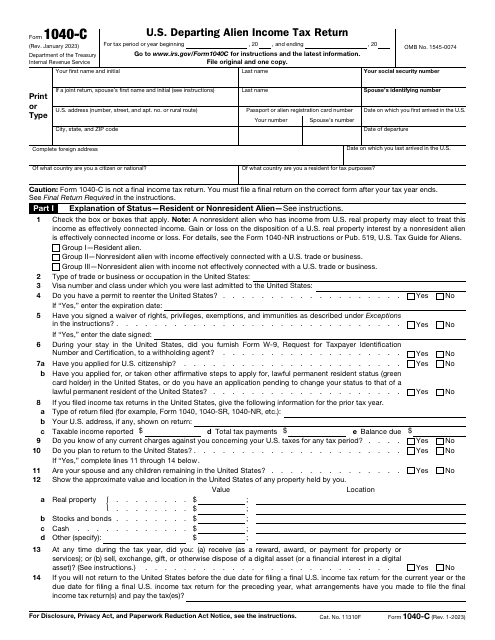

This version of the form is not currently in use and is provided for reference only. Download this version of

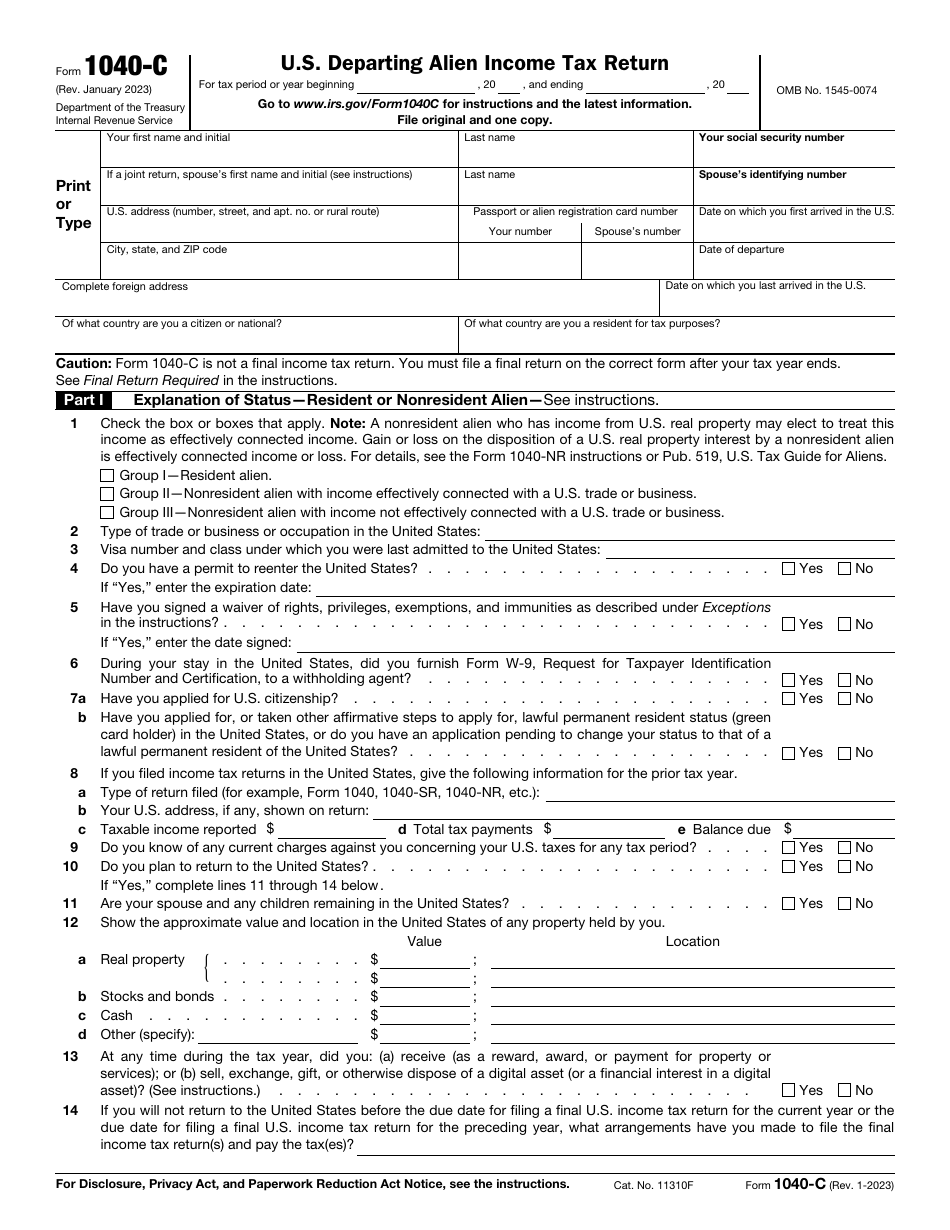

IRS Form 1040-C

for the current year.

IRS Form 1040-C U.S. Departing Alien Income Tax Return

What Is IRS Form 1040-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who should file IRS Form 1040-C?

A: Nonresident aliens who are leaving the United States and need to report and pay any income tax due.

