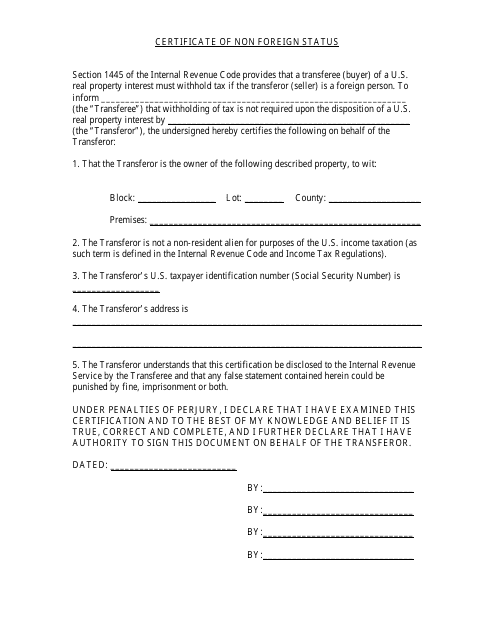

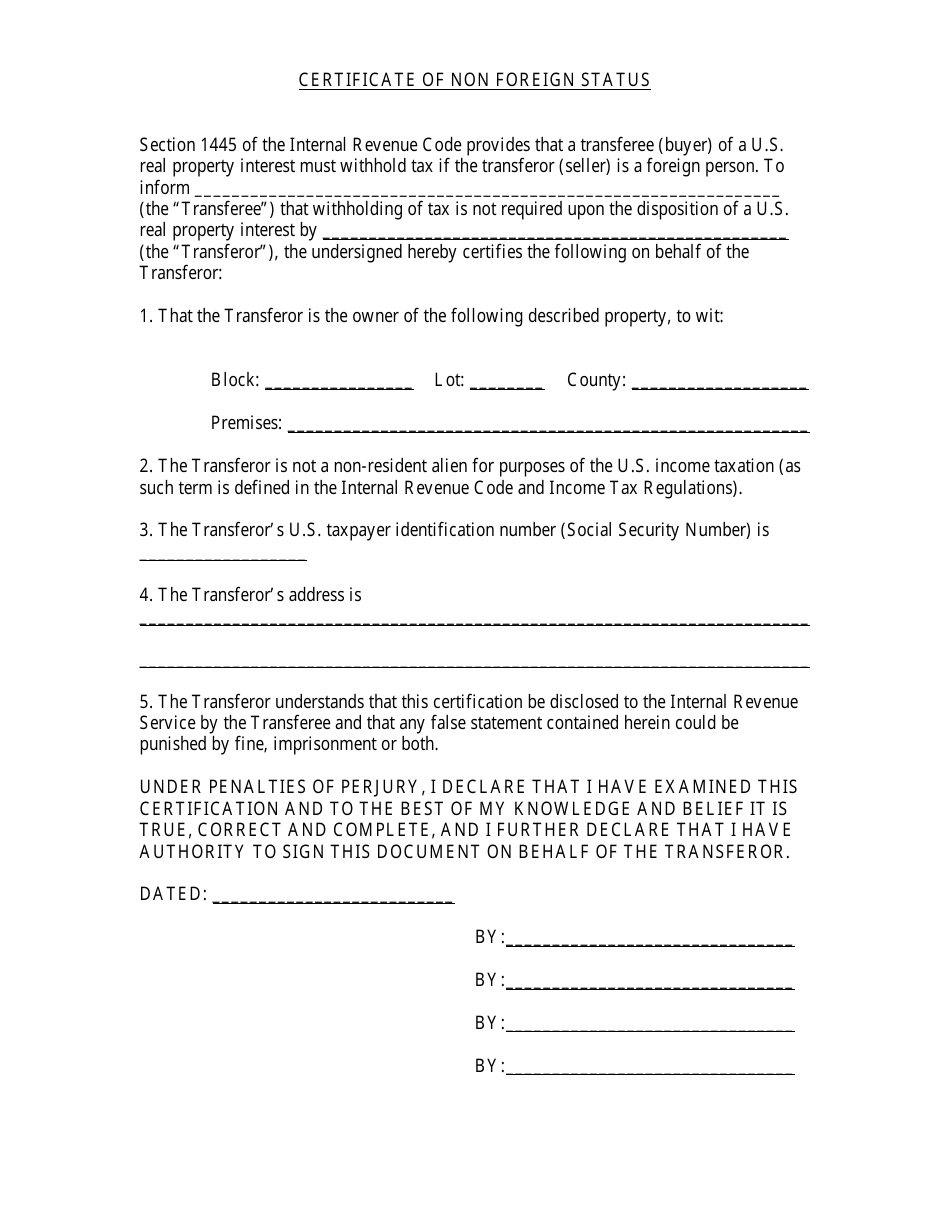

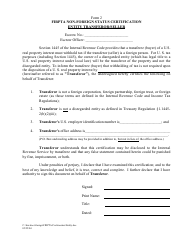

FIRPTA Certificate of Non Foreign Status

FIRPTA Certificate of Non Foreign Status is a 1-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is a FIRPTA Certificate of Non Foreign Status?

A: A FIRPTA Certificate of Non Foreign Status is a document used to establish that the seller of a U.S. real property interest is not a foreign person and, therefore, not subject to withholding of taxes under the Foreign Investment in Real Property Tax Act (FIRPTA).

Q: Why is a FIRPTA Certificate of Non Foreign Status required?

A: The FIRPTA law requires withholding of taxes when a foreign person sells a U.S. real property interest. However, if the seller can provide a valid FIRPTA Certificate of Non Foreign Status, withholding may not be required.

Q: Who needs to obtain a FIRPTA Certificate of Non Foreign Status?

A: Any seller of a U.S. real property interest who is not a U.S. citizen or resident alien needs to obtain a FIRPTA Certificate of Non Foreign Status.

Q: How can I obtain a FIRPTA Certificate of Non Foreign Status?

A: The buyer or the buyer's agent typically requests the seller to complete and sign a FIRPTA Certificate of Non Foreign Status. The form is then submitted to the Internal Revenue Service (IRS) for processing.

Q: What happens if a seller does not provide a FIRPTA Certificate of Non Foreign Status?

A: If a seller fails to provide a valid FIRPTA Certificate of Non Foreign Status, the buyer or the buyer's agent may need to withhold a portion of the purchase price and remit it to the IRS as required by FIRPTA law.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of the form through the link below or browse more documents in our library of IRS Forms.