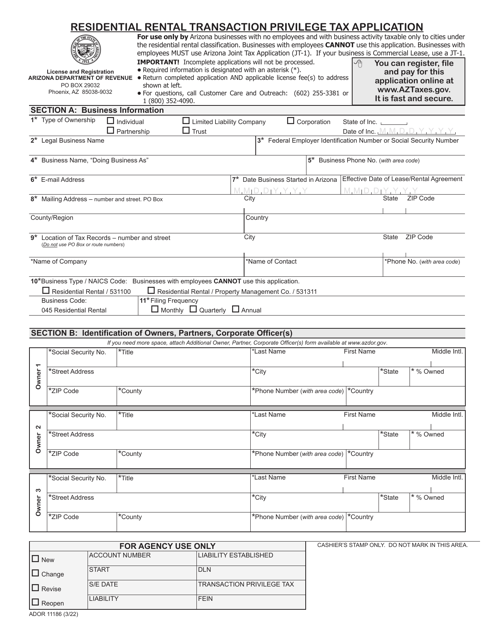

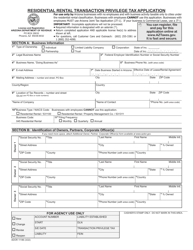

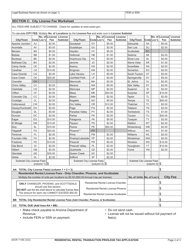

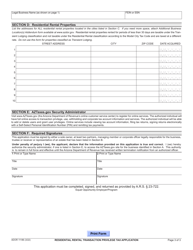

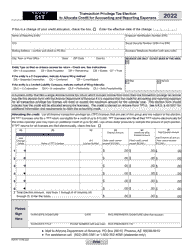

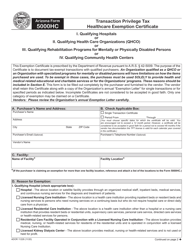

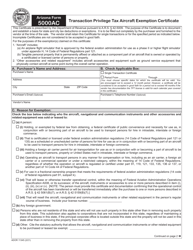

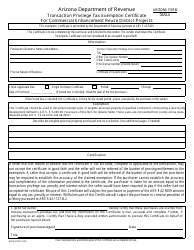

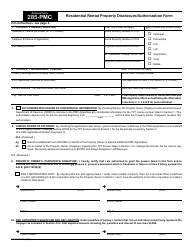

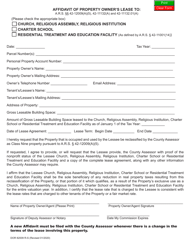

Form ADOR11186 Residential Rental Transaction Privilege Tax Application - Arizona

What Is Form ADOR11186?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR11186?

A: Form ADOR11186 is the Residential RentalTransaction Privilege Tax Application in Arizona.

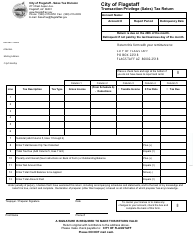

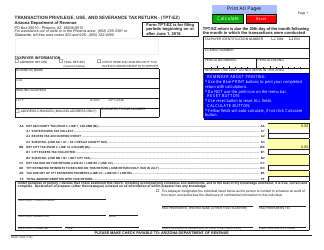

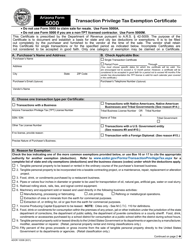

Q: What is a Residential Rental Transaction Privilege Tax?

A: A Residential Rental Transaction Privilege Tax is a tax imposed on residential rental income in Arizona.

Q: Who needs to file Form ADOR11186?

A: Anyone who is engaged in the business of renting residential property in Arizona needs to file Form ADOR11186.

