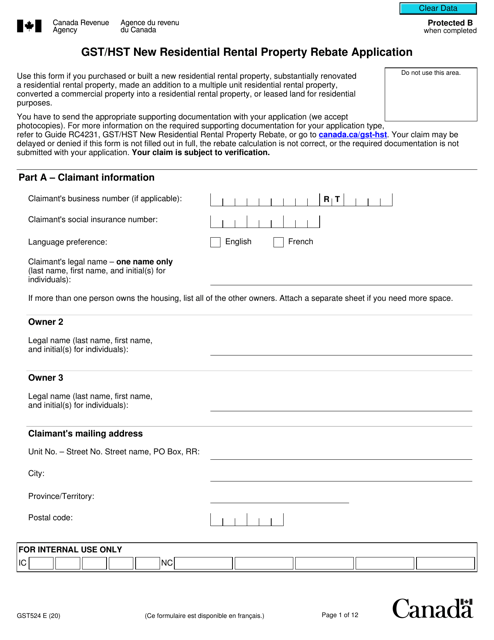

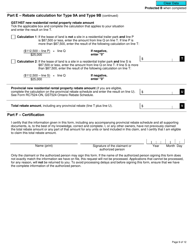

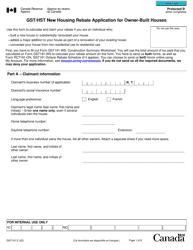

Form GST524 Gst / Hst New Residential Rental Property Rebate Application - Canada

