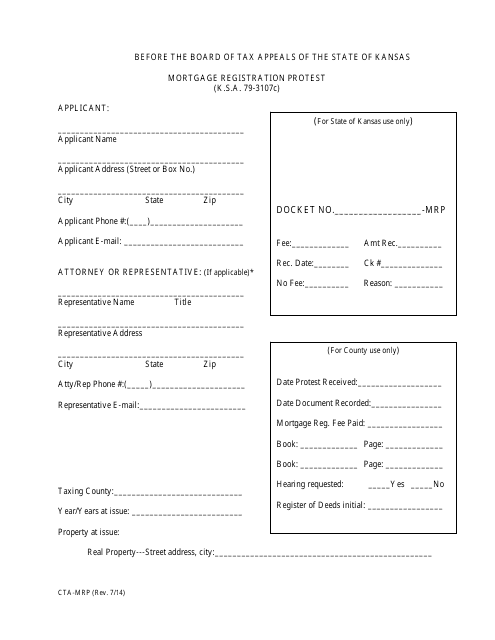

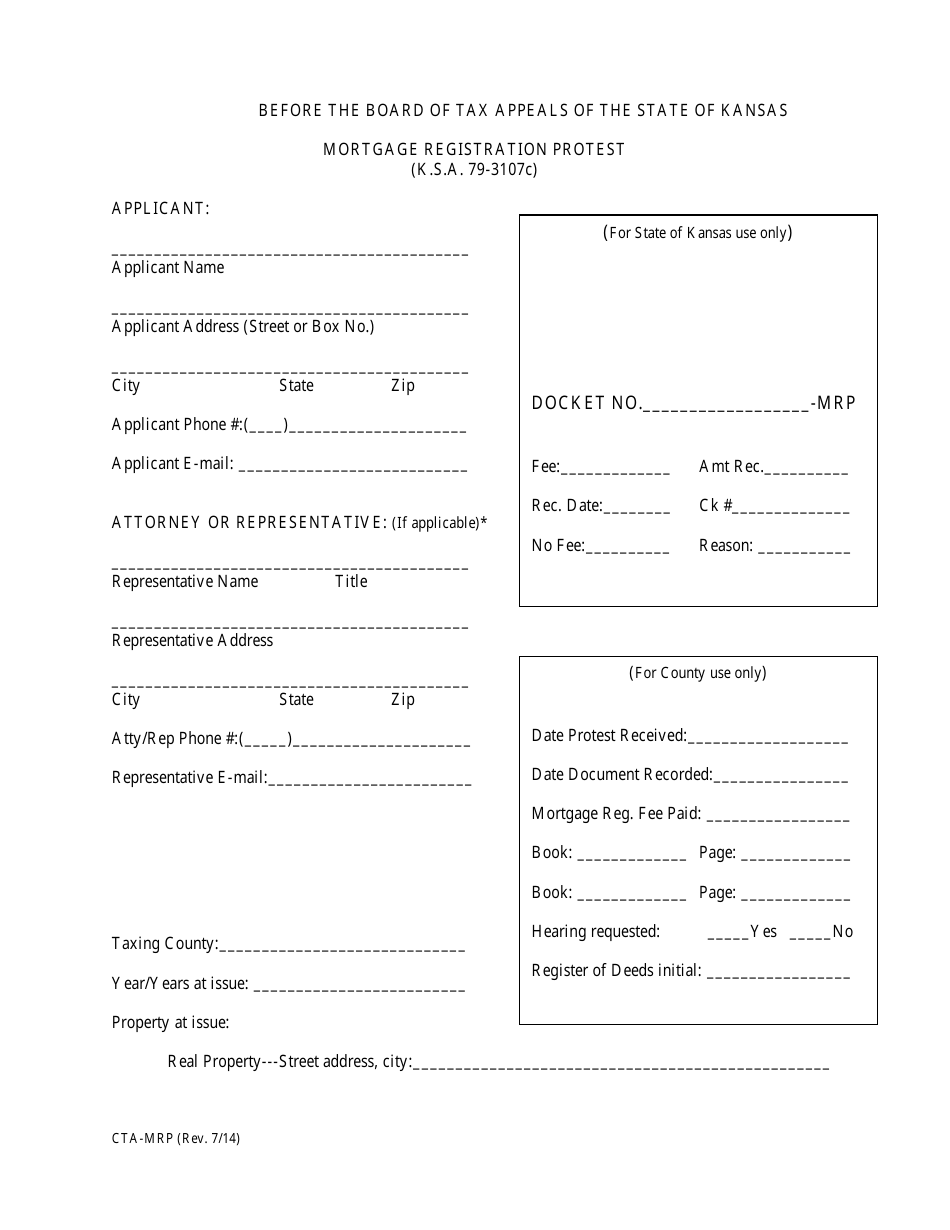

Mortgage Registration Protest - Kansas

Mortgage Registration Protest is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

