This version of the form is not currently in use and is provided for reference only. Download this version of

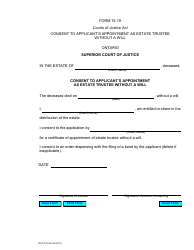

Form 1205E

for the current year.

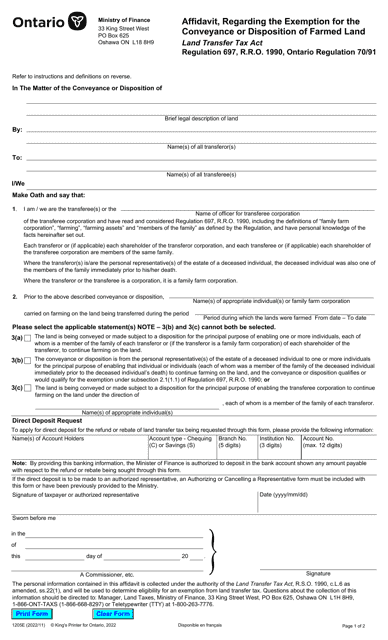

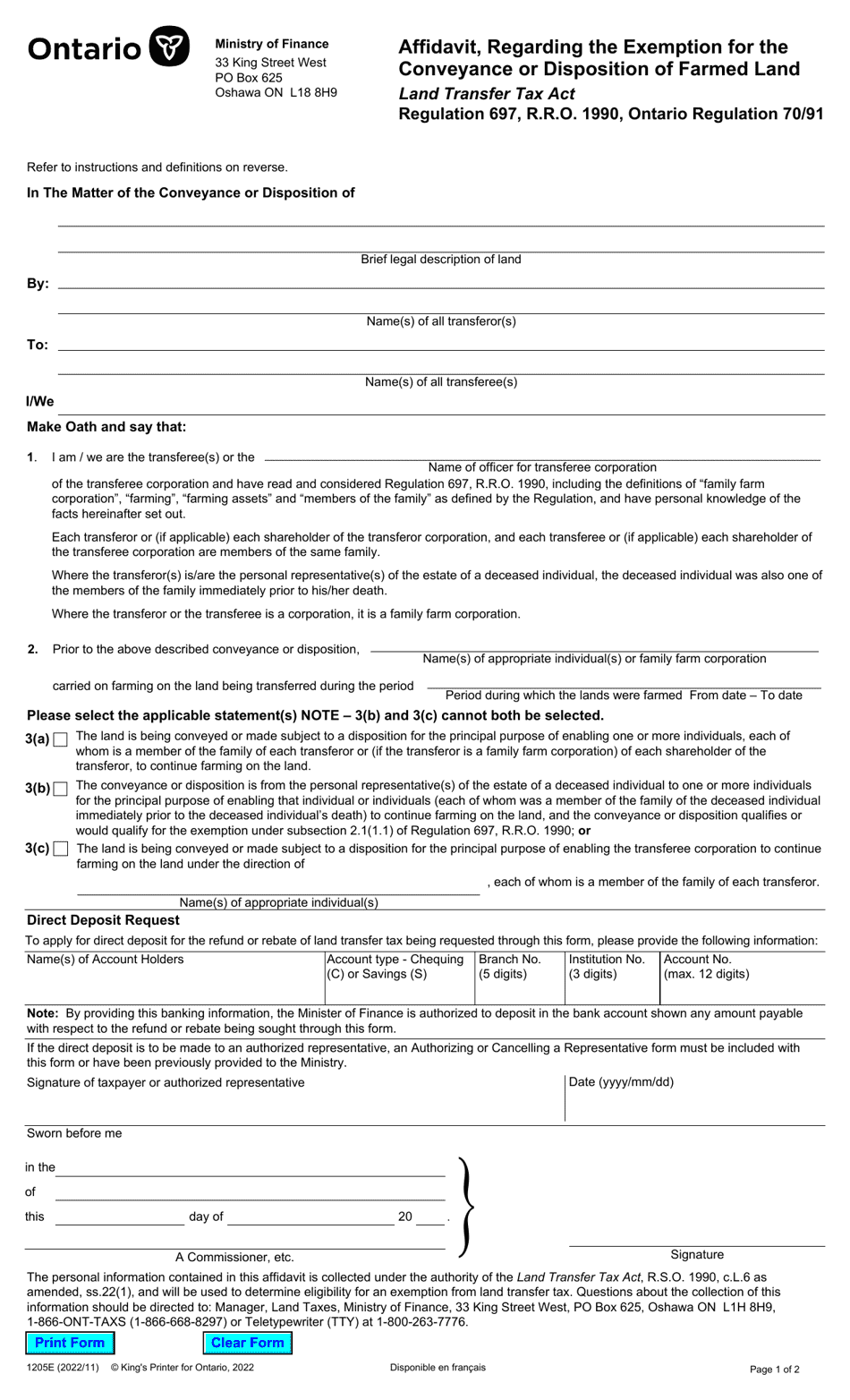

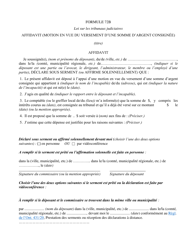

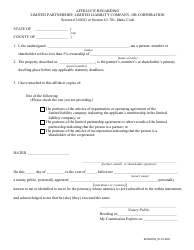

Form 1205E Affidavit, Regarding the Exemption for the Conveyance or Disposition of Farmed Land - Ontario, Canada

Form 1205E Affidavit is used in Ontario, Canada to claim an exemption for the conveyance or disposition of farmed land. This form helps individuals or entities establish their eligibility for a tax exemption related to agricultural land.

The Form 1205E Affidavit, regarding the exemption for the conveyance or disposition of farmed land in Ontario, Canada, is filed by the seller of the farmed land.

FAQ

Q: What is Form 1205E Affidavit?

A: Form 1205E Affidavit is a document used in Ontario, Canada to claim an exemption for the conveyance or disposition of farmed land.

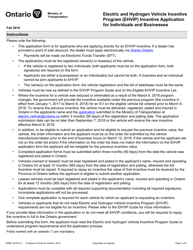

Q: Who needs to fill out Form 1205E Affidavit?

A: Anyone who wants to claim an exemption for the conveyance or disposition of farmed land in Ontario, Canada needs to fill out Form 1205E Affidavit.

Q: What is the purpose of the exemption for the conveyance or disposition of farmed land?

A: The exemption is designed to provide tax relief to farmers in Ontario, Canada when transferring or selling their farmland.

