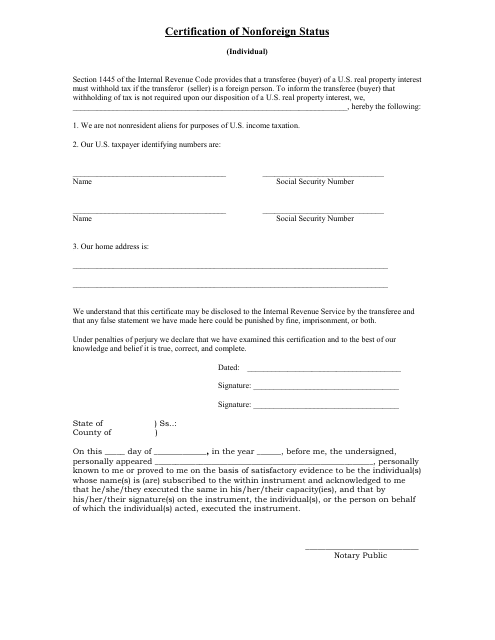

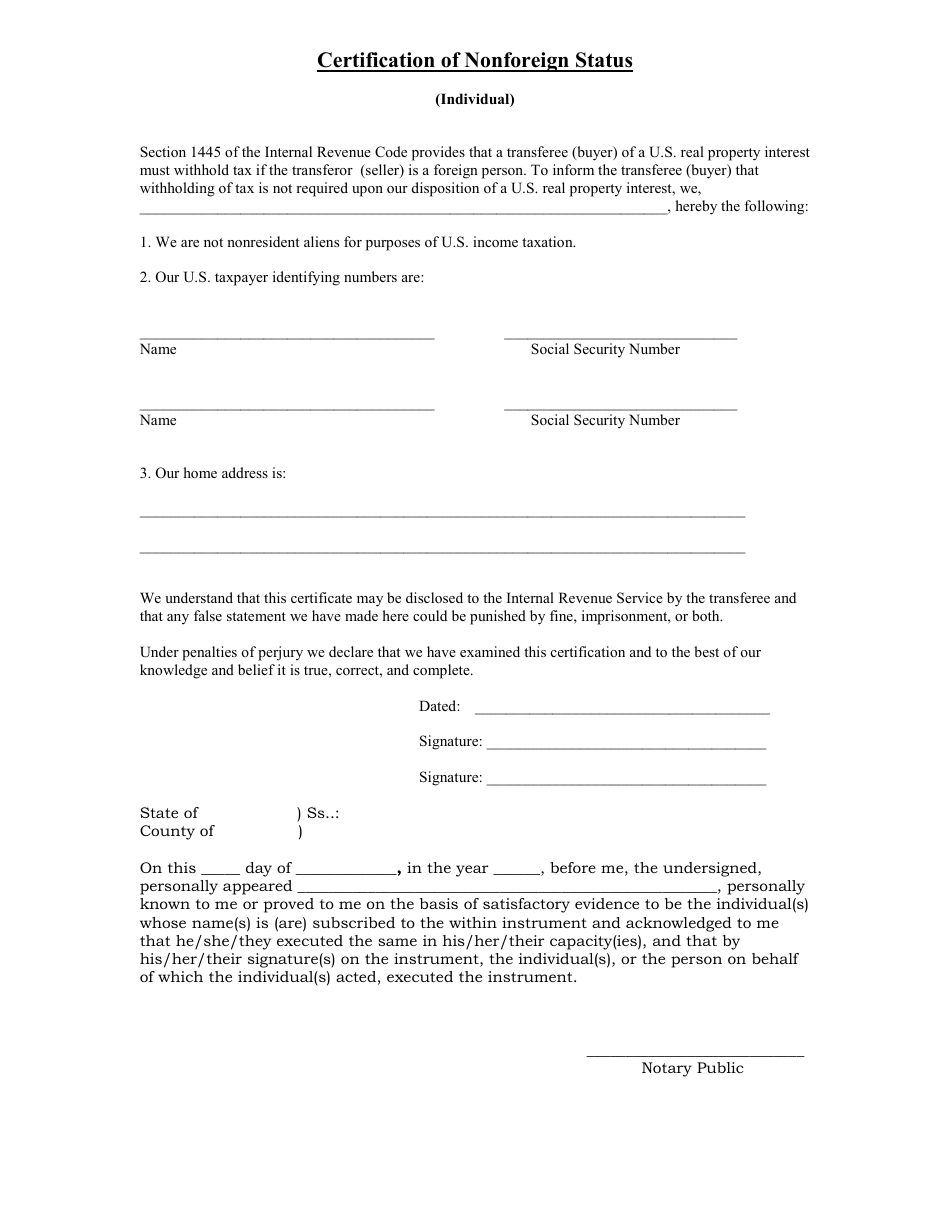

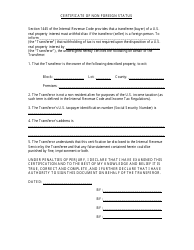

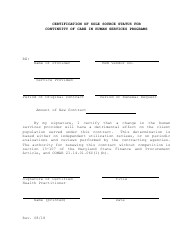

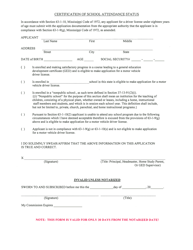

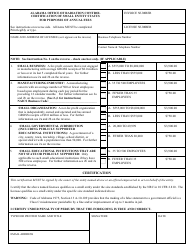

Certification of Nonforeign Status (Individual)

The Certification of Nonforeign Status (Individual) is used for tax purposes to declare that an individual is not a foreign person and is therefore eligible for certain tax benefits or exemptions.

The Certification of Nonforeign Status (Individual) is typically filed by an individual who wants to declare their non-foreign status for tax purposes. This form is used to claim certain tax benefits or to prevent tax withholding on income received from U.S. sources.

FAQ

Q: What is a Certification of Nonforeign Status (Individual)?

A: A Certification of Nonforeign Status (Individual) is a document used to certify that an individual is not a foreign person for tax purposes.

Q: Who needs to complete a Certification of Nonforeign Status (Individual)?

A: Individuals who are U.S. residents or U.S. citizens may need to complete a Certification of Nonforeign Status (Individual) when required by financial institutions or other entities.

Q: What is the purpose of a Certification of Nonforeign Status (Individual)?

A: The purpose of a Certification of Nonforeign Status (Individual) is to establish an individual's status as a U.S. resident or U.S. citizen for tax purposes.

Q: How do I complete a Certification of Nonforeign Status (Individual)?

A: To complete a Certification of Nonforeign Status (Individual), you will typically need to provide your full name, address, Social Security Number, and sign the certification.

Q: Is a Certification of Nonforeign Status (Individual) mandatory?

A: The requirement to complete a Certification of Nonforeign Status (Individual) may vary depending on the entity or institution requesting it. It is best to check with the specific entity or institution to determine if it is mandatory in your situation.