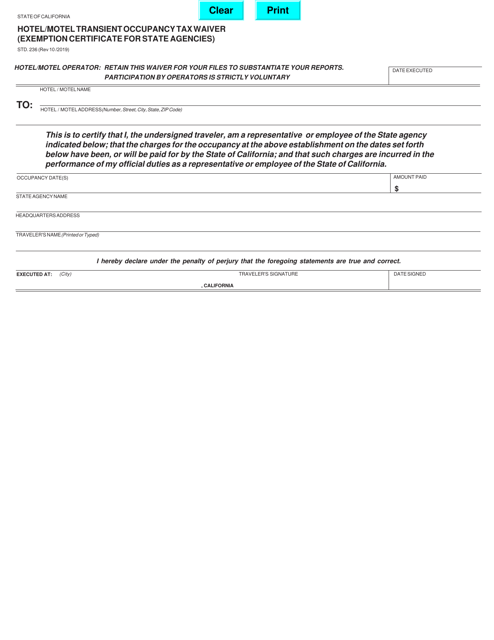

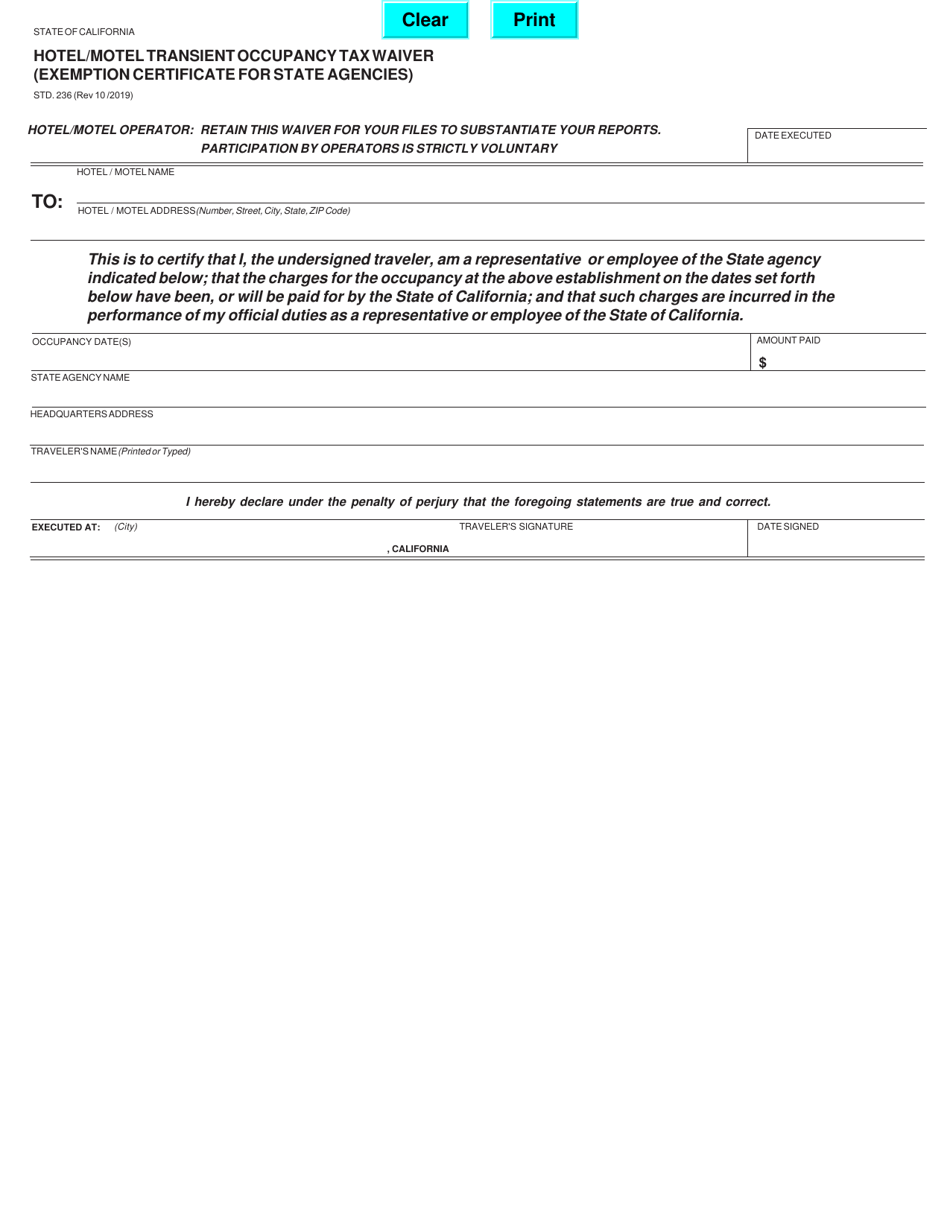

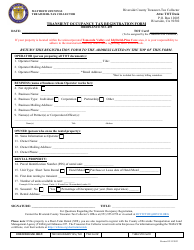

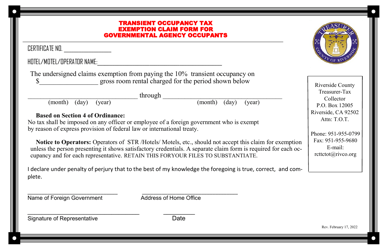

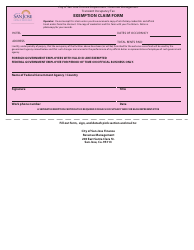

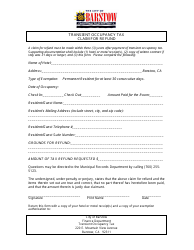

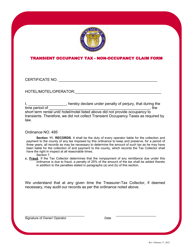

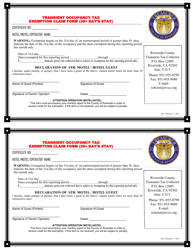

Form STD.236 Hotel / Motel Transient Occupancy Tax Waiver (Exemption Certificate for State Agencies) - California

What Is Form STD.236?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.236?

A: Form STD.236 is Hotel/Motel Transient Occupancy Tax Waiver (Exemption Certificate for State Agencies) form in California.

Q: Who uses Form STD.236?

A: Form STD.236 is used by State Agencies in California to request exemption from Hotel/Motel Transient Occupancy Tax.

Q: What is the purpose of Form STD.236?

A: The purpose of Form STD.236 is to request exemption from Hotel/Motel Transient Occupancy Tax for State Agencies in California.

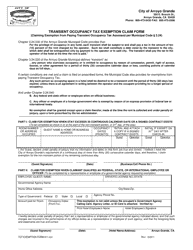

Q: Do all State Agencies in California qualify for tax exemption using Form STD.236?

A: No, not all State Agencies qualify for tax exemption. The eligibility for exemption is determined by the California State Board of Equalization (BOE).

Q: Are there any specific requirements or conditions for using Form STD.236?

A: Yes, there are specific requirements and conditions for using Form STD.236. These requirements and conditions are outlined in the instructions provided with the form.

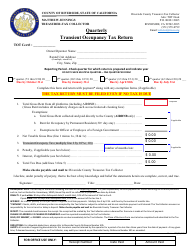

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.236 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.