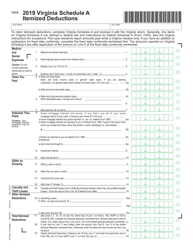

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule A

for the current year.

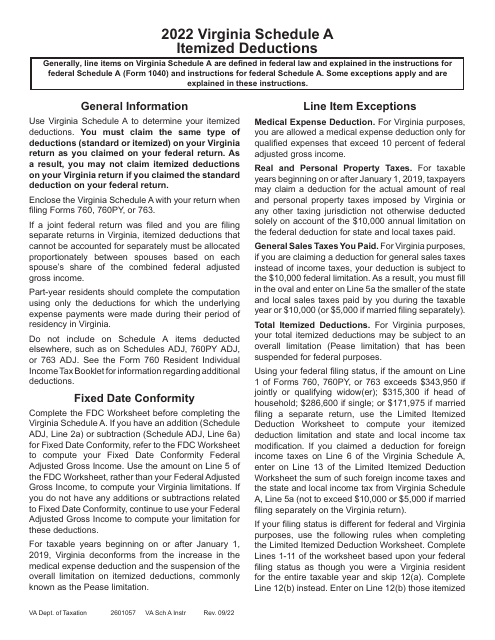

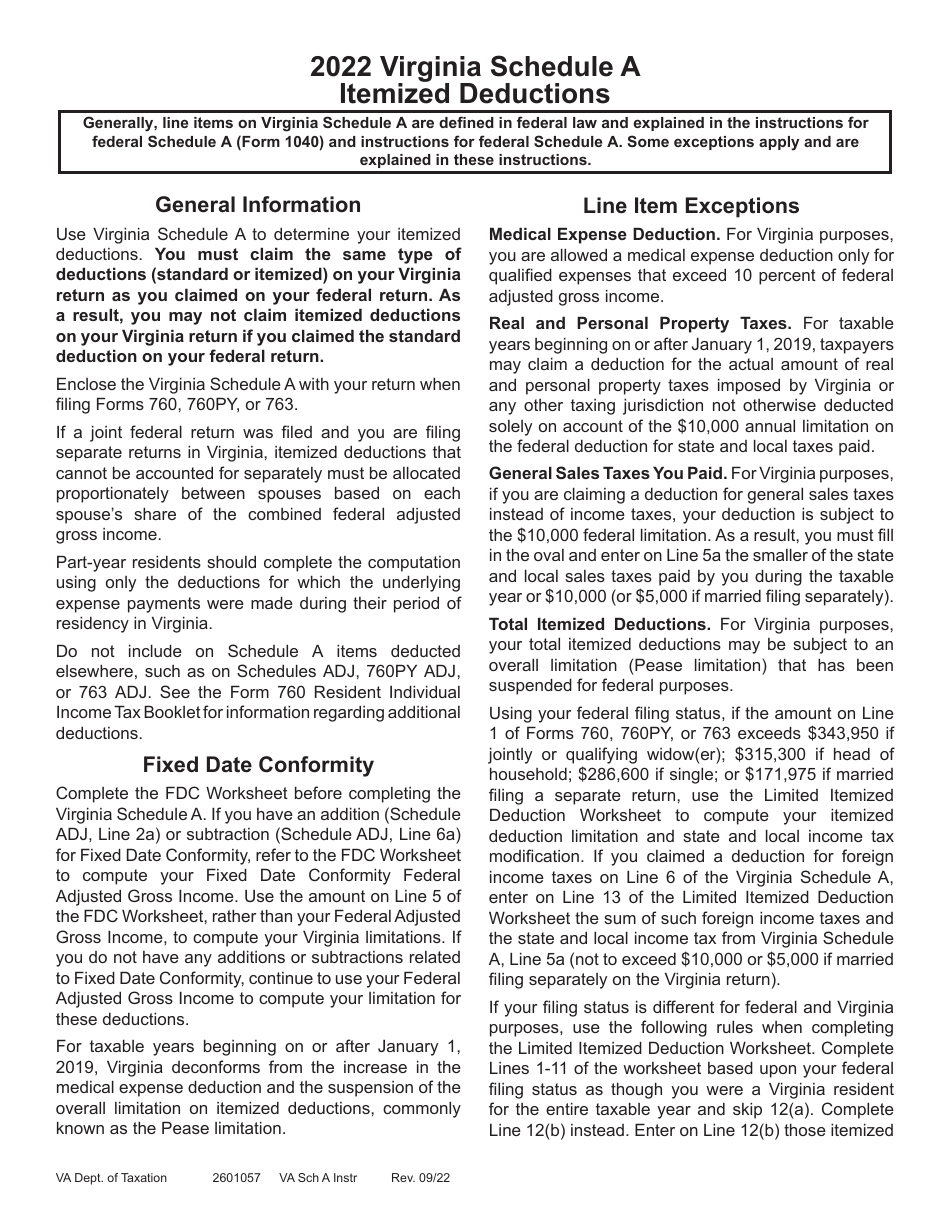

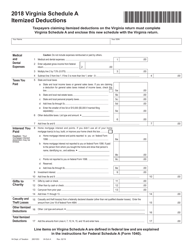

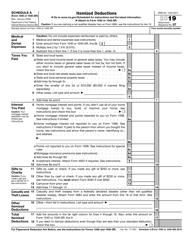

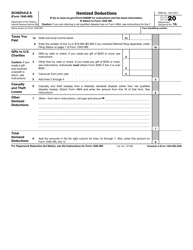

Instructions for Schedule A Itemized Deductions - Virginia

This document contains official instructions for Schedule A , Itemized Deductions - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Schedule A?

A: Schedule A is a tax form used to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can subtract from your adjusted gross income to reduce your taxable income.

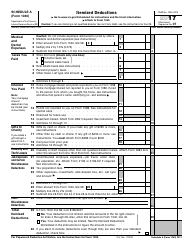

Q: What expenses can I deduct on Schedule A?

A: Some common expenses that can be deducted on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Can I deduct all of my expenses on Schedule A?

A: No, you can only deduct expenses that exceed a certain threshold. This threshold is based on your income and can change each year.

Q: What is the standard deduction?

A: The standard deduction is a fixed amount that you can subtract from your adjusted gross income if you choose not to itemize your deductions.

Q: Should I itemize or take the standard deduction?

A: You should compare your total itemized deductions to the standard deduction. If your itemized deductions are greater than the standard deduction, it may be beneficial to itemize.

Q: What records do I need to keep for my itemized deductions?

A: You should keep receipts, invoices, and other supporting documentation for any expenses you plan to deduct on Schedule A.

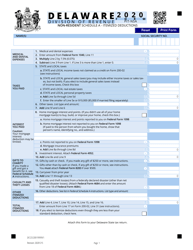

Q: Do I need to file Schedule A for state taxes?

A: The requirements for state taxes vary by state. You should consult the tax laws of your specific state to determine if you need to file Schedule A for state taxes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.