This version of the form is not currently in use and is provided for reference only. Download this version of

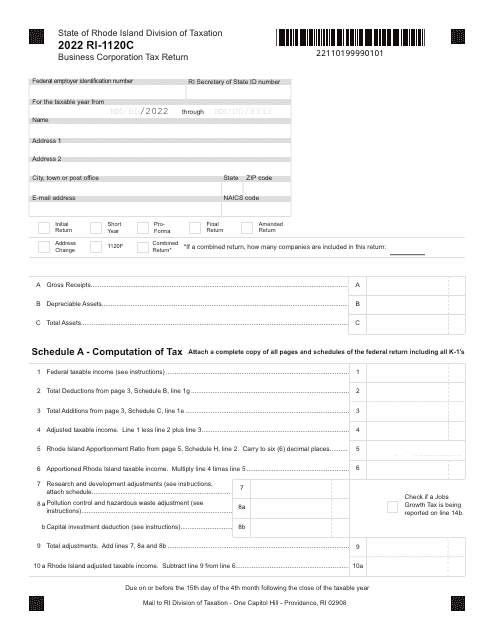

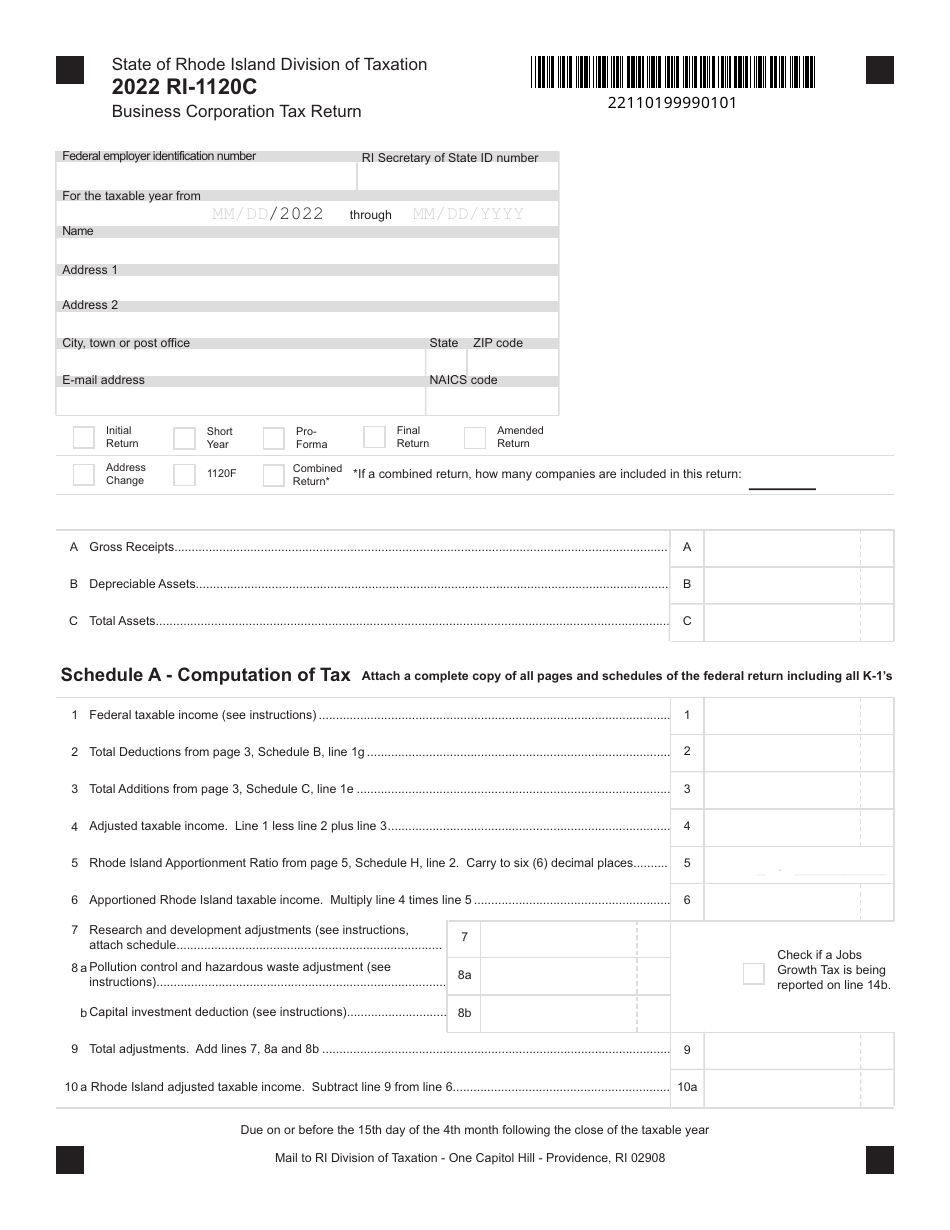

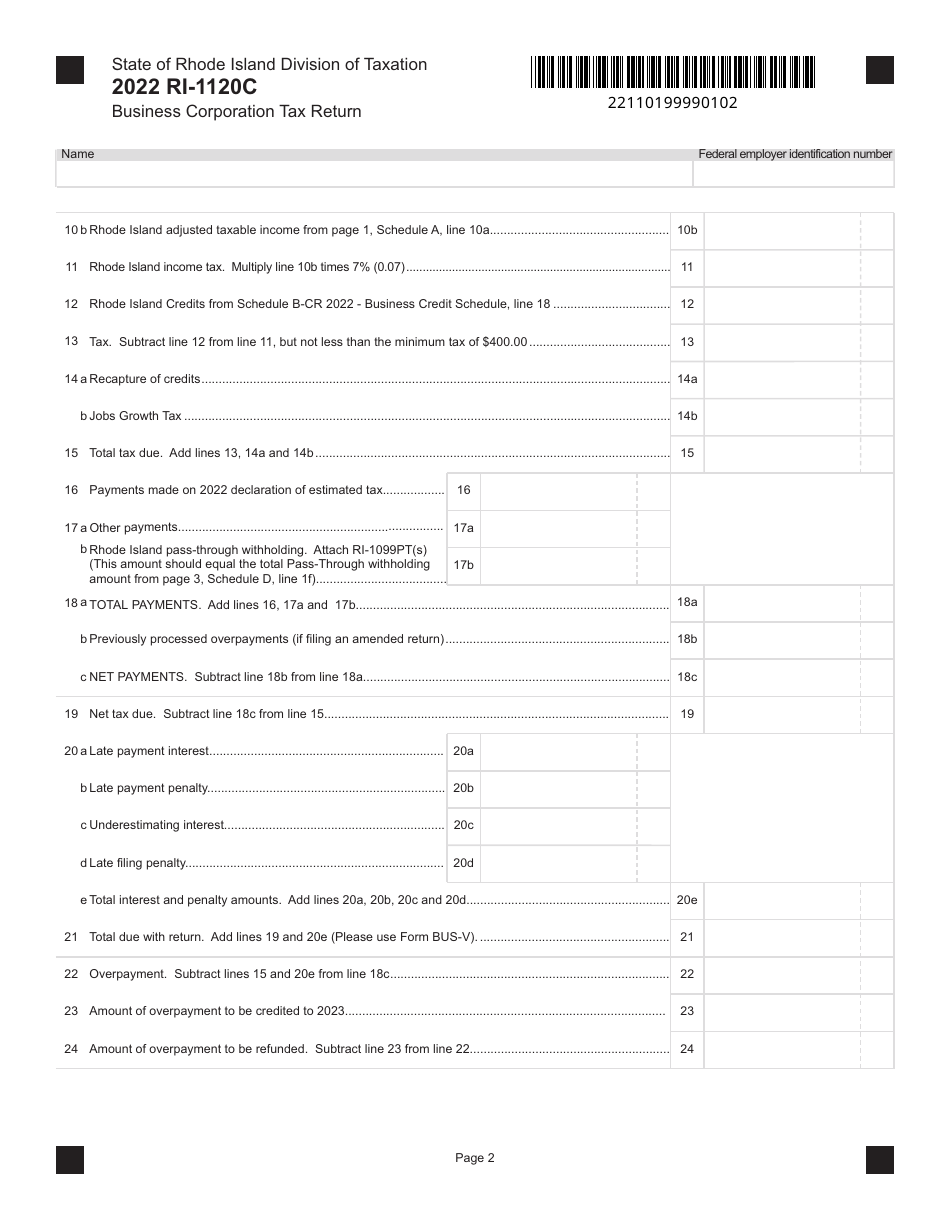

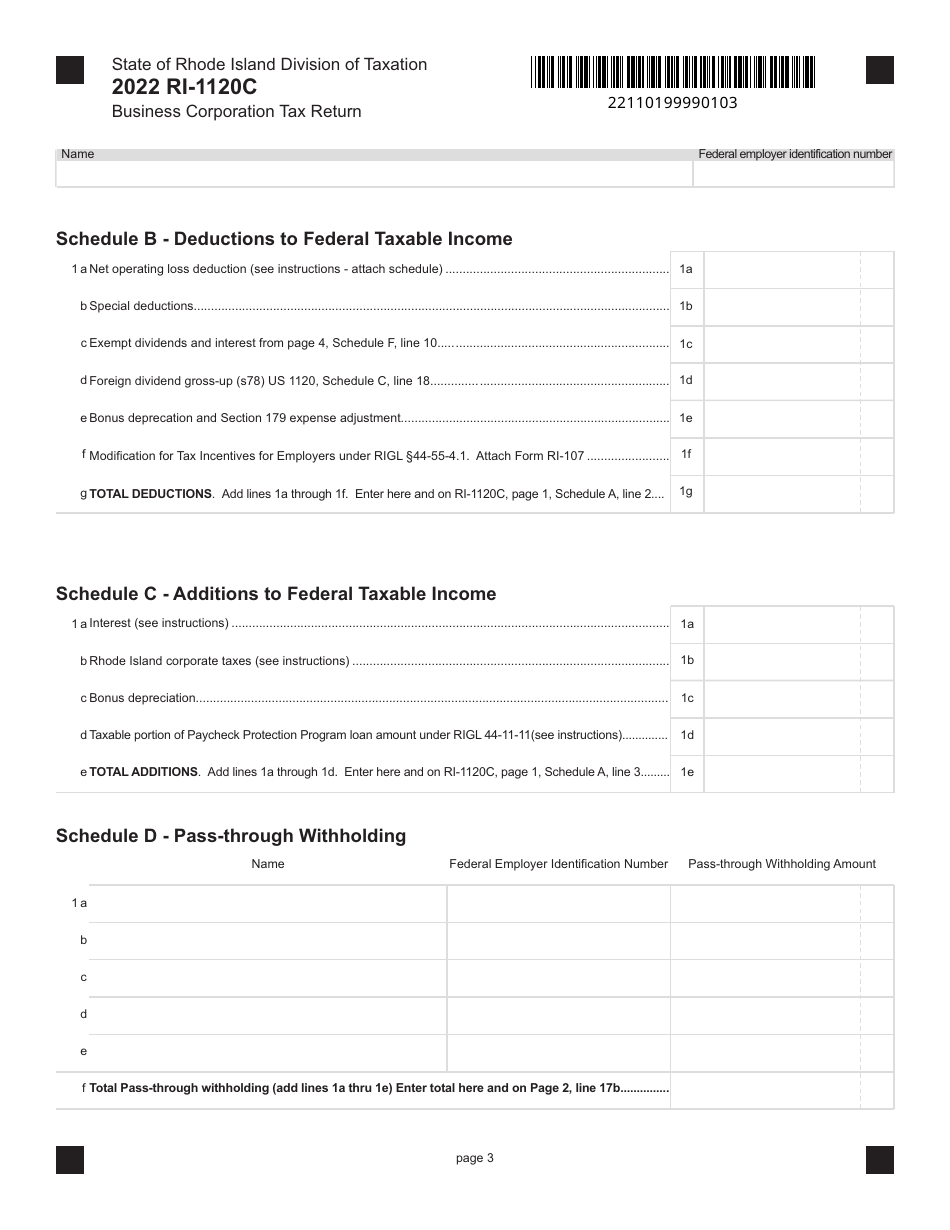

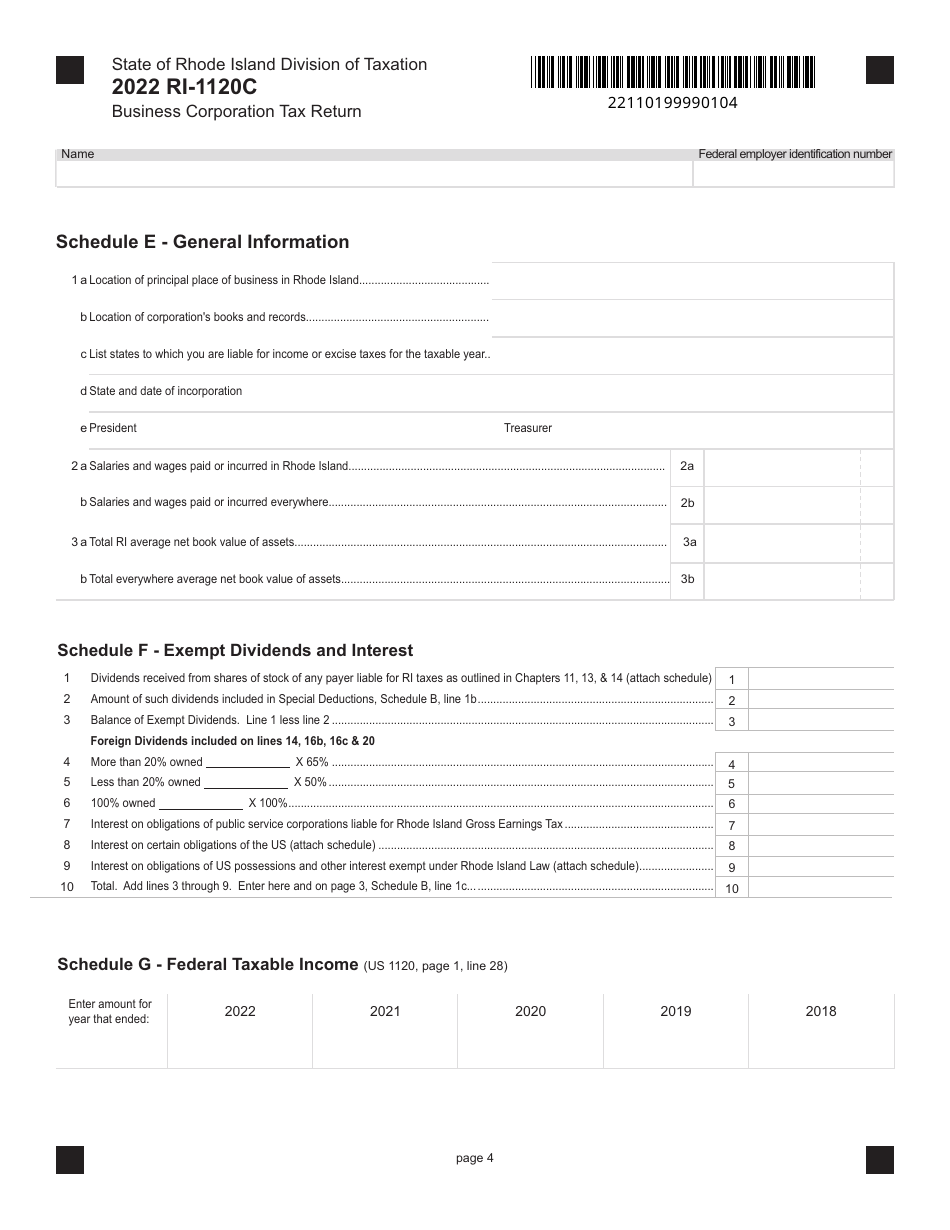

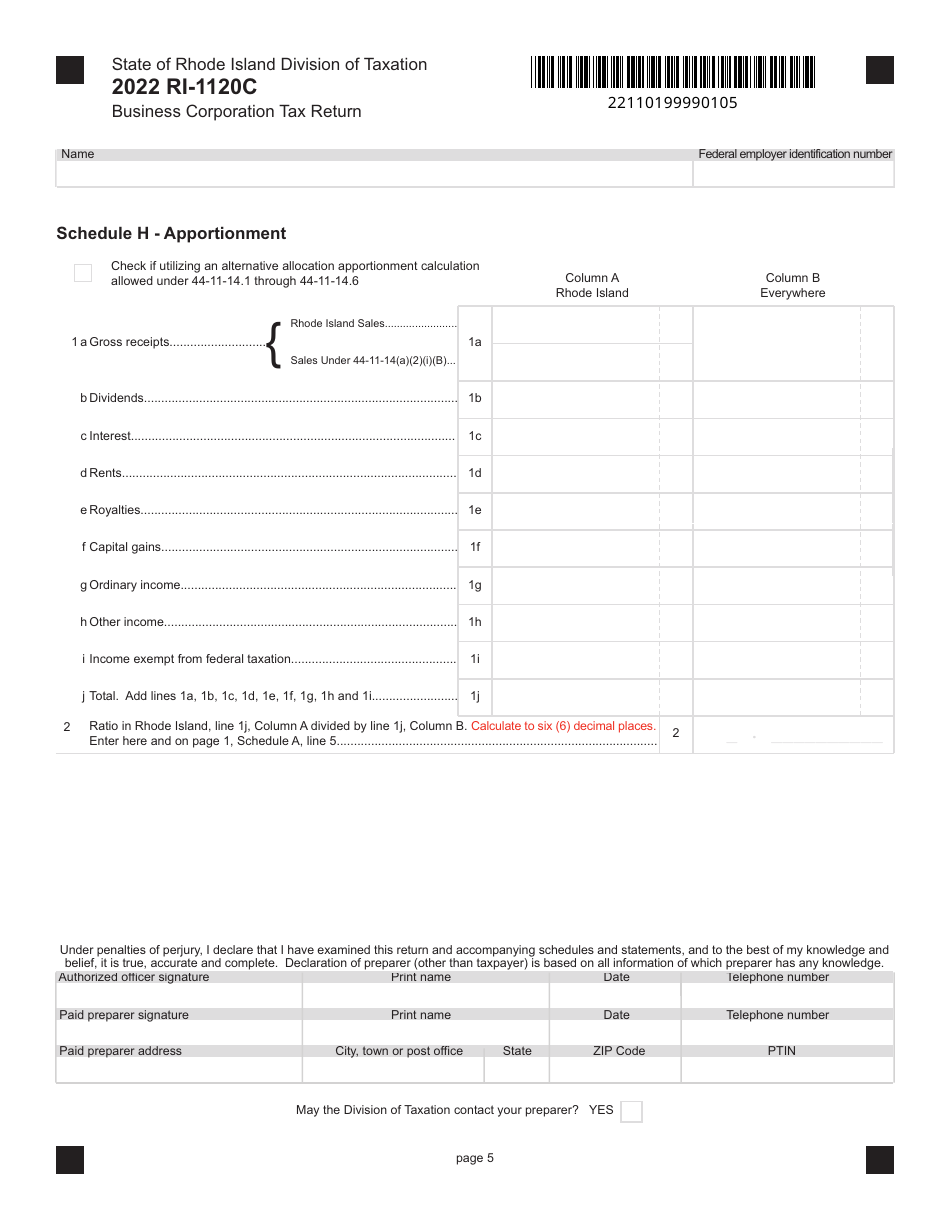

