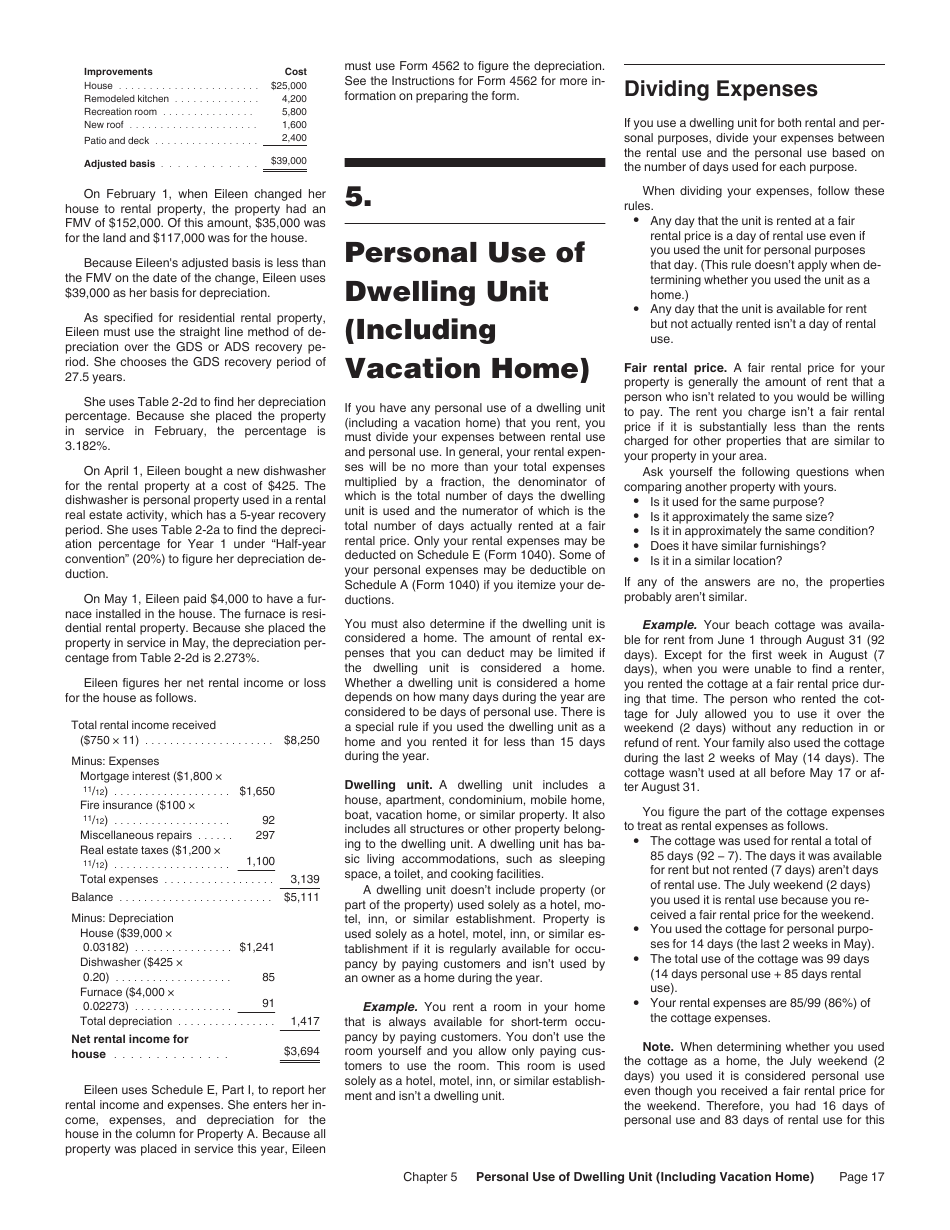

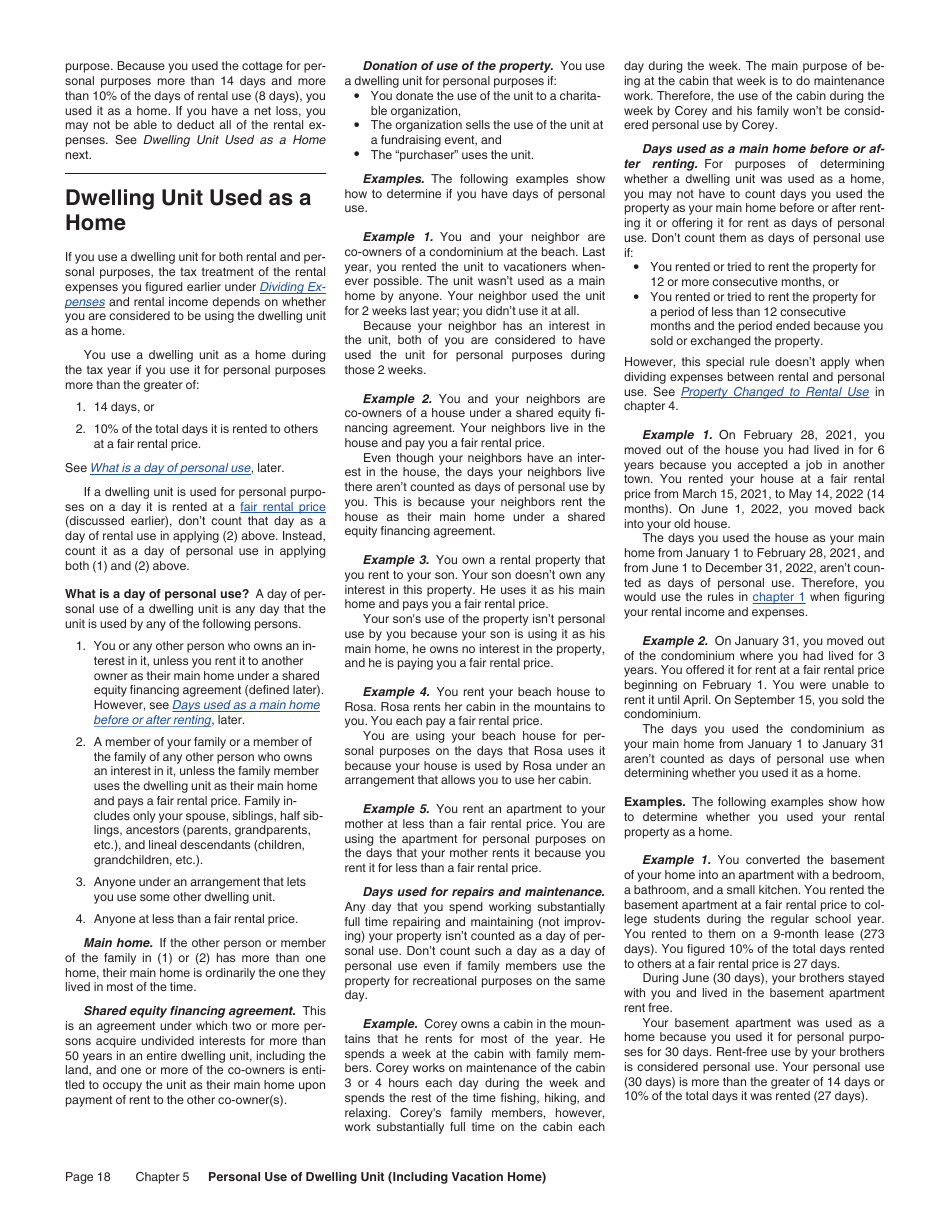

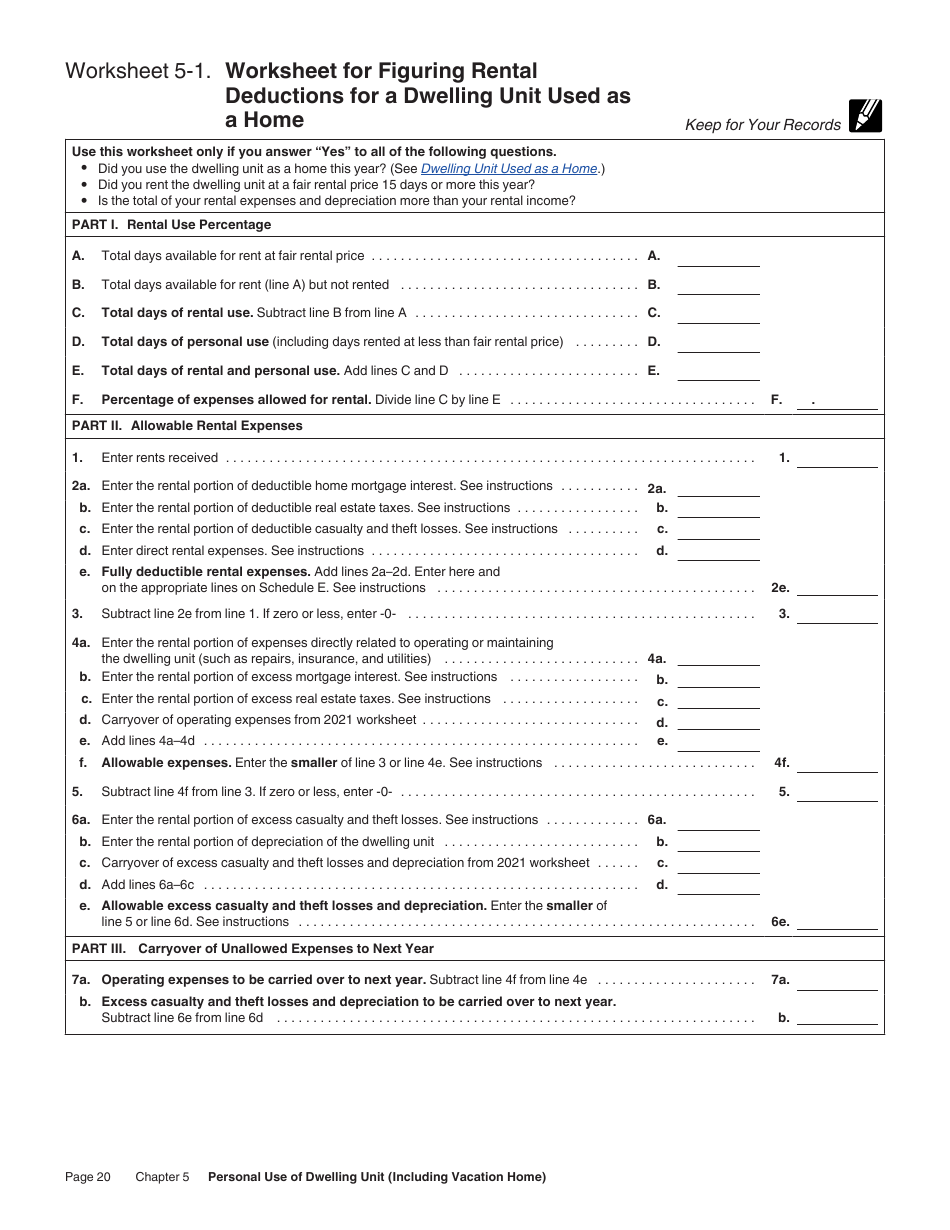

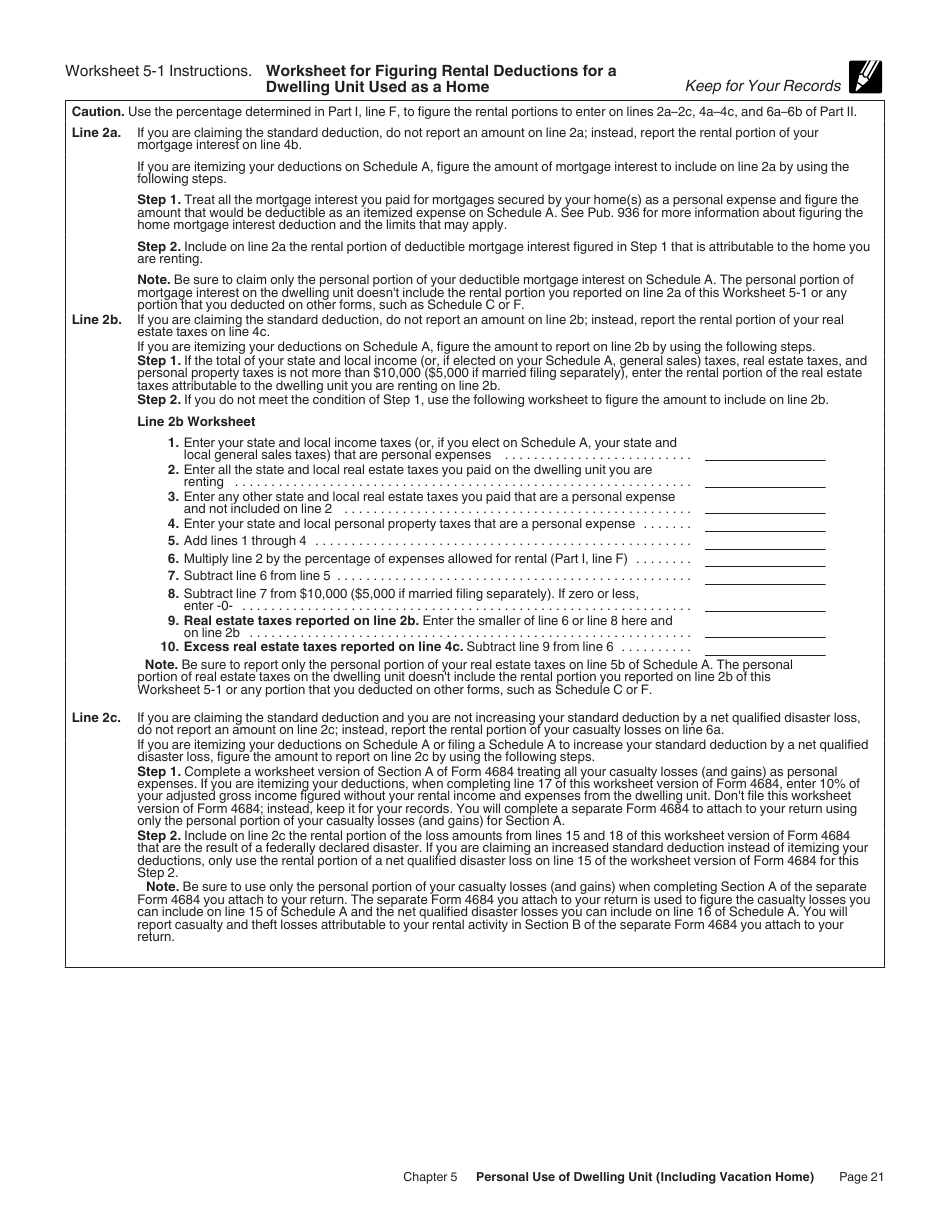

