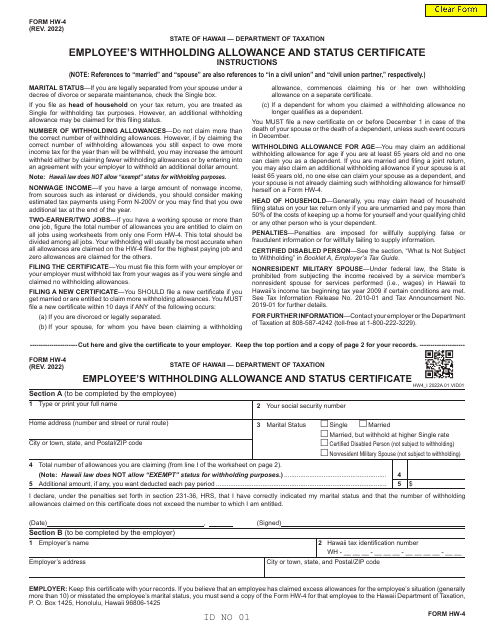

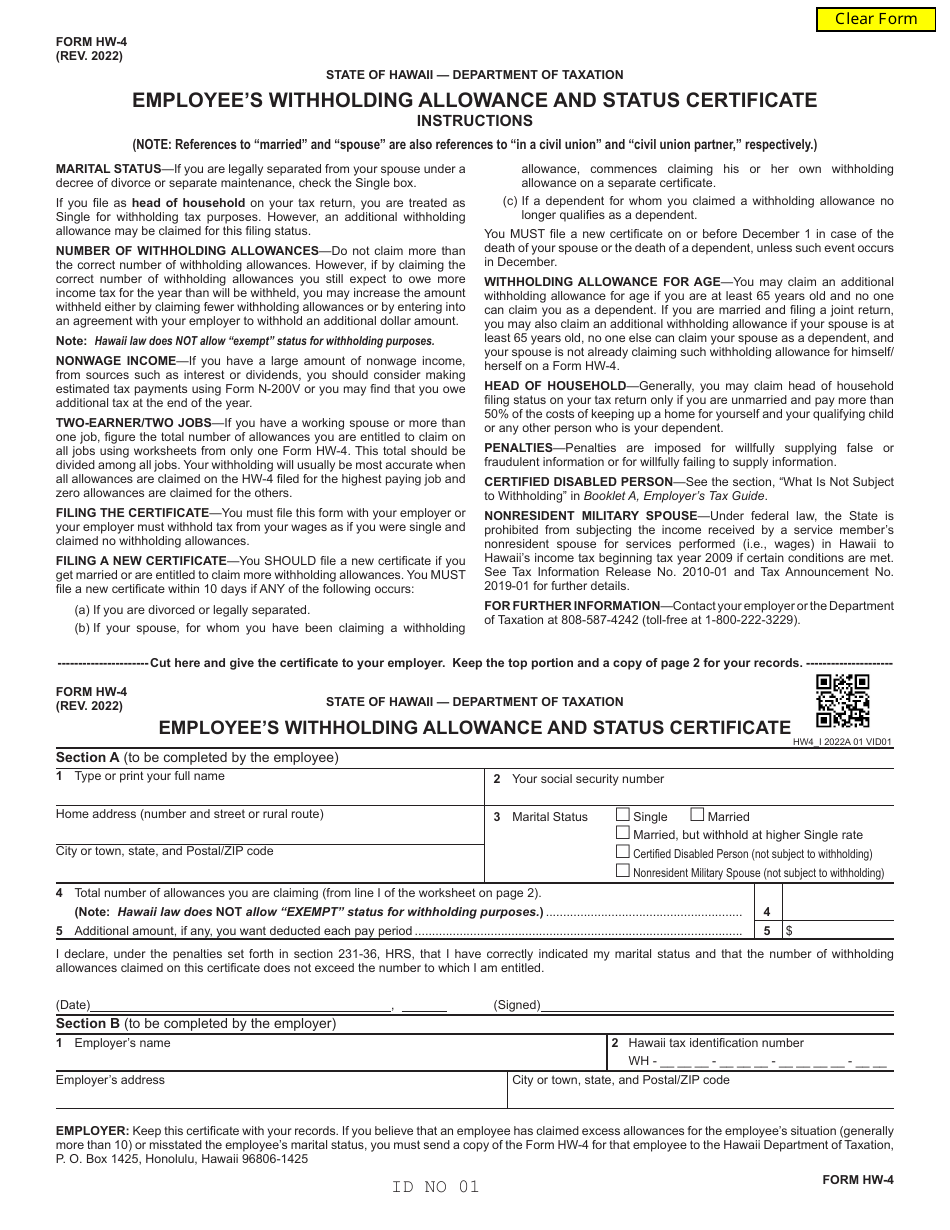

Form HW-4, Employee's Withholding Allowance and Status Certificate , is a legal document completed by an employee for their employer's records to provide information about withholding allowances. If this document is not submitted, the employer will withhold tax from the employee's wages as if the individual is single and claimed no withholding allowances. You have to file a new certificate within ten days if you are divorced or legally separated, your spouse begins claiming their own withholding allowance, or the dependent for whom you claimed a withholding allowance can no longer qualify as a dependent. Submit a new certificate before December 1 if your spouse or dependent dies, unless it happens in December.

This form was released by the Hawaii Department of Taxation . The latest version of the form was issued on January 1, 2022 , with all previous editions obsolete. You can download a fillable HW-4 Form through the link below.

How to Fill Out an HW-4 Form?

Provide the following details in the Hawaii HW-4 Form:

- Employee information - completed by the employee. Write down your full name, social security number, and address. Indicate your marital status - single, married, married but withhold at a higher single rate, certified disabled person, or nonresident military spouse. State the total number of allowances you are claiming - use the worksheet on the second page to find out this number. It is allowed to claim fewer, but not more, withholding allowances than you are entitled to claim. Add the amount of money you want to deduct each pay period. Sign and date the form;

- Employer information - completed by the employer. Indicate the employer's name, address, and Hawaii tax identification number.

