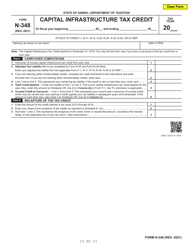

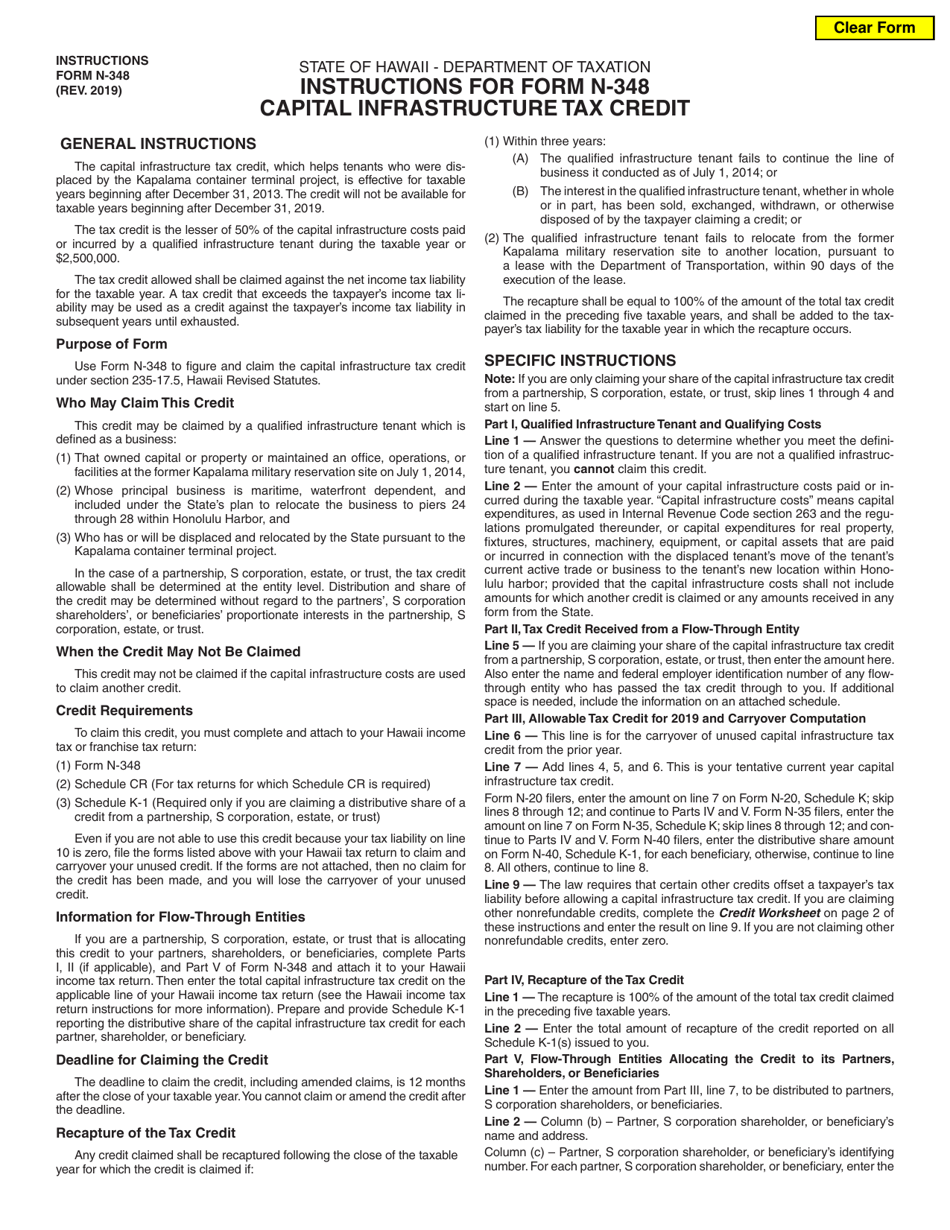

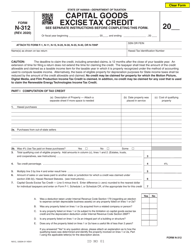

Instructions for Form N-348 Capital Infrastructure Tax Credit - Hawaii

This document contains official instructions for Form N-348 , Capital Infrastructure Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-348 is available for download through this link.

FAQ

Q: What is Form N-348?

A: Form N-348 is the form for claiming the Capital Infrastructure Tax Credit in Hawaii.

Q: Who can claim the Capital Infrastructure Tax Credit?

A: Any taxpayer who made eligible capital infrastructure investments in Hawaii can claim the tax credit.

Q: What are eligible capital infrastructure investments?

