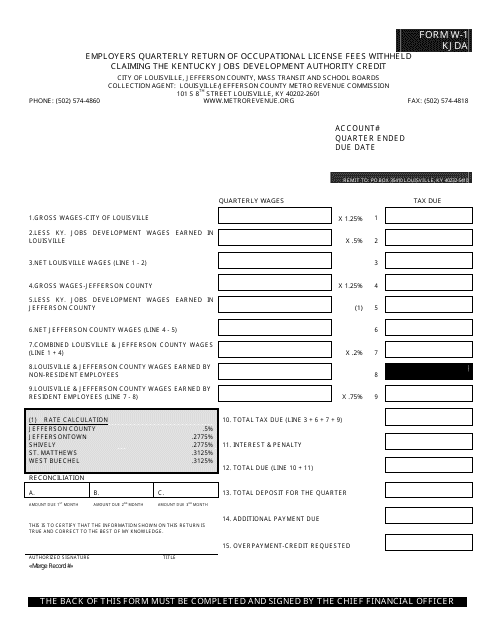

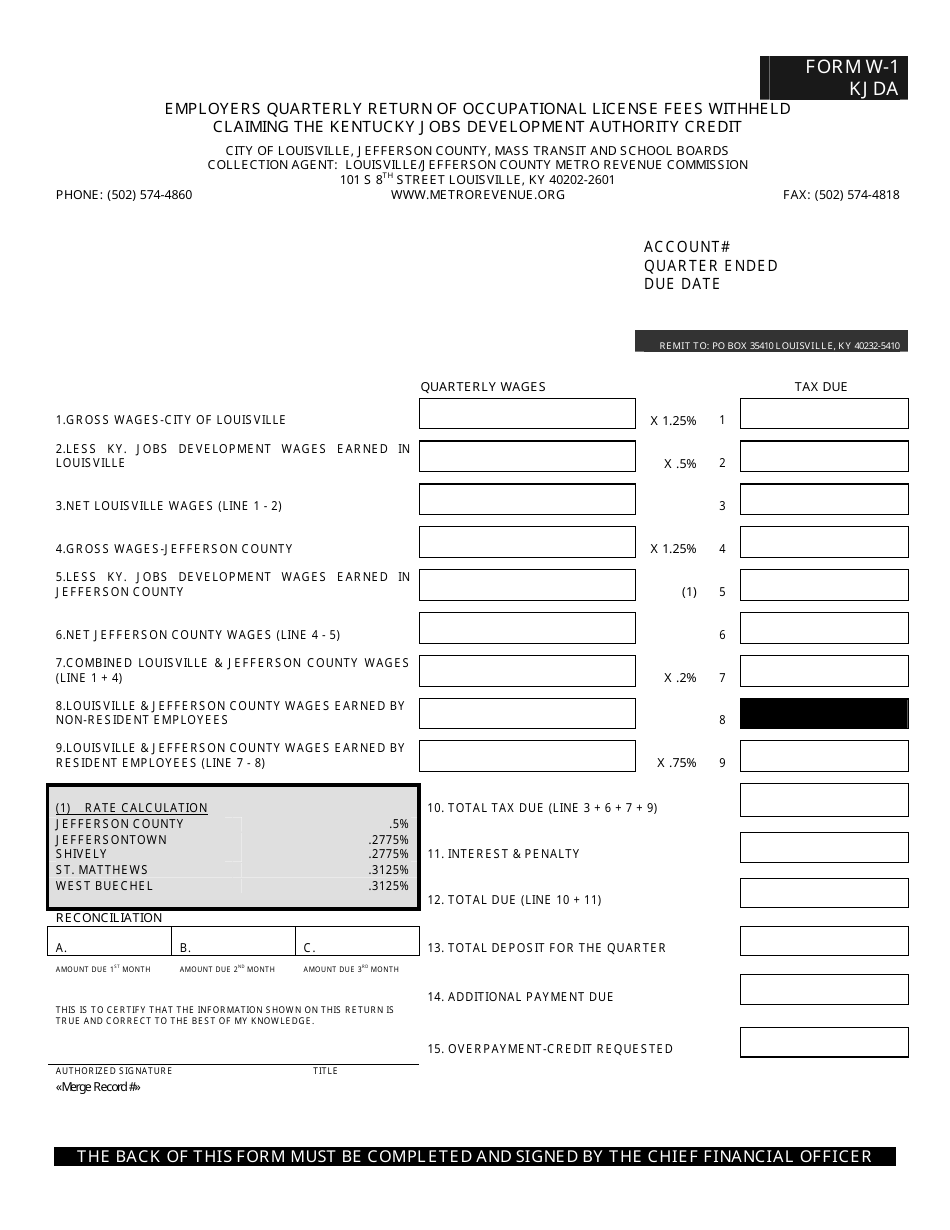

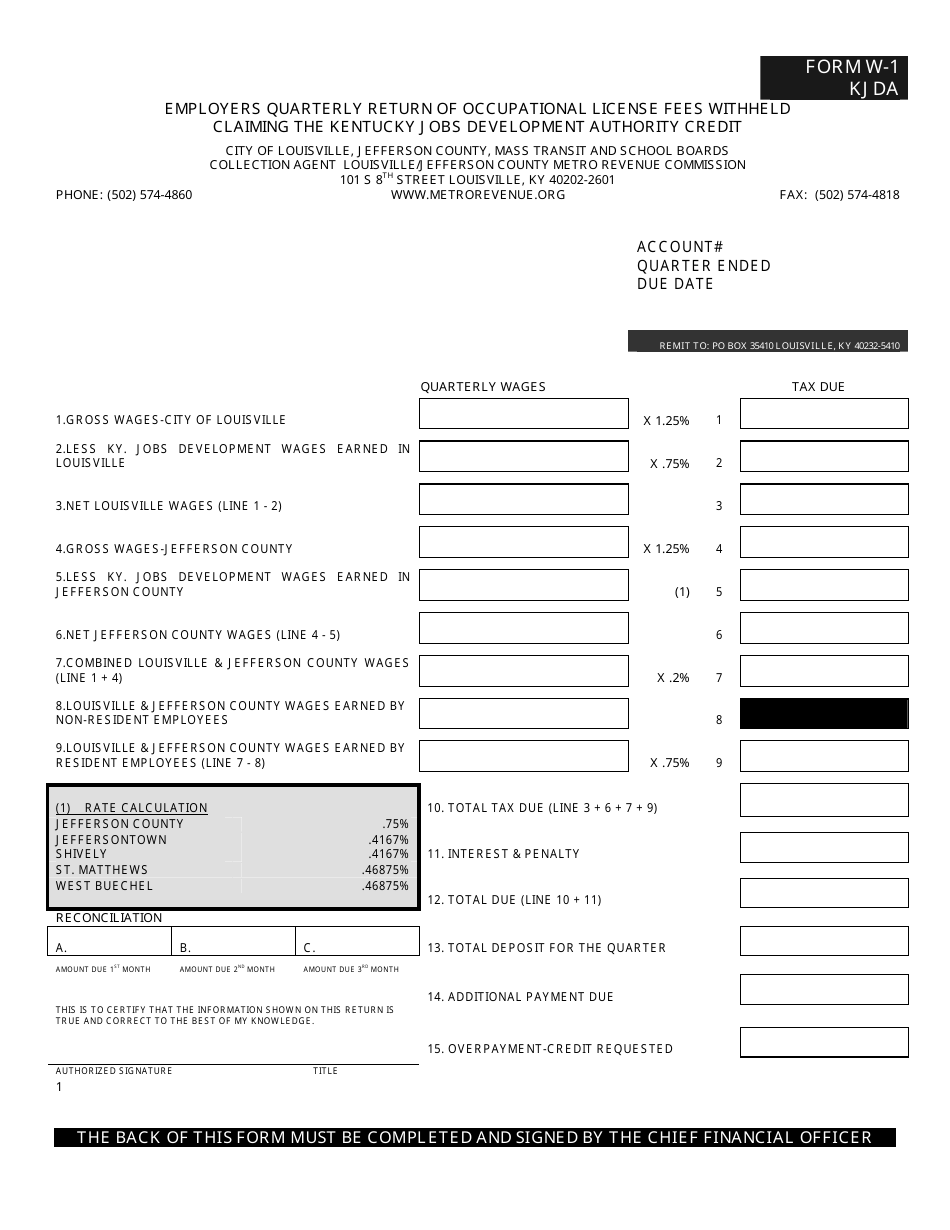

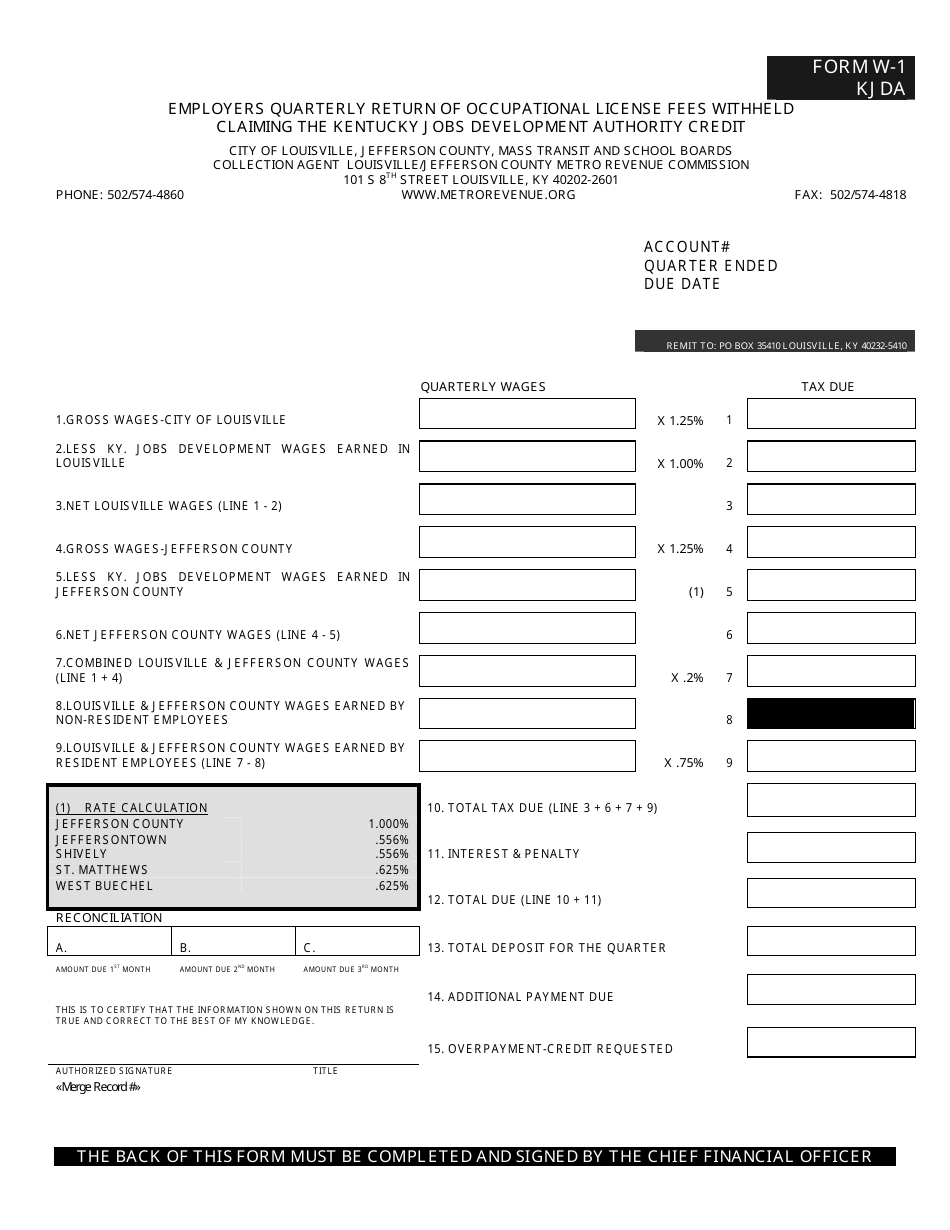

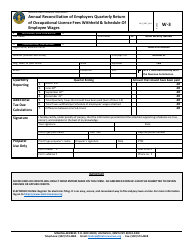

Form W-1 KJDA Employers Quarterly Return of Occupational License Fees Withheld Claiming the Kentucky Jobs Development Authority Credit - Kentucky

What Is Form W-1 KJDA?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-1 KJDA?

A: Form W-1 KJDA is the Employers Quarterly Return of Occupational License Fees Withheld Claiming the Kentucky Jobs Development Authority Credit.

Q: Who needs to file Form W-1 KJDA?

