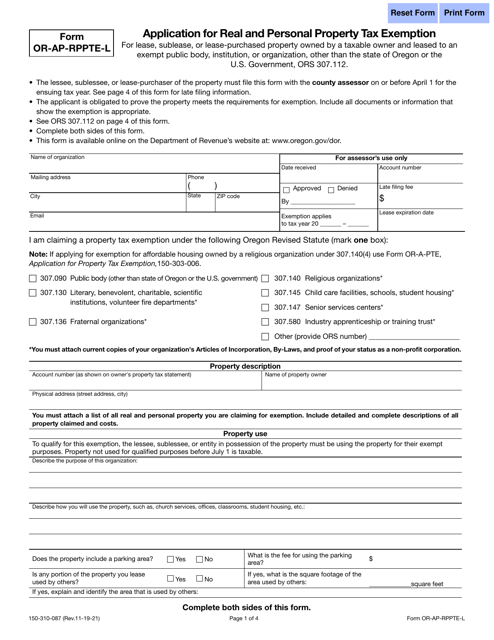

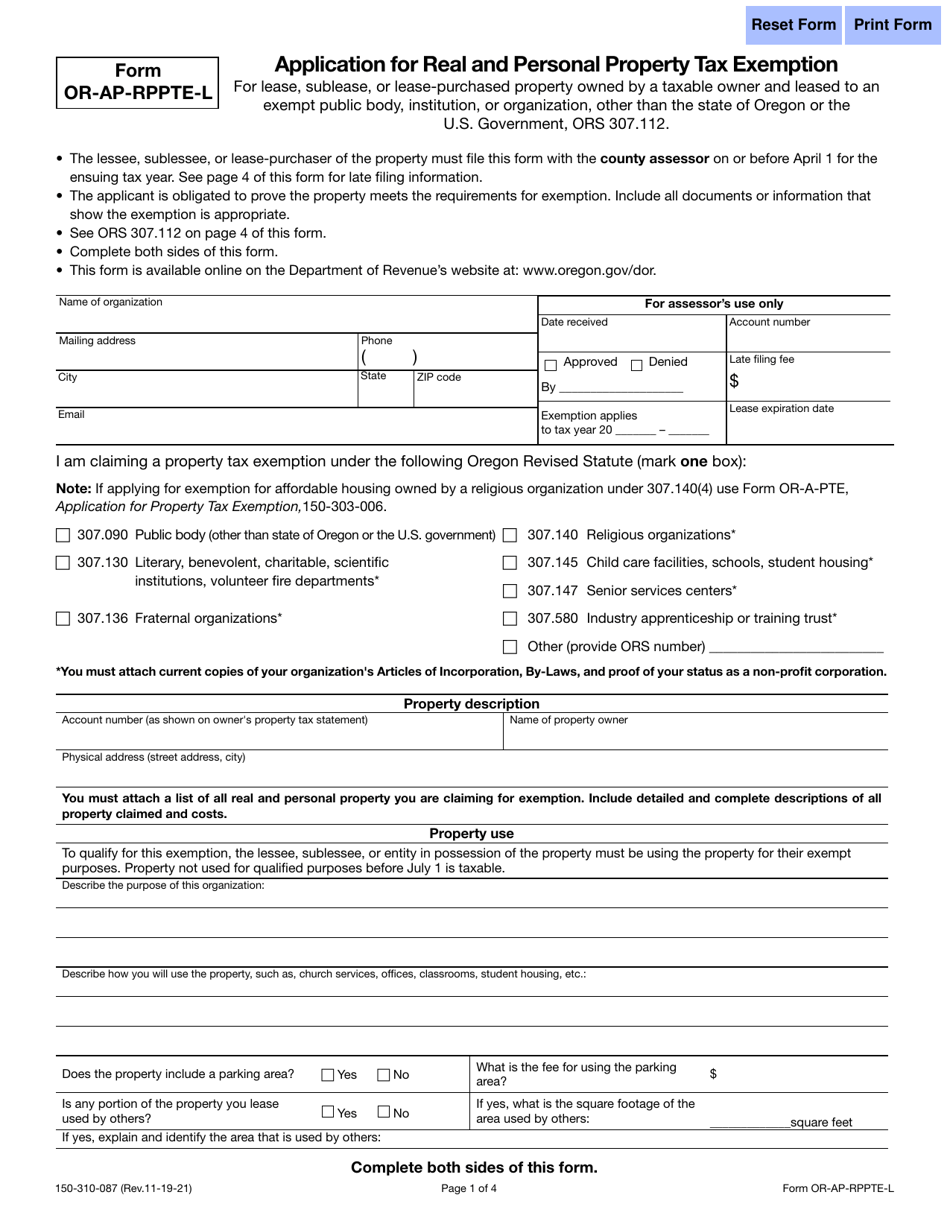

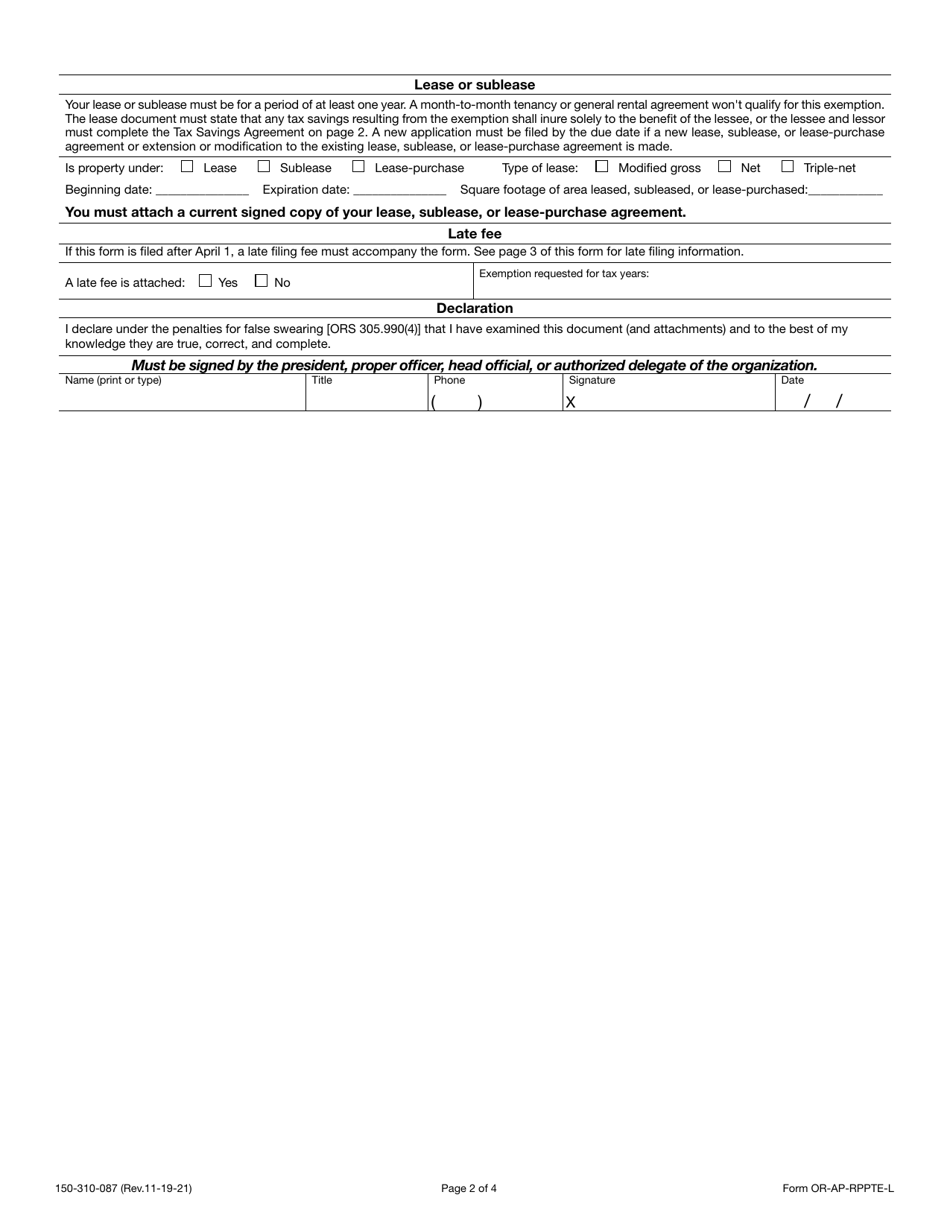

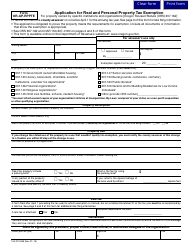

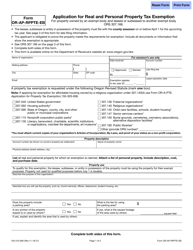

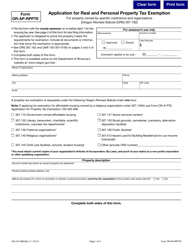

Form OR-AP-RPPTE-L (150-310-087) Application for Real and Personal Property Tax Exemption for Lease, Sublease, or Lease-Purchased Property Owned by a Taxable Owner and Leased to an Exempt Public Body, Institution, or Organization - Oregon

What Is Form OR-AP-RPPTE-L (150-310-087)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-AP-RPPTE-L?

A: Form OR-AP-RPPTE-L is an application for real and personal property tax exemption for lease, sublease, or lease-purchased property owned by a taxable owner and leased to an exempt public body, institution, or organization in Oregon.

Q: Who can use Form OR-AP-RPPTE-L?

A: Form OR-AP-RPPTE-L can be used by taxable owners who own lease, sublease, or lease-purchased property that is being leased to an exempt public body, institution, or organization in Oregon.

Q: What is the purpose of Form OR-AP-RPPTE-L?

A: The purpose of Form OR-AP-RPPTE-L is to apply for a real and personal property tax exemption for lease, sublease, or lease-purchased property that is owned by a taxable owner and leased to an exempt public body, institution, or organization in Oregon.

Q: What information do I need to complete Form OR-AP-RPPTE-L?

A: You will need information about the property, the taxable owner, the exempt public body, institution, or organization, and the terms of the lease or sublease.

Q: Are there any fees associated with filing Form OR-AP-RPPTE-L?

A: There are no fees associated with filing Form OR-AP-RPPTE-L.

Q: When is the deadline to file Form OR-AP-RPPTE-L?

A: The deadline to file Form OR-AP-RPPTE-L is April 15th of the assessment year.

Form Details:

- Released on November 19, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-AP-RPPTE-L (150-310-087) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.