This version of the form is not currently in use and is provided for reference only. Download this version of

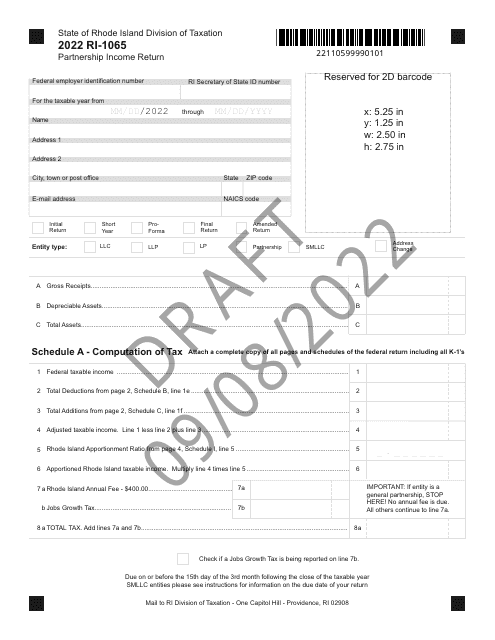

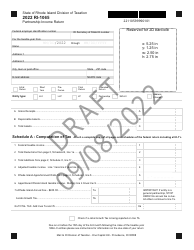

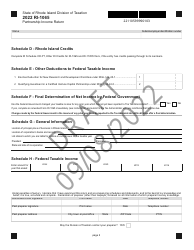

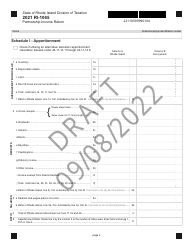

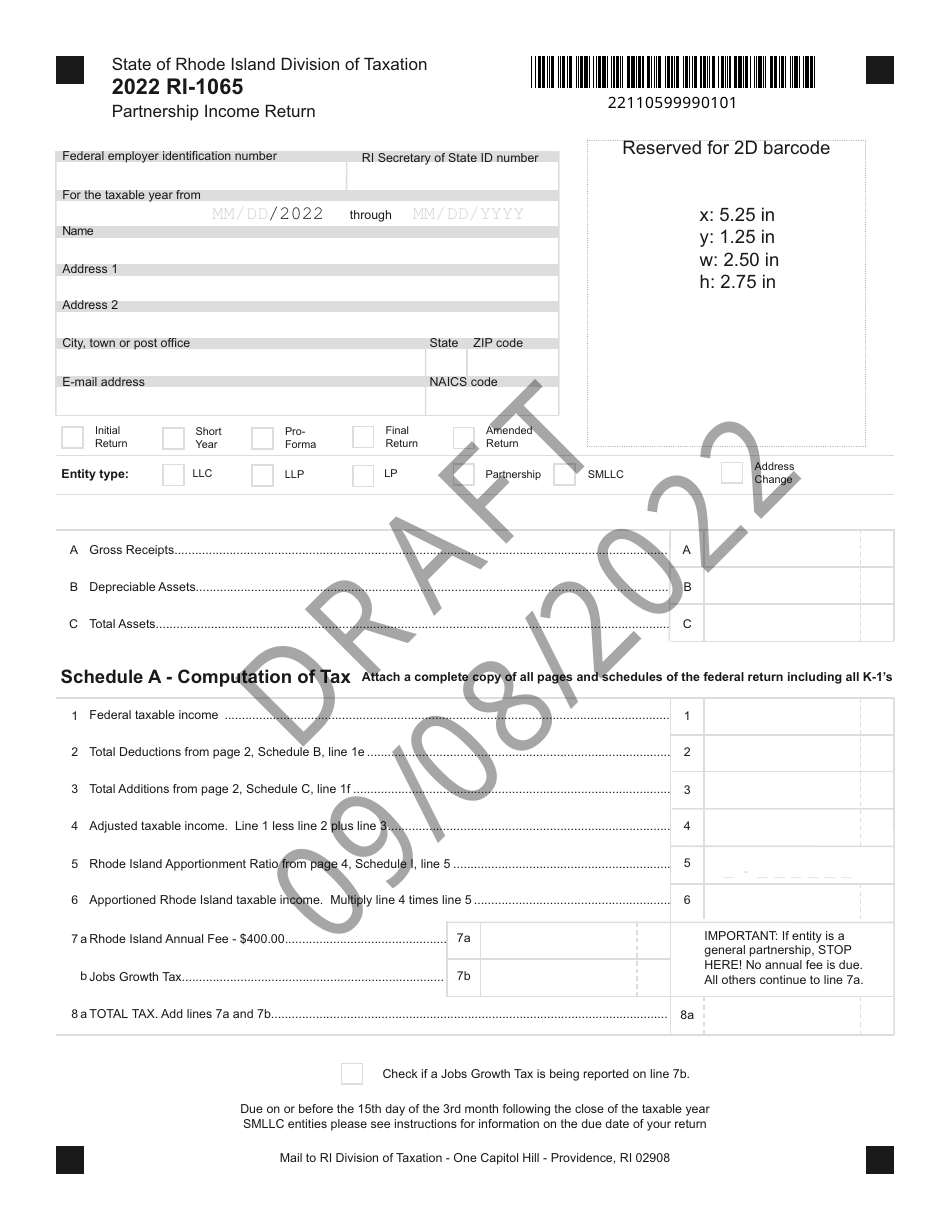

Form RI-1065

for the current year.

Form RI-1065 Partnership Income Return - Draft - Rhode Island

What Is Form RI-1065?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1065?

A: Form RI-1065 is the Partnership Income Return for the state of Rhode Island.

Q: Who needs to file Form RI-1065?

A: Partnerships in Rhode Island need to file Form RI-1065.

Q: What is the purpose of Form RI-1065?

A: Form RI-1065 is used to report the partnership's income, deductions, and credits in Rhode Island.

Q: When is Form RI-1065 due?

A: Form RI-1065 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form RI-1065?

A: Yes, there are penalties for late filing of Form RI-1065. The penalty is 5% of the unpaid tax per month, up to a maximum of 25%.

Q: Are there any special instructions for completing Form RI-1065?

A: Yes, there are instructions provided with the form that guide you on how to fill it out correctly.

