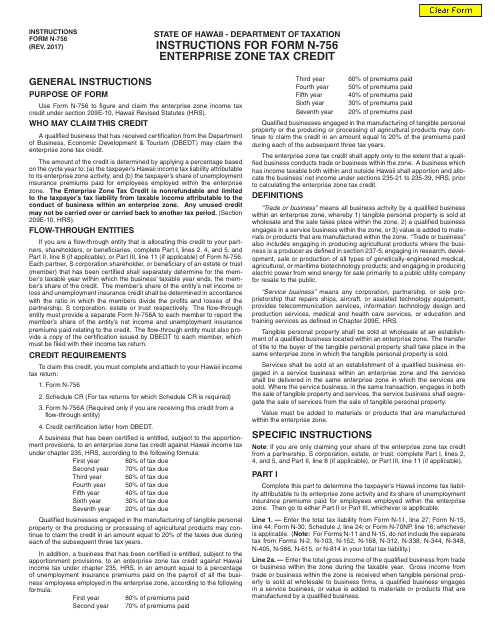

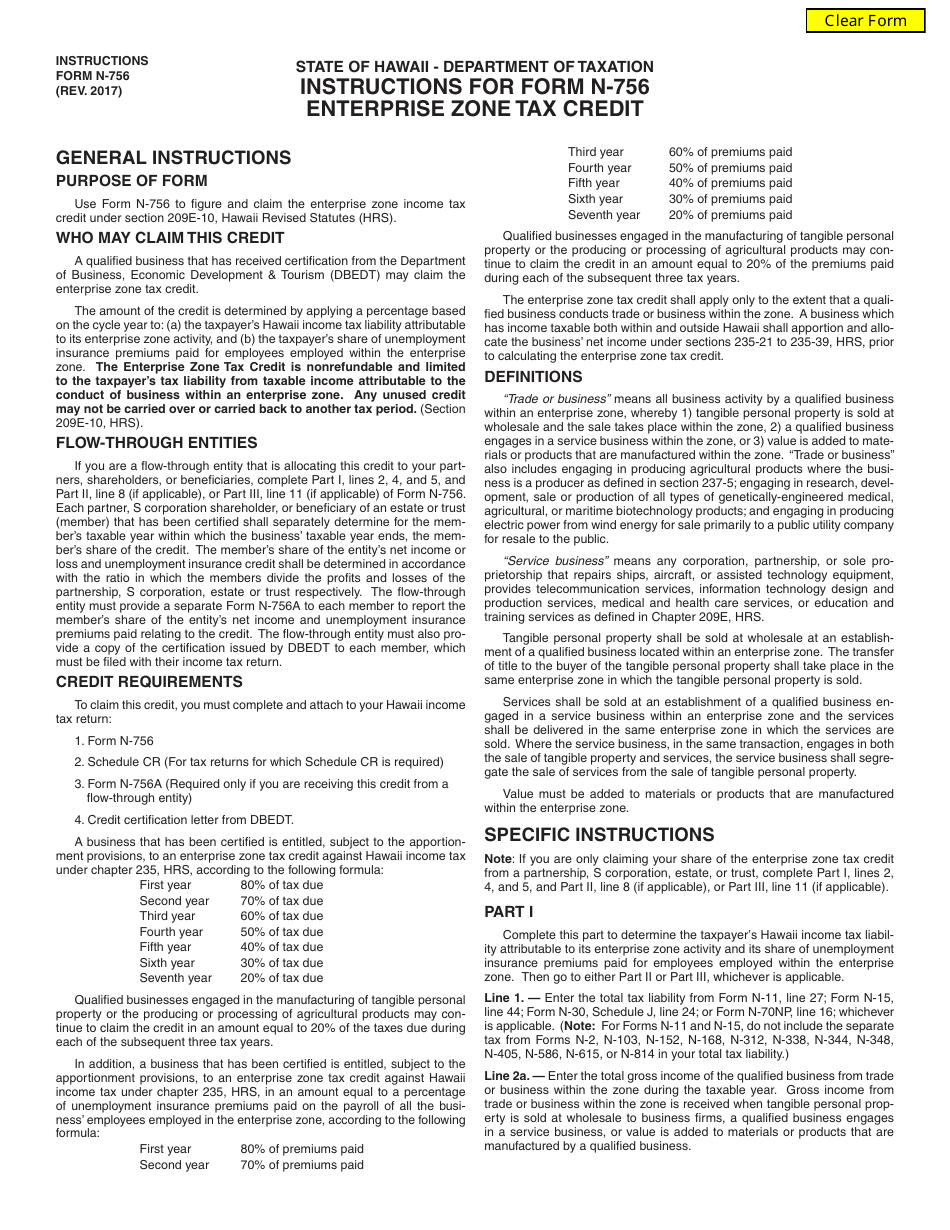

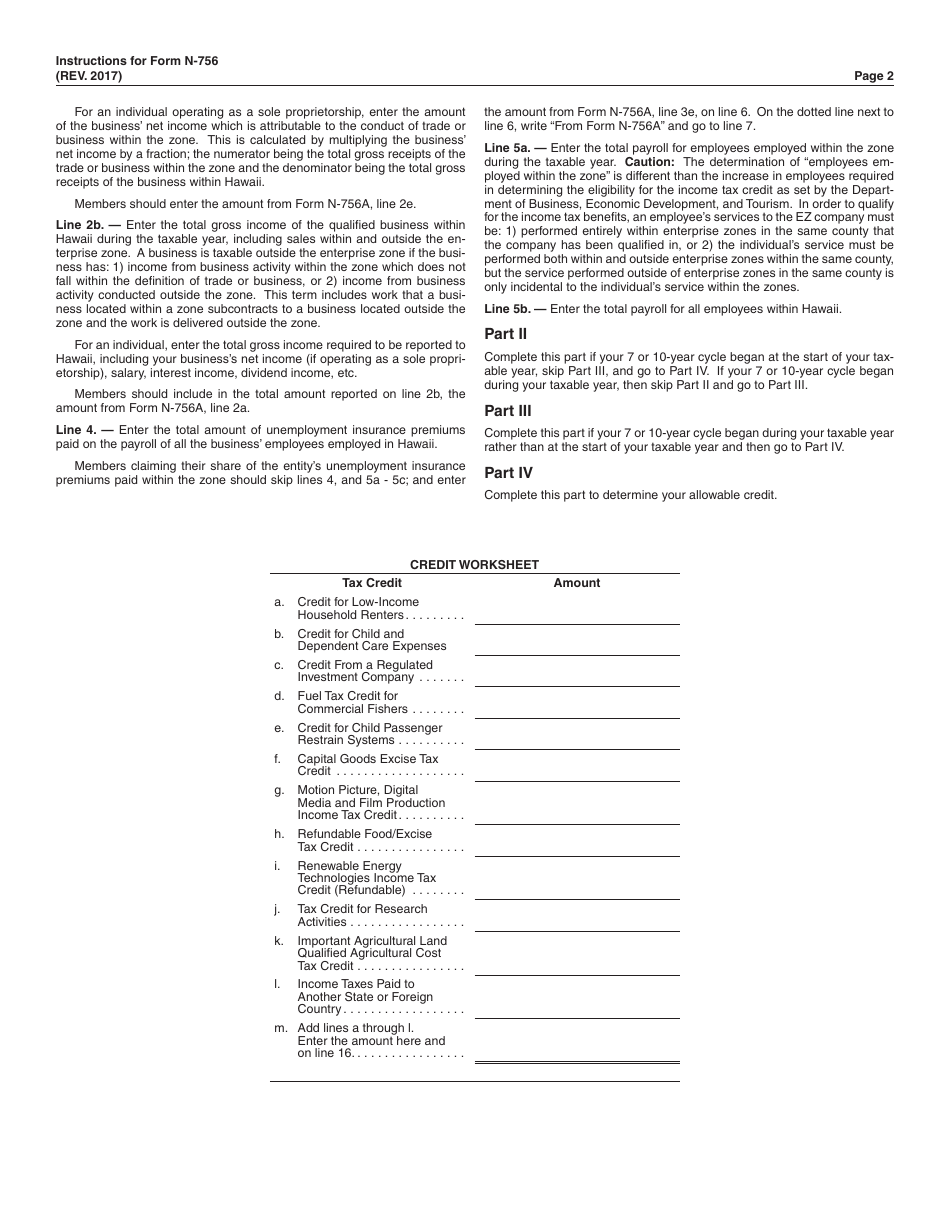

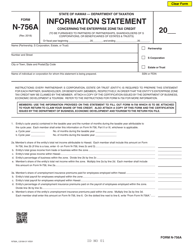

Instructions for Form N-756 Enterprise Zone Tax Credit - Hawaii

This document contains official instructions for Form N-756 , Enterprise Zone Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-756 is available for download through this link.

FAQ

Q: What is Form N-756?

A: Form N-756 is a document used to claim the Enterprise ZoneTax Credit in Hawaii.

Q: What is the Enterprise Zone Tax Credit?

A: The Enterprise Zone Tax Credit is a program aimed at encouraging economic development in designated areas of Hawaii.

Q: Who is eligible for the Enterprise Zone Tax Credit?

A: Businesses that operate within a designated enterprise zone in Hawaii may be eligible for the tax credit.

Q: How do I claim the Enterprise Zone Tax Credit?

A: To claim the tax credit, you must complete and submit Form N-756 to the Hawaii Department of Taxation.

Q: What information is required on Form N-756?

A: Form N-756 requires details about your business, including location, number of employees, and expenses incurred.

Q: When is the deadline to file Form N-756?

A: The deadline to file Form N-756 is typically the same as the due date for your Hawaii tax return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.