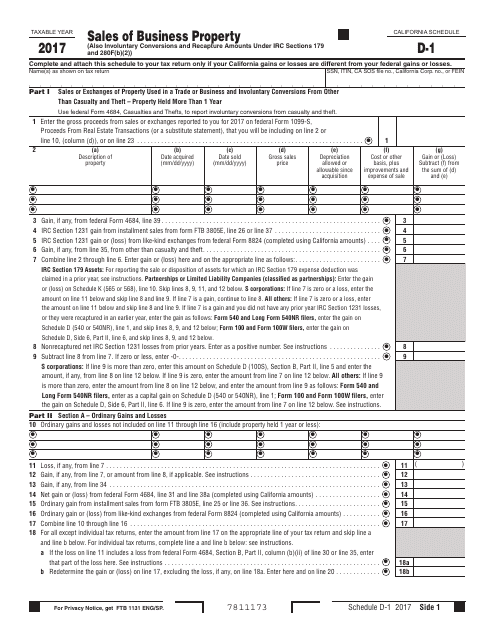

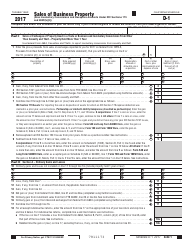

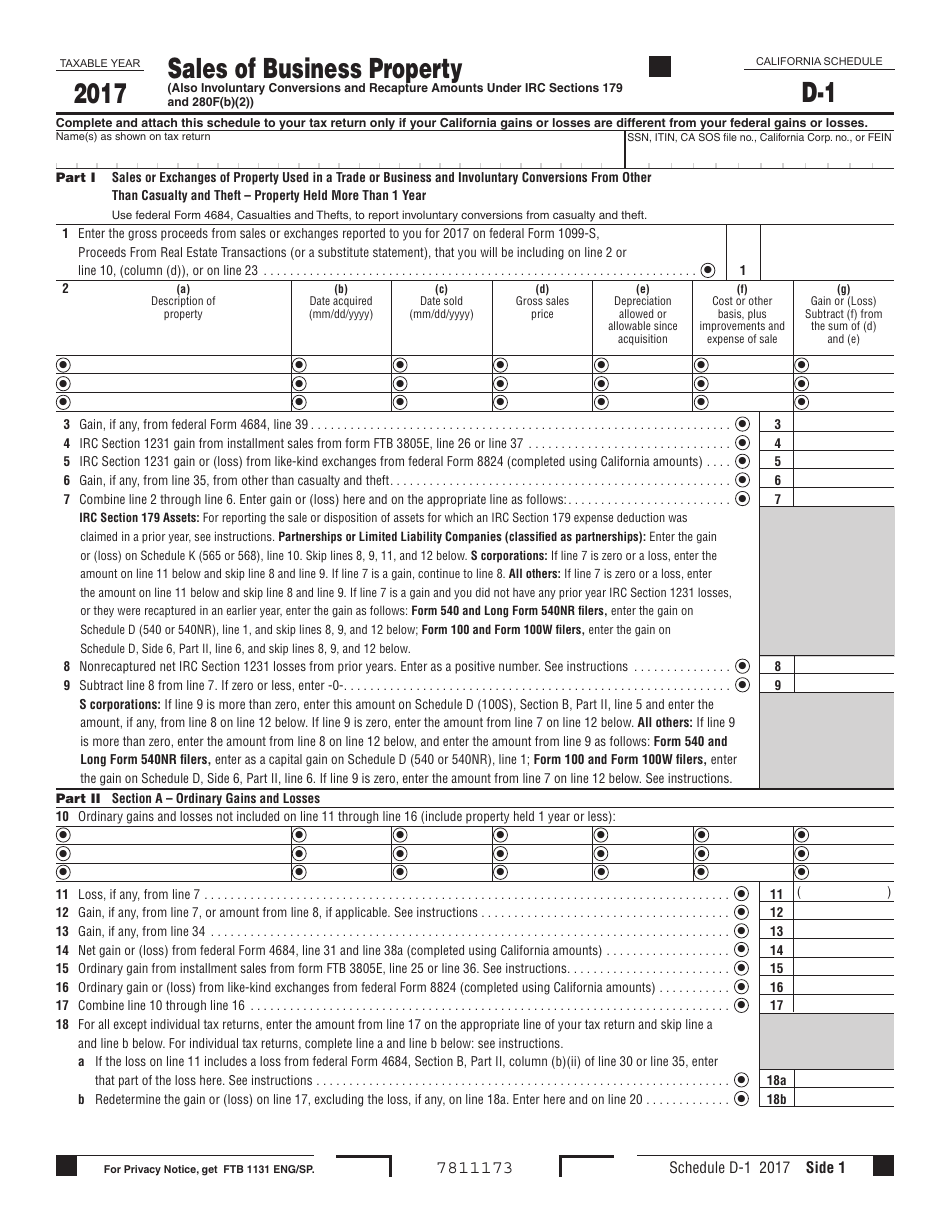

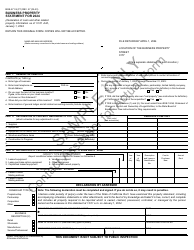

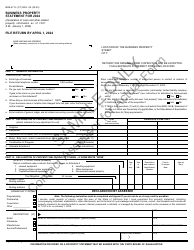

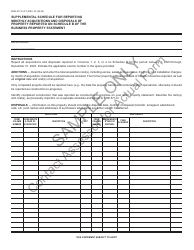

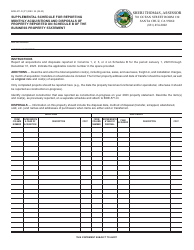

Form 540 Schedule D-1 Sales of Business Property - California

What Is Form 540 Schedule D-1?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540 Schedule D-1?

A: Form 540 Schedule D-1 is a tax form used in California to report the sales of business property.

Q: Who is required to file Form 540 Schedule D-1?

A: Individuals or businesses who have sold or disposed of business property in California may need to file Form 540 Schedule D-1.

Q: When is Form 540 Schedule D-1 due?

A: Form 540 Schedule D-1 is typically due on the same date as your California income tax return, which is usually April 15th.

Q: What should I include on Form 540 Schedule D-1?

A: You should include information about the sales or dispositions of business property, including the dates of sale, cost basis, and proceeds.

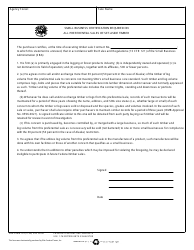

Q: Are there any penalties for not filing Form 540 Schedule D-1?

A: Yes, there may be penalties for not filing or filing Form 540 Schedule D-1 late. It's important to comply with the tax filing requirements to avoid penalties.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 540 Schedule D-1 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.