Q: What is the purpose of Form 1040-C?

A: The purpose of Form 1040-C is to report and pay any income tax liability for nonresident aliens before leaving the United States.

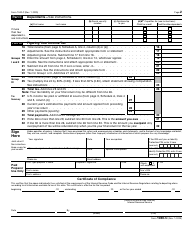

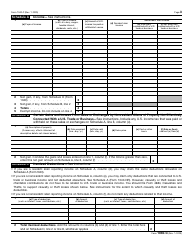

Q: What information is required on Form 1040-C?

A: Form 1040-C requires information about the nonresident alien's income, deductions, and tax credits.

Q: When should Form 1040-C be filed?

A: Form 1040-C should be filed before leaving the United States.

Q: Can Form 1040-C be e-filed?

A: No, Form 1040-C cannot be e-filed. It must be filed by mail.

Q: What is the penalty for failing to file Form 1040-C?

A: The penalty for failing to file Form 1040-C can vary, but it may include additional interest and penalties.

Q: Is Form 1040-C only for U.S. residents?

A: No, Form 1040-C is specifically for nonresident aliens who are leaving the United States.

Q: Are there any exceptions to filing Form 1040-C?

A: There are certain exceptions for nonresident aliens who qualify as exempt individuals. They may not need to file Form 1040-C.

Form Details:

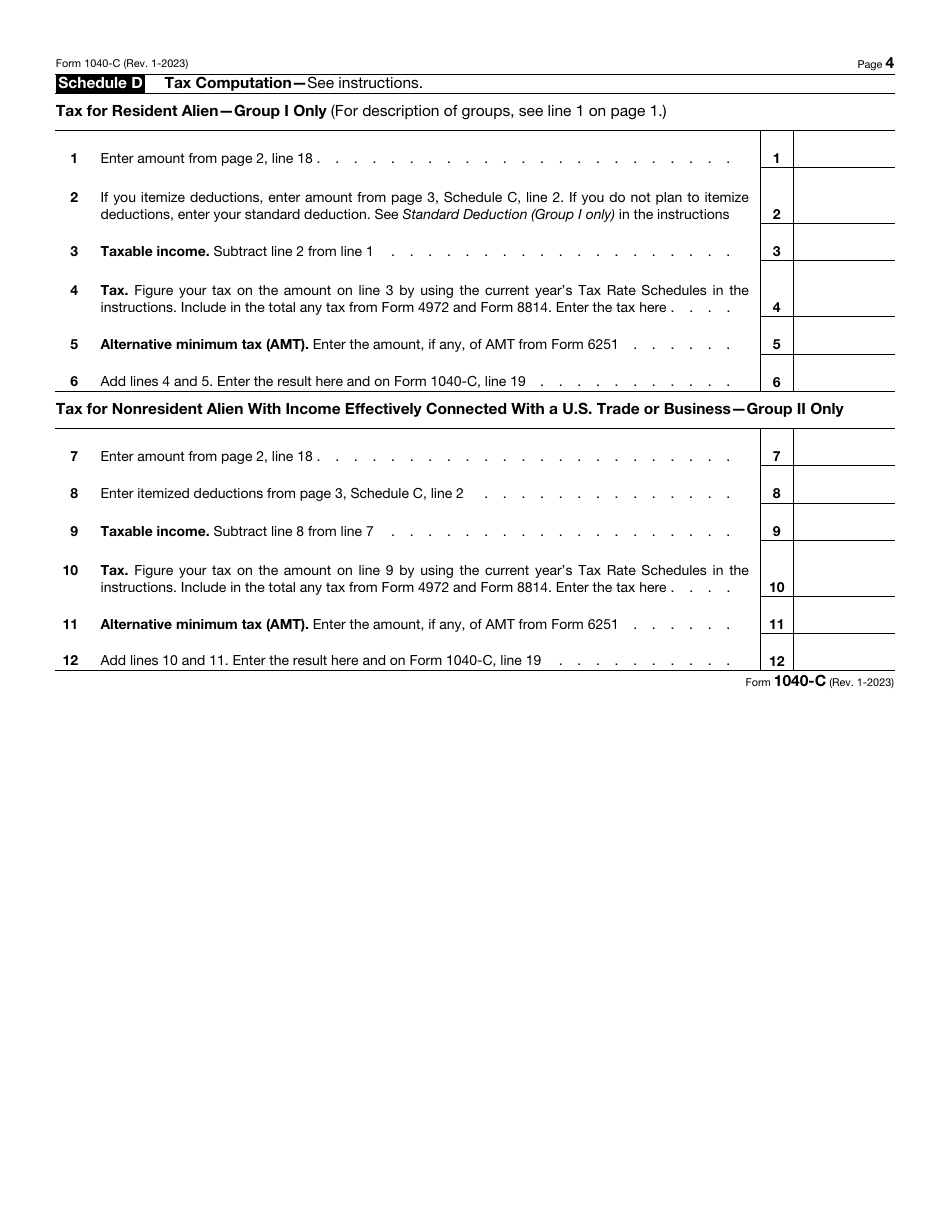

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-C through the link below or browse more documents in our library of IRS Forms.