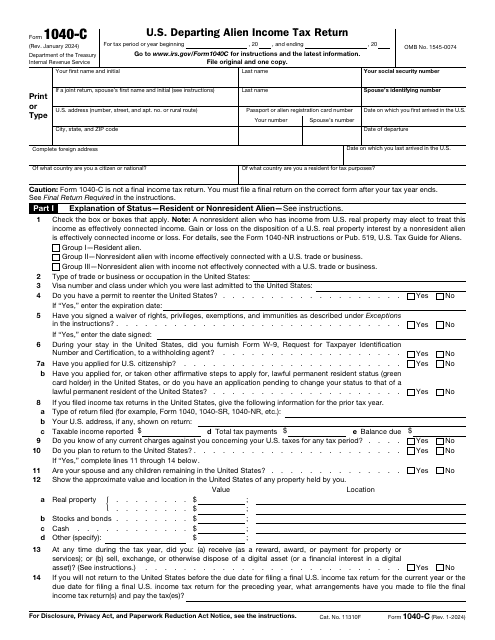

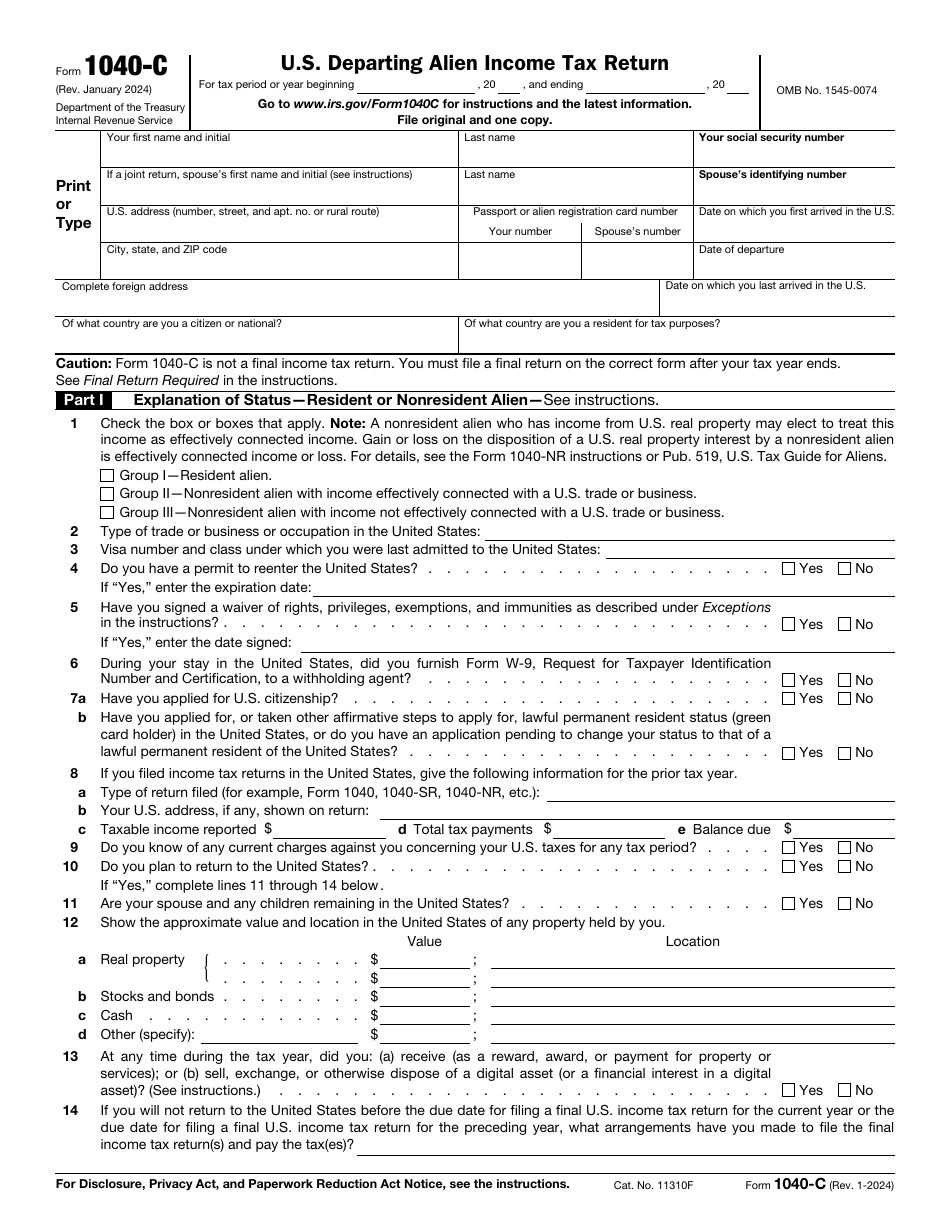

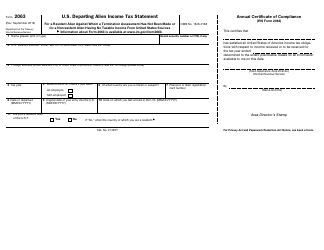

IRS Form 1040-C U.S. Departing Alien Income Tax Return

What Is Form 1040-C?

IRS Form 1040-C, U.S. Departing Alien Income Tax Return is a document used by aliens who are going to depart from the United States or any of its OCONUS areas. The form was issued by the Internal Revenue Service (IRS) and is re-released annually.

Fill out this document if you are an alien leaving the United States and want to:

- Report the income you received or expect to receive for the tax year;

- Pay the expected tax on that income (only if you are required to do so).

Complete and submit your departing alien income tax return before you leave the United States or any of its possessions. You are not allowed to leave the country without getting the certificate of compliance. To receive a certificate of compliance, you need to file IRS Form 1040-C and all the other required tax returns at least two weeks but no more than 30 days before leaving the United States. If you do not provide the required information or provide incorrect information, you may be subjected to penalties.

How to Fill Out 1040-C Form?

The IRS provides a detailed review of the form in its official instructions. Additional tips can be found below. You can download the form by clicking this link or contact the IRS to order a paper version. Paper versions of the form are usually sent within 10 business days.

IRS Form 1040-C Instructions

IRS 1040-C Form consists of three parts. Fill it out as follows:

- Specify your personal information in the top part of the form. If you fill out a joint return, you are required to provide your spouse's personal information as well. In this case, you will have to include your spouse's information in Parts I and III;

- Part I. Explanation of Status - Resident or Nonresident Alien. Provide detailed information that specifies your status. To be considered as a resident alien, you need to pass either a substantial presence test or green card test. Answer all the applicable questions. If you are filing a joint tax return, it may be necessary to fill out a separate Part I for your spouse;

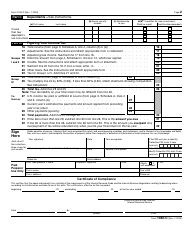

- Part II. Dependents. List the names and SSNs of the dependents you want to claim a tax credit for. The list of criteria that denote if a person can be qualified as your dependent and the type of credit you can claim is provided in the instructions for the Form 1040 or Form 1040-NR;