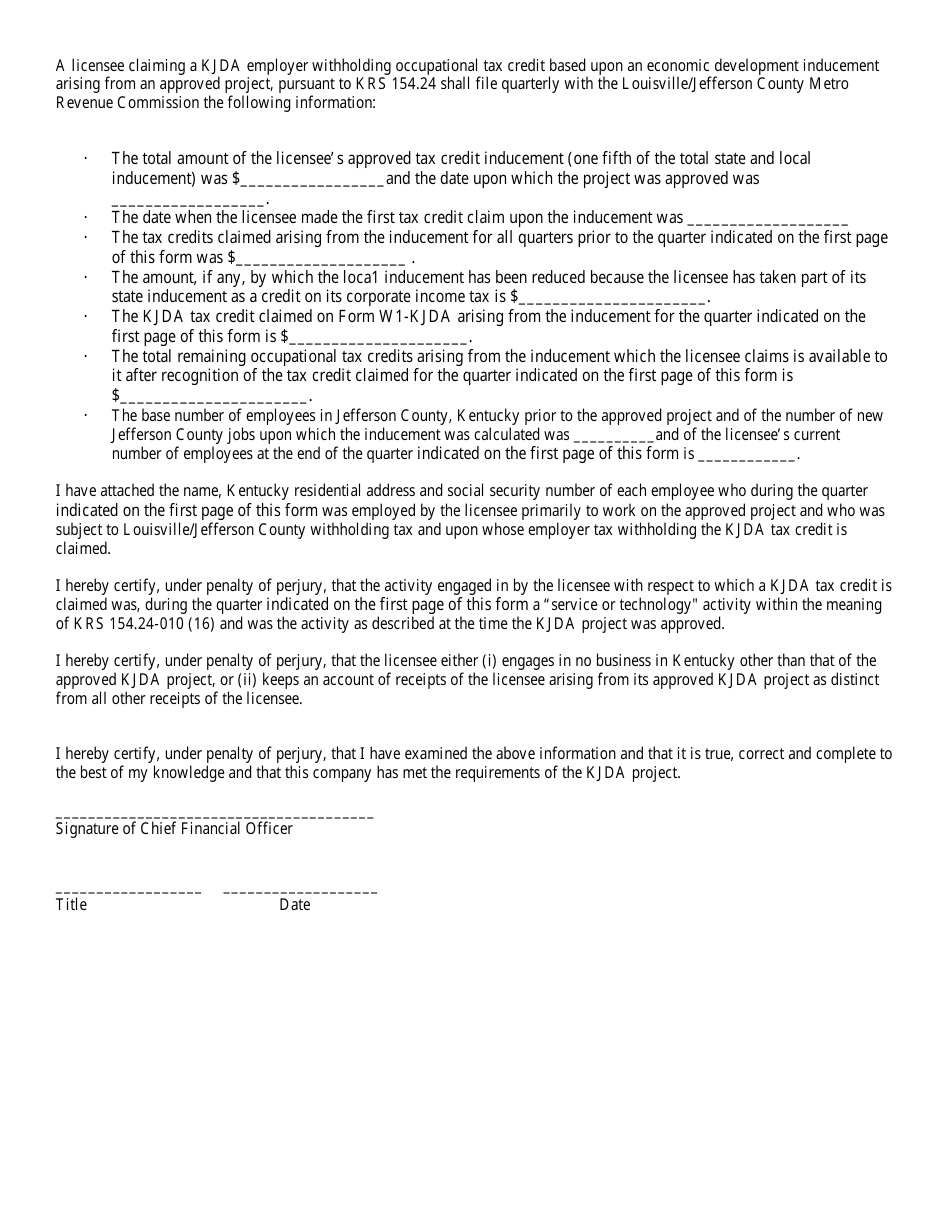

A: Employers who have withheld occupational license fees from employees' wages and are claiming the Kentucky Jobs Development Authority Credit need to file Form W-1 KJDA.

Q: What is the Kentucky Jobs Development Authority Credit?

A: The Kentucky Jobs Development Authority Credit is a credit that employers can claim for a portion of the occupational license fees withheld from employees' wages.

Q: What information is required on Form W-1 KJDA?

A: Form W-1 KJDA requires information such as the employer's name, address, federal employer identification number, and the amount of occupational license fees withheld and claimed as credit.

Form Details:

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-1 KJDA by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.