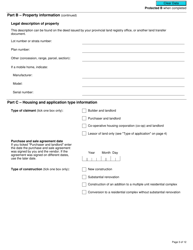

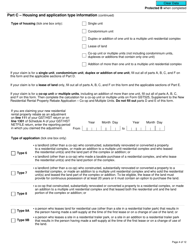

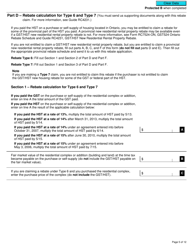

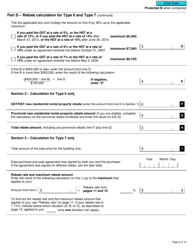

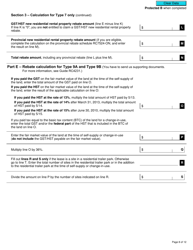

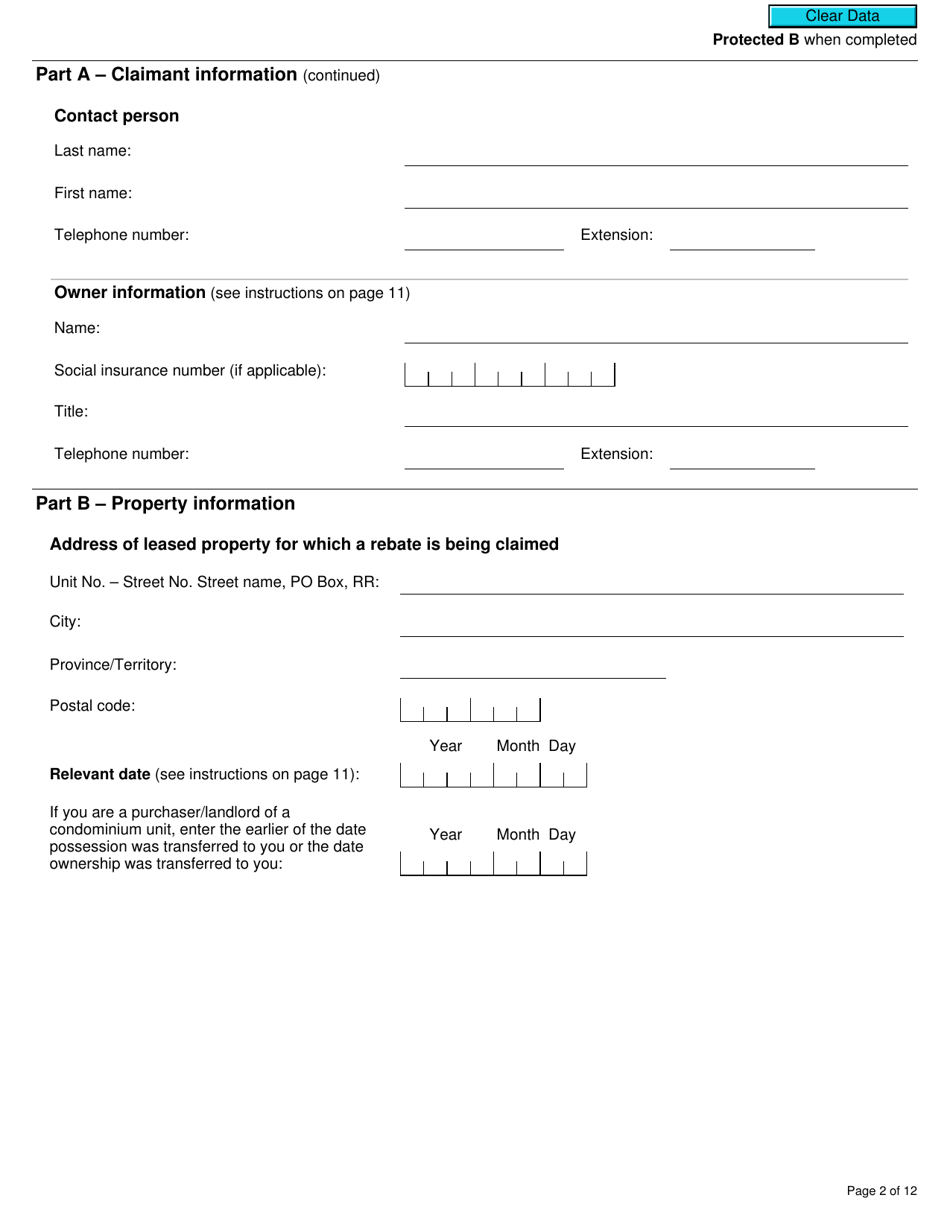

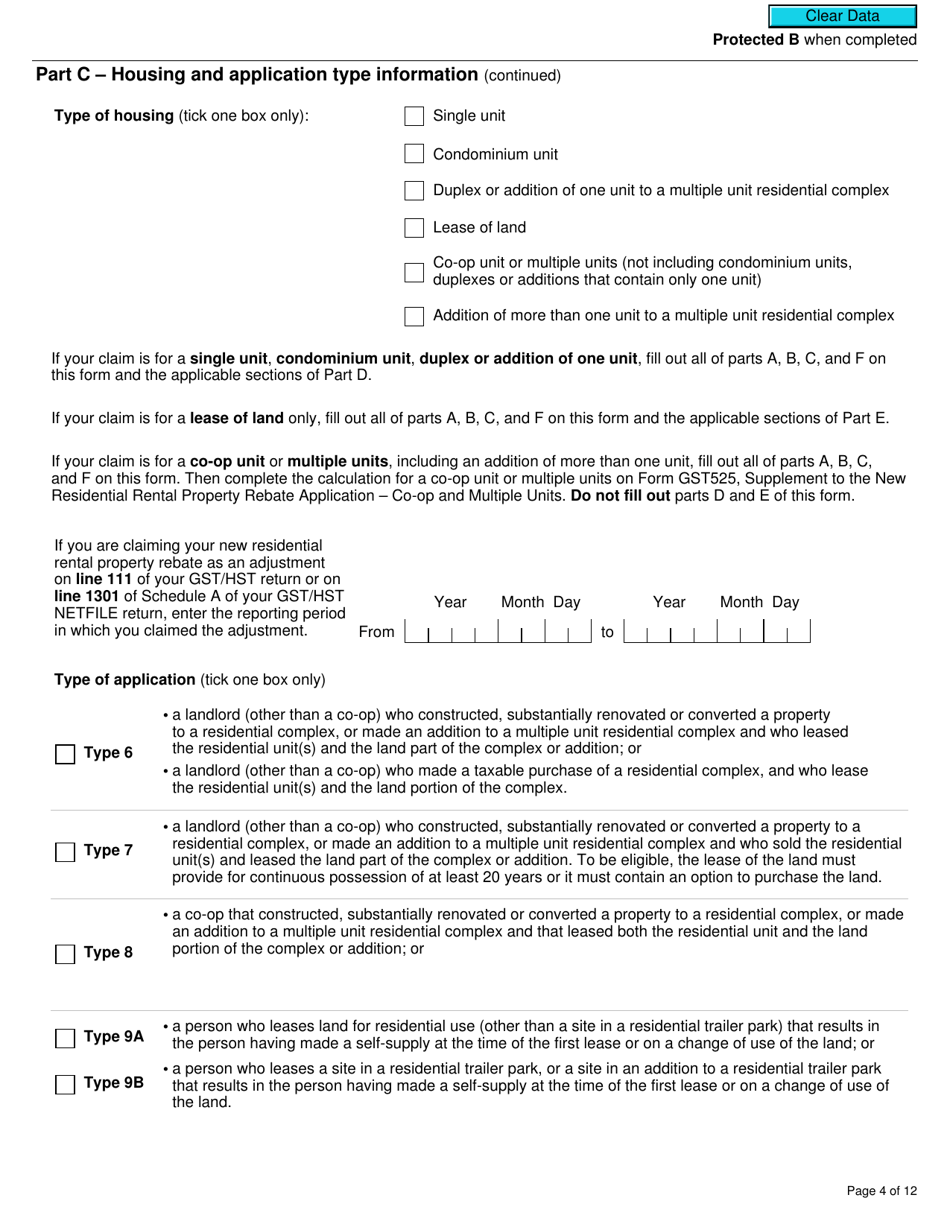

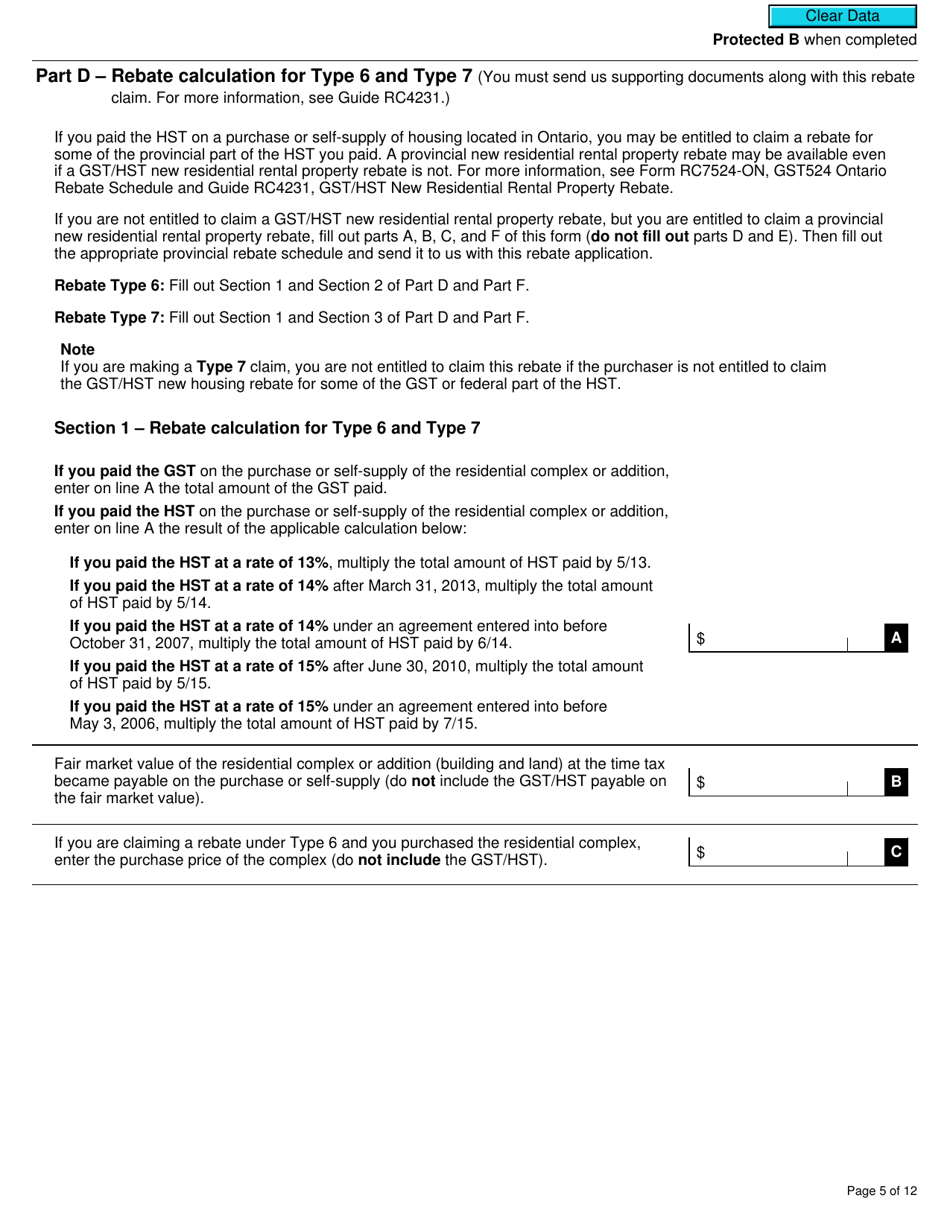

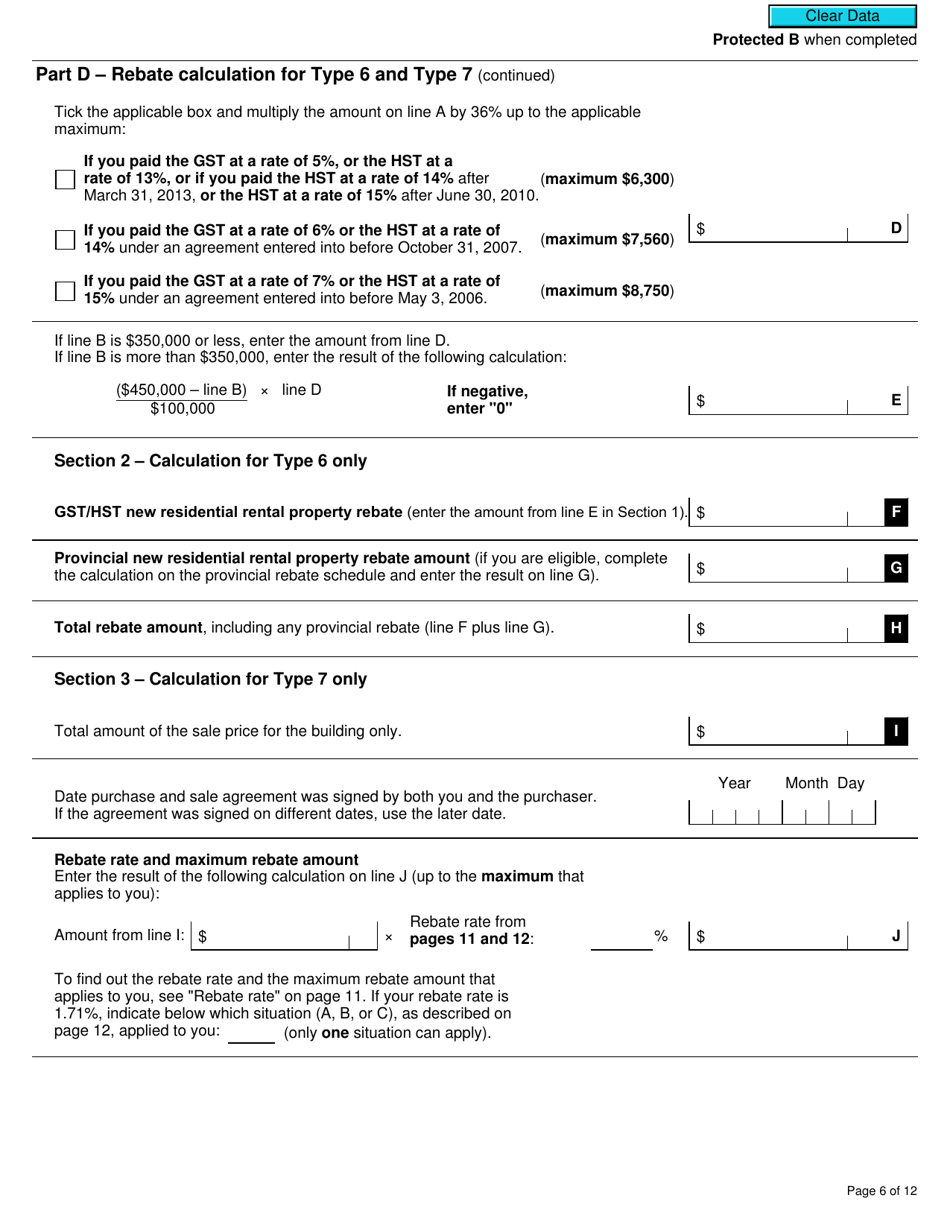