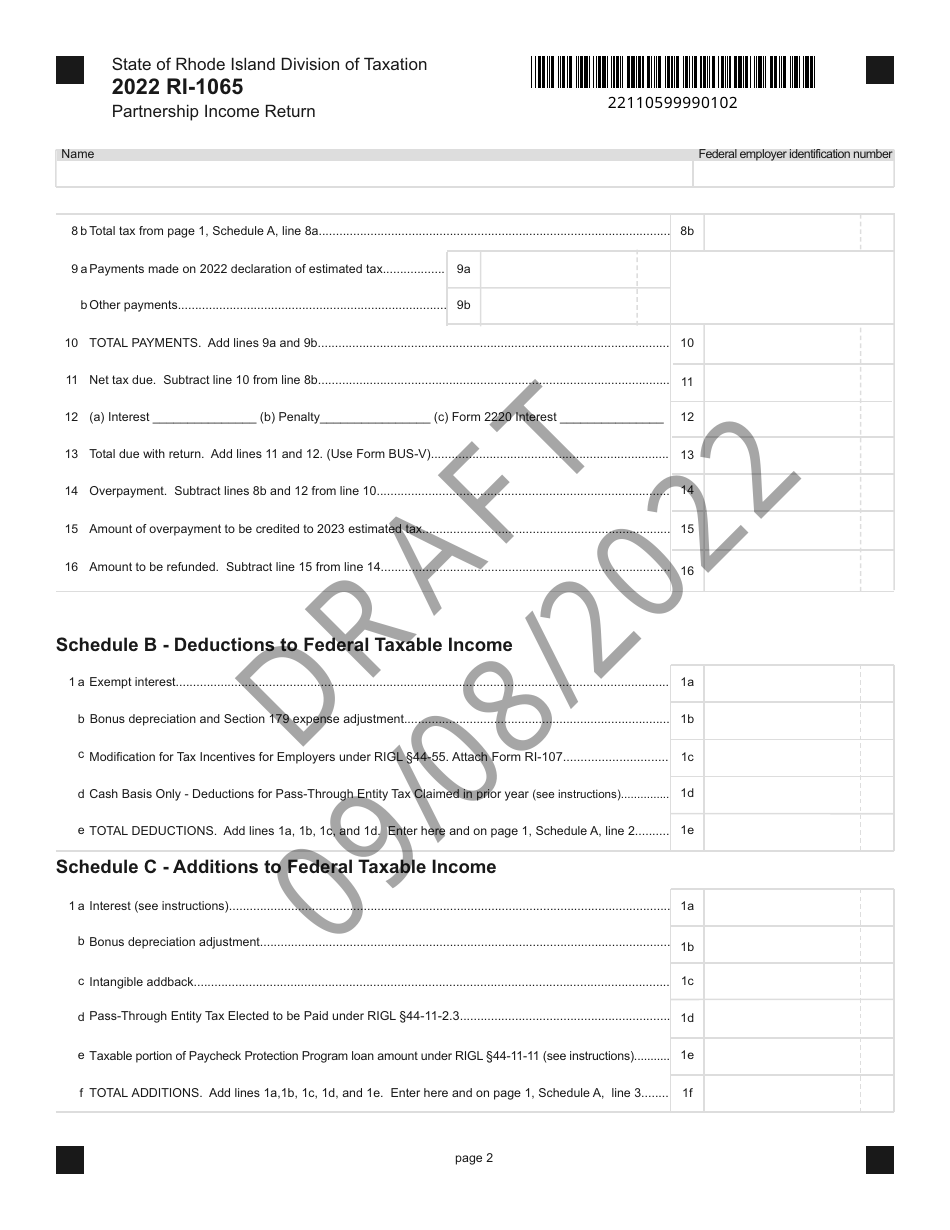

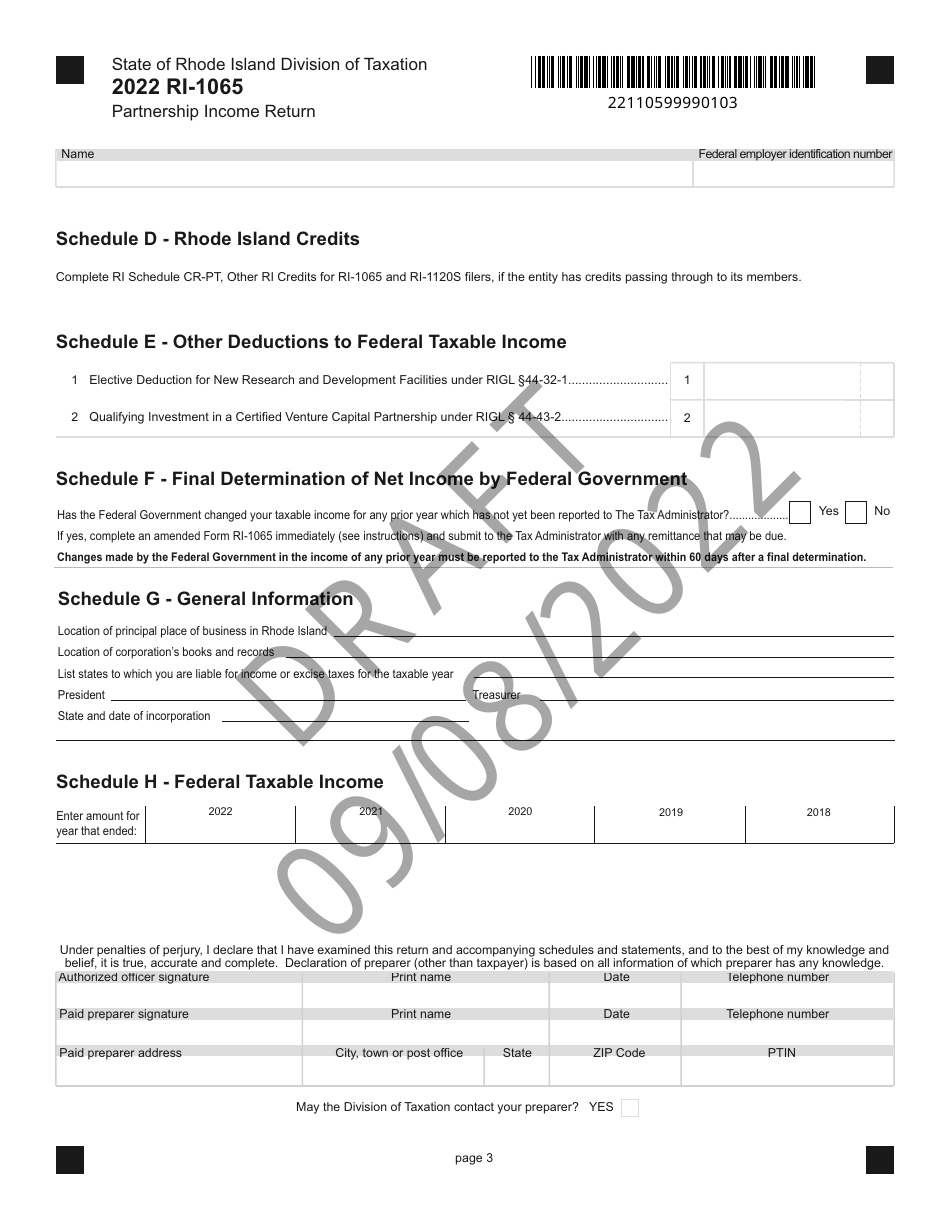

Q: Do I need to include any supporting documents with Form RI-1065?

A: Yes, you may need to include supporting documents such as schedules and attachments depending on your partnership's income and deductions.

Q: Can I amend Form RI-1065 if I made an error?

A: Yes, you can amend Form RI-1065 by filing Form RI-1065X and providing the corrected information.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1065 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.