This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-C

for the current year.

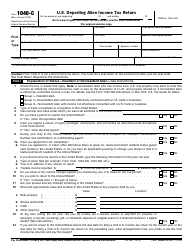

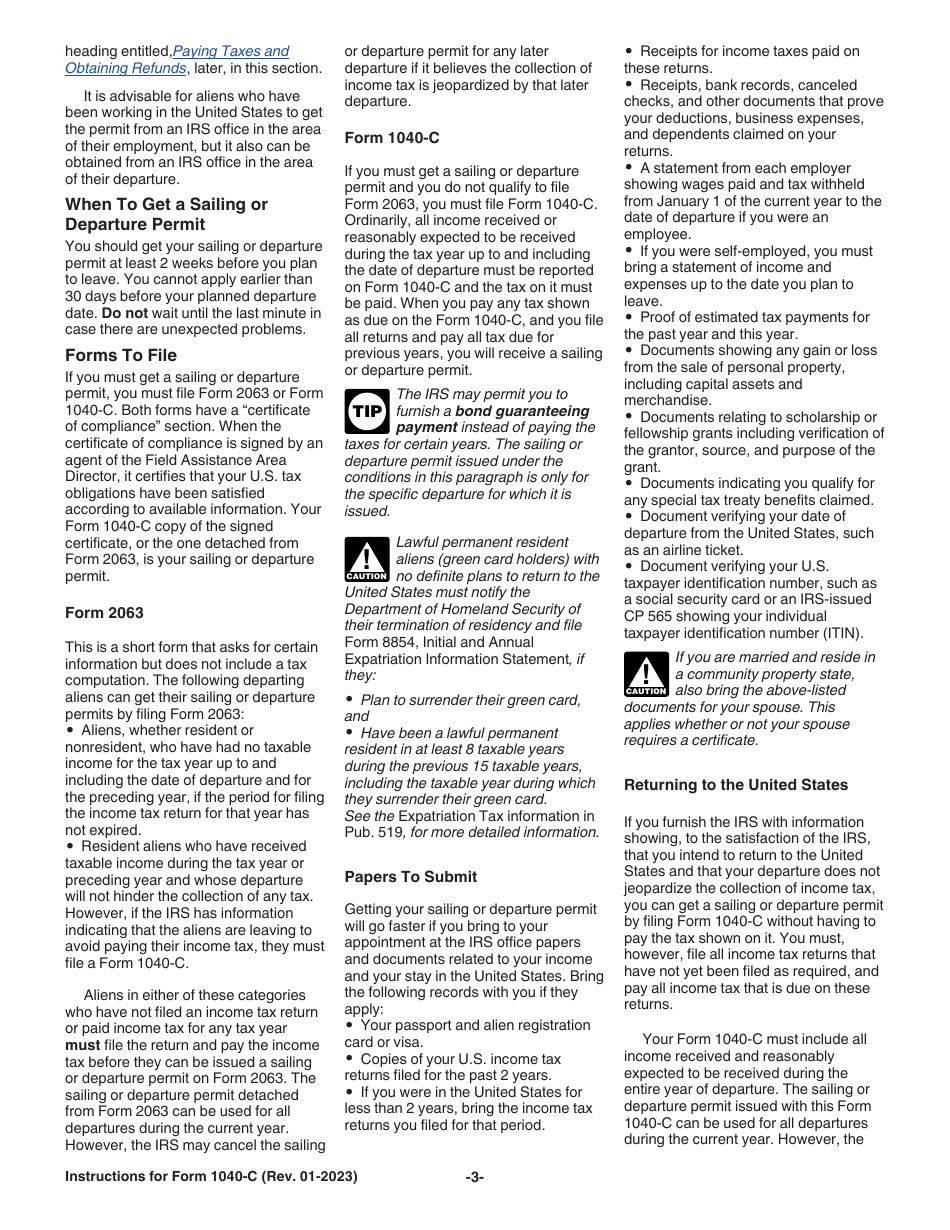

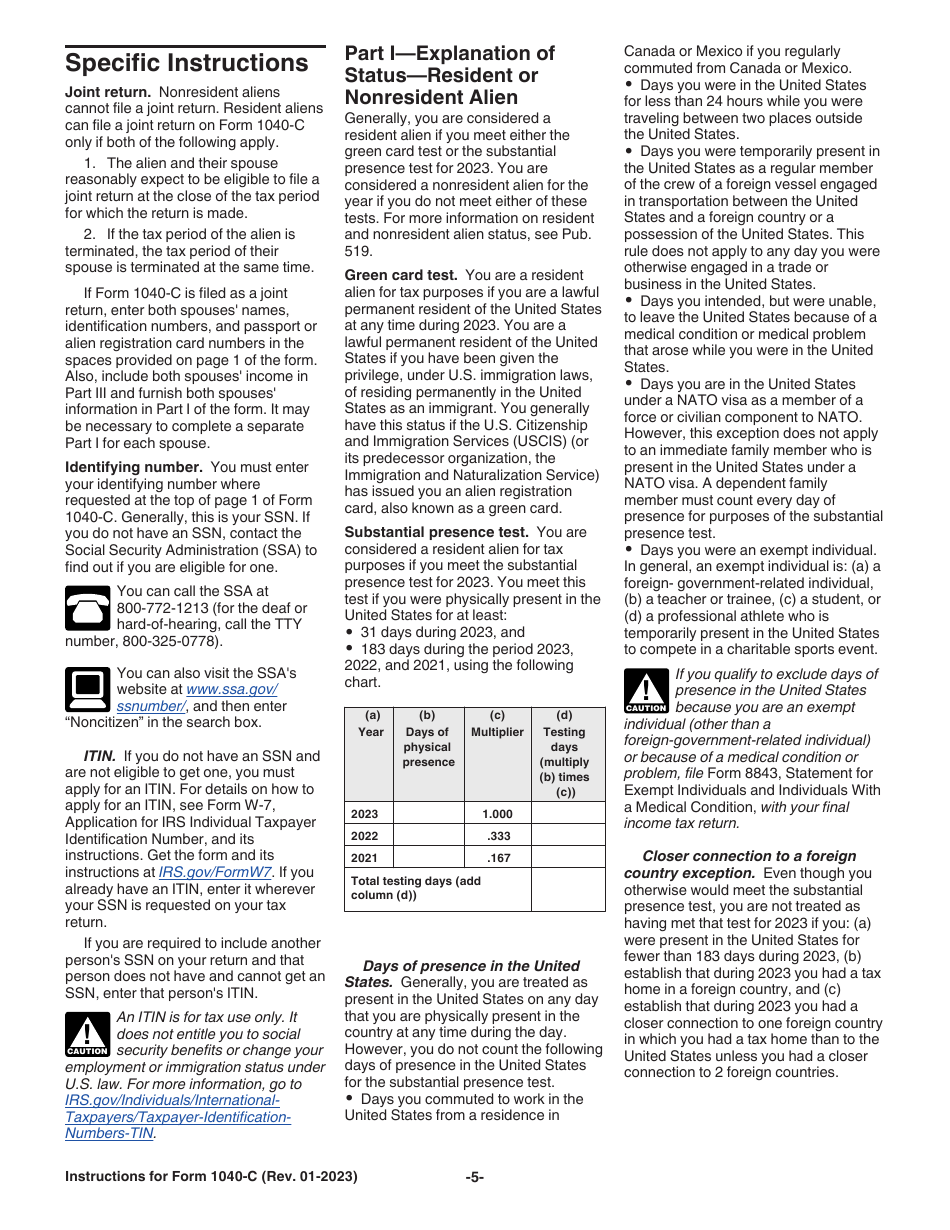

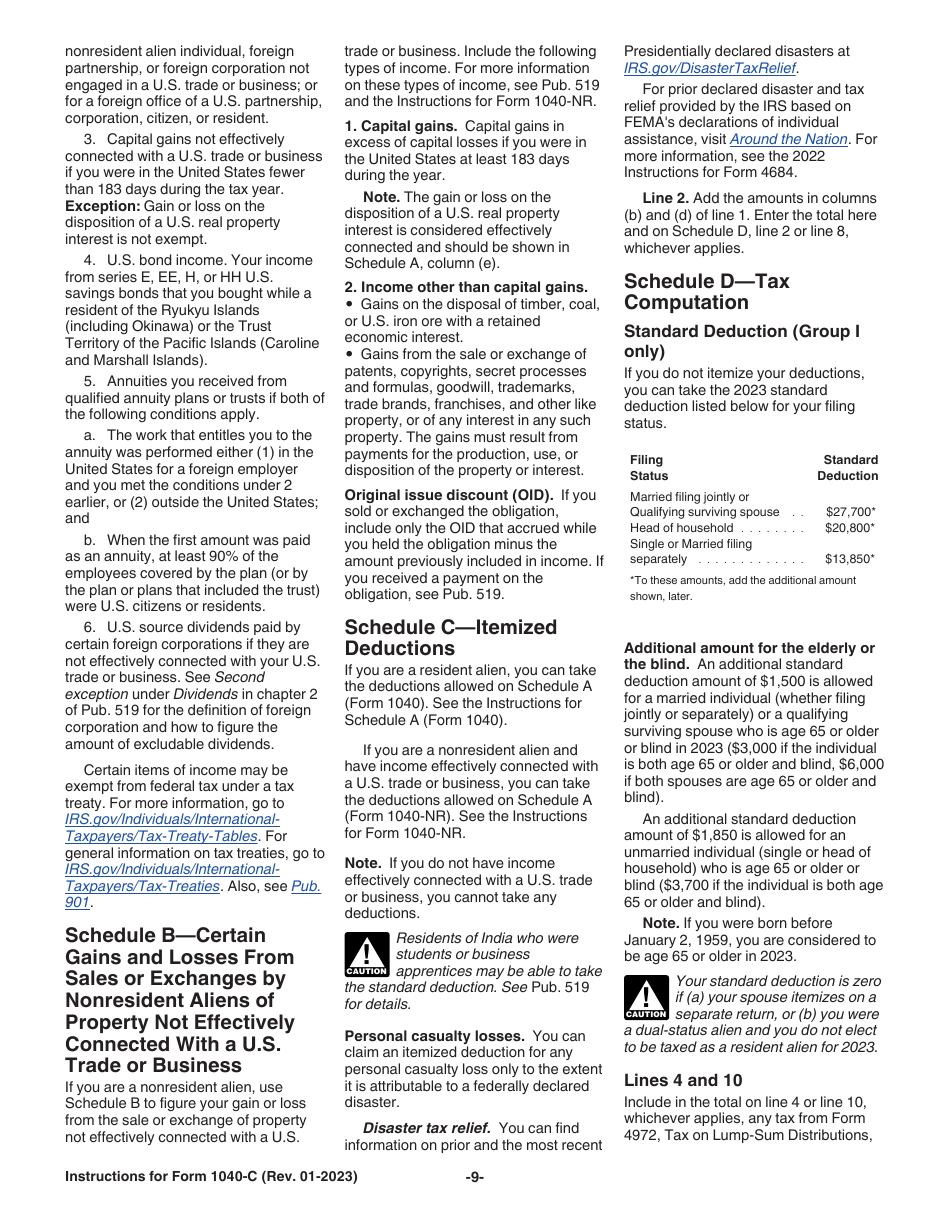

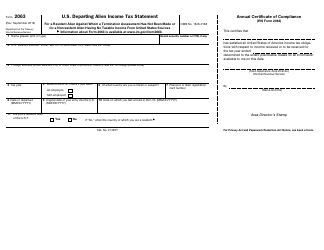

Instructions for IRS Form 1040-C U.S. Departing Alien Income Tax Return

This document contains official instructions for IRS Form 1040-C , U.S. Departing Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-C is available for download through this link.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file Form 1040-C?

A: Form 1040-C is for nonresident aliens who are leaving the United States and need to report their U.S. source income.

Q: When is Form 1040-C due?

A: Form 1040-C is due on the date of departure from the United States.

Q: What income should be reported on Form 1040-C?

A: You should report all income from U.S. sources, such as wages, salaries, and rental income.

Q: Are there any deductions or credits available on Form 1040-C?

A: No, Form 1040-C does not allow deductions or credits.

Q: Can I e-file Form 1040-C?

A: No, Form 1040-C cannot be e-filed. It must be filed on paper.

Q: Do I need a Social Security Number (SSN) to file Form 1040-C?

A: No, if you don't have an SSN, you can apply for an Individual Taxpayer Identification Number (ITIN) and use it on Form 1040-C.

Q: Are there any penalties for not filing Form 1040-C?

A: Yes, failing to file Form 1040-C or paying the tax due can result in penalties and interest.

Q: Is Form 1040-C the final tax return for leaving the United States?

A: No, Form 1040-C is not the final tax return. You may still need to file other tax forms depending on your circumstances.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.