This version of the form is not currently in use and is provided for reference only. Download this version of

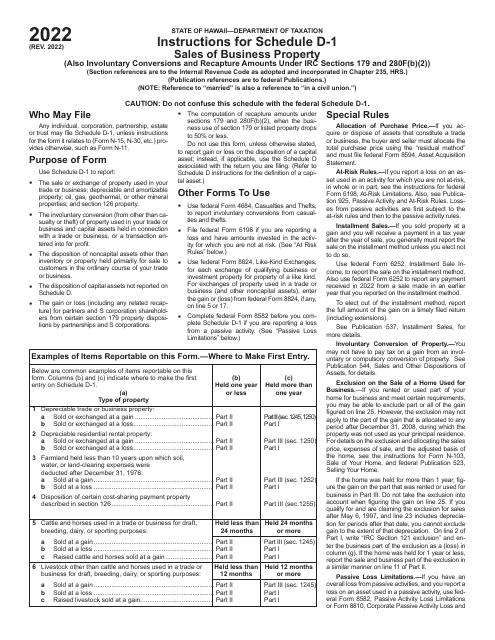

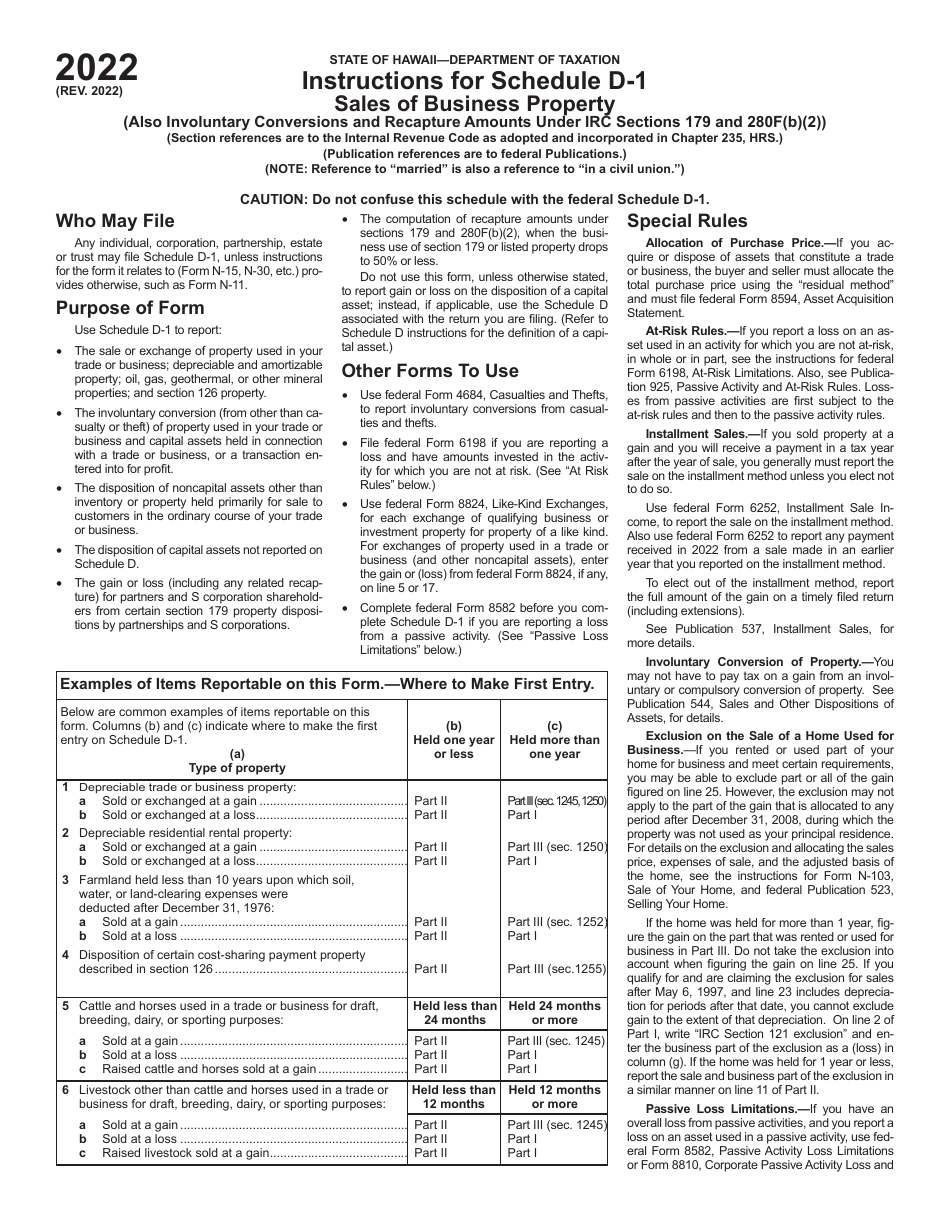

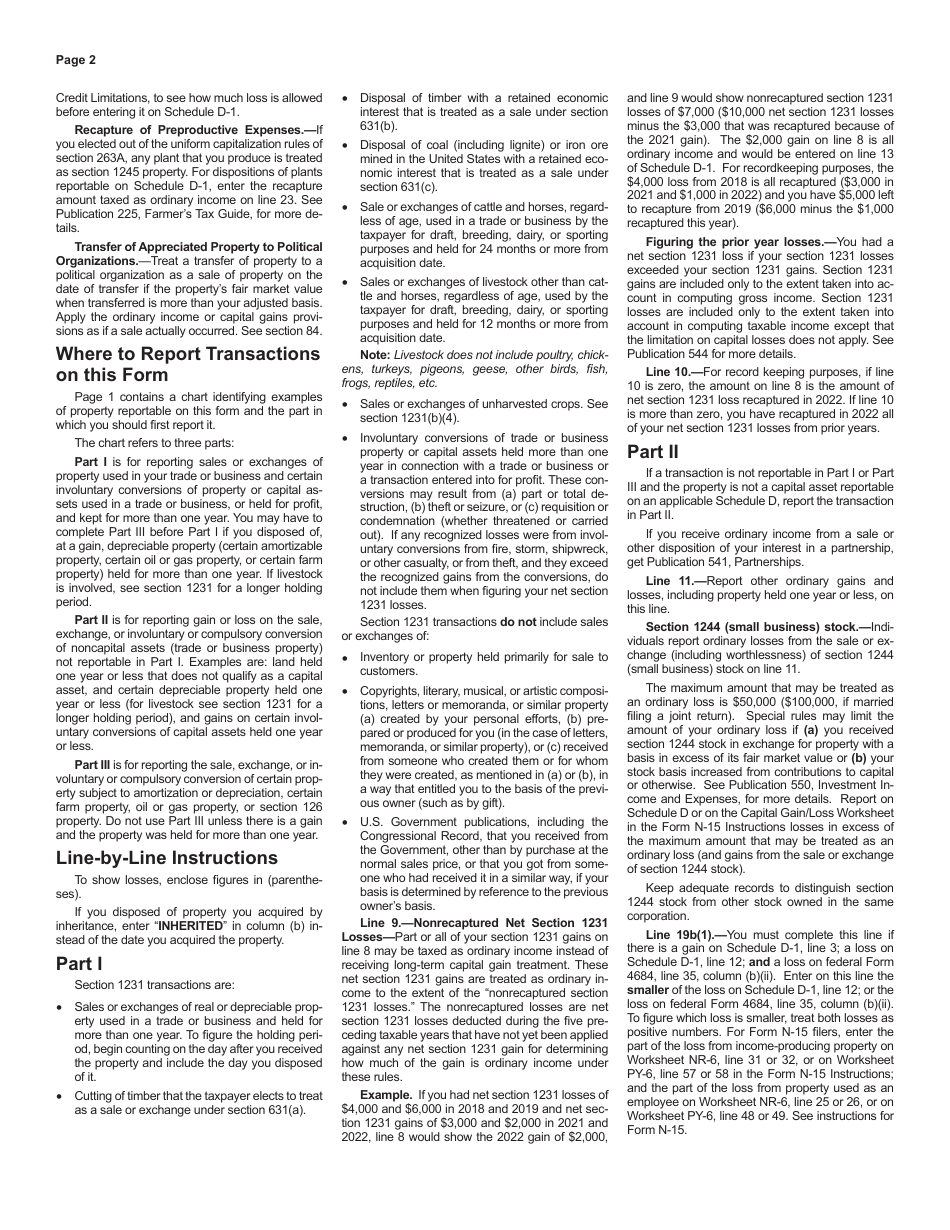

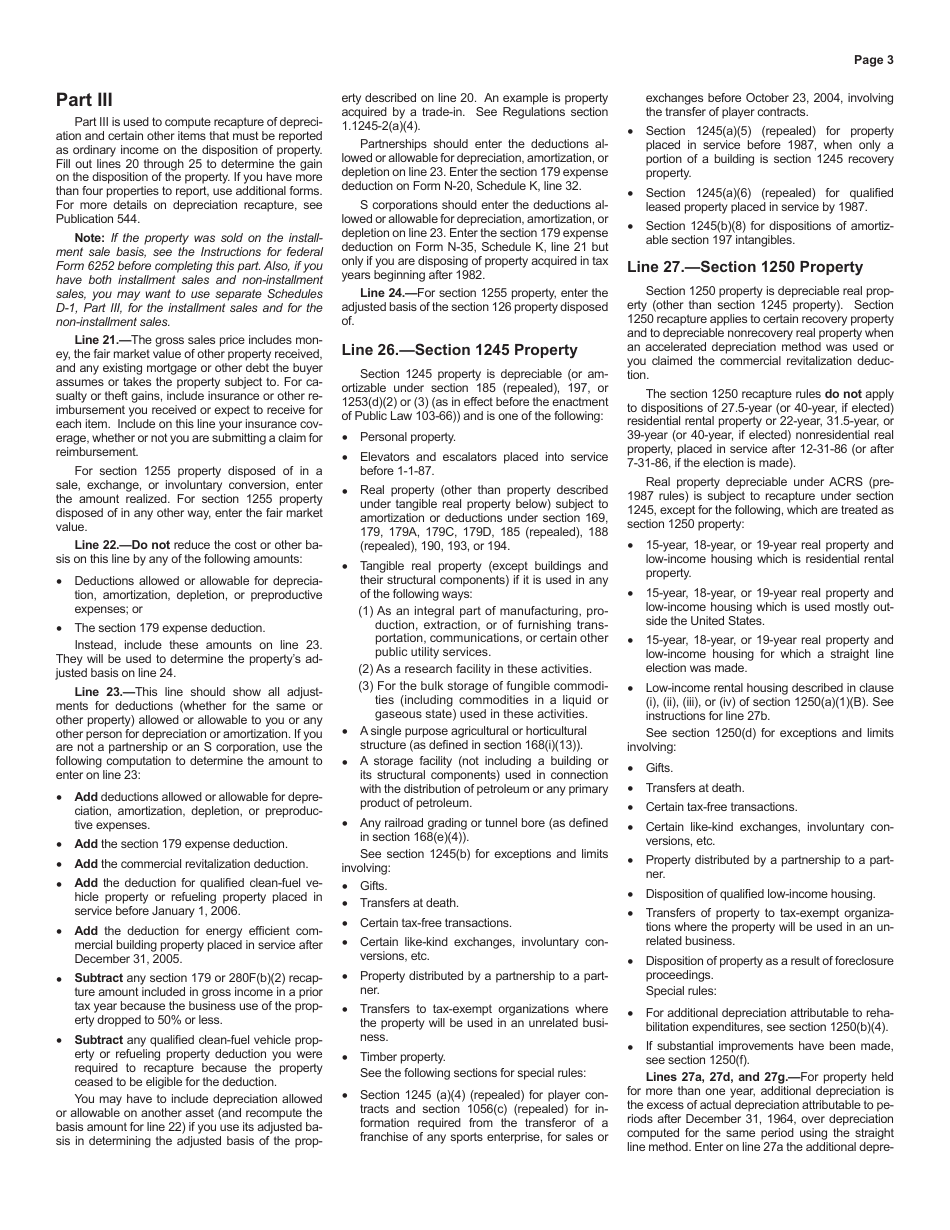

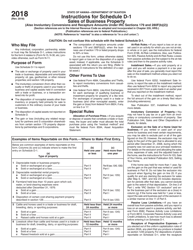

Instructions for Schedule D-1

for the current year.

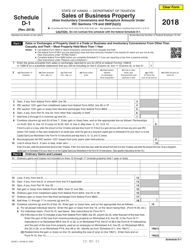

Instructions for Schedule D-1 Sales of Business Property - Hawaii

This document contains official instructions for Schedule D-1 , Sales of Business Property - a form released and collected by the Hawaii Department of Taxation.

FAQ

Q: What is Schedule D-1?

A: Schedule D-1 is a tax form used in Hawaii to report the sales of business property.

Q: Who needs to file Schedule D-1?

A: Any individual or business that has sold or transferred business property in Hawaii needs to file Schedule D-1.

Q: What information is required on Schedule D-1?

A: You will need to provide details about the property sold, the date of sale, the amount received, and any expenses associated with the sale.

Q: When is the deadline to file Schedule D-1?

A: The deadline to file Schedule D-1 is the same as the deadline for your Hawaii income tax return, which is usually April 20th.

Q: Are there any penalties for not filing Schedule D-1?

A: Yes, if you fail to file Schedule D-1 or if you underreport the sales of business property, you may be subject to penalties and interest.

Q: Can I e-file Schedule D-1?

A: No, currently Hawaii does not offer electronic filing for Schedule D-1. You will need to file a paper copy.

Q: Can I claim any deductions on Schedule D-1?

A: Yes, you may be able to deduct certain expenses related to the sale of business property, such as commissions and legal fees. Consult a tax professional for more information.

Q: Do I need to include supporting documents with Schedule D-1?

A: It is recommended to keep all supporting documents, such as sales contracts and receipts, but you do not need to submit them with your Schedule D-1. Keep them for your records in case of an audit.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.