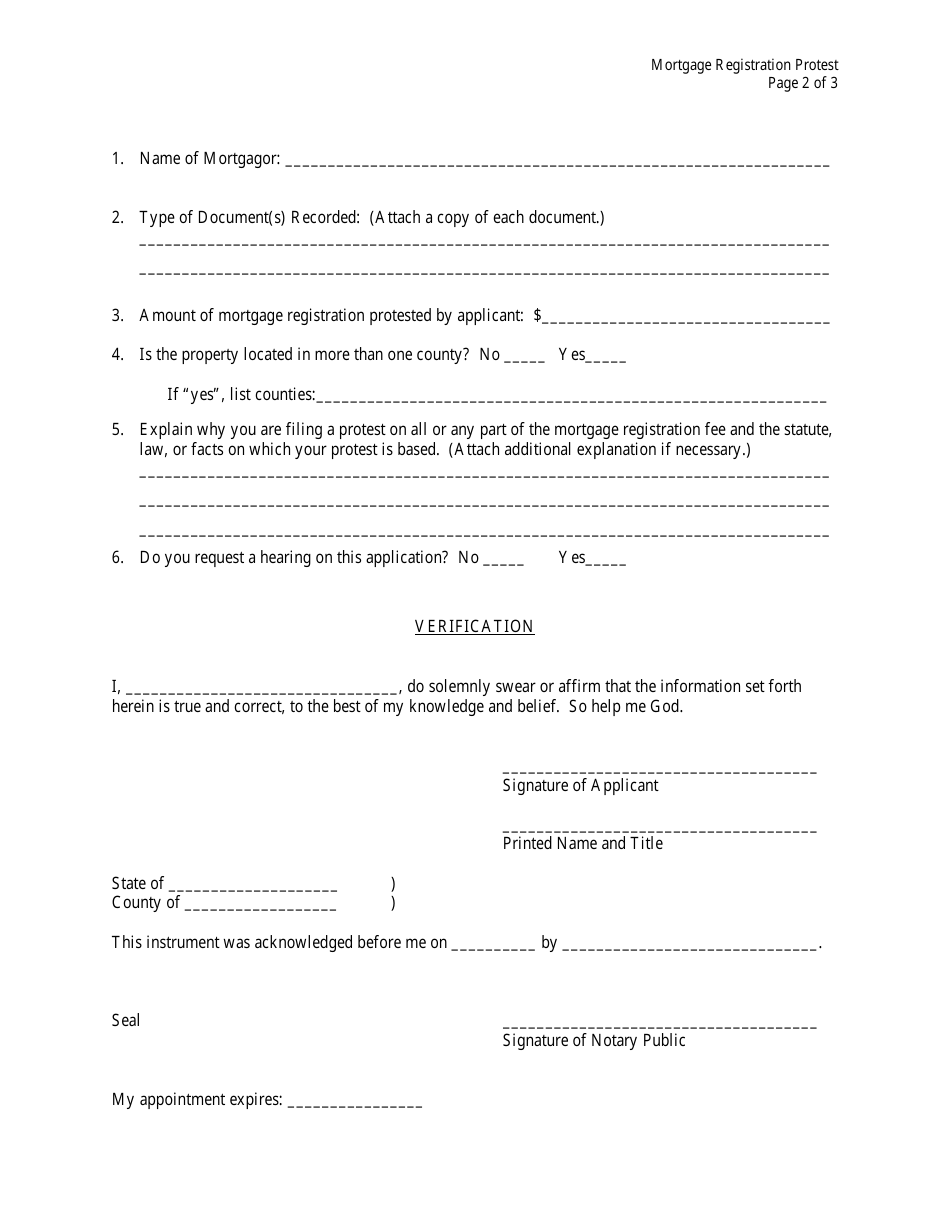

Q: What is a mortgage registration protest?

A: A mortgage registration protest is a legal action in Kansas where a party disputes the validity or enforceability of a mortgage document.

Q: Who can file a mortgage registration protest in Kansas?

A: Any person who has an interest in the real estate or mortgage document can file a mortgage registration protest in Kansas.

Q: Why would someone file a mortgage registration protest?

A: Someone might file a mortgage registration protest if they believe there are errors or defects in the mortgage document or if they want to challenge its validity.

