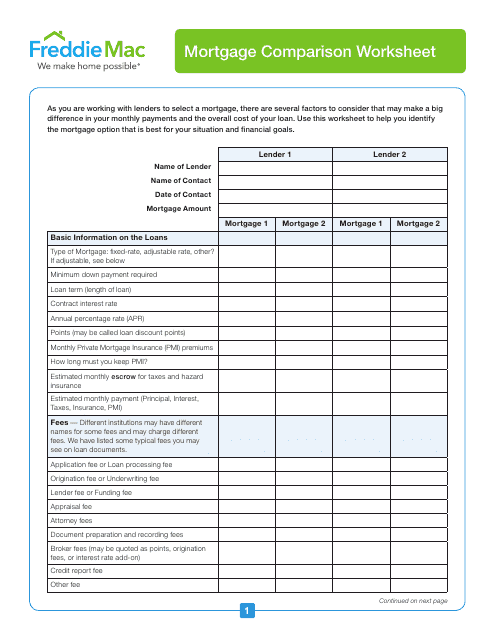

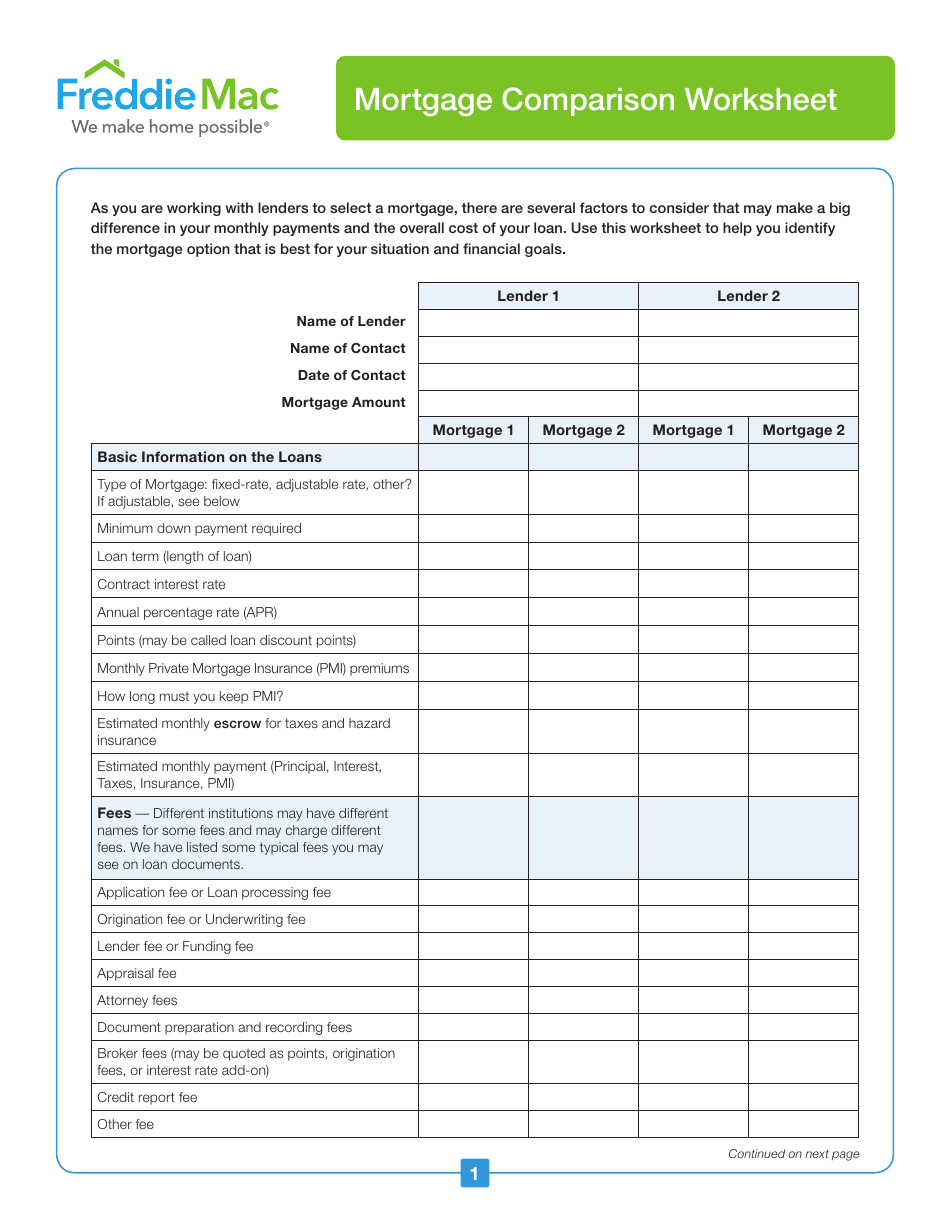

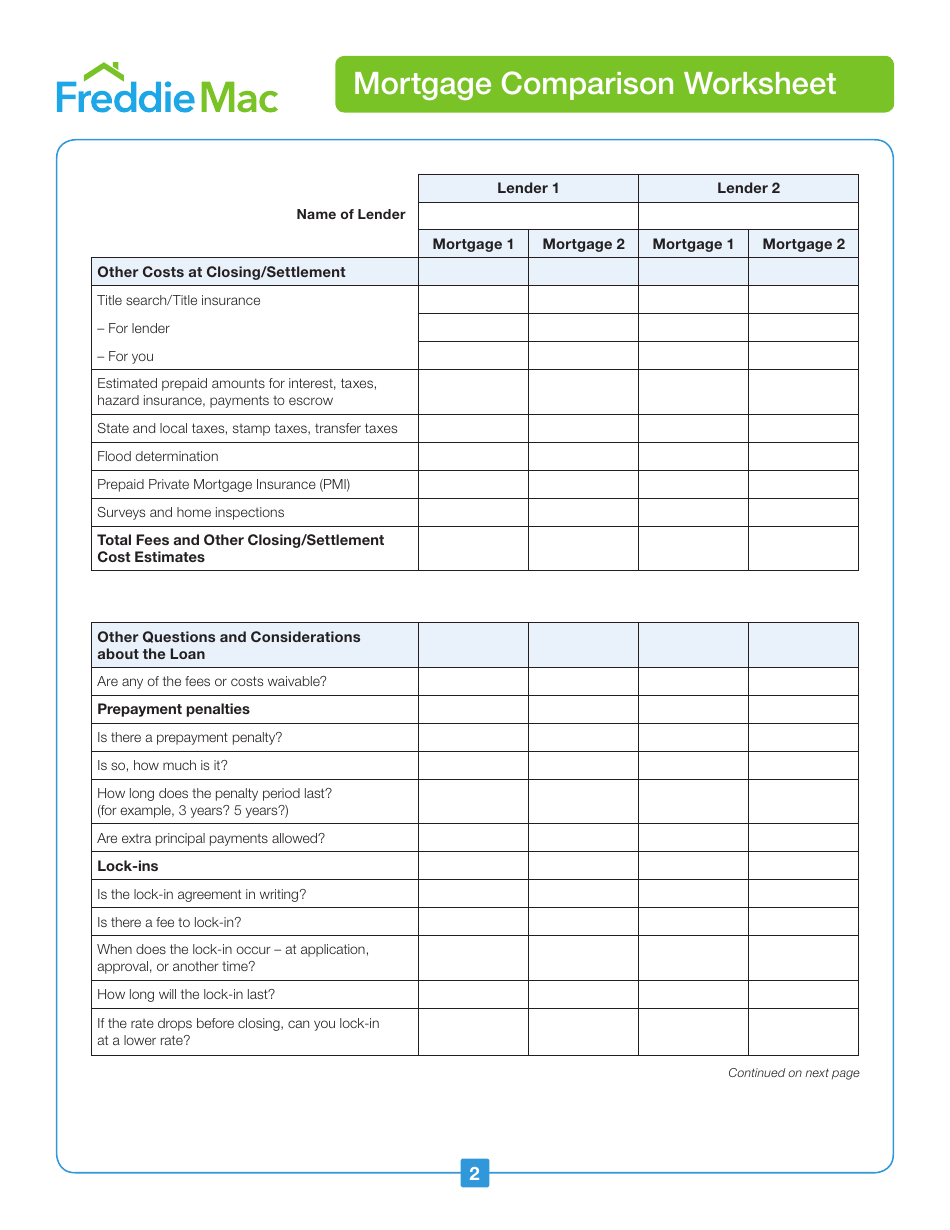

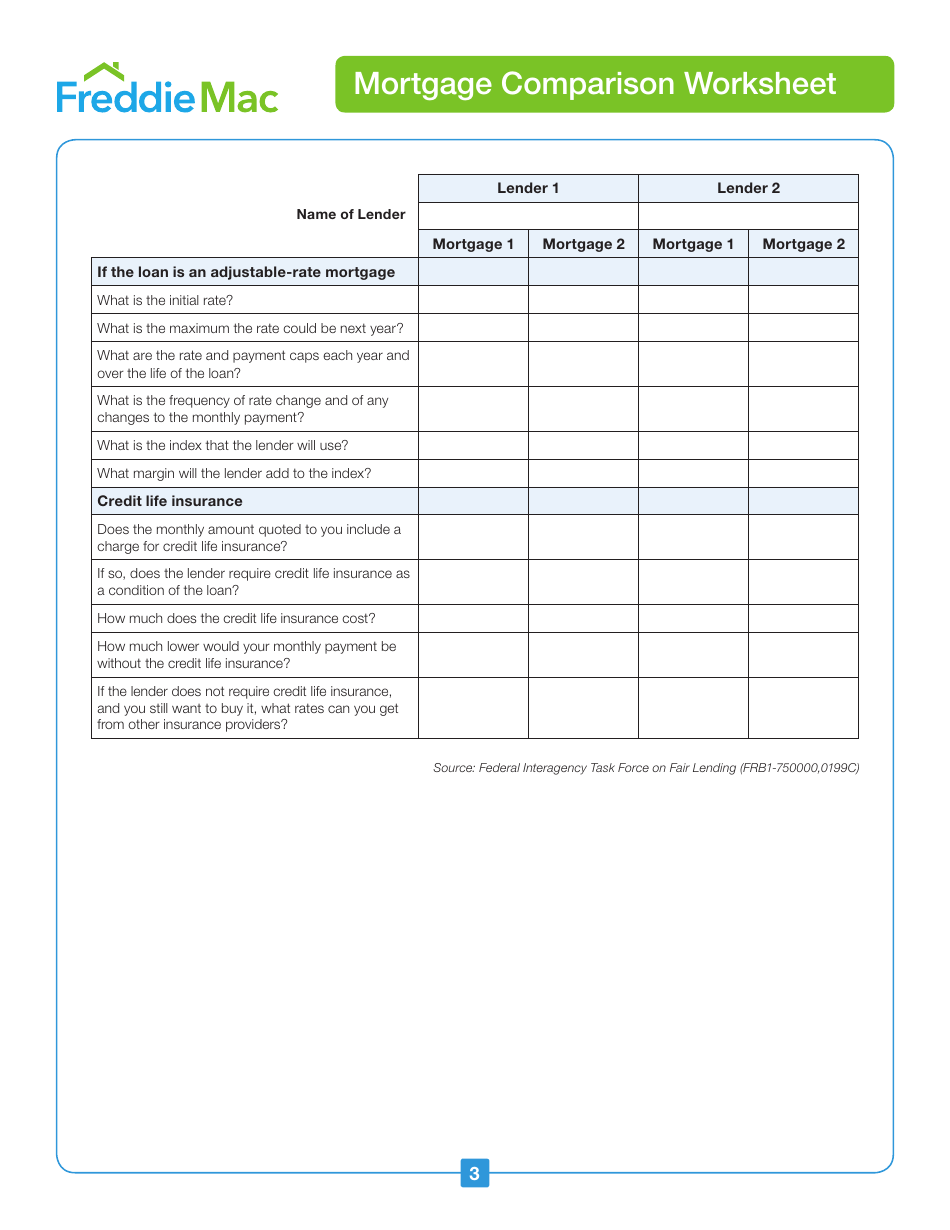

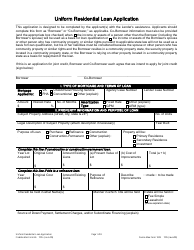

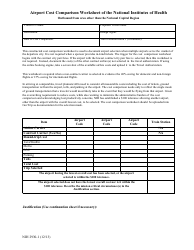

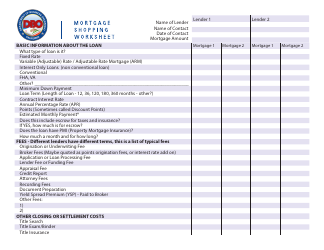

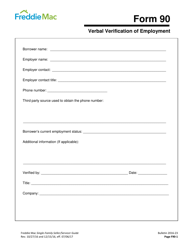

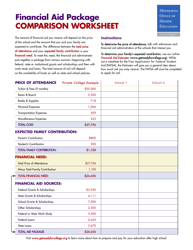

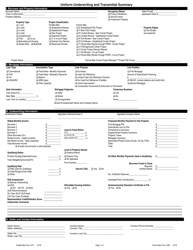

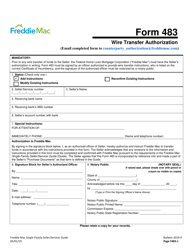

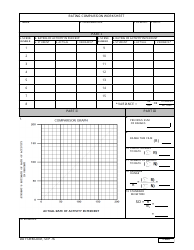

Mortgage Comparison Worksheet - Freddie Mac

The Mortgage Comparison Worksheet - Freddie Mac is a tool designed to help consumers compare different