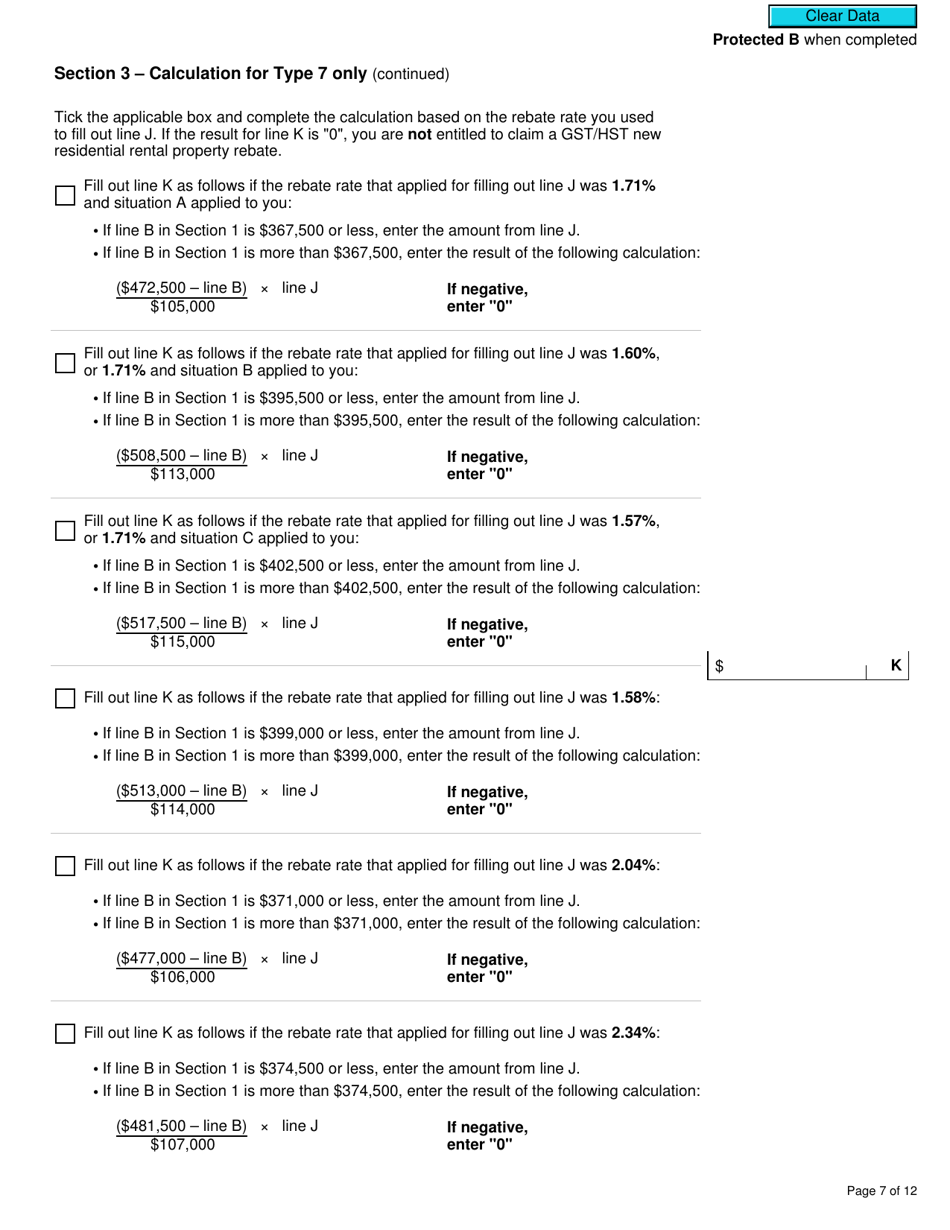

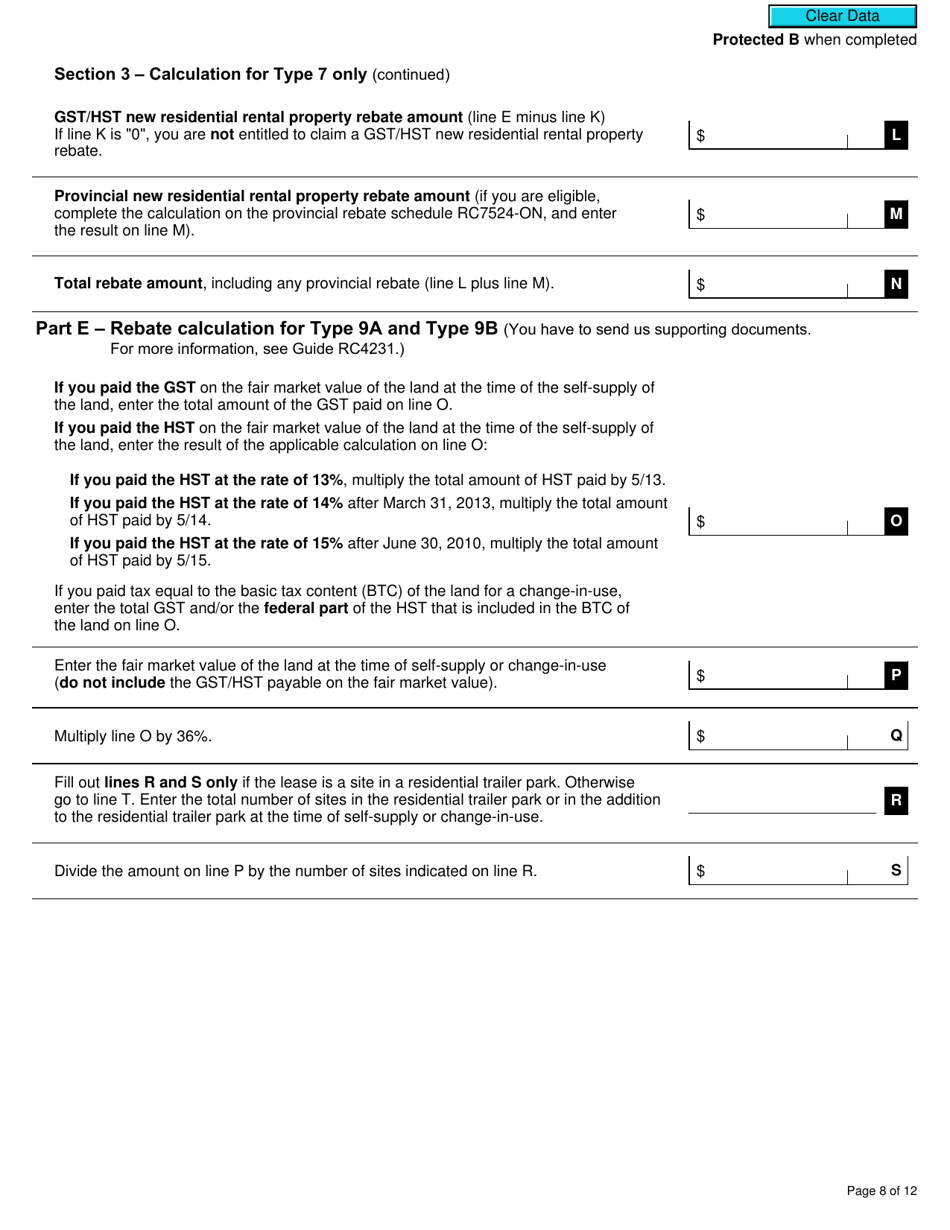

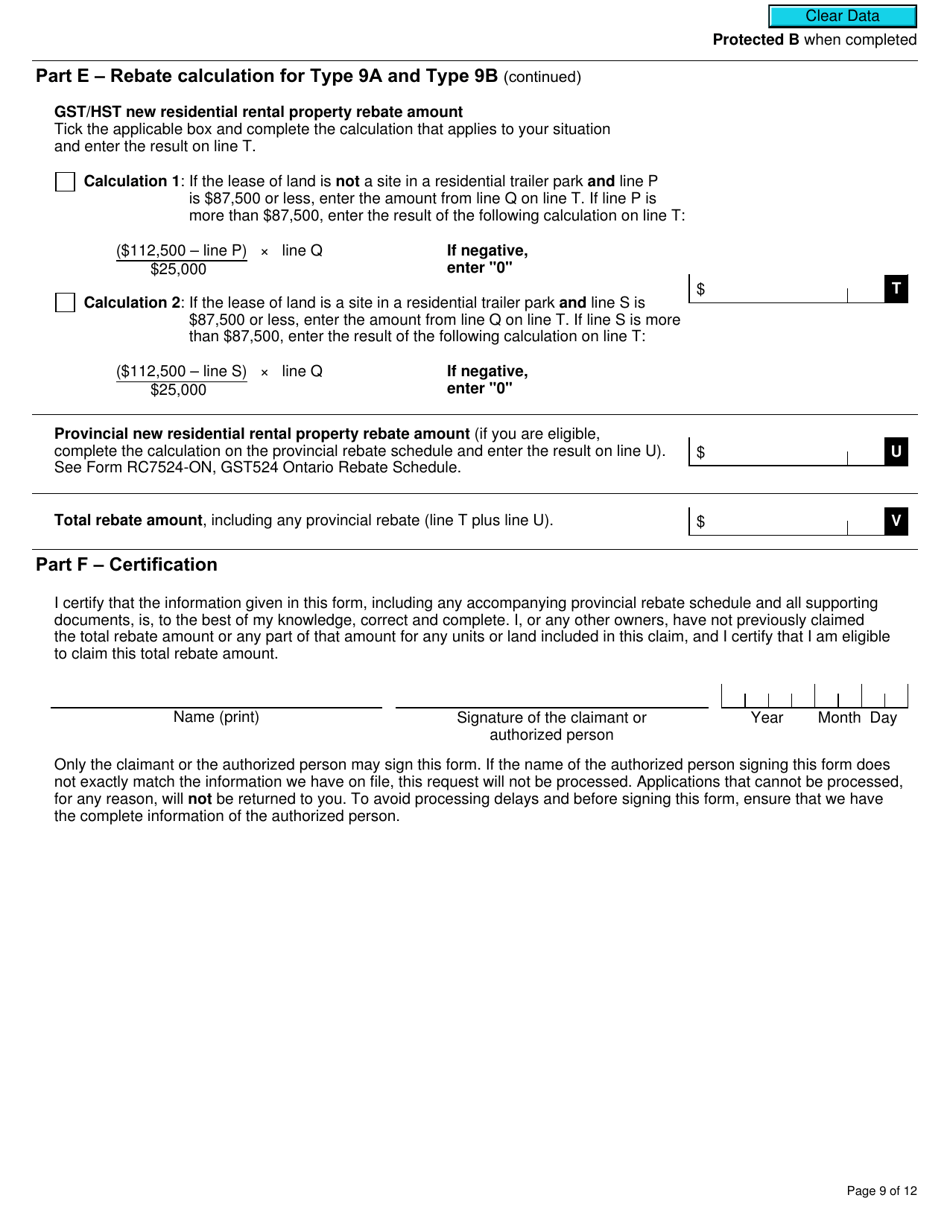

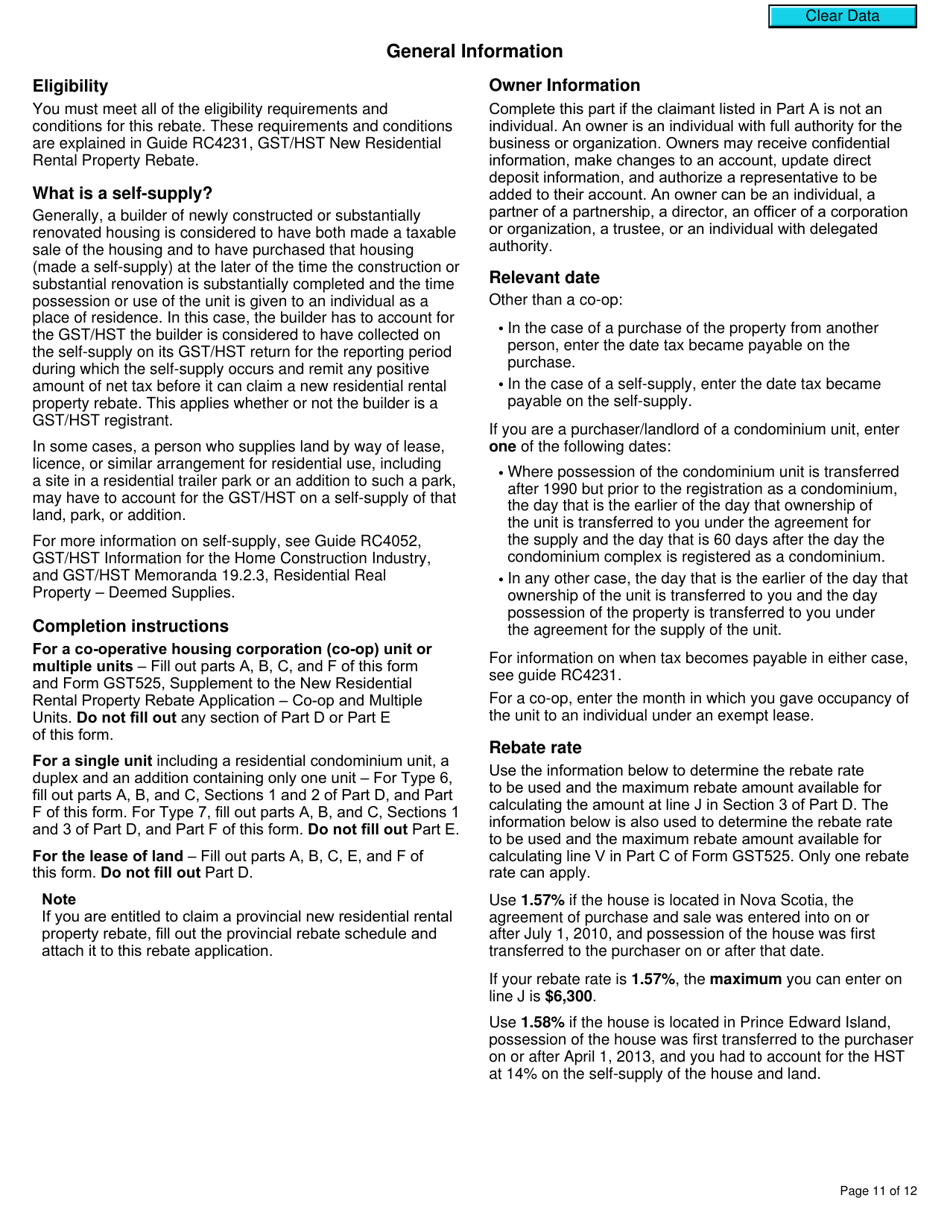