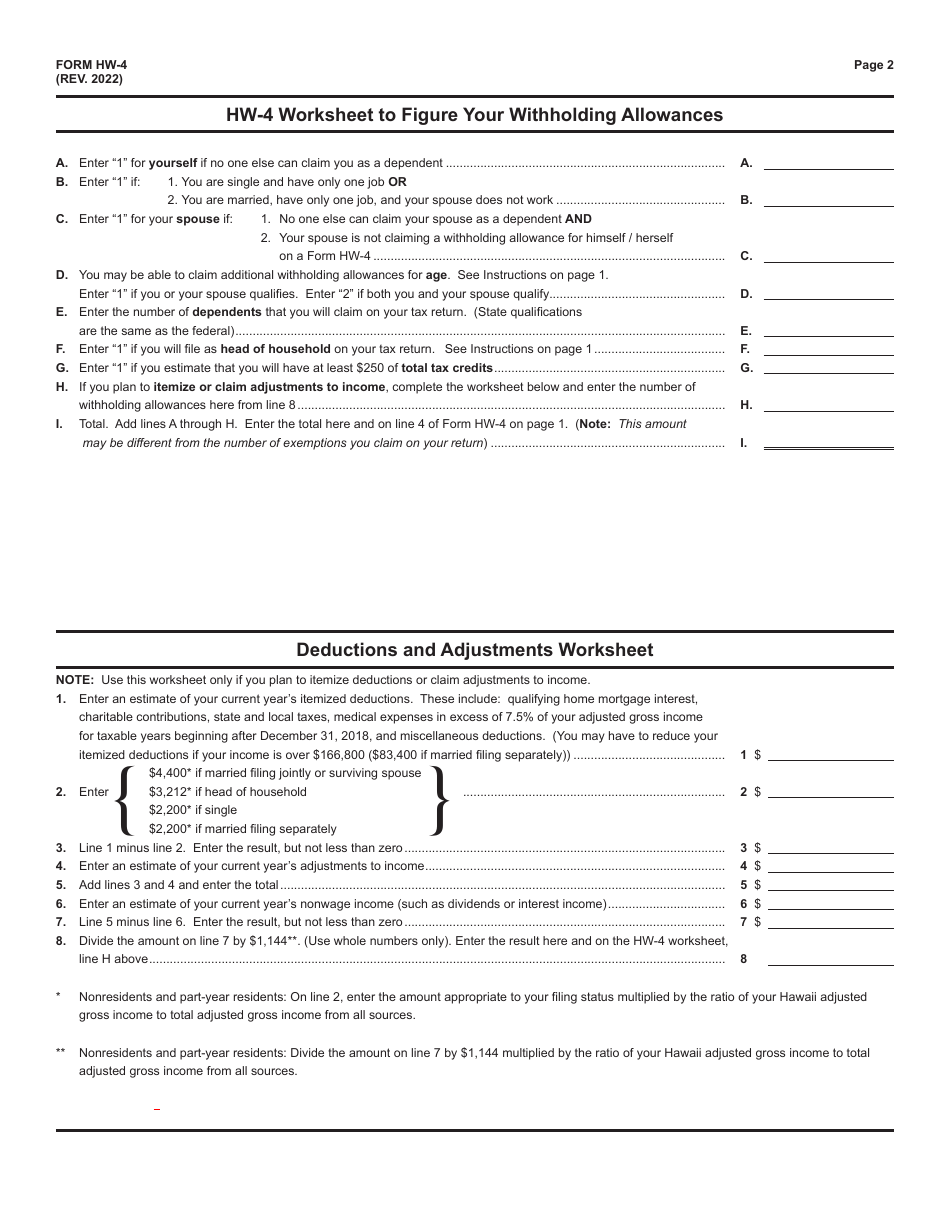

The second page of the form provides the employee with two worksheets - to figure out withholding allowances, adjustments to income, and itemizing deductions. The employee keeps the worksheets and gives the certificate cut from the rest of the form to the employer.

Hawaii HW-4 Related Forms:

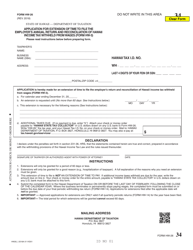

- HW-2, Statement of Hawaii Income Tax Withheld and Wages Paid, is prepared by an employer for each employee to whom wages have been paid. Make four copies of this form - for the Hawaii State Tax Collector, employee's records, employer's files, and one to be filed with the employee's tax return;

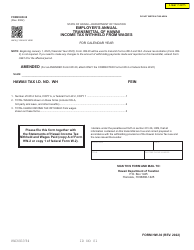

- HW-3, Employer's Annual Return & Reconciliation of Hawaii Income Tax Withheld from Wages. Report the total wages paid during the reporting year and the total amount of tax withheld. Mail this document with Form HW-2;

- HW-6, Employee's Statement to Employer Concerning Non-Residence in the State of Hawaii, is used by a nonresident employee to notify their employer about their status. This form is required for such individuals to qualify for the exemption from withholding on your wages;

- HW-7, Exemption from Withholding on Nonresident Employee's Wages, is required when the withholding is not claimed on an employee's wages for services performed in the State of Hawaii. Submit this document with Form HW-6;

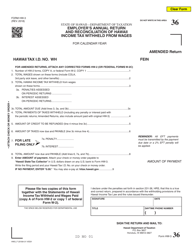

- HW-14, Periodic Withholding Tax Return. This document is filed with the Department of Taxation for the preceding quarterly period for which taxes have been withheld. Provide information on all the wages paid during the reporting period which are subject to withholding, and wages paid to disabled individuals even though they cannot be withheld;

- HW-26, Application for Extension of Time for Filing Employer's Return & Reconciliation. You may request an extension to file Forms HW-3 and HW-2 by filing this document, but only if you have a good reason, for instance, hospitalization of the taxpayer.