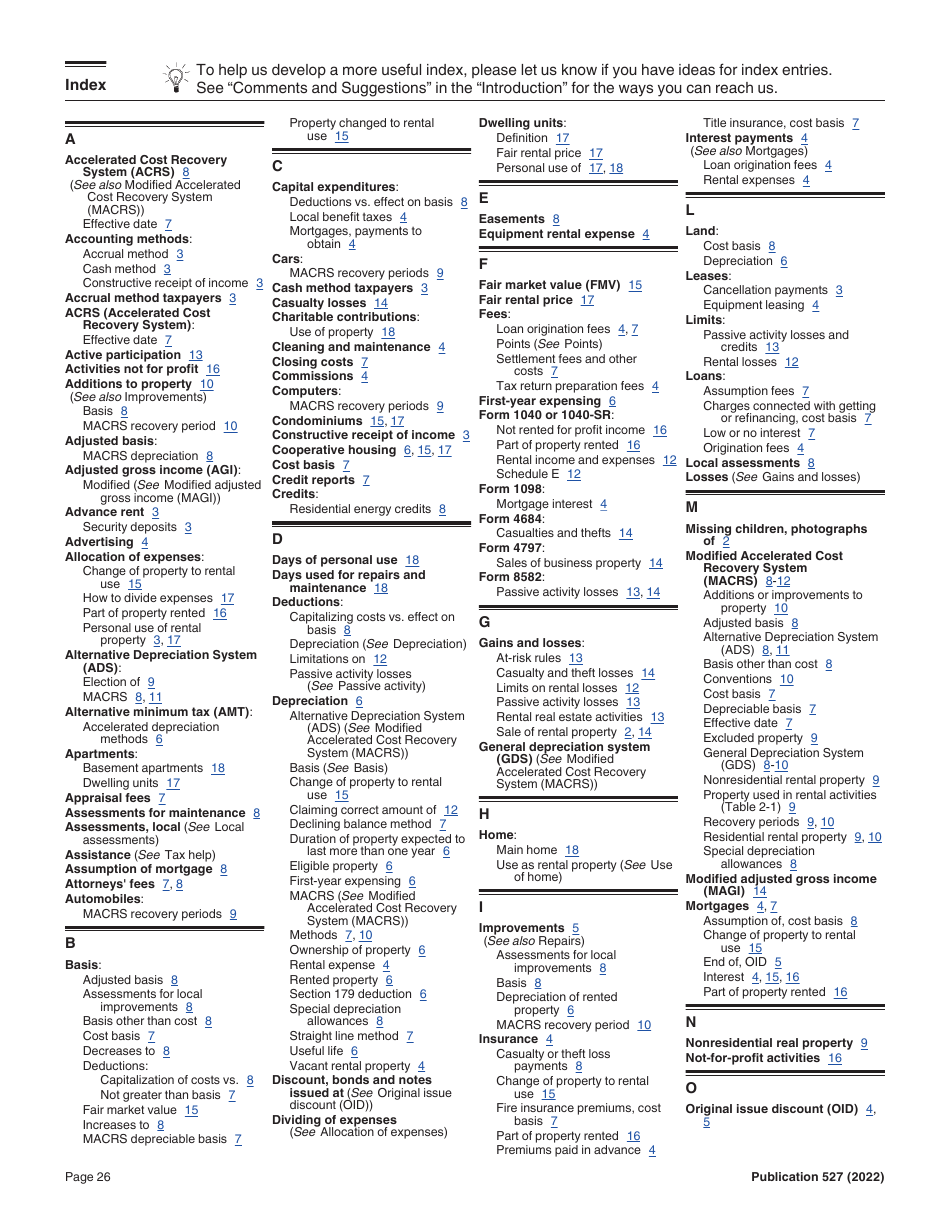

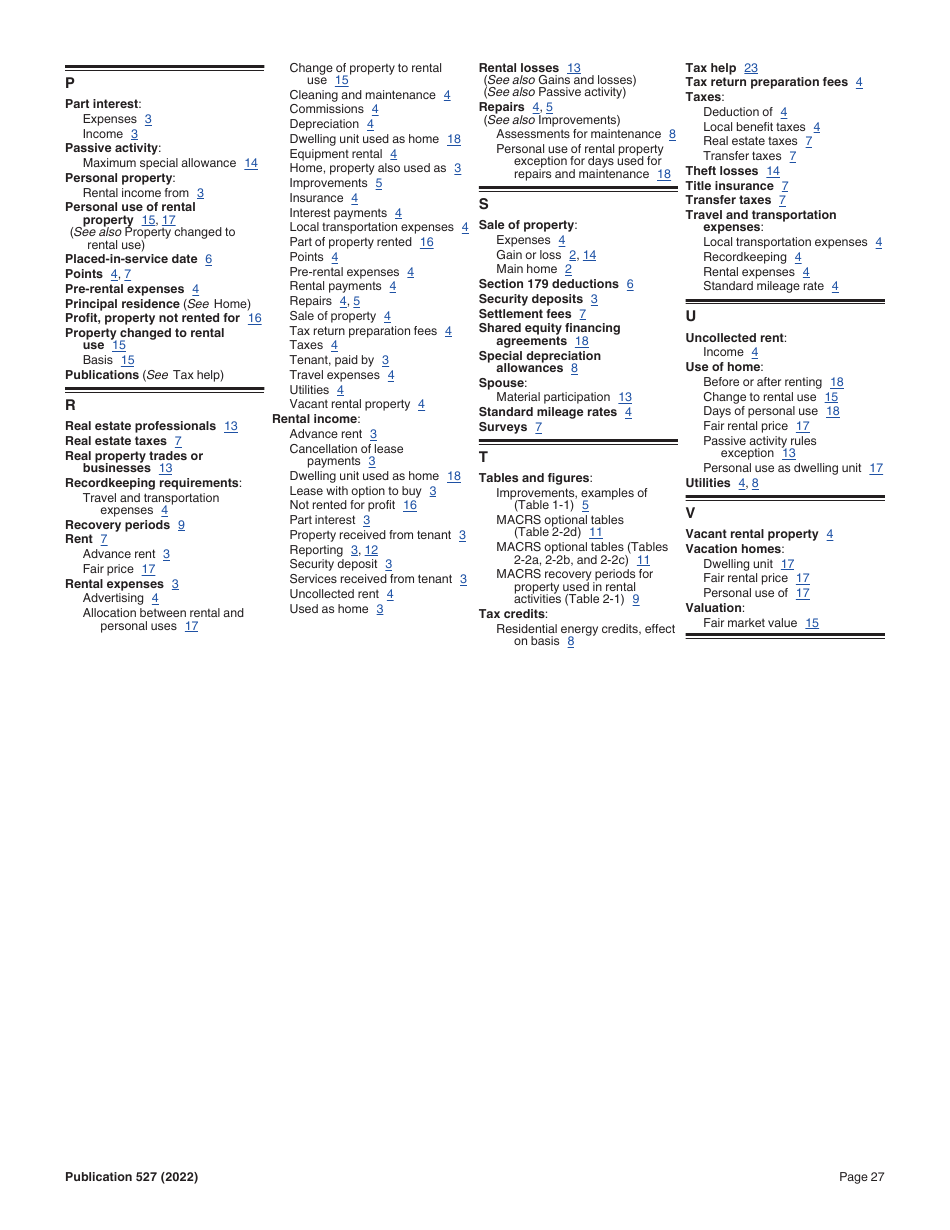

Instructions for IRS Form 527 Residential Rental Property

This document contains official instructions for IRS Form 527 , Residential Rental Property - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

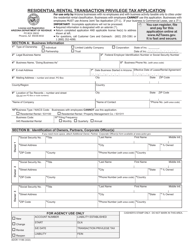

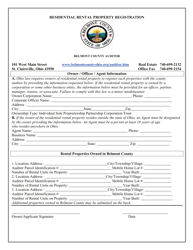

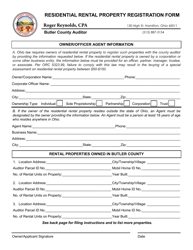

Q: What is IRS Form 527?

A: IRS Form 527 is a form used for reporting income and expenses related to residential rental property.

Q: Who needs to file IRS Form 527?

A: Individuals or businesses who own residential rental properties need to file IRS Form 527.

Q: What information is required on IRS Form 527?