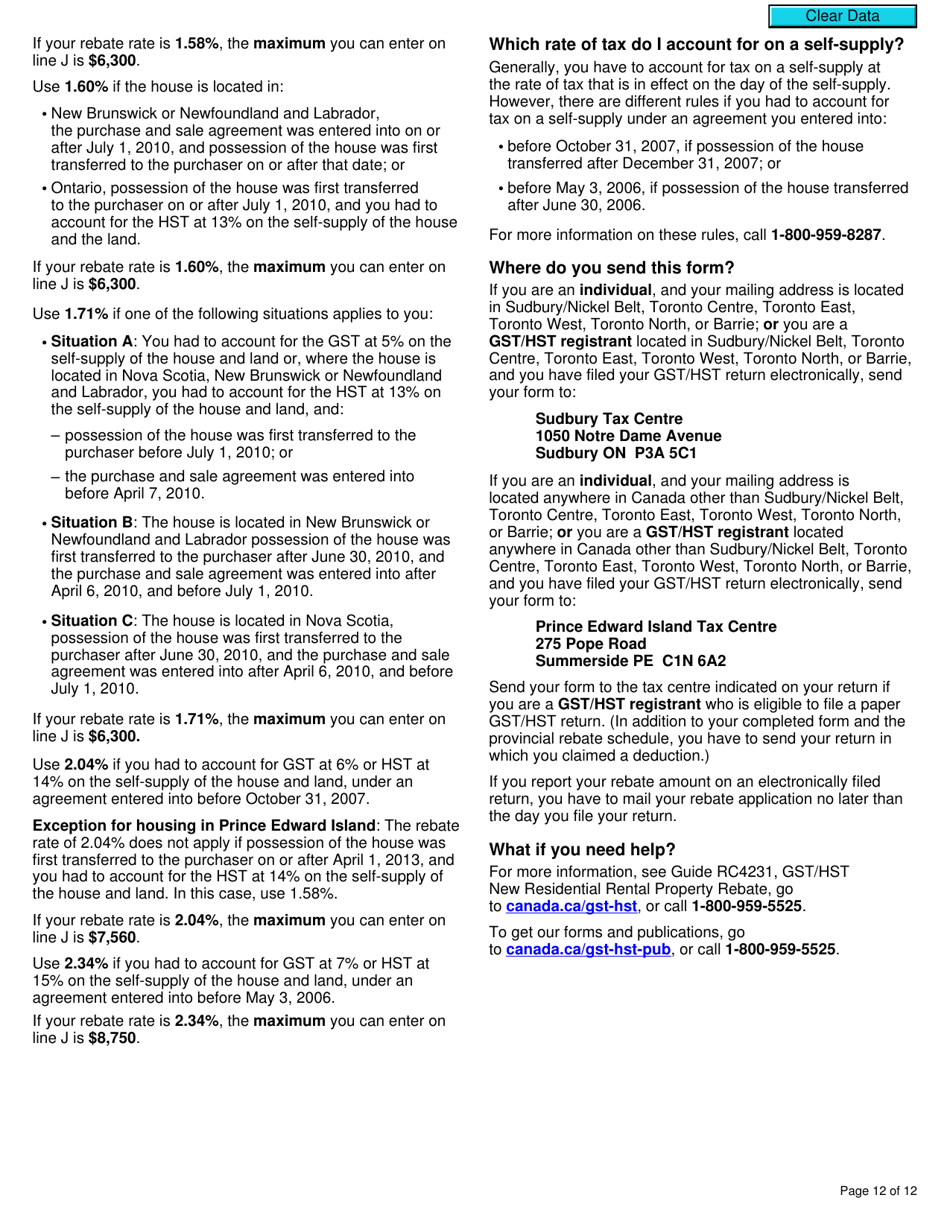

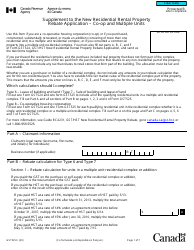

Form GST524 is the application for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) New Residential Rental