This version of the form is not currently in use and is provided for reference only. Download this version of

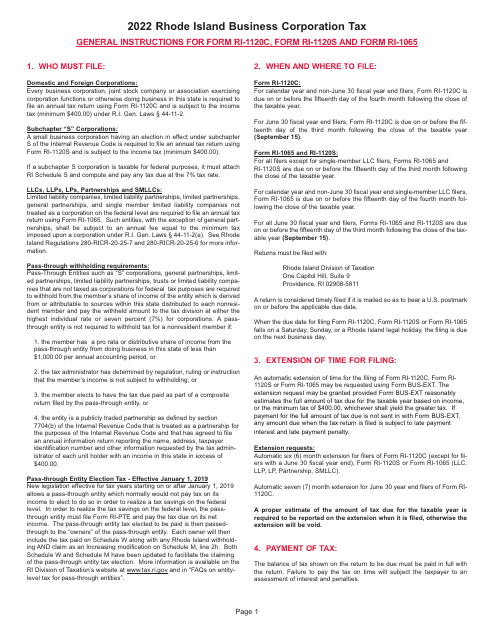

Instructions for Form RI-1120C, RI-1120S, RI-1065

for the current year.

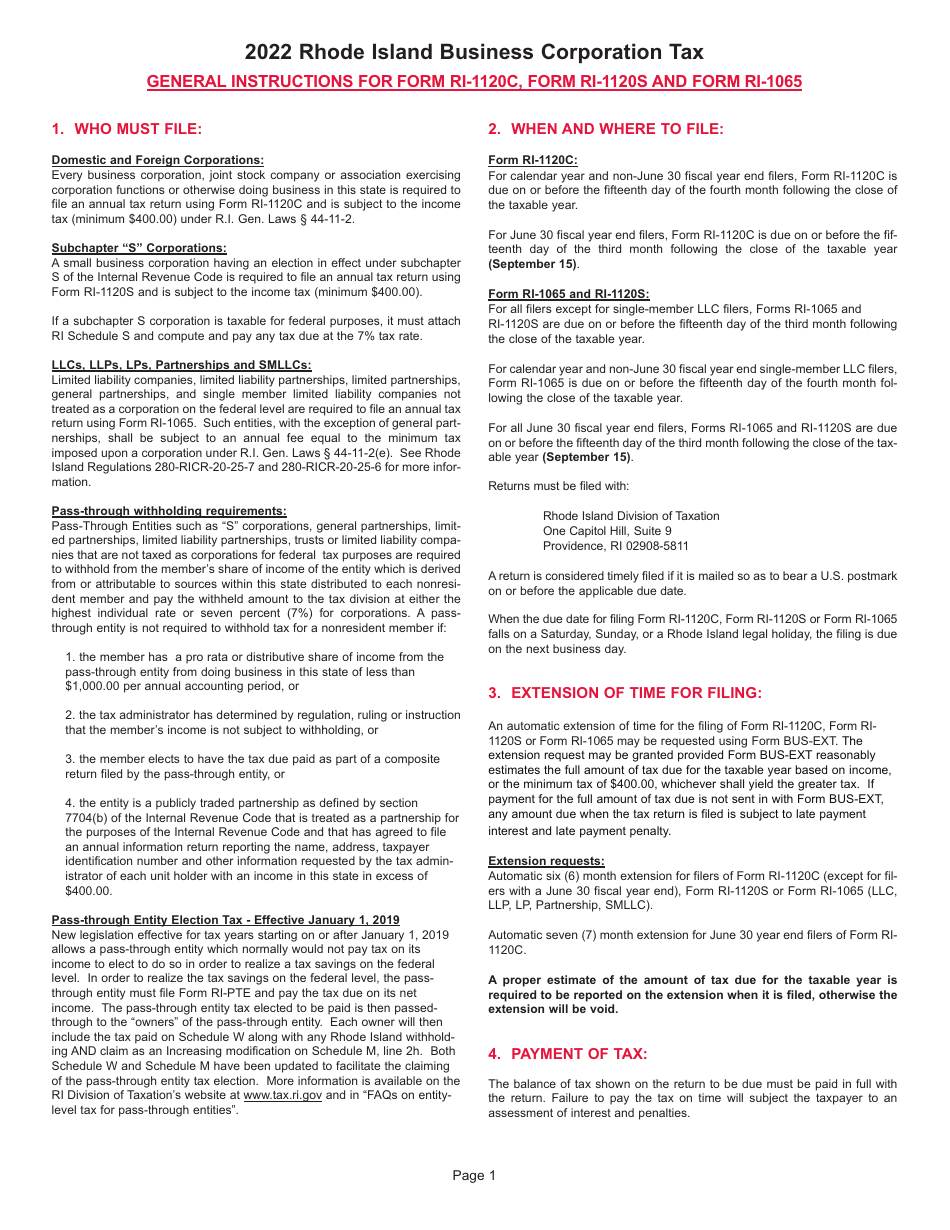

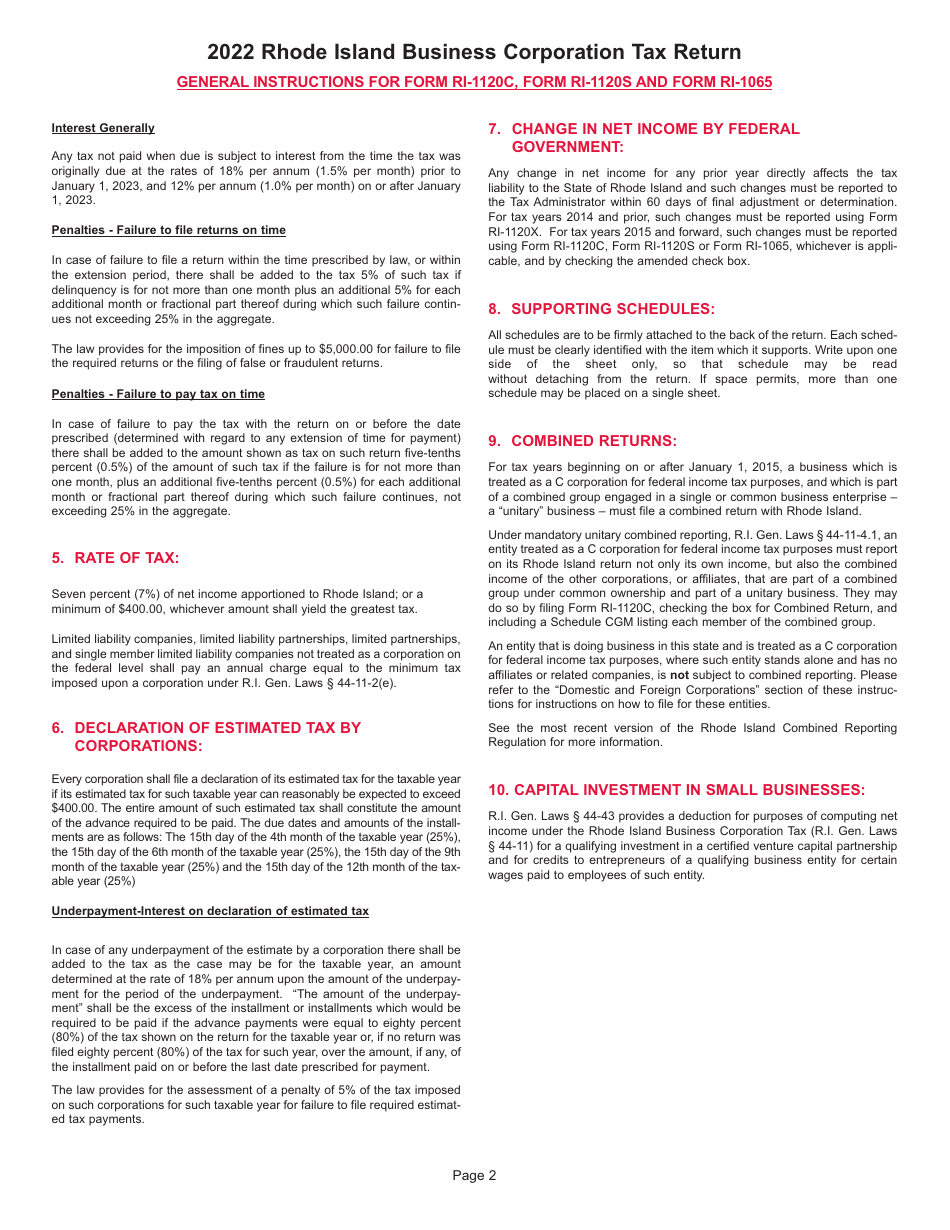

Instructions for Form RI-1120C, RI-1120S, RI-1065 - Rhode Island

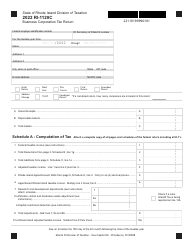

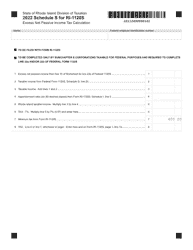

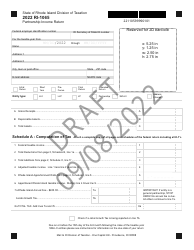

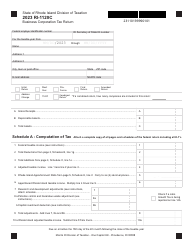

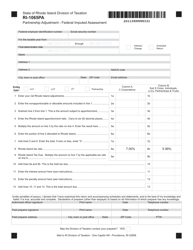

This document contains official instructions for Form RI-1120C , Form RI-1120S , and Form RI-1065 . All forms are released and collected by the Rhode Island Department of Revenue - Division of Taxation. An up-to-date fillable Form RI-1120C is available for download through this link. The latest available Form RI-1120S Schedule S can be downloaded through this link. Form RI-1065 can be found here.

FAQ

Q: What are Form RI-1120C, RI-1120S, and RI-1065?

A: These are tax forms used in Rhode Island for different types of businesses.

Q: Who needs to file Form RI-1120C?

A: Form RI-1120C is for C corporations that are doing business in Rhode Island.

Q: Who needs to file Form RI-1120S?

A: Form RI-1120S is for S corporations that are doing business in Rhode Island.

Q: Who needs to file Form RI-1065?

A: Form RI-1065 is for partnerships that are doing business in Rhode Island.

Q: When are Form RI-1120C, RI-1120S, and RI-1065 due?

A: The due date for these forms is generally on or around April 15th, but you should check with the Rhode Island Division of Taxation for the specific due date each year.

Q: Is there a penalty for filing these forms late?

A: Yes, there may be penalties for filing these forms late, so it's important to submit them on time.

Q: Do I need to include any additional documentation with these forms?

A: Yes, you may need to include supporting documentation such as schedules and attachments, depending on your specific business situation.

Q: What if I have questions or need assistance with these forms?

A: If you have questions or need assistance, you can contact the Rhode Island Division of Taxation for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Revenue - Division of Taxation.