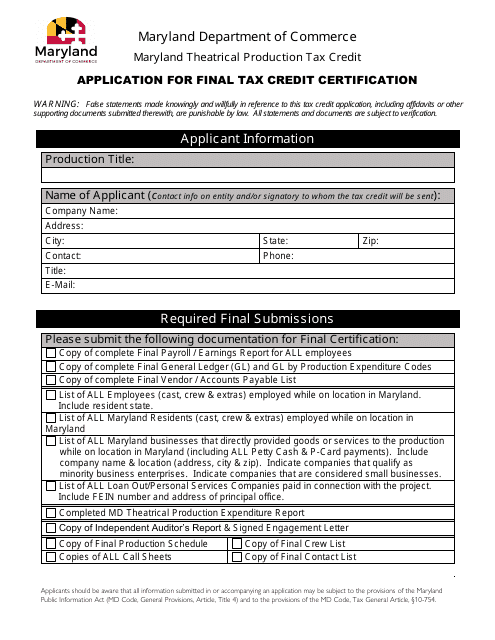

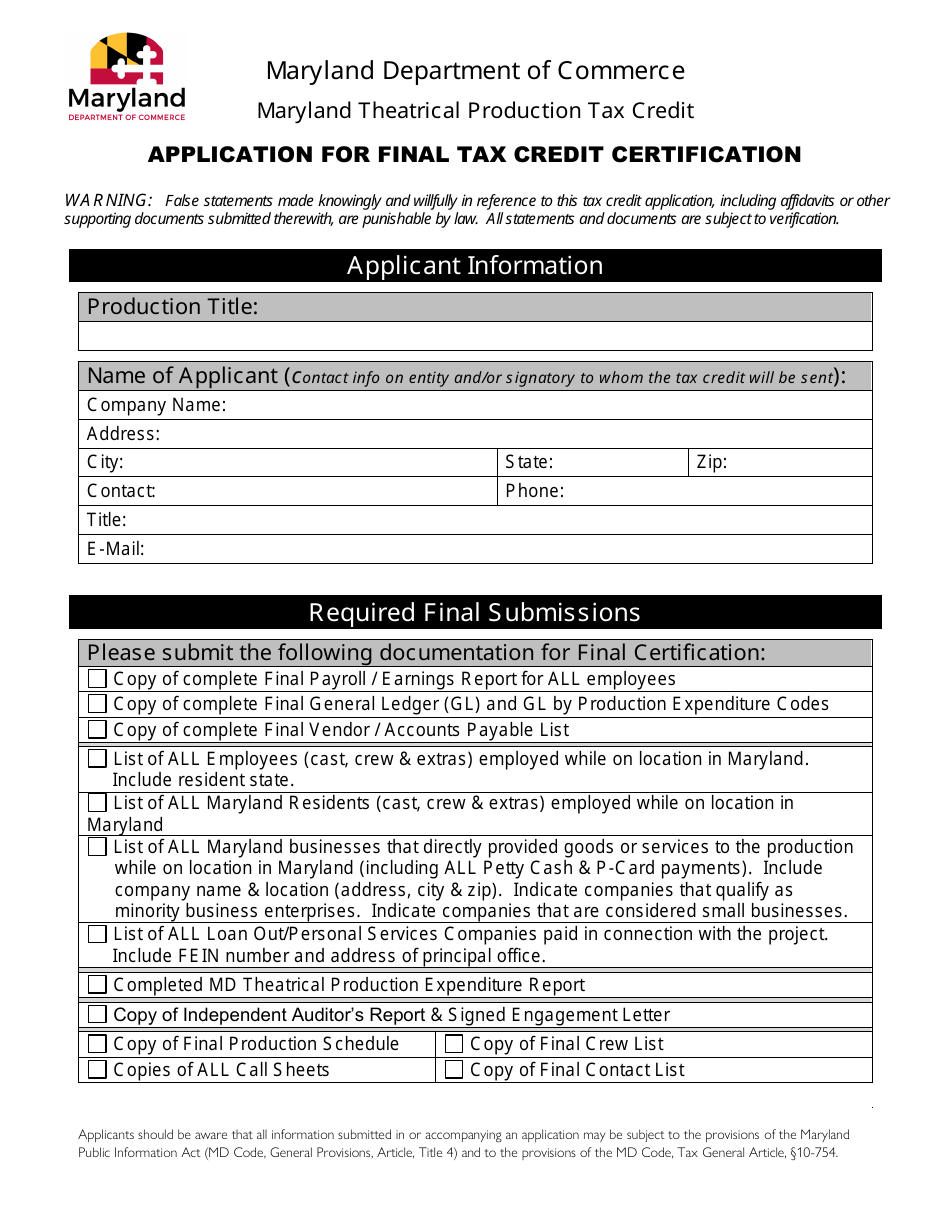

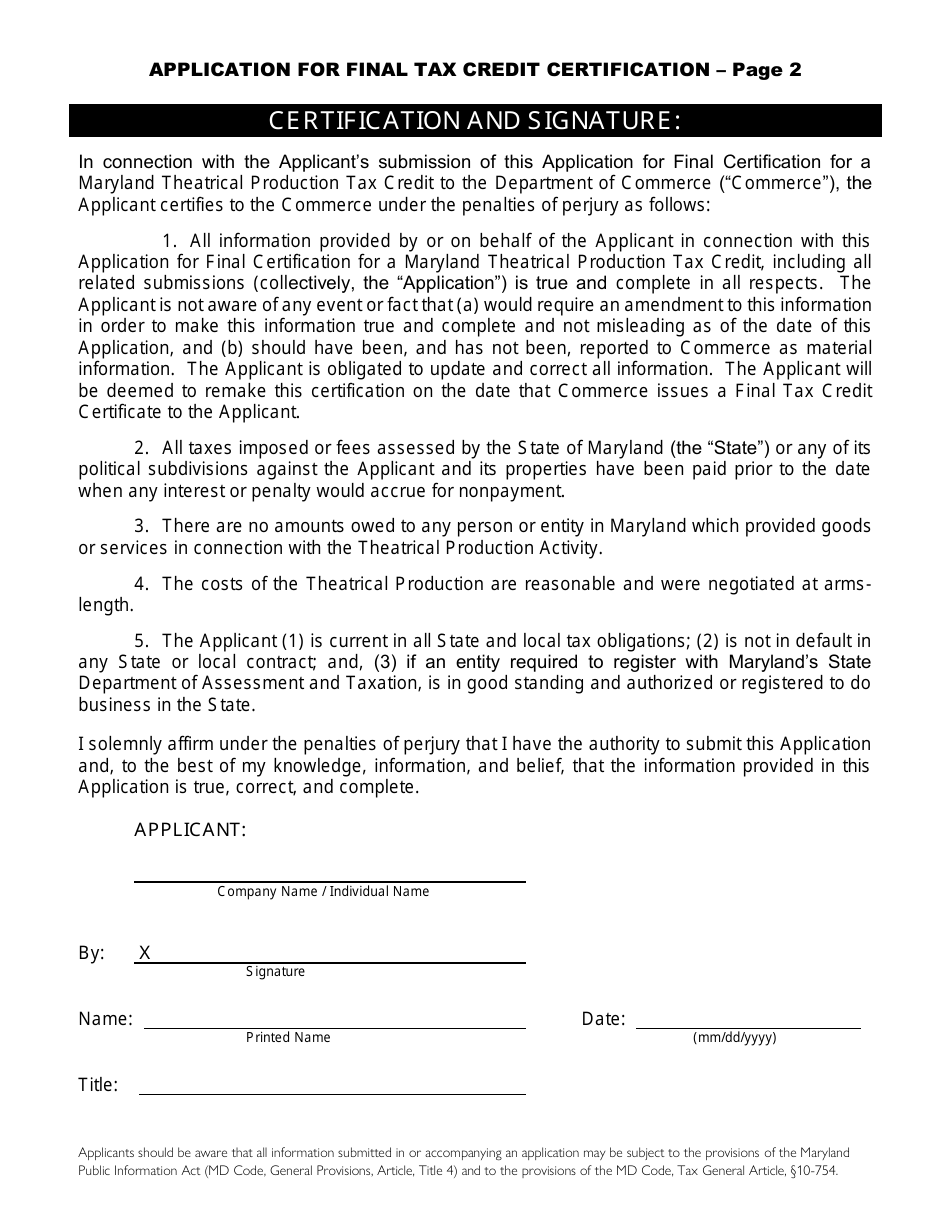

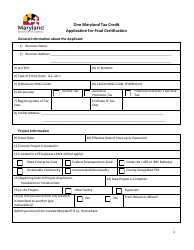

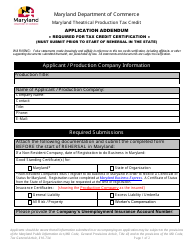

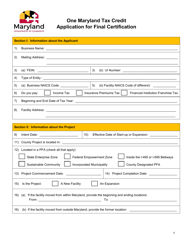

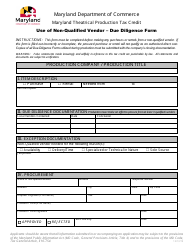

Application for Final Tax Credit Certification - Maryland Theatrical Production Tax Credit - Maryland

Application for Final Tax Credit Certification - Maryland Theatrical Production Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

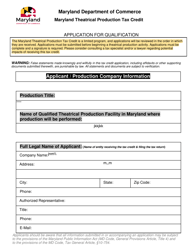

Q: What is the Maryland Theatrical Production Tax Credit?

A: The Maryland Theatrical Production Tax Credit is a program that provides tax credits for qualified expenses incurred in the production of qualified theatrical productions in Maryland.