A: Eligible capital infrastructure investments include the construction, improvement, or expansion of certain types of infrastructure in Hawaii.

Q: How do I claim the Capital Infrastructure Tax Credit?

A: To claim the tax credit, you need to complete Form N-348 and attach it to your Hawaii state tax return.

Q: Is there a deadline for claiming the tax credit?

A: Yes, the tax credit must be claimed within three years from the due date of the tax return or within three years from the date the return was filed, whichever is later.

Q: How much is the Capital Infrastructure Tax Credit?

A: The amount of the tax credit is 20% of the eligible capital infrastructure investments made by the taxpayer.

Q: Can the tax credit be carried forward or back?

A: No, the tax credit cannot be carried forward or back. It can only be applied against the taxpayer's Hawaii income tax liability for the year the credit is claimed.

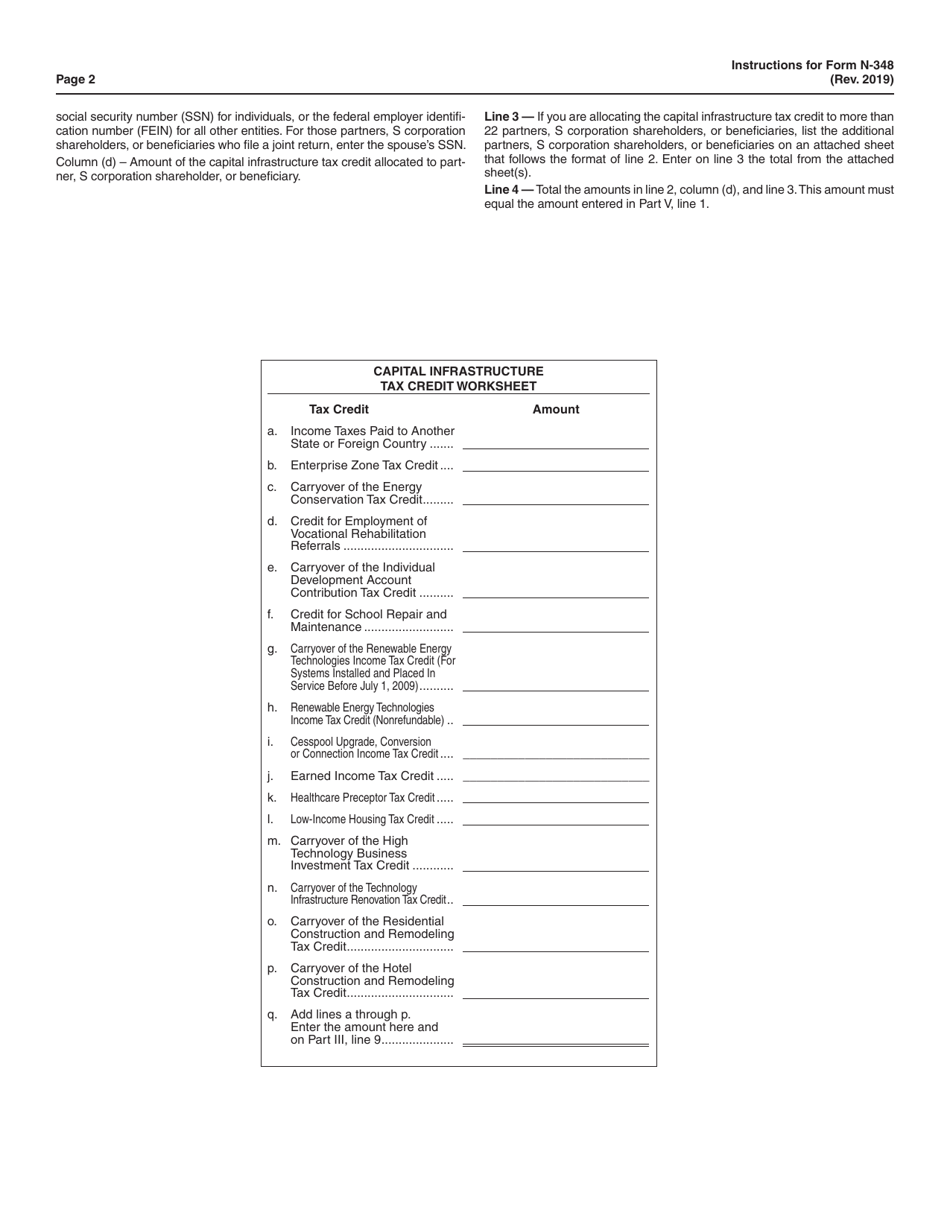

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there may be limitations and restrictions on the tax credit depending on the specific circumstances. Consult the instructions for Form N-348 for more information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.