This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule CR

for the current year.

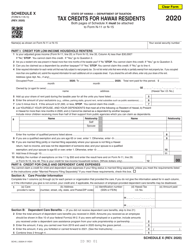

Instructions for Schedule CR Schedule of Tax Credits - Hawaii

This document contains official instructions for Schedule CR , Schedule of Tax Credits - a form released and collected by the Hawaii Department of Taxation.

FAQ

Q: What is Schedule CR?

A: Schedule CR is a form used to calculate and claim tax credits in the state of Hawaii.

Q: What types of tax credits can be claimed on Schedule CR?

A: Schedule CR allows you to claim various tax credits, such as the renewable energy technologies income tax credit, research activities tax credit, and film production tax credit.

Q: Is Schedule CR required for all taxpayers in Hawaii?

A: No, Schedule CR is only required for taxpayers who are eligible to claim tax credits.

Q: Are there any specific guidelines or qualifications for each tax credit?

A: Yes, each tax credit on Schedule CR has its own set of guidelines and qualifications. You should refer to the instructions provided with the form for more information.

Q: Can I carry forward any unused tax credits from Schedule CR?

A: Yes, unused tax credits claimed on Schedule CR can be carried forward for up to five years.

Q: What documents should I keep as proof of my claimed tax credits?

A: You should keep all supporting documents, such as receipts, invoices, and any other relevant records, as proof of your claimed tax credits.

Q: When is the deadline to file Schedule CR?

A: The deadline to file Schedule CR is the same as the deadline for filing your Hawaii state income tax return, which is typically April 20th.

Q: What should I do if I have questions or need assistance with Schedule CR?

A: If you have any questions or need assistance with Schedule CR, you should contact the Hawaii Department of Taxation or consult a tax professional.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.