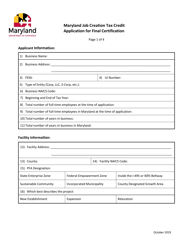

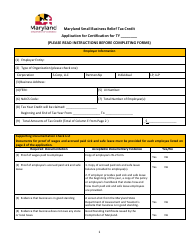

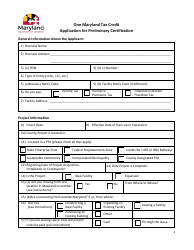

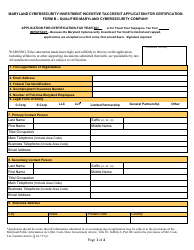

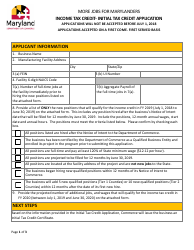

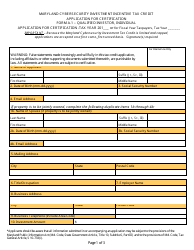

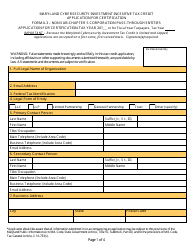

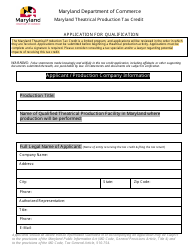

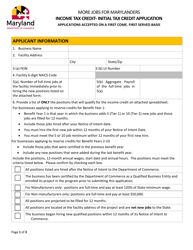

Q: Who is eligible for the tax credit?

A: Eligible applicants include production companies or entities that have entered into an agreement with a production company for the production of a qualified theatrical production in Maryland.

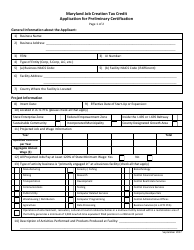

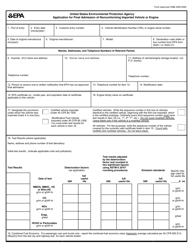

Q: What expenses are eligible for the tax credit?

A: Eligible expenses include costs associated with the pre-production, production, and post-production stages of a qualified theatrical production.

Q: How much is the tax credit?

A: The tax credit is equal to 25% of eligible expenses incurred in Maryland, up to a maximum of $5 million per production.

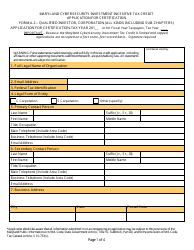

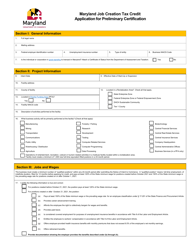

Q: How can I apply for the tax credit?

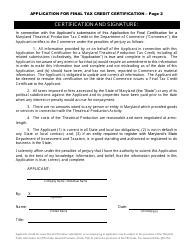

A: To apply for the tax credit, you must complete and submit an Application for Final Tax Credit Certification to the Maryland Film Office.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.