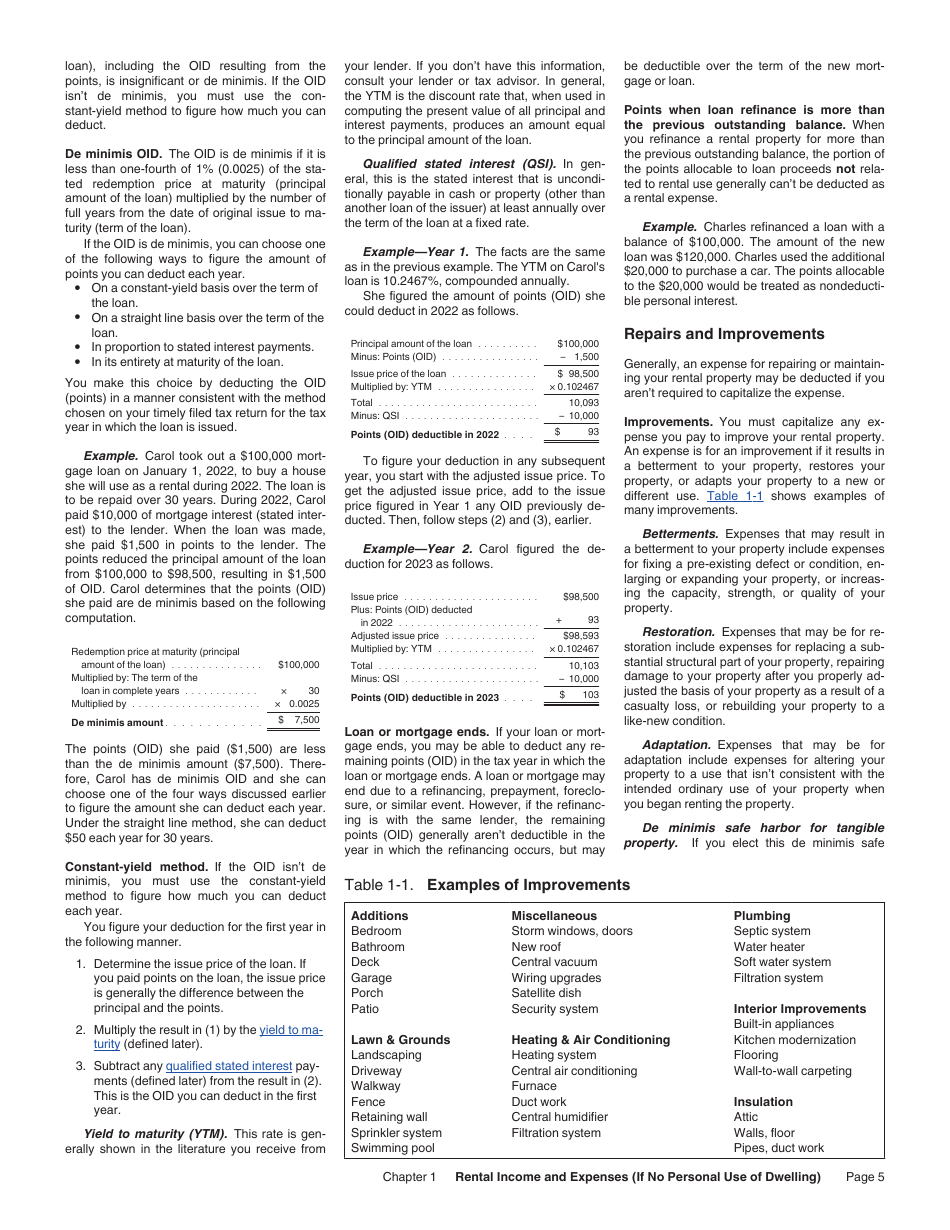

A: IRS Form 527 requires information about rental income, deductible expenses, and depreciation.

Q: When is IRS Form 527 due?

A: IRS Form 527 is typically due on April 15th of the following year.

Q: Are there any penalties for not filing IRS Form 527?

A: Yes, there may be penalties for not filing IRS Form 527 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Can I e-file IRS Form 527?

A: No, you cannot e-file IRS Form 527. It must be filed by mail.

Instruction Details:

- This 27-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.