Property Rebate in Canada. It is used by individuals or organizations to claim a rebate for the GST/HST paid on the purchase or construction of a new residential rental property.

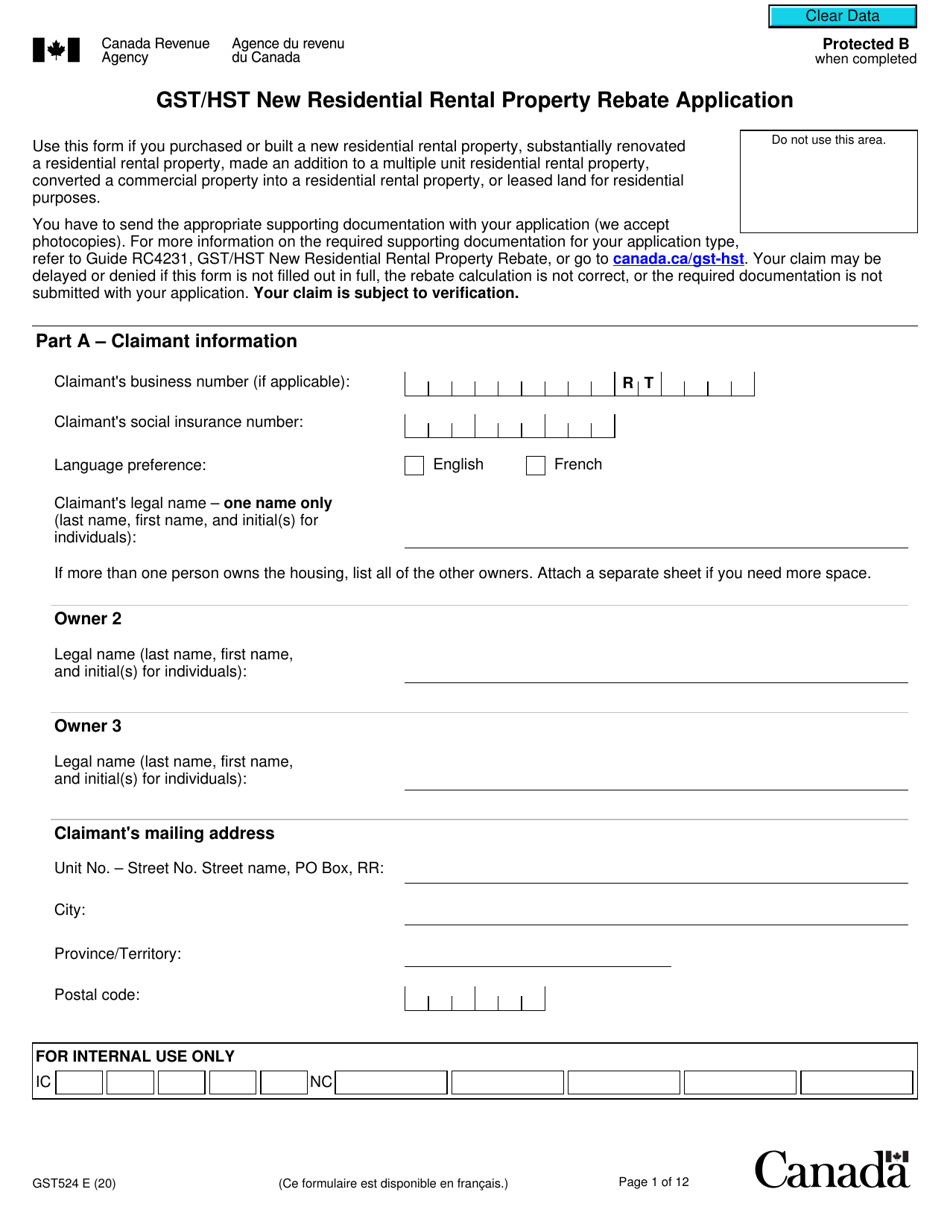

The Form GST524 Gst/Hst New Residential Rental Property Rebate Application in Canada is filed by the property owner or their authorized agent.

