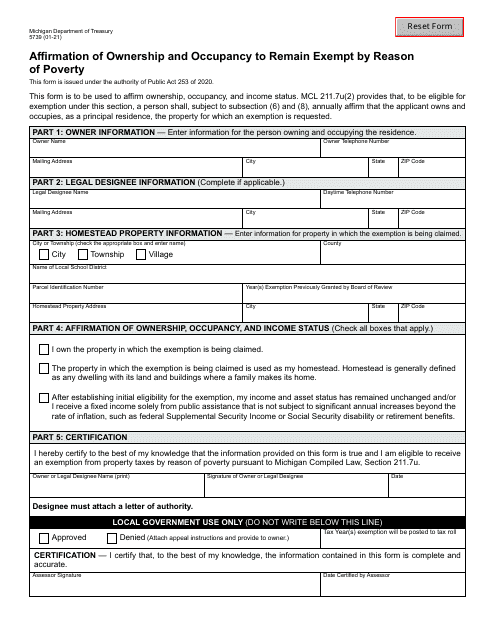

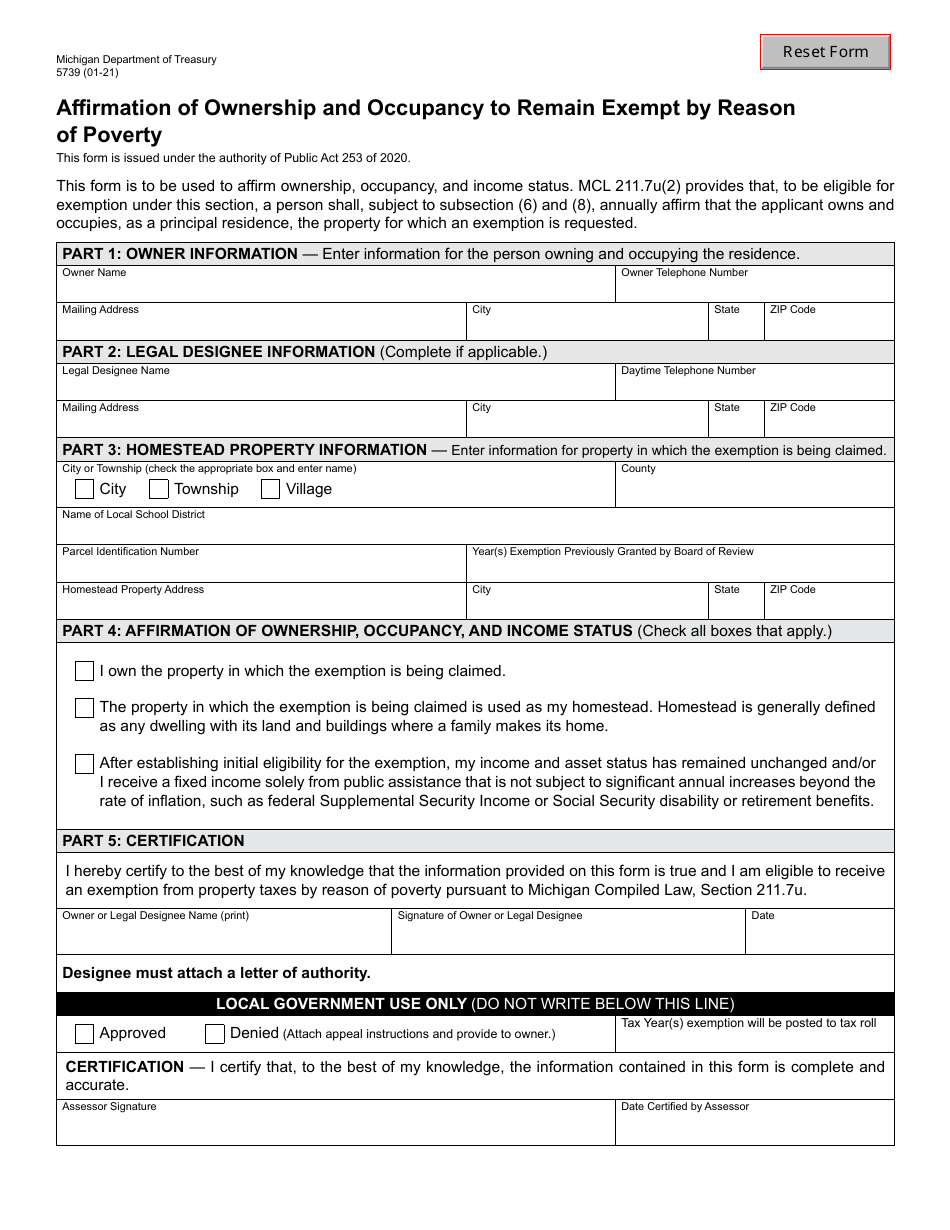

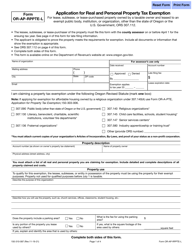

Form 5739 Affirmation of Ownership and Occupancy to Remain Exempt by Reason of Poverty - Michigan

What Is Form 5739?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5739?

A: Form 5739 is the Affirmation of Ownership and Occupancy to Remain Exempt by Reason of Poverty form in Michigan.

Q: What is the purpose of Form 5739?

A: The purpose of Form 5739 is to affirm the ownership and occupancy of a property in order to remain exempt from property taxes due to poverty.

Q: Who needs to fill out Form 5739?

A: Property owners in Michigan who are seeking exemption from property taxes due to poverty need to fill out Form 5739.

Q: How does Form 5739 help in remaining exempt from property taxes?

A: By filling out Form 5739, property owners can provide proof of their ownership and occupancy of the property, which can help them remain exempt from property taxes due to poverty.

Q: Is there a deadline for submitting Form 5739?

A: Yes, there is a deadline for submitting Form 5739. The deadline is usually determined by the local tax assessor's office, and it is important to submit the form before the deadline to remain eligible for the property tax exemption.

Q: What should I do if I have questions or need help with Form 5739?

A: If you have questions or need help with Form 5739, you can contact the Michigan Department of Treasury or your local tax assessor's office for assistance.

Q: Are there any fees associated with filing Form 5739?

A: There are no fees associated with filing Form 5739.

Q: Can I use Form 5739 for properties located outside of Michigan?

A: No, Form 5739 is specifically for properties located in Michigan.

Q: What happens if I do not fill out Form 5739?

A: If you do not fill out Form 5739, you may not be eligible for the property tax exemption and may be required to pay property taxes on your property.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5739 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.