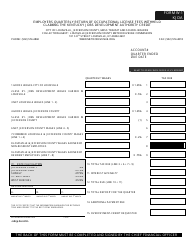

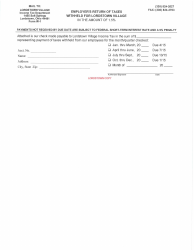

Instructions for Form E-1 Employers Return of License Fee Withheld - City of Owensboro, Kentucky

The Instructions for Form E-1 Employers Return of License Fee Withheld - City of Owensboro, Kentucky provides guidance on how employers in Owensboro should complete and submit their return of license fee withheld. It explains the requirements, calculations, and due dates for the form.

The employer files the Instructions for Form E-1, Employers Return of License Fee Withheld with the City of Owensboro, Kentucky.

FAQ

Q: What is Form E-1?

A: Form E-1 is the Employers Return of License Fee Withheld.

Q: Who needs to file Form E-1?

A: Employers in the City of Owensboro, Kentucky need to file Form E-1.

Q: What is the purpose of Form E-1?

A: Form E-1 is used to report and remit license fee withholdings for employers in Owensboro, Kentucky.

Q: How often should Form E-1 be filed?

A: Form E-1 should be filed on a quarterly basis.

Q: What information is required on Form E-1?

A: Form E-1 requires information such as the employer's name, address, number of employees, and the amount of license fee withheld.

Q: When is the deadline for filing Form E-1?

A: Form E-1 must be filed by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form E-1?

A: Yes, there may be penalties for late filing of Form E-1, so it is important to file on time.

Q: Is Form E-1 specific to Owensboro, Kentucky?

A: Yes, Form E-1 is specific to employers in the City of Owensboro, Kentucky.