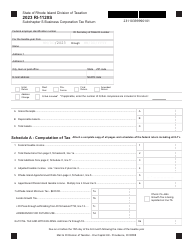

Form RI-1120C

for the current year.

Form RI-1120C Business Corporation Tax Return - Rhode Island

What Is Form RI-1120C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120C?

A: Form RI-1120C is a tax return form for Business Corporations in Rhode Island.

Q: Who needs to file Form RI-1120C?

A: Business Corporations in Rhode Island need to file Form RI-1120C.

Q: What is the purpose of Form RI-1120C?

A: The purpose of Form RI-1120C is to report and pay the business corporation tax in Rhode Island.

Q: When is Form RI-1120C due?

A: Form RI-1120C is generally due on the 15th day of the 3rd month following the close of the tax year.

Q: Are there any penalties for late filing of Form RI-1120C?

A: Yes, there may be penalties for late filing of Form RI-1120C. It is important to file the form and pay the tax on time to avoid penalties.

Q: Can I get an extension to file Form RI-1120C?

A: Yes, you can request an extension to file Form RI-1120C. The extension request must be submitted before the original due date of the form.

Q: What supporting documents do I need to attach to Form RI-1120C?

A: You may need to attach copies of federal tax returns, schedules, and other supporting documents to Form RI-1120C. Review the instructions for the form for specific requirements.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.