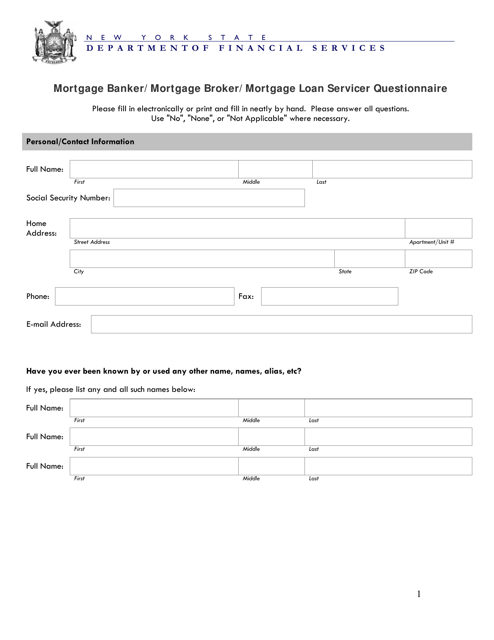

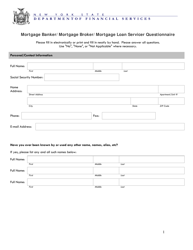

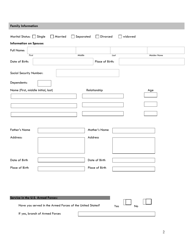

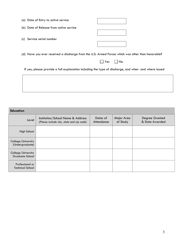

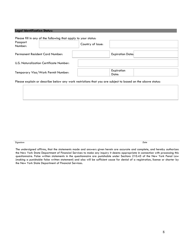

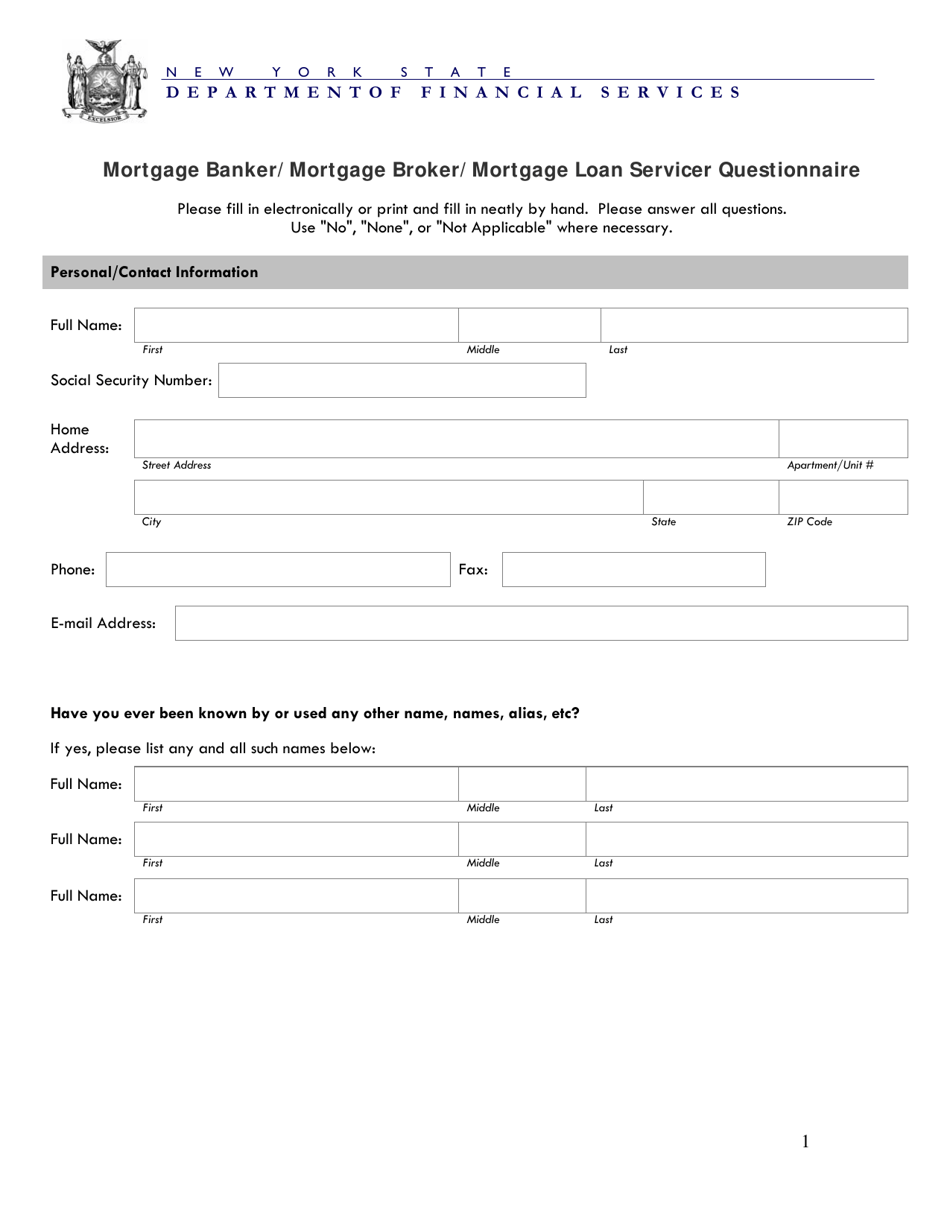

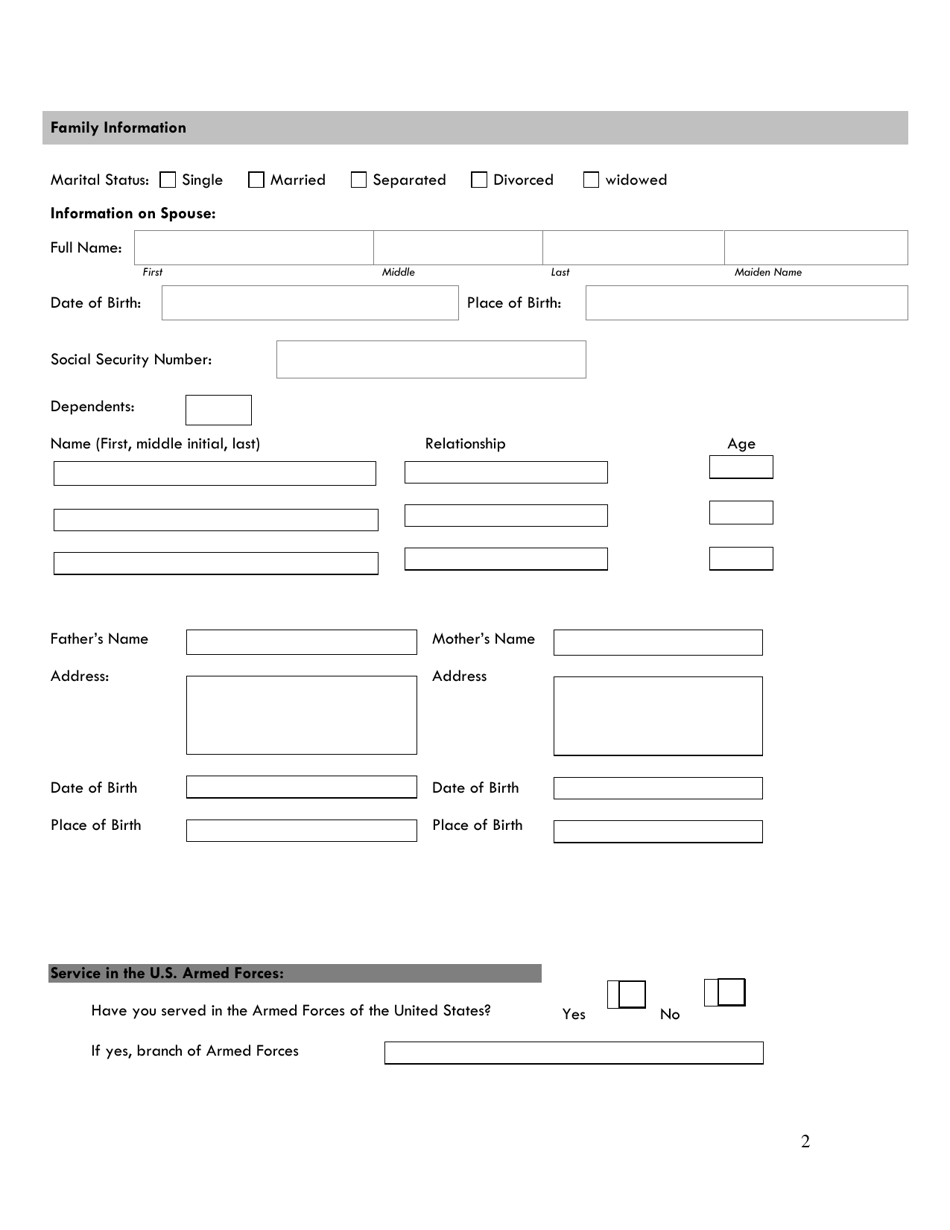

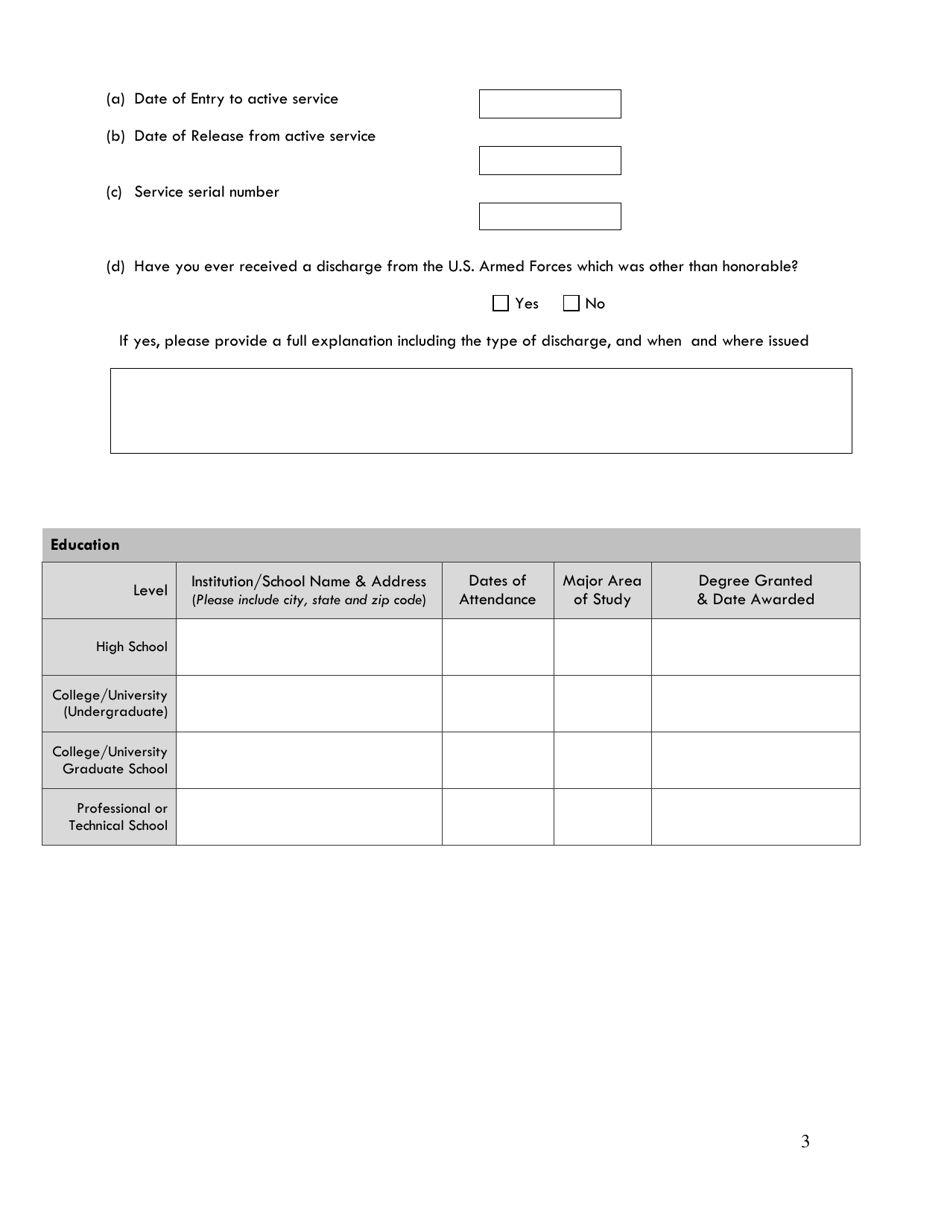

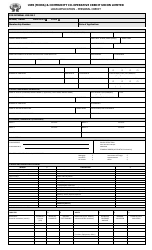

Mortgage Banker / Mortgage Broker / Mortgage Loan Servicer Questionnaire - New York

Mortgage Banker/Mortgage Broker/Mortgage Loan Servicer Questionnaire is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is a mortgage banker?

A: A mortgage banker is a company or individual that originates and funds mortgage loans.

Q: What is a mortgage broker?

A: A mortgage broker is a financial professional who acts as an intermediary between borrowers and lenders, helping borrowers find and secure mortgage loans.

Q: What is a mortgage loan servicer?

A: A mortgage loan servicer is a company that collects mortgage payments, manages escrow accounts, and handles other administrative tasks related to servicing a mortgage loan.

Q: What does it mean to originate a mortgage loan?

A: To originate a mortgage loan means to process and fund a loan for a borrower, often including determining eligibility, verifying documentation, and underwriting the loan.