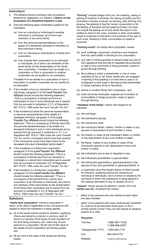

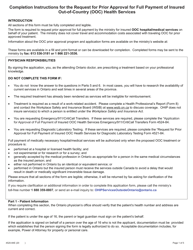

Q: Are there any eligibility criteria for claiming the exemption?

A: Yes, there are specific eligibility criteria that must be met in order to claim the exemption. These criteria include requirements related to the size and use of the farmed land.

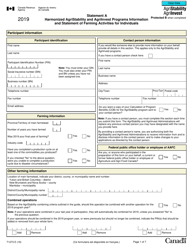

Q: Do I need to include any supporting documents with Form 1205E Affidavit?

A: Yes, you may be required to include supporting documents such as a copy of the deed for the farmed land or other relevant documentation.

Q: Is there a deadline for submitting Form 1205E Affidavit?

A: Yes, Form 1205E Affidavit must be submitted within 30 days of the conveyance or disposition of the farmed land.

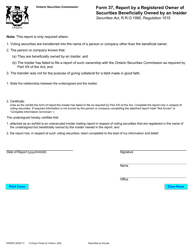

Q: What happens after Form 1205E Affidavit is submitted?

A: After submitting Form 1205E Affidavit, the Ontario Ministry of Finance will review the application and determine if the exemption can be granted.

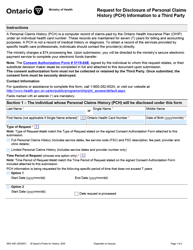

Q: Can I appeal if my application for the exemption is denied?

A: Yes, if your application for the exemption is denied, you have the right to appeal the decision.

Q: Who should I contact for more information about Form 1205E Affidavit?

A: You can contact the Ontario Ministry of Finance or a local tax office in Ontario, Canada for more information about Form 1205E Affidavit.