mortgage options offered by Freddie Mac, a government-sponsored enterprise that provides funding for home mortgages. It assists in evaluating the terms, costs, and features of various loan options to help borrowers make an informed decision.

FAQ

Q: What is a mortgage comparison worksheet?

A: A mortgage comparison worksheet is a tool used to compare different mortgage options.

Q: What does Freddie Mac do?

A: Freddie Mac is a government-sponsored enterprise that buys mortgages from lenders, pools them together, and sells them as mortgage-backed securities to investors.

Q: Why should I use a mortgage comparison worksheet?

A: Using a mortgage comparison worksheet can help you compare different mortgage options to find the best one for your needs.

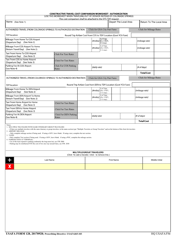

Q: What information should I include in a mortgage comparison worksheet?

A: A mortgage comparison worksheet should include information such as interest rates, loan terms, monthly payments, and closing costs.

Q: How can a mortgage comparison worksheet help me save money?

A: By comparing different mortgage options, you can identify the one with the lowest interest rate and fees, which can save you money over the life of the loan.

Q: What should I consider when comparing mortgages?

A: When comparing mortgages, you should consider factors such as interest rates, loan terms, closing costs, and any special features or benefits offered by the lender.

Q: Should I only consider interest rates when comparing mortgages?

A: No, you should also consider other factors such as loan terms, closing costs, and any special features or benefits offered by the lender.

Q: Can a mortgage comparison worksheet help me make a better decision?

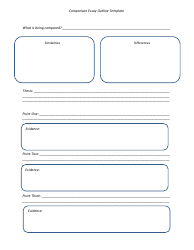

A: Yes, a mortgage comparison worksheet can help you make a more informed decision by providing a side-by-side comparison of different mortgage options.