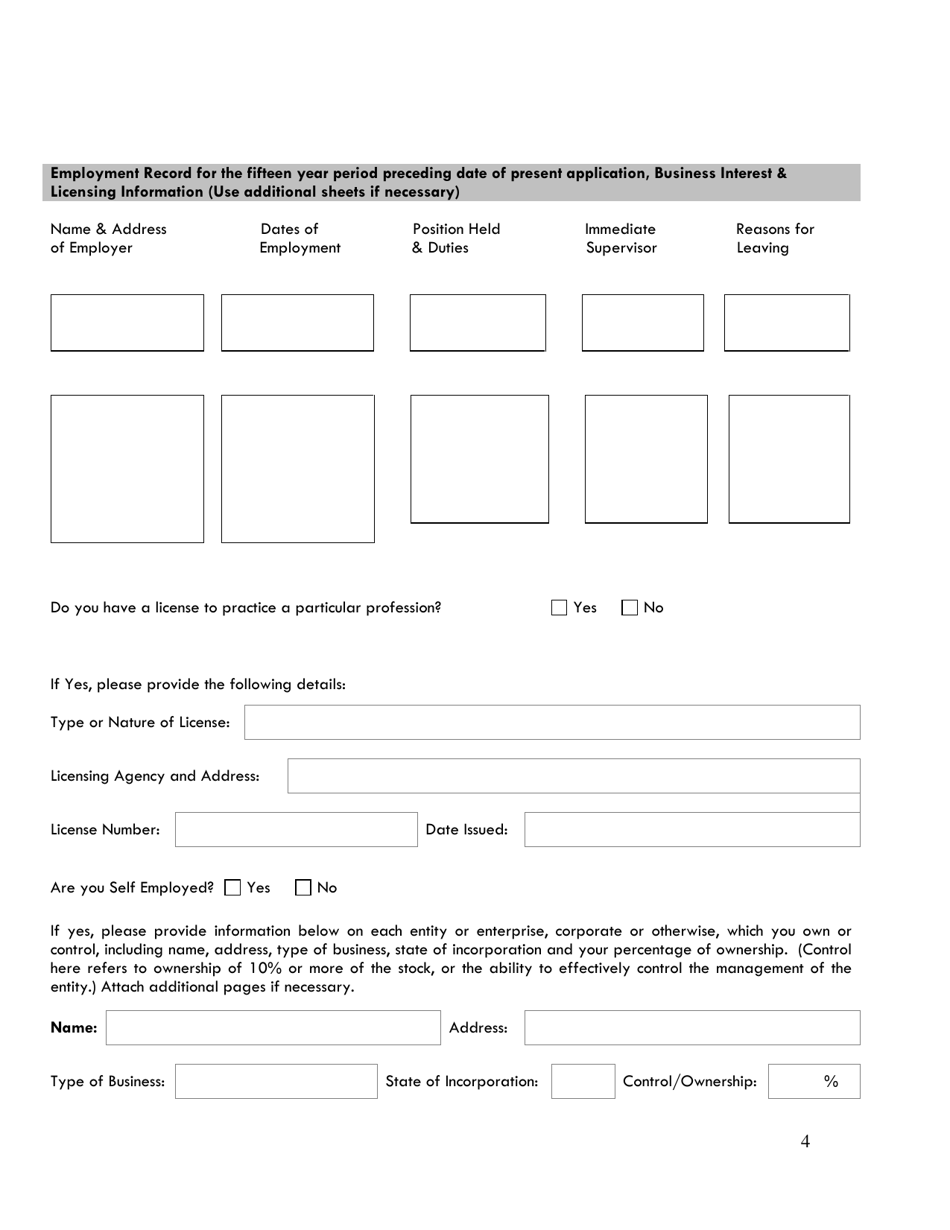

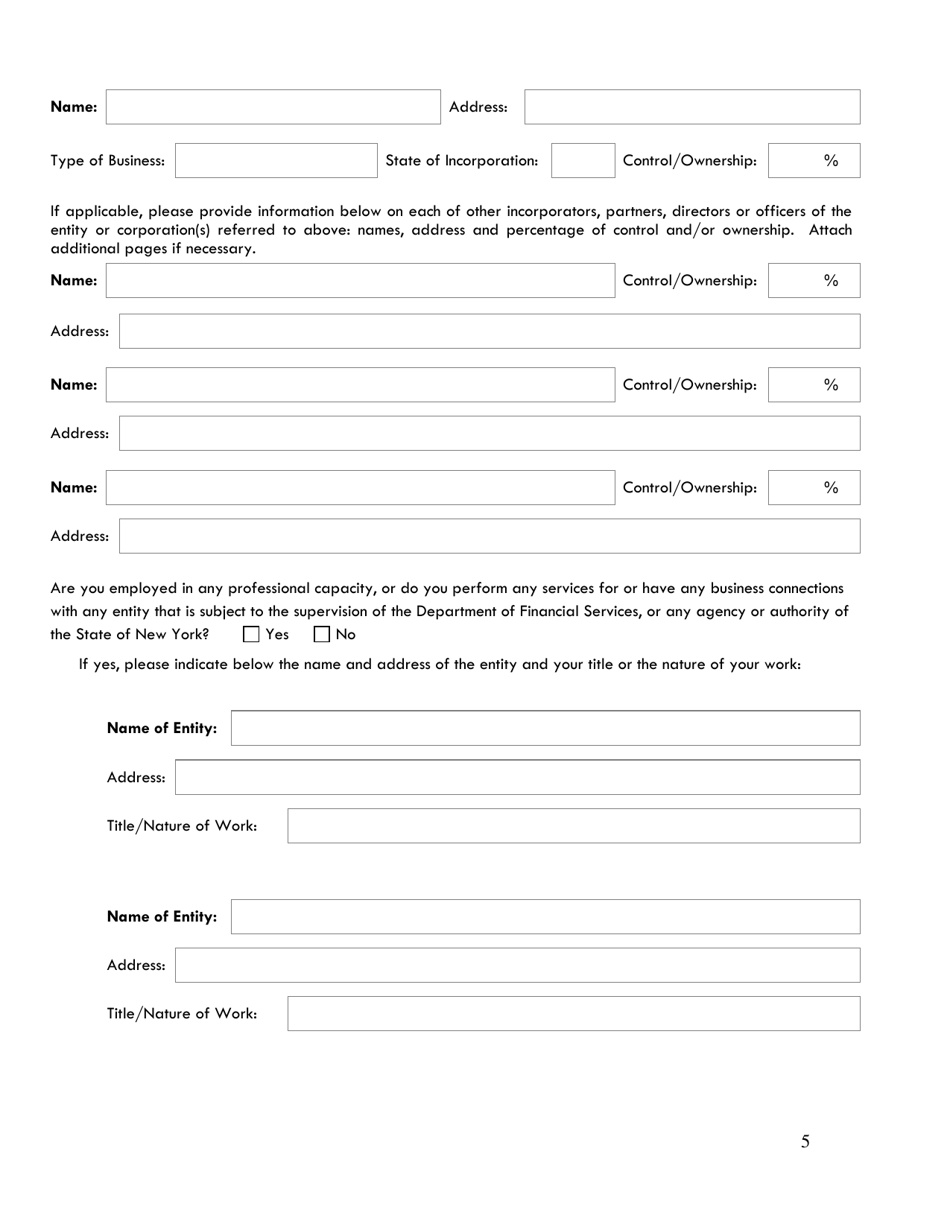

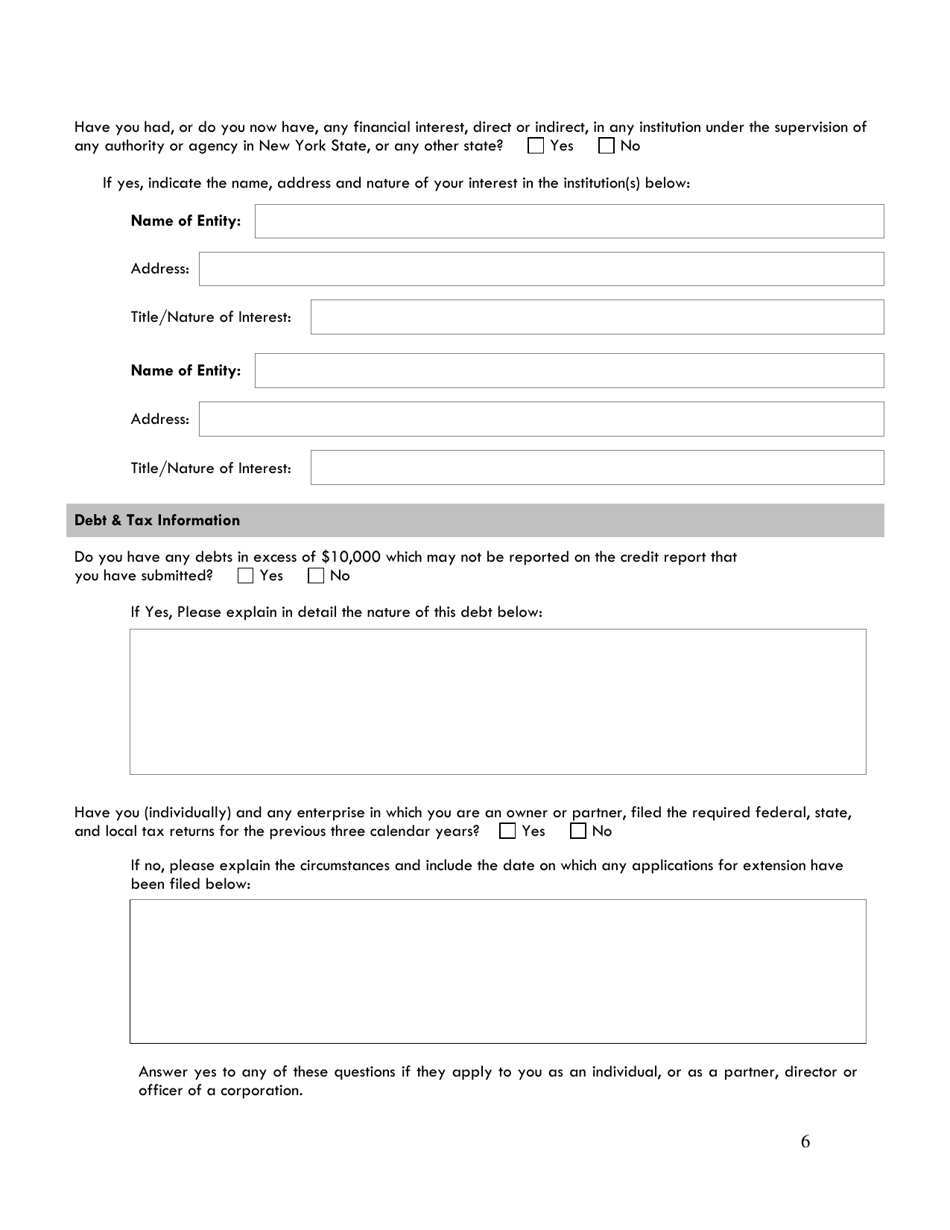

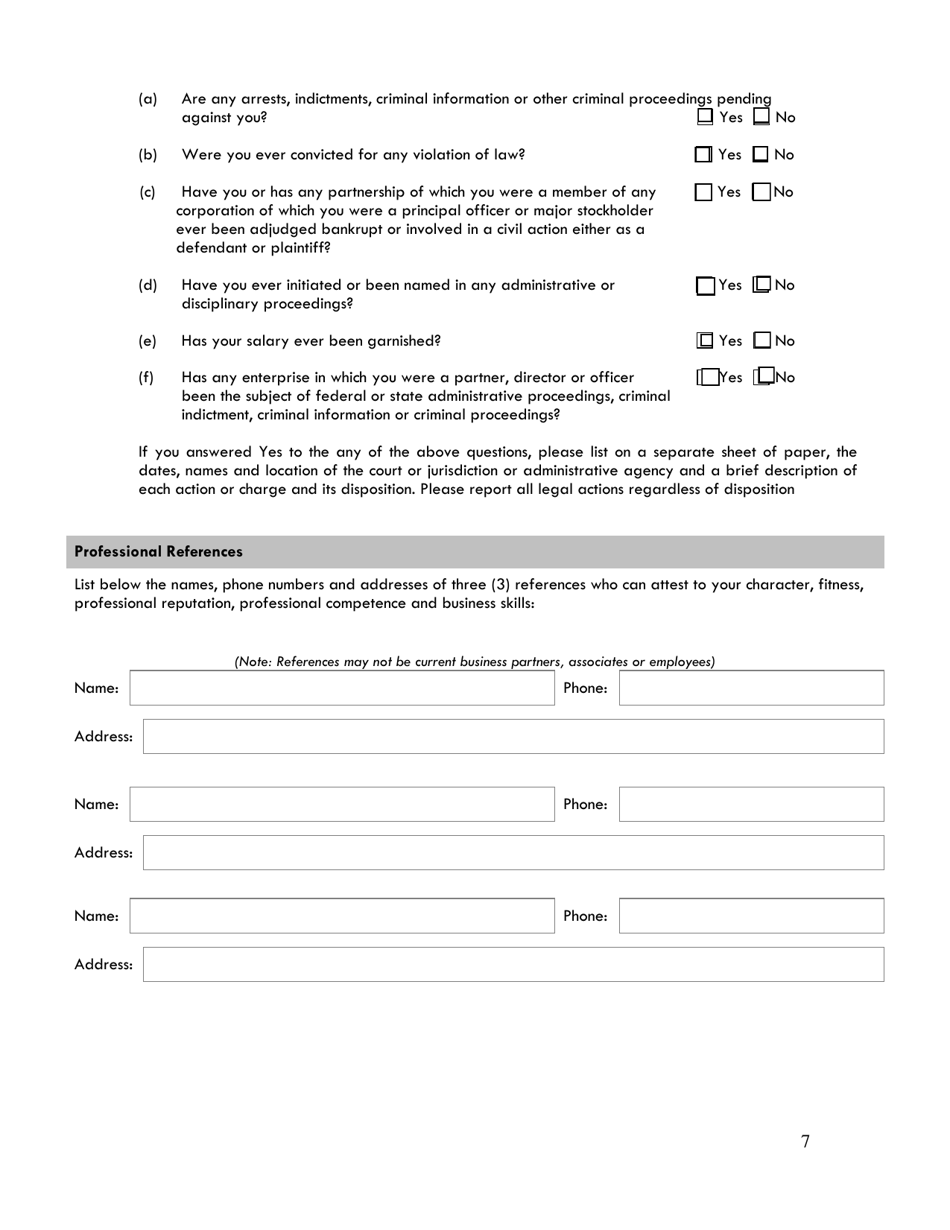

Q: What are the requirements to become a mortgage banker, mortgage broker, or mortgage loan servicer in New York?

A: The requirements to become a mortgage banker, mortgage broker, or mortgage loan servicer in New York can vary, but generally include obtaining the necessary licenses, completing pre-licensing education, passing an exam, and meeting certain financial and character requirements.

Form Details:

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.