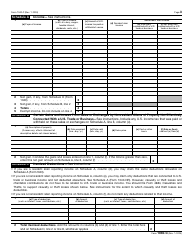

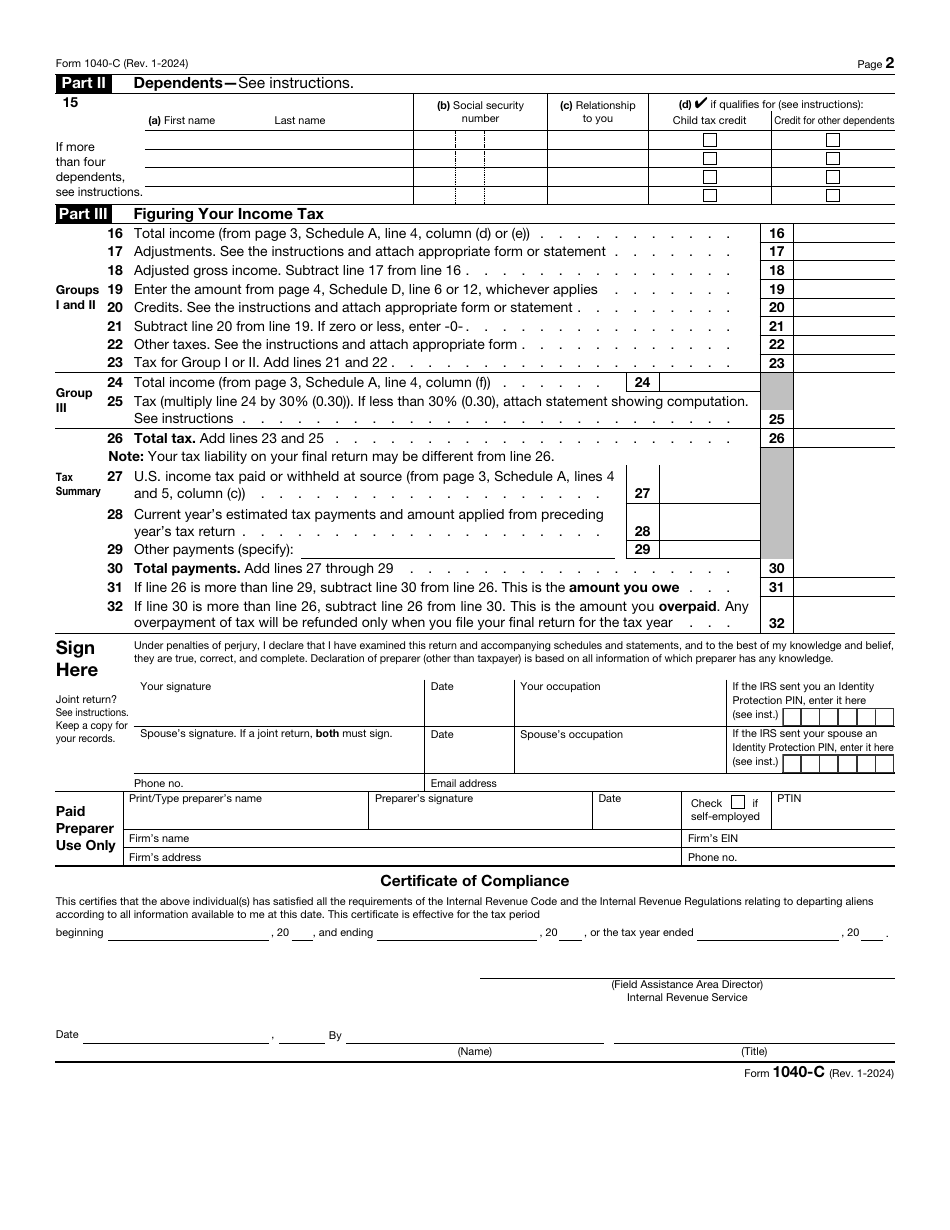

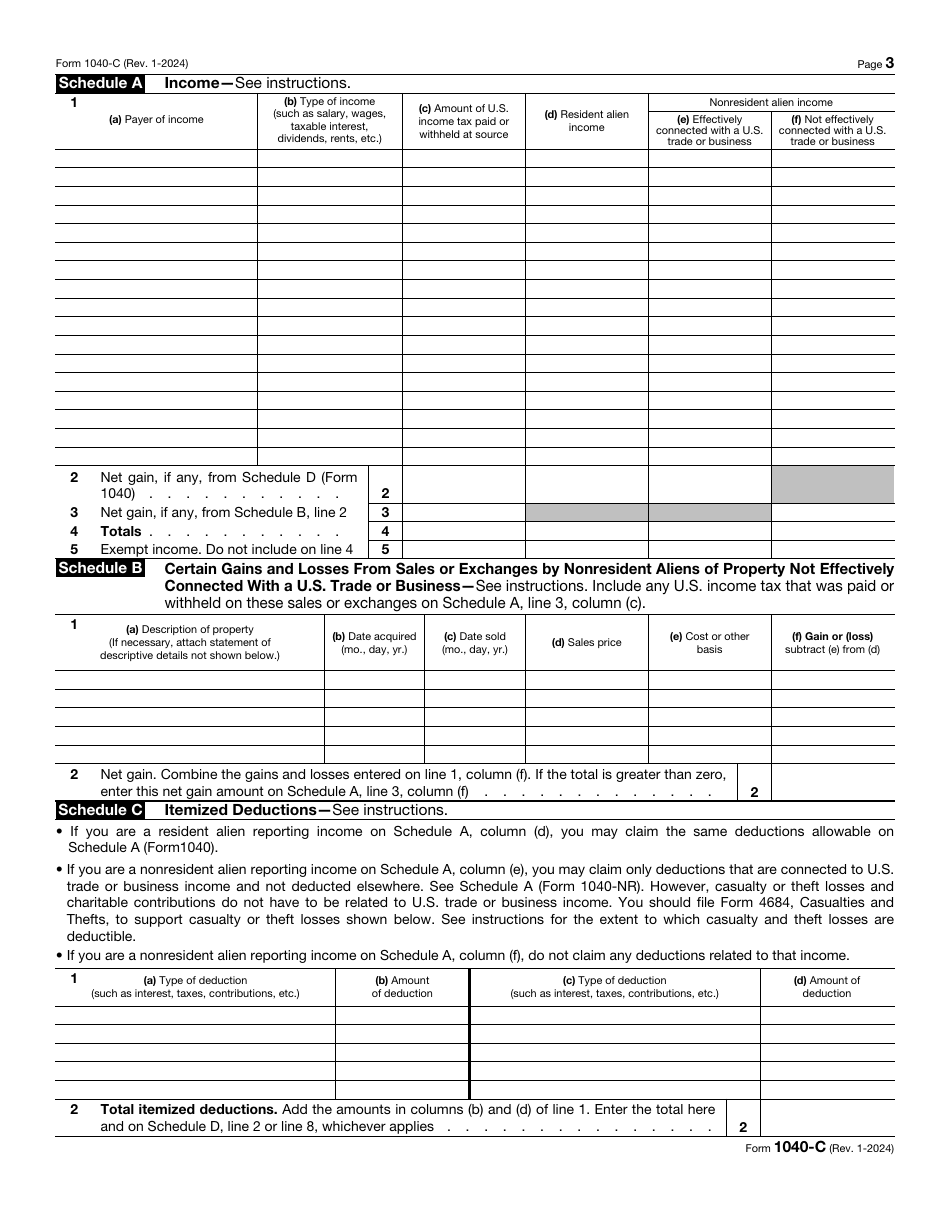

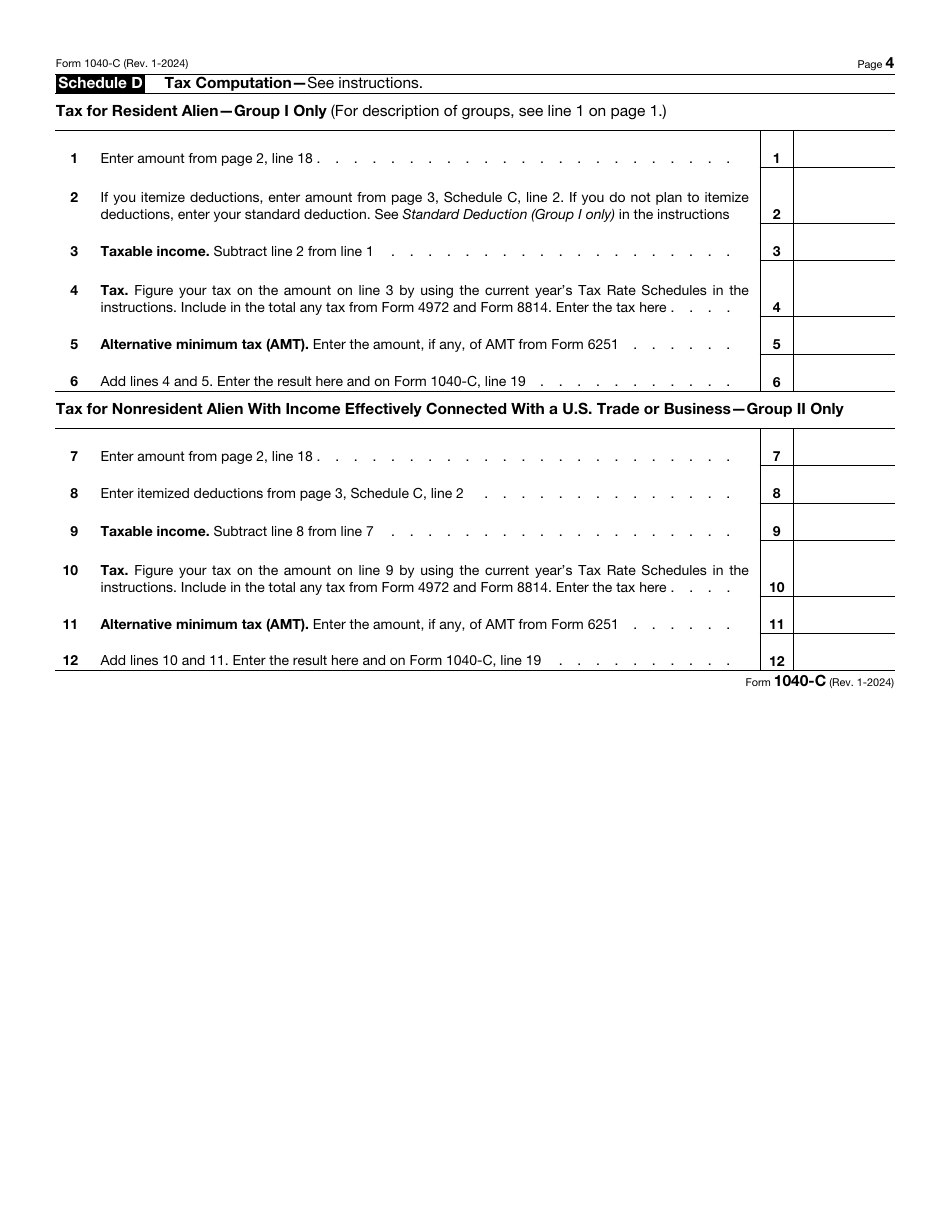

- Part III. Figuring Your Income Tax. If you have checked Group I or II in Part I, Item 1, use lines 15 - 22 to figure your taxes. If you have checked Group III, fill out lines 23 and 24. If you are a nonresident alien and both Group II and Group III apply to you, complete lines 15 - 24. Before filling out this part, look through and complete the applicable lines on schedules A through D.

- Sign the 1040-C tax return form, otherwise, it will not be considered valid.

IRS 1040-C Related Forms

- IRS Form 1040, U.S. Individual Income Tax Return;

- IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- IRS Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents;

- IRS Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico);

- IRS Form 1040-V, Payment Voucher;

- IRS Form 1040X, Amended U.S. Individual Income Tax Return;

- IRS Form 1040-ES, Estimated Tax for Individuals;

- IRS Form 56, Notice Concerning Fiduciary Relationship;

- IRS Form 843, Claim for Refund and Request for Abatement;

- IRS Form 2063, U.S. Departing Alien Income Tax Statement;

- IRS Form 4136, Credit For Federal Tax Paid on Fuels;

- IRS Form 4255, Recapture of Investment Credit.