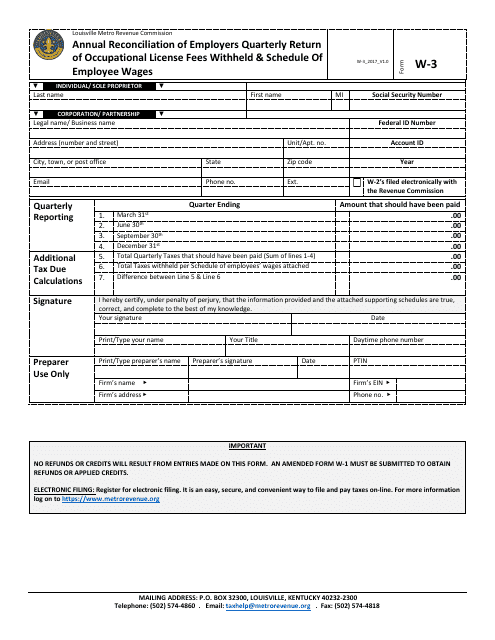

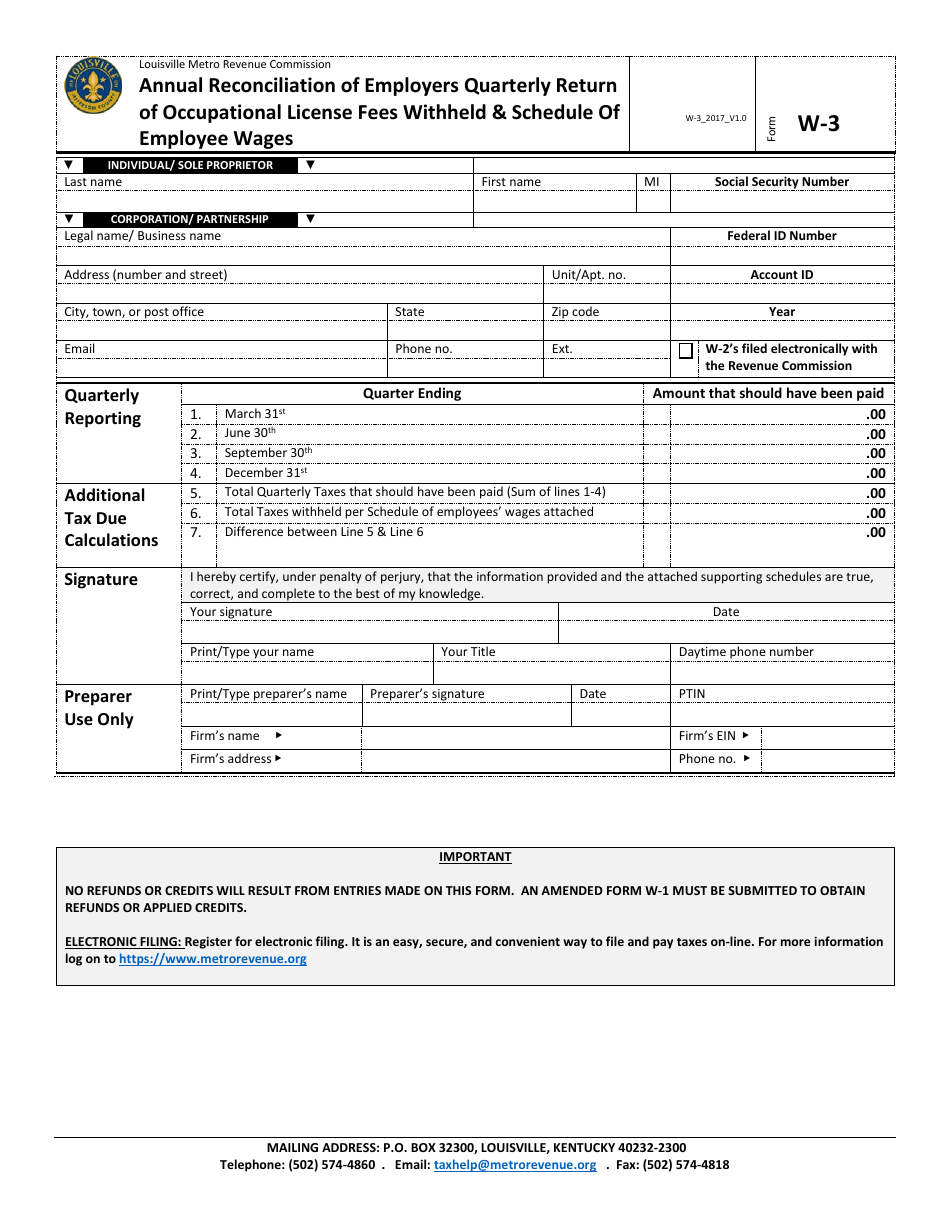

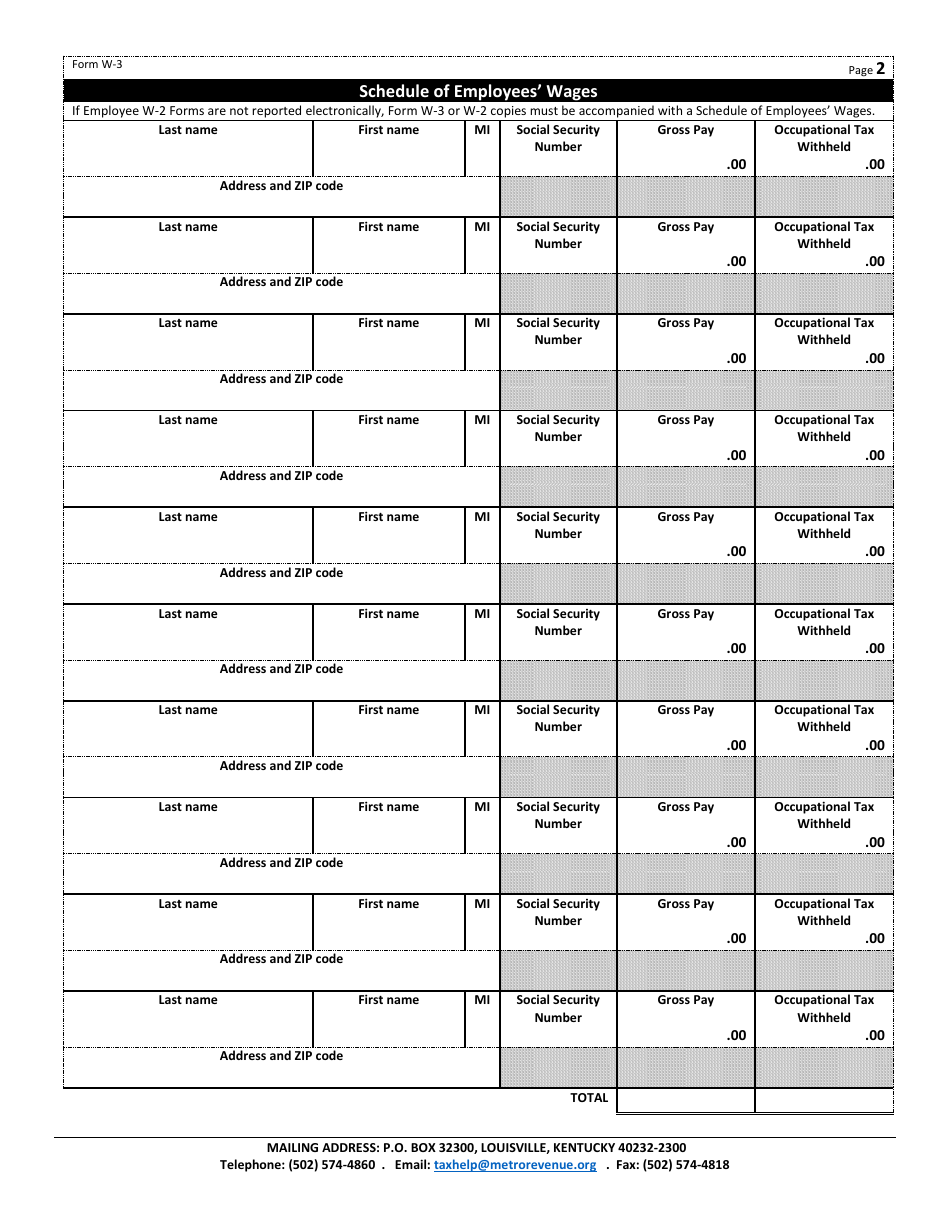

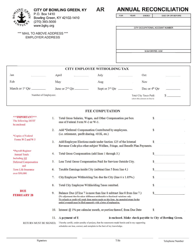

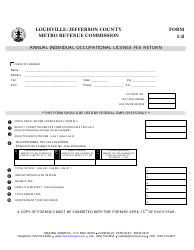

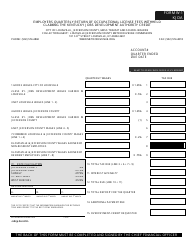

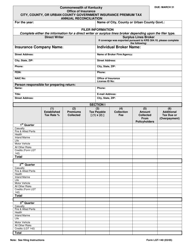

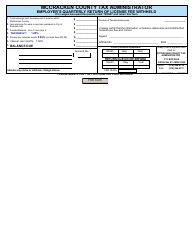

Form W-3 Annual Reconciliation of Employers Quarterly Return of Occupational License Fees Withheld & Schedule of Employee Wages - Louisville / Jefferson County Metro Government, Kentucky

What Is Form W-3?

This is a legal form that was released by the Revenue Commission - Louisville, Kentucky - a government authority operating within Kentucky. The form may be used strictly within Louisville/Jefferson County Metro Government. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-3?

A: Form W-3 is the Annual Reconciliation of Employers Quarterly Return of Occupational License Fees Withheld & Schedule of Employee Wages.

Q: What is the purpose of Form W-3?

A: The purpose of Form W-3 is to report the annual summary of the withholding taxes and employee wages for employers in Louisville/Jefferson County Metro Government, Kentucky.

Q: Who needs to file Form W-3?

A: Employers in Louisville/Jefferson County Metro Government, Kentucky who withhold occupational license fees and have quarterly returns of those fees must file Form W-3.

Q: When is Form W-3 due?

A: Form W-3 is usually due on or before January 31st of the following year.

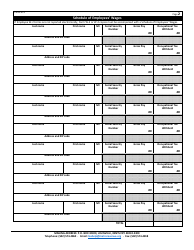

Q: What information do I need to complete Form W-3?

A: You will need information such as total employee wages, total occupational license fees withheld, and quarterly return information.

Q: Are there any penalties for not filing Form W-3?

A: Yes, there may be penalties for not filing Form W-3 or filing it late. It is important to comply with the deadlines to avoid penalties.

Form Details:

- The latest edition provided by the Revenue Commission - Louisville, Kentucky;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-3 by clicking the link below or browse more documents and templates provided by the Revenue Commission - Louisville, Kentucky.