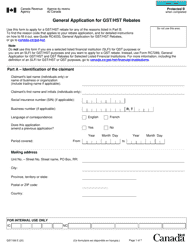

Form GST524 Gst/Hst New Residential Rental Property Rebate Application - Canada - Frequently Asked Questions (FAQ)

Q: What is the GST/HST New Residential Rental Property Rebate? A: The GST/HST New Residential Rental Property Rebate is a rebate provided to individuals who purchase or build new residential rental properties in Canada.

Q: Who is eligible for the GST/HST New Residential Rental Property Rebate? A: Individuals who purchase or build new residential rental properties in Canada are eligible for the GST/HST New Residential Rental Property Rebate.

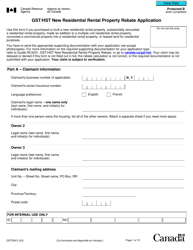

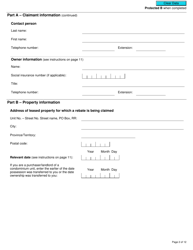

Q: How do I apply for the GST/HST New Residential Rental Property Rebate? A: To apply for the GST/HST New Residential Rental Property Rebate, you need to complete and submit Form GST524.

Q: What documents do I need to include with my application? A: You may need to include documents such as proof of purchase or construction, lease agreements, and other supporting documents with your application.

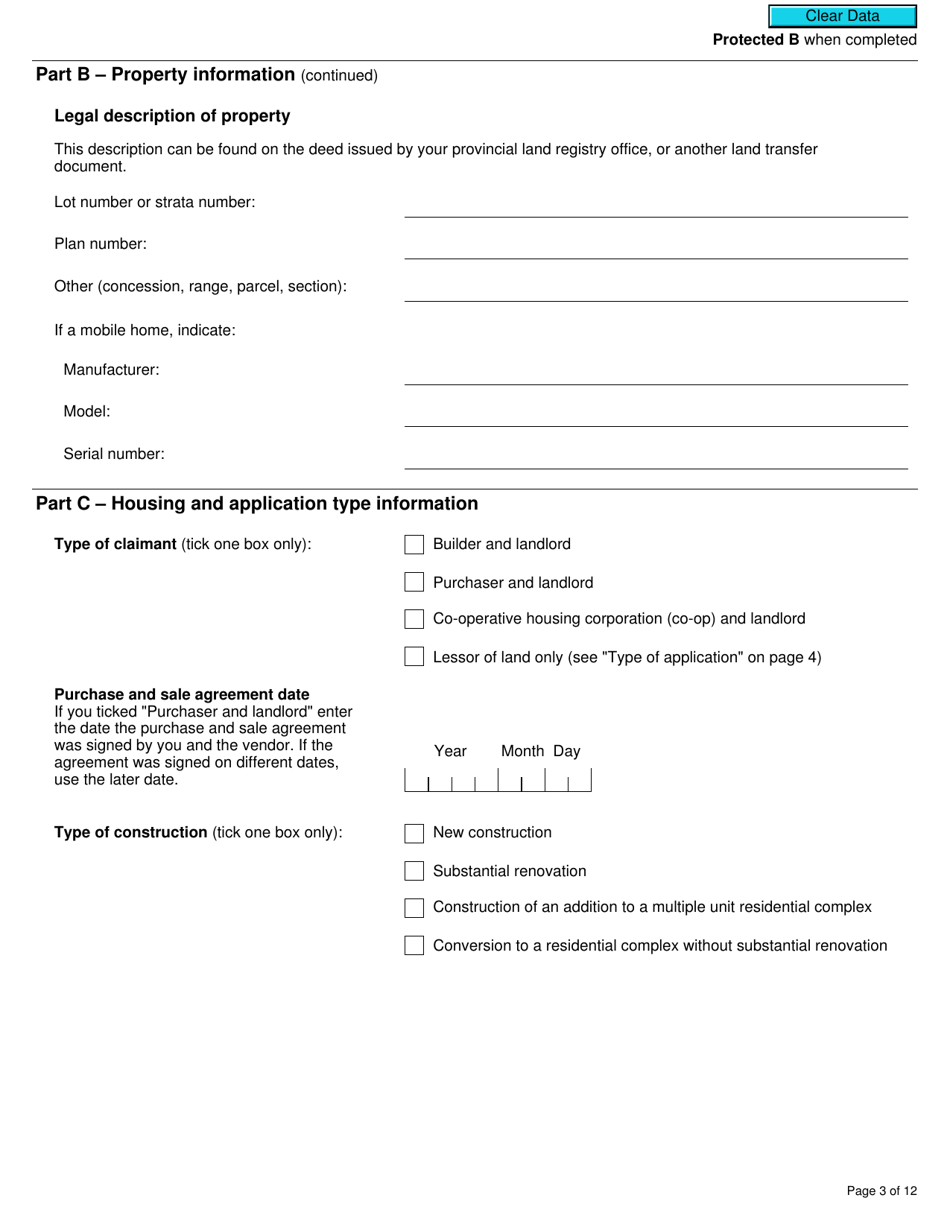

Q: What is the deadline to apply for the GST/HST New Residential Rental Property Rebate? A: Generally, you must apply for the GST/HST New Residential Rental Property Rebate within 2 years of the property's purchase or completion date.

Q: How long does it take to process the rebate application? A: The processing time for the GST/HST New Residential Rental Property Rebate application can vary, but it usually takes several weeks to months to receive a decision.

Q: Can I claim the rebate for a property that is not used as a rental property? A: No, the GST/HST New Residential Rental Property Rebate is specifically for new residential rental properties.

Q: Is the rebate taxable? A: No, the GST/HST New Residential Rental Property Rebate is not taxable.

Q: What happens if my application is denied? A: If your application is denied, you may have the option to appeal the decision or provide additional information to support your eligibility.