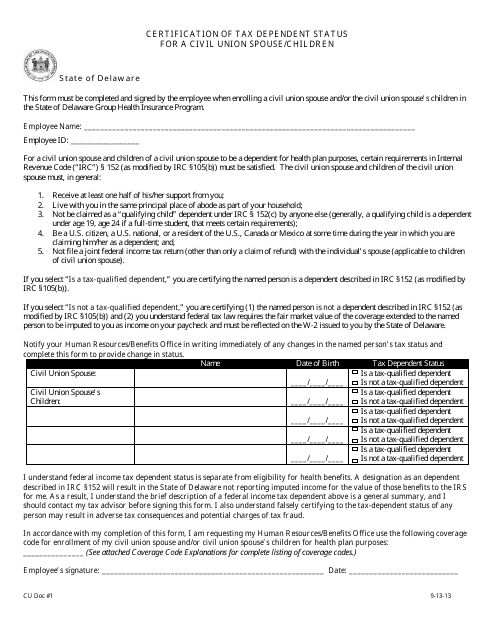

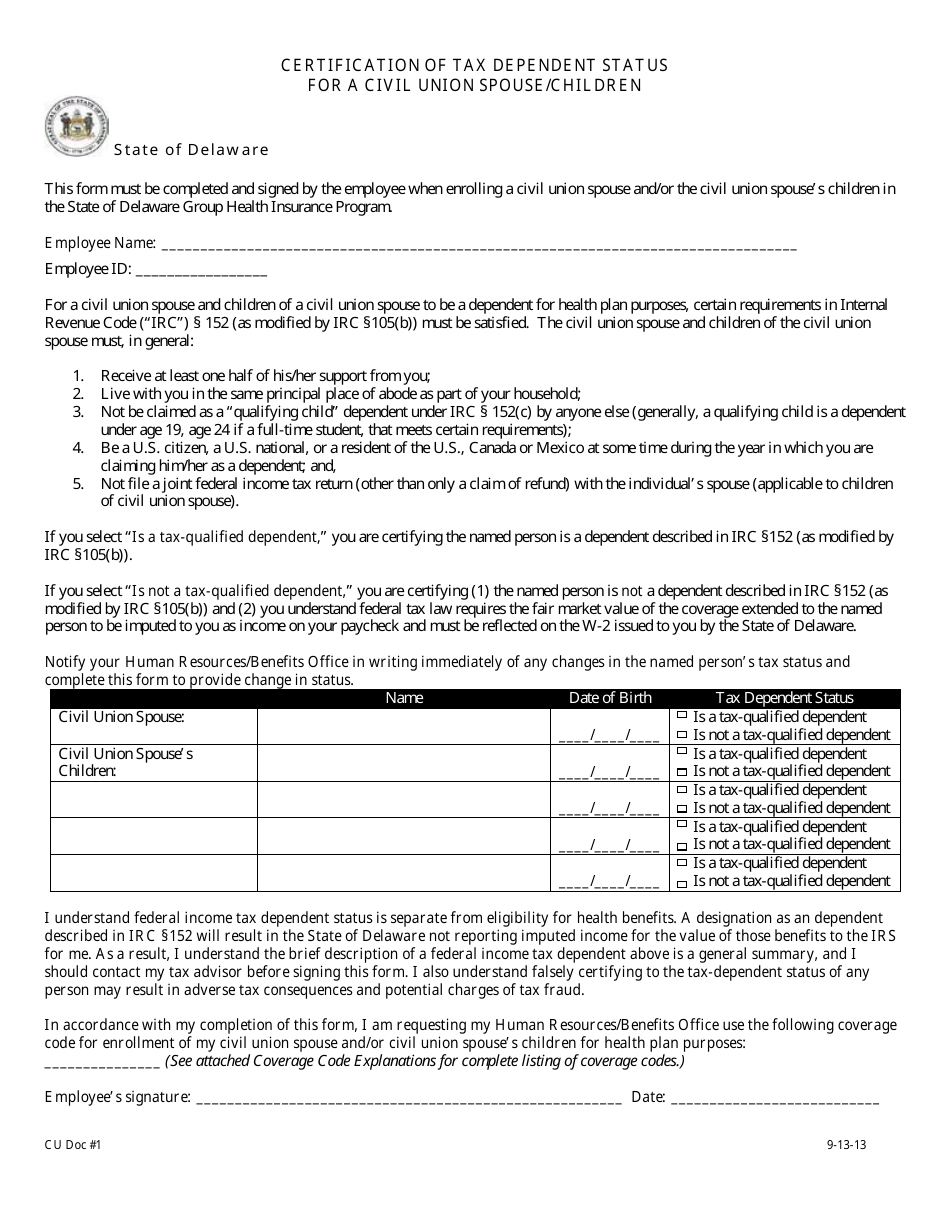

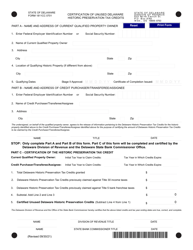

Certification of Tax Dependent Status for a Civil Union Spouse / Children - Delaware

Certification of Tax Dependent Status for a Civil Union Spouse/Children is a legal document that was released by the Delaware Department of Human Resources - a government authority operating within Delaware.

FAQ

Q: What is certification of tax dependent status for a civil union spouse/children?

A: It is a process to officially recognize a civil union spouse or children as dependents for tax purposes.

Q: Who can certify tax dependent status for a civil union spouse/children in Delaware?

A: The Delaware Department of Revenue can certify tax dependent status.

Q: Why would I need to certify tax dependent status for a civil union spouse/children?

A: Certifying tax dependent status allows you to claim deductions or credits related to your civil union spouse or children.

Q: How do I apply for certification of tax dependent status for a civil union spouse/children?

A: You can apply by submitting a completed application form to the Delaware Department of Revenue.

Q: Are there any eligibility requirements for certification of tax dependent status for a civil union spouse/children?

A: Yes, you need to meet certain criteria set by the Delaware Department of Revenue.

Form Details:

- Released on September 13, 2013;

- The latest edition currently provided by the Delaware Department of Human Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Human Resources.