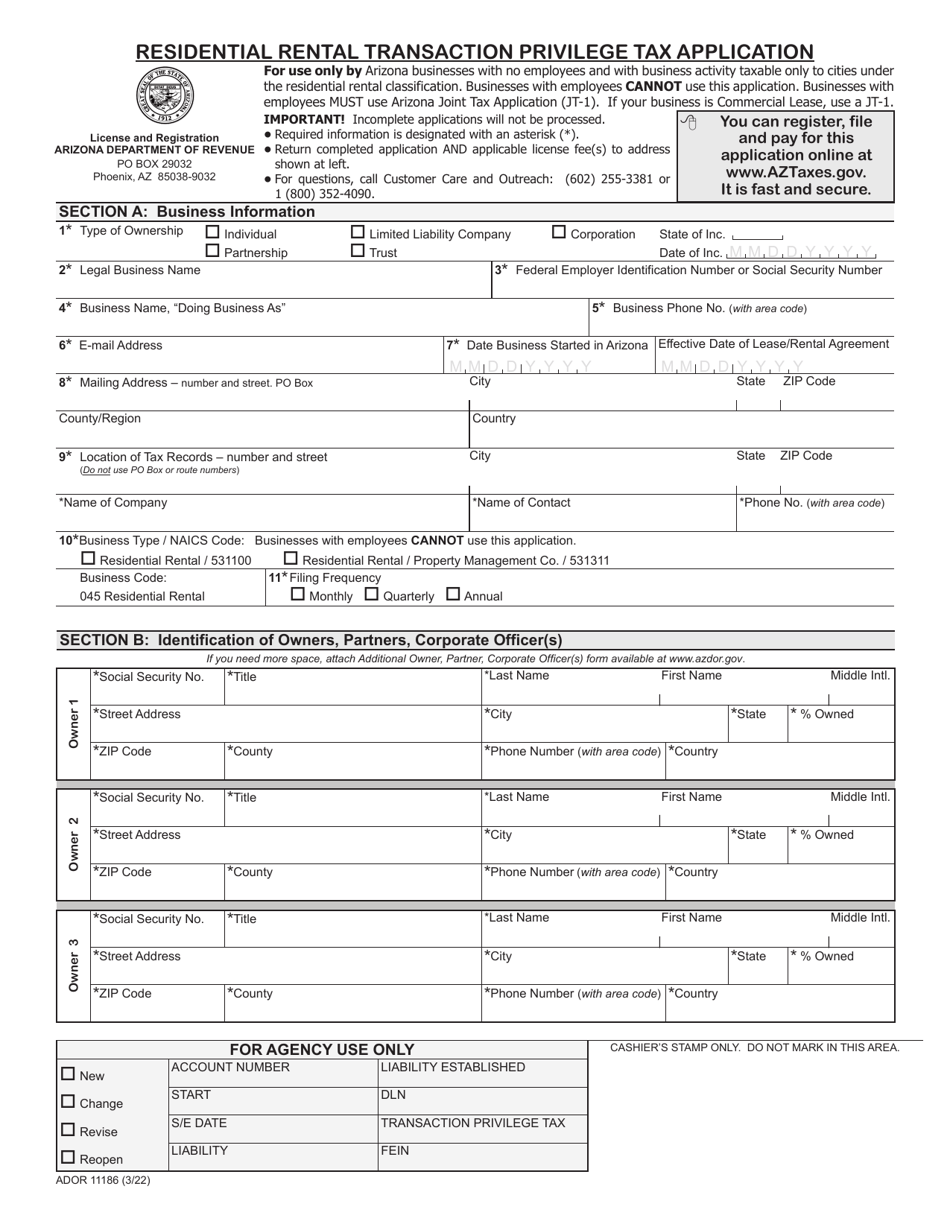

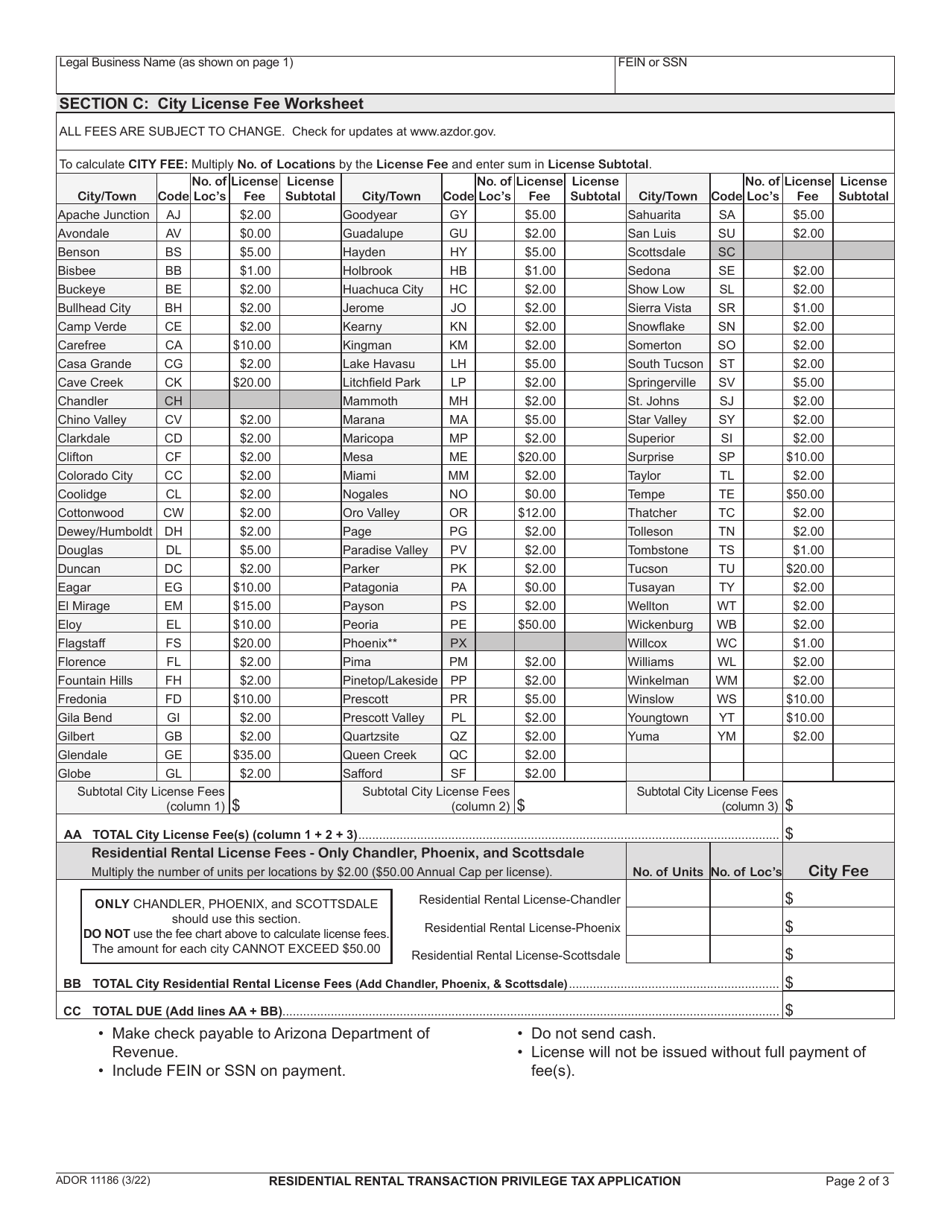

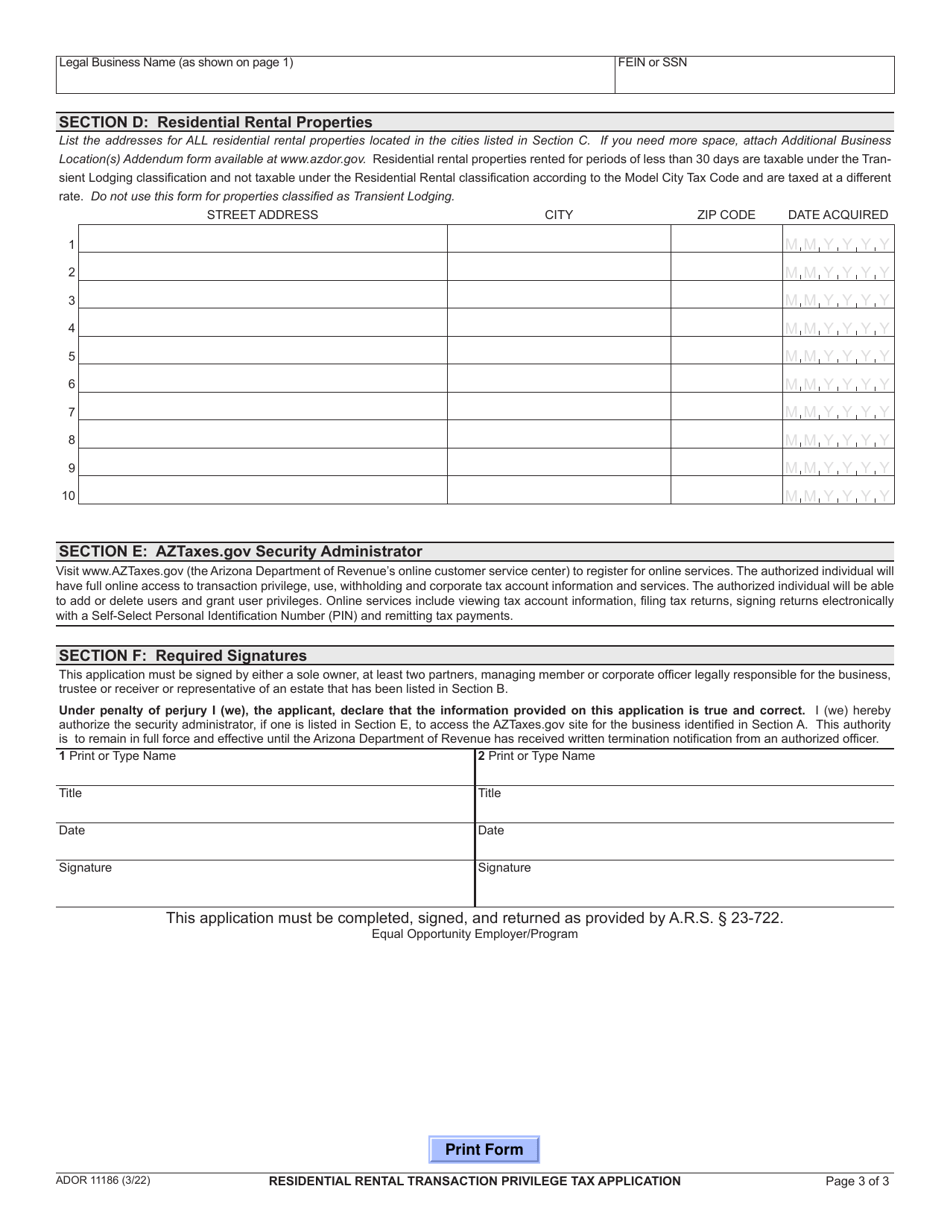

Q: What information is required on Form ADOR11186?

A: Form ADOR11186 requires information such as the taxpayer's name, address, rental property details, and annual rental income.

Q: When is Form ADOR11186 due?

A: Form ADOR11186 is generally due on the 20th day of the month following the end of the reporting period.

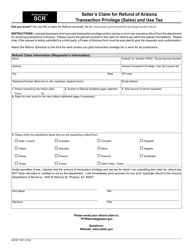

Q: Are there any exemptions or deductions available for Residential Rental Transaction Privilege Tax?

A: Yes, there are certain exemptions and deductions available for Residential Rental Transaction Privilege Tax. It is recommended to consult the Arizona Department of Revenue for specific details.

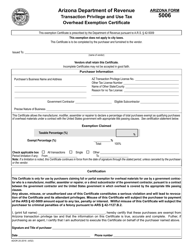

Q: What are the consequences of not filing Form ADOR11186?

A: Failure to file Form ADOR11186 or pay the required tax on time may result in penalties and interest charges.

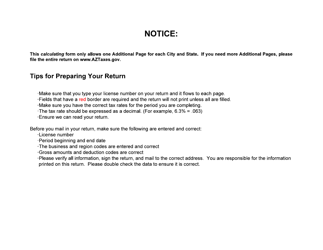

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11186 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.