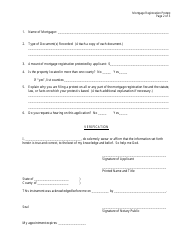

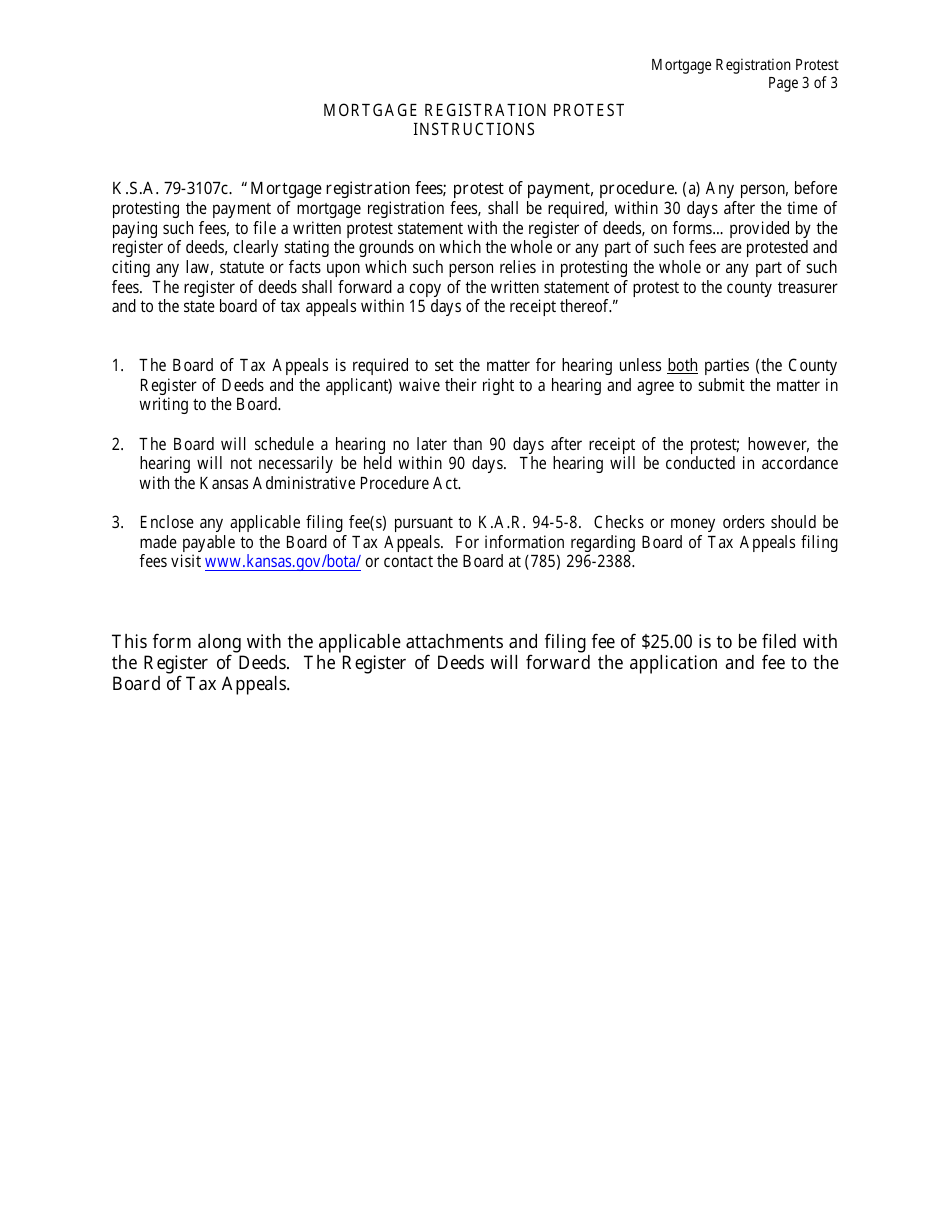

Q: What is the process for filing a mortgage registration protest in Kansas?

A: The process for filing a mortgage registration protest in Kansas involves submitting the necessary paperwork, including a written statement explaining the basis for the protest, to the appropriate county office.

Q: What happens after a mortgage registration protest is filed?

A: After a mortgage registration protest is filed, the county office will review the protest and may hold a hearing to determine the validity of the mortgage document.

Q: Can a mortgage be enforced during a mortgage registration protest?

A: Yes, a mortgage can still be enforced during a mortgage registration protest, unless a court orders otherwise.

Q: Are there any fees associated with filing a mortgage registration protest in Kansas?

A: Yes, there are fees associated with filing a mortgage registration protest in Kansas. Contact the county office for specific information on the fees.

Q: Is legal representation required for filing a mortgage registration protest?

A: Legal representation is not required for filing a mortgage registration protest in Kansas, but it may be advisable to consult with an attorney.

Q: Can a mortgage registration protest be resolved through negotiation or settlement?

A: Yes, a mortgage registration protest can be resolved through negotiation or settlement between the parties involved.

Form Details:

